US pot stocks are flying, will they encourage the Aussie laggards to follow?

If Australian cannabis stocks bear any resemblance to the broader market, this week may see them spike, following a similar movement in North America.

The ASX has a tendency to follow the overnight movements of US markets and late last week North American pot stocks began to rise sharply.

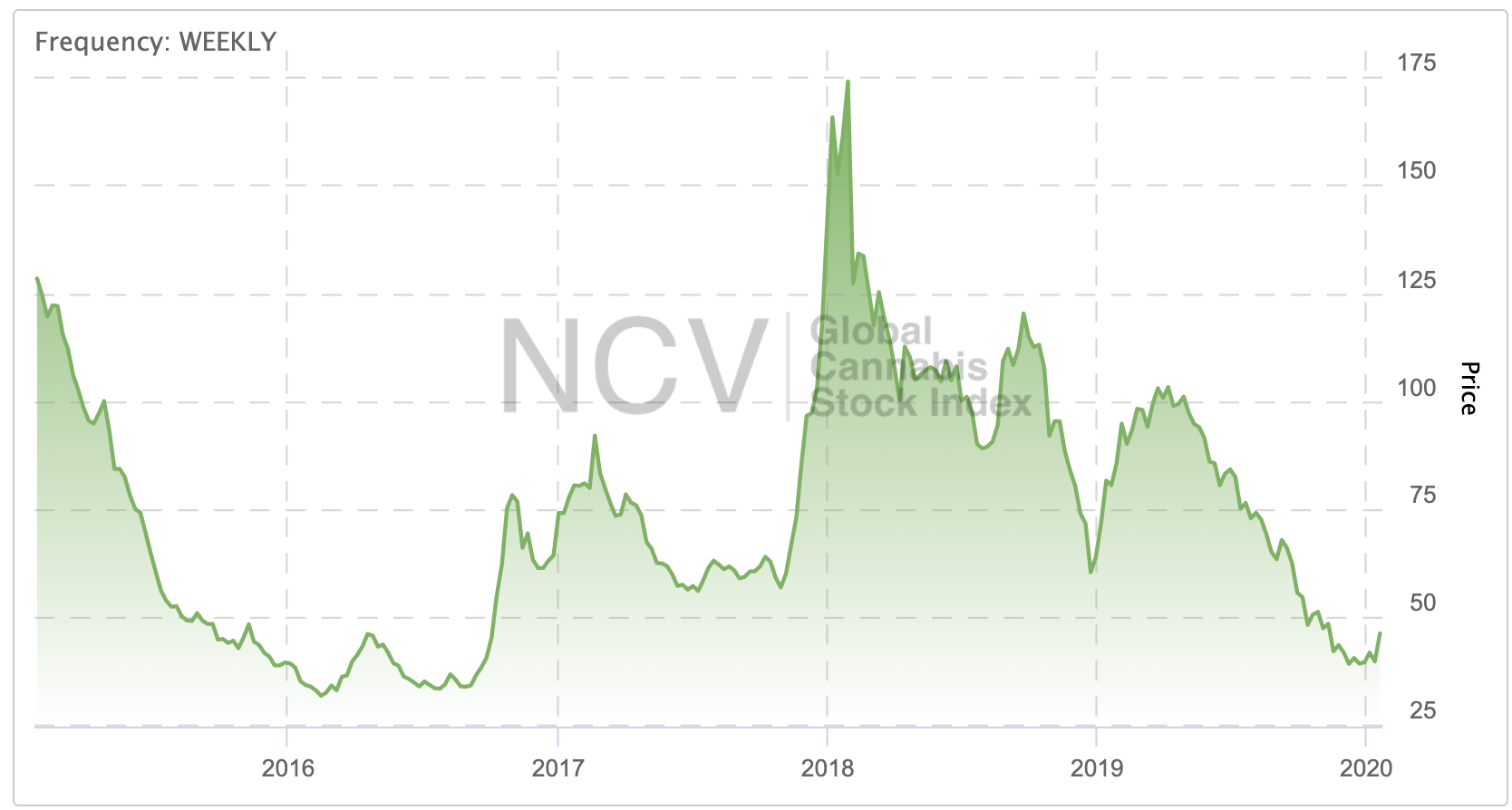

The New Cannabis Ventures Global Cannabis Stock Index rallied 16.3 per cent, an index consisting of the largest US-listed pot stocks, the largest movement since May 2018 when Canada began to implement reforms to legalise weed for recreational use.

This is, albeit, off a very low base. North American pot stocks hit lows not seen since late 2016 in December.

“Driving the index higher was the largest Canadian LPs… These nine stocks, along with Sundial and Tilray, represent 27 per cent of the broader market index,” that would hopefully signal the end of the downturn that began in late March, New Cannabis Ventures said in a note.

“The rally in the beaten up large LPs and other names follows two years of sharply negative returns for the sector that followed two very strong years.”

Bad news from majors — a weaker outlook for Aphria and stronger revenue but from a one-off source for Organigram — was not reflected as the market took off.

“While the capital crunch will persist and likely weigh on the market this year, it seems as though traders and investors may be realising that the worst is probably behind for most companies. For example, the vaping crisis appears to have played out,” the note said.

2020 is expected to bring better products and distribution chains, and more US states legalising recreational marijuana use as well as the possibility of an Act passing through the US legislature legalising banking for cannabis companies.

In Australia, since the start of the month pot stocks on the whole have begun ticking upwards as plans, both actionable and aspirational, have been announced.

READ MORE:

Weed Week: Cannabis munchies not a safe bake

Weed Week: Study shows pot can be orgasmic

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.