US giant puts a Buy on US giant as ‘protection against the coming storm’

I got you babe. Via Getty

Left field? Screw it. Let’s go left hemisphere.

So here’s a brief and utterly other end of town investment tip from the bank that ate Merrill Lynch & Co after that whole Global Financial Crisis thing.

The far-ranging risk-takers at the eighth-largest bank in the world the Bank of America (BoA) have a it’s-just-so-crazy-it-might-work-idea for anyone looking for a solid suit of fiscal armour to don during a global economic downswing.

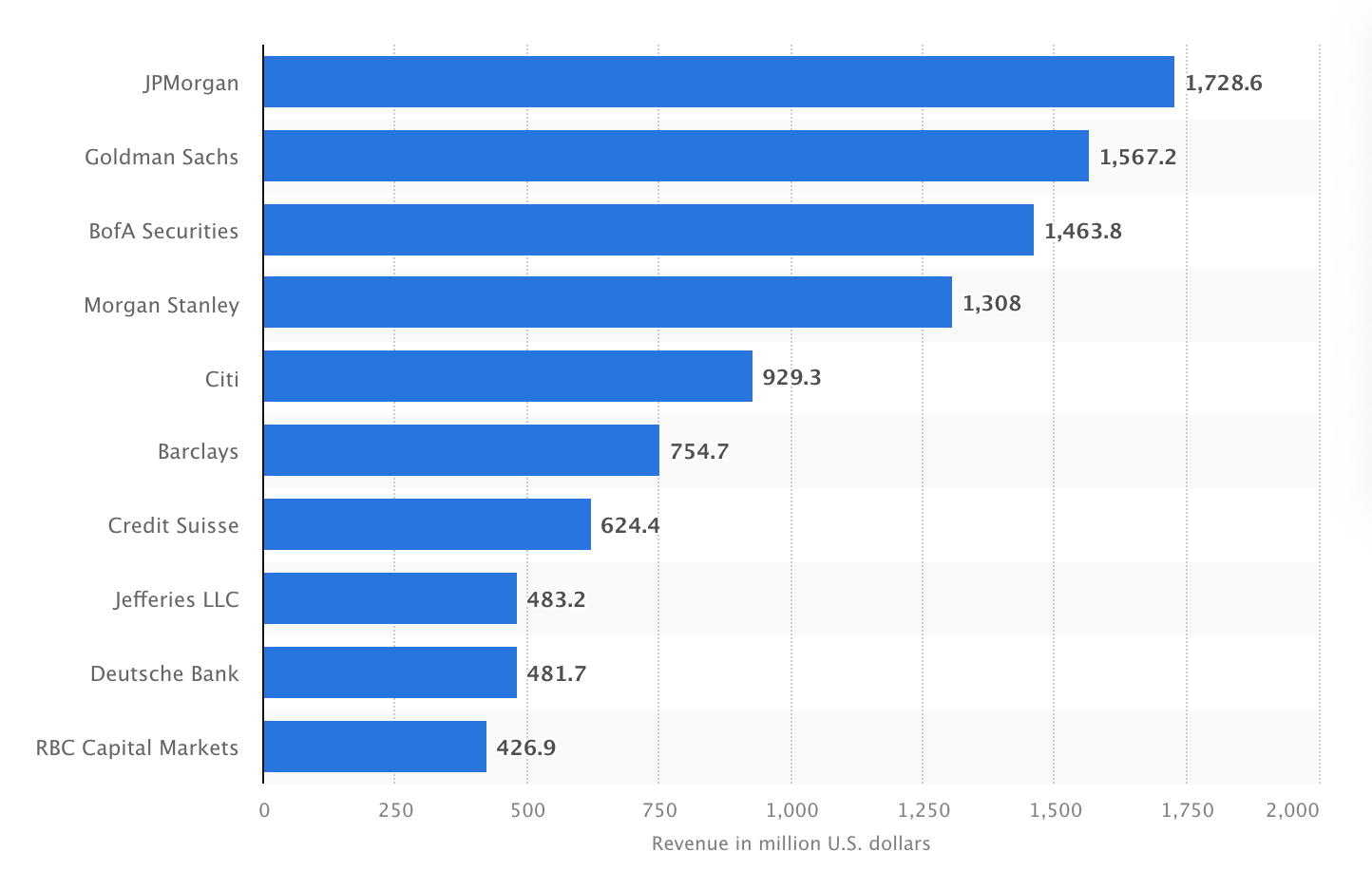

Overnight, BoA, the second-largest bank in America recommended investors buy shares in Goldman Sachs – the second-largest investment bank in America.

Curiously both Brobdingnagian bridesmaids each share an eternal second fiscal fiddle position in their respective fields to the unquestioned behemoth of corporate banking, JP Morgan Chase. Although I’m sure this wasn’t a consideration, because banks aren’t like that.

‘Buying protection against the coming storm’

Anyhoo, BoA analyst Ebrahim Poonawala – in a rather chillingly titled note – “Buying Protection Against the Coming Storm” – reckons Goldman has all the required genetics to blossom as the economic universe collapses around the teeming and surprised-lookin’ faces of the unsuspecting proles.

Goldman climbed about 2% overnight after Mr Poonawala upgraded the investment beast to Buy from Neutral, saying Goldman gives “relatively better value” than its stonkingly big banking buddies as the economic world heads downtown.

Leading banks 2022, by investment revenue (in US$ million)

Goldman, BoA says, is the go-to bank when the chips are down

As uncertainty unhinges digital assets and hesitancy disrupts fintech, no-one is better placed than Goldman to profiteer from new business and buying opportunities than the bank which has a hard-earned and reassuring reputation for an absence of ethical due-diligence, a track-record of bedding down with cashed-up tyrants, a preternaturally cozy relationship with the US federal government (the US Treasury is a bit like a Goldman finishing school) and of course an alleged knack for driving up commodity prices through market controlling speculation.

Interestingly, this week the investment bank backed dotty oil prices to hit US$140 per barrel. Here’s Bevis most astutely pointing out Goldman pointing out underinvestment in sector would drive prices higher, with money running away from oil when it should be ‘racing towards it’.

BoA says this stuff suits GS to a tee.

The current volatile markets, the gathering geopolitical tensions and incoming and (potentially) erratic changes in monetary policy could all help lift Goldman’s revenue and bring on an intensification of opportunity for the global investor.

“Revenue growth could see a boost from a volatile geo-political backdrop and monetary policy, both have the potential to drive elevated trading activity for the foreseeable future,” Poonawala said.

Even better, BoA sees the stock as cheap as chips on a price-to-tangible book value basis.

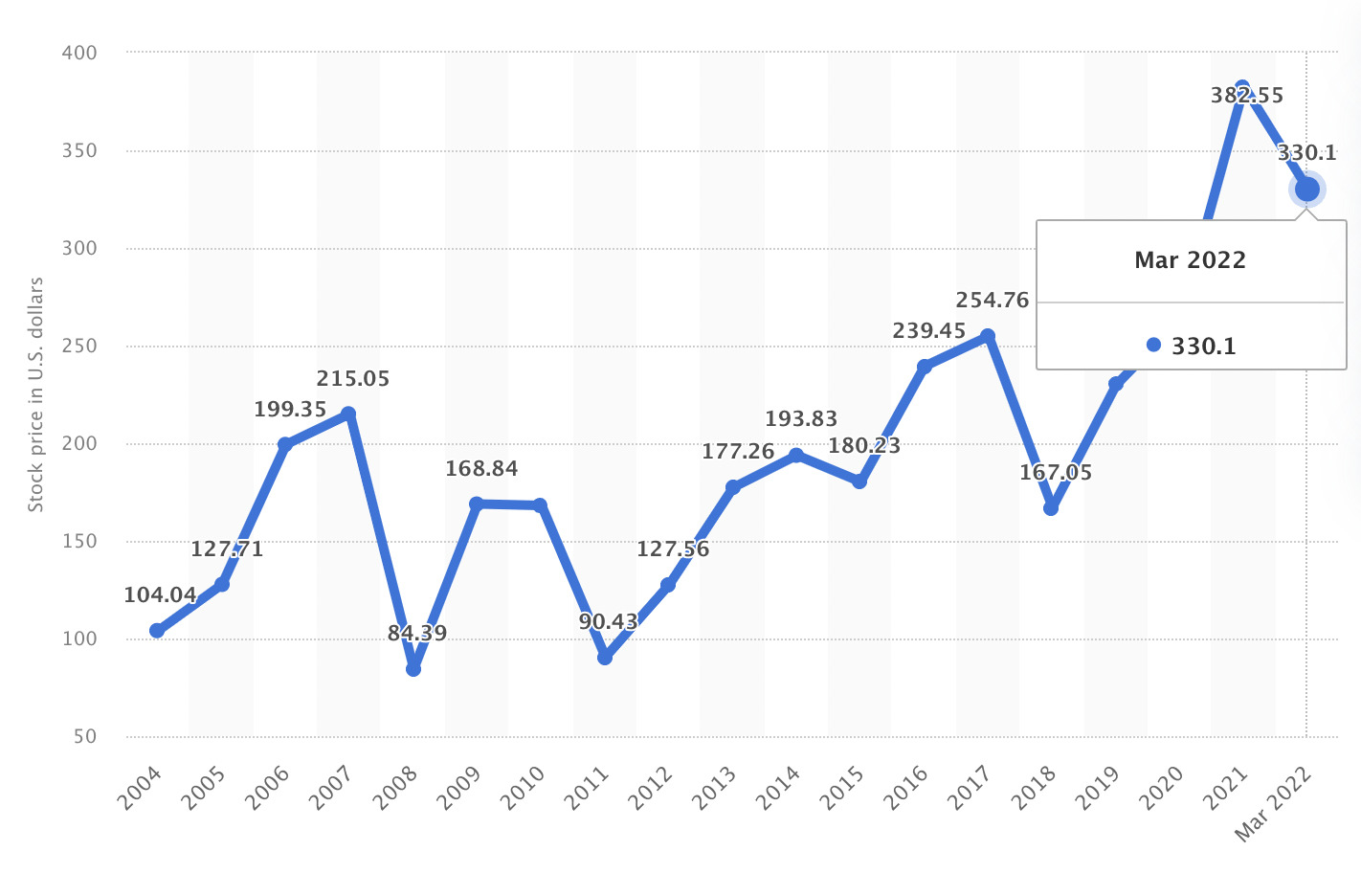

It’s certainly true shares in Goldman have crashed by almost a full quarter (about 23%) since Christmas, but according to the BoA that stock could easily find its funk as the world falls apart – with an expected rally of at least another 27% based on Bank of America’s latest price target of $380 a pop.

“Our ratings change – first upgrade of 2022 – does not indicate an improved outlook for bank stocks,” he added.

“To the contrary, we see the stock as well-positioned to outperform in what is likely to be a worsening economic backdrop that could weigh more materially on the EPS outlooks for its balance sheet lending-heavy peers.”

Poonawala raised his price target on Goldman by about $20 to $380.

Still, Goldman’s earnings estimate for 2022 got a shave like everyone else (to $33.17 a share from $38.73) and the ’23 earnings forecast was also clipped to $36.83 a share from $38.50.

Over the period above, the average return on shareholder equity at Goldman is a shade over 11%.

I suppose that shouldn’t be too surprising. Although the bank operates across whatever particular segment of the global banking industry takes its fancy, it’s probably best known for never being too far from the ol’ M&A action, as well as being one of the pole positioned underwriters for big game initial public offerings.

Goldman brought us last year’s record breaking IPOs for the crypto player Coinbase and for Roblox, the insanely ubiquitous but dull-looking gaming platform my wee one uses to hone his murder skills – both of which went down as two of the largest IPOs in history.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.