US Fed holds, Wall Street explodes

Via Getty

US Stock markets surged for the final few hours of Wednesday trade in New York after the US central bank delivered a crowd pleasing call on interest rates, holding the cost of borrowing (federal funds rate) steady.

Here’s the tl/dr version if reading’s too hard:

For the rest of you, at 6am in Sydney, the SPI Futures index is pointing to a gain on Thursday of 0.7%.

Forlorn hopes of an escalating rate cut timetable as well as any stubborn vestiges of a hawkish bias were extinguished by the highly-anticipated, yet widely-expected decision, made at 2pm in New York.

Within 90 minutes of the announcement, the dithering three major US indices renewed their bullying of record high levels.

Federal Reserve held rates at a 23-year high and maintained expectations for three cuts before the end of 2024.

In the full Federal Open Market Committee Meeting (FOMC) statement released at 5am on Thursday, (AEST), US traders likely noted that Federal Reserve chairman Jerome Powell’s team stuck to their guns by maintaining previous expectations of three cuts to the FFR before the end of 2024.

Current US rates – at between 5.25% and 5.5% – are cresting a 23-year high.

On Wall St, with 30 mins to play, the S&P500 went from 0.2% before the decision to topping the 5,200 level and smashing a new intraday high.

The Nasdaq Composite also moved toward a record close, moving from a 0.4% advantage to one of more than 1.1%.

The Dow Jones Industrial Average moved from a gain of 115 points, or 0.3% to adding well over 370 points, or 1%, to clock its own new record high.

“The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 per cent,” the FOMC bank said.

The decision to plan to cut rates three times before the end of the year reaffirms its previous forecast. That said, the central bank said it needs to achieve greater confidence that inflation is moving toward its target.

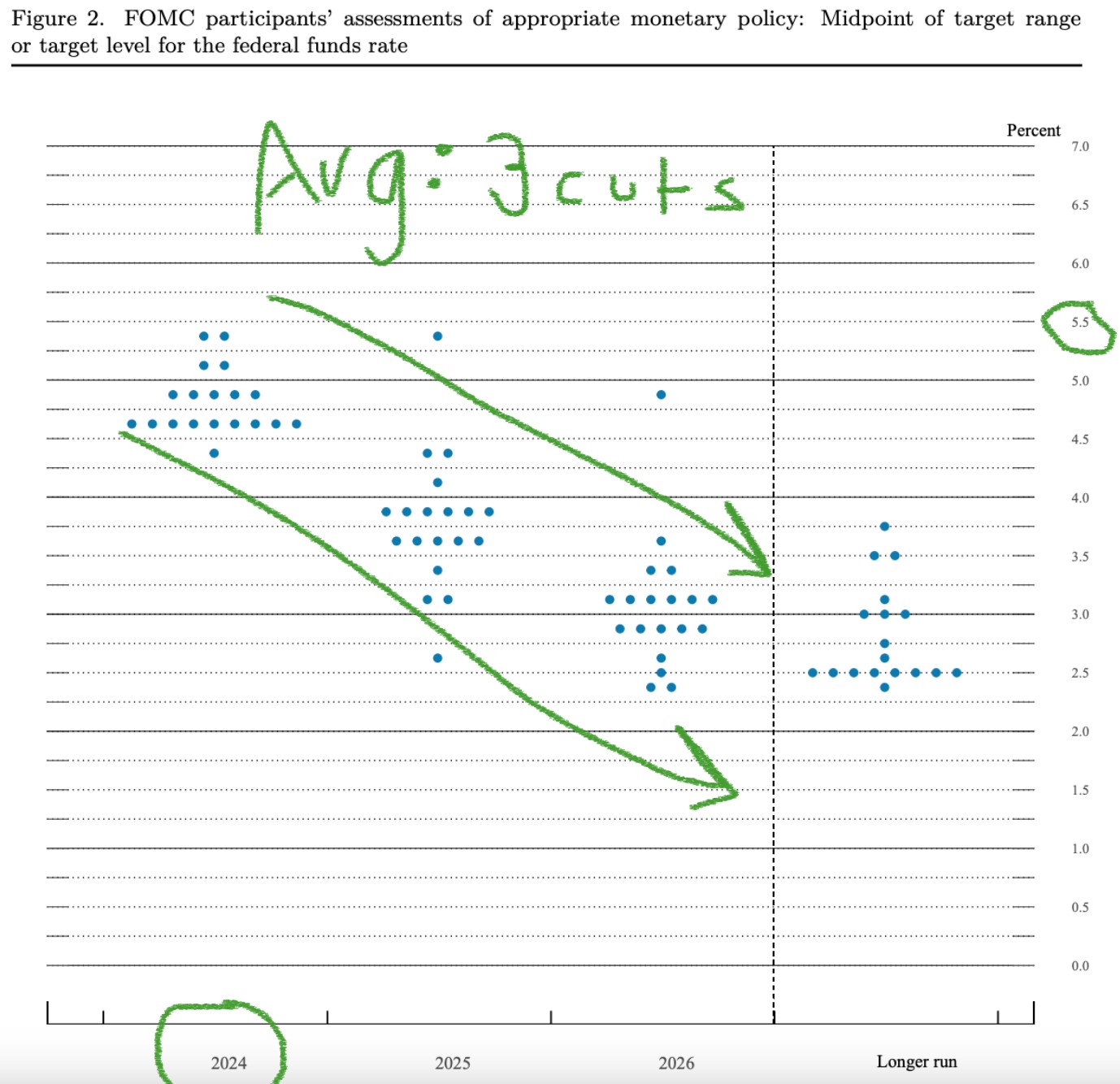

After the two-day meet (March 19–20), the FOMC members* have to share their own best guess projections for everything from US real gross domestic product (GDP) growth, the jobless rate, inflation and for their own preferences for rate cuts (this is the famous dot plot) for each year from 2024 to 2026 and over the longer run.

Ed: *know your US FOMC members: (Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Michael S. Barr; Raphael W. Bostic; Michelle W. Bowman; Lisa D. Cook; Mary C. Daly; Philip N. Jefferson; Adriana D. Kugler; Loretta J. Mester; and Christopher J. Waller)

If there’s a Goldilocks zone for market expectations of the US central bank’s decision, then the near ‘copy and paste’ nature of this March meeting to the previous FOMC get-together is probably it.

Recent mixed economic indicators out of the States which seemed to offset a cracking economy with several sticky inflation reads will have moderated hopes of any fast-track rate cuts; that said, the so-called dot plot also shows the FOMC still largely envisions x3 rate cuts taking place sometime this year.

The FOMC ‘dot plot’ (March 19-20)

Ed: “Appropriate monetary policy” is basically “the future path of policy” each FOMC participant “deems most likely”.

According to the dotty chart, the gathering of Fed officials still expect to cut interest rates by around three-quarters (75 basis points) of a percentage point by the end of the year, sticking with an earlier forecast despite the recent mixed economic data.

However, they now see interest rates remaining a little higher for a little longer over the following (2025-2026) years.

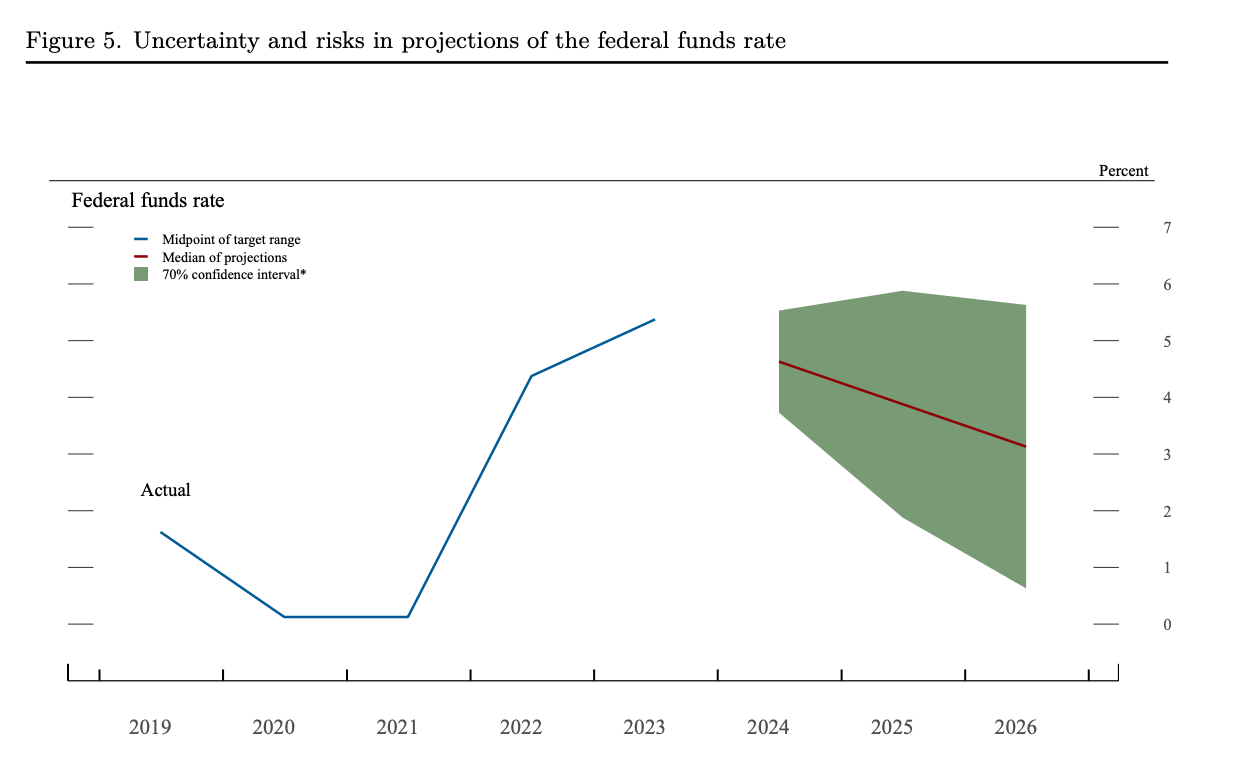

This is a cool chart (if monetary policy is your bag), which the Fed releases alongside the other projections…

x

In the post-match press conference, chair J. Powell acknowledged that overall inflation remains too high, but that price growth has “eased notably.

As expected Powell also put a lid on ideas that the FOMC might be twitchy about getting rates back on the downward cycle before the central bank’s job of stifling rising prices was achieved.

“Straying too soon or too much (could) ultimately require even tighter policy to get inflation back to 2%,” Powell warned.

The US Financial sector was Wall Street’s main beneficiary overnight. The sector led gains following the decision, with traders betting on the confidence of a US economy continuing to grow.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.