UBS: Reporting season confirms ‘bullish expectations’ for ASX stocks

UBS expects the ASX to climb to new all-time highs by the end of the year. (Pic: Getty)

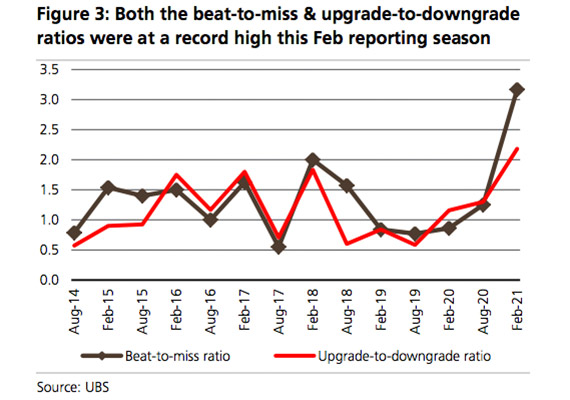

The number of ASX companies that beat earnings expectations in February reporting season was “historically high”, UBS says.

The ratio of companies with earnings beats compared to an earnings miss was 3.3 to 1; easily the highest number going back to at least 2014:

UBS said the earnings beats were partly a function of the disruption in 2020, when many companies ditched forecasts entirely due to the uncertainty stemming from the pandemic.

Heading into this year, the consensus view among analysts for 2021 earnings revisions was “overly conservative”.

As a result, EPS (earnings per share) estimates were upgraded by an average of about five per cent, when usually they are downgraded.

So all in all, “reporting season delivered on our bullish expectations”, said the UBS equities team, led by analyst Pieter Stoltz.

The bank expects a broadly positive backdrop for equities in 2021 as the economy emerges from the pandemic.

In recent research, UBS put a year-end price target of 7,600 for the ASX200, which marks a gain of more than 10 per cent from current levels.

While Australia’s banking sector was among the lead performers in the December reporting season, some big tech names failed to deliver.

Market darling Appen (ASX:APX) got sold off sharply following its results, as did circuit software company Altium (ASX:ALU) and medtech stock Nanosonics (ASX:NAN).

“A common theme was uncertainty about lofty future growth expectations,” UBS said.

The Bevan Slattery-founded NextDC (ASX:NXT) bucked the trend after beating expectations on EBITDA growth and upgrading its forward guidance.

ALSO READ: Zero to Hero: How NextDC went from start-up to $5.5b stock in 10 years

While February reporting season was strong, it was disrupted somewhat by some rumbles in the bond market in the second half of the month.

While the bond sell-off has created a talking point about how higher yields will impact equity valuations, Stoltz doesn’t expect it to give rise to a broader downward re-rating.

“We think earnings-per-share growth this year (+34%) should offset most of the negative impact from higher bond yields,” UBS said.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.