UBS is Fed up, so consume this sector with some discretion

The first half of 2022 will be remembered for some really historic crapness.

Already in the Top 5 of Worst Half Ever For Global Equities, the finger pointing is underway with market fears of a recession leading directly back to the big boots of the Federal Reserve and it’s catch up footy hiking of interest rates to fight an inflation game many think is already lost.

Stocks big and small have had a tortuous 2022 so far, stateside the S&P 500 is down by well over one fifth and stock markets willy-nilly are tumbling into bear market territory.

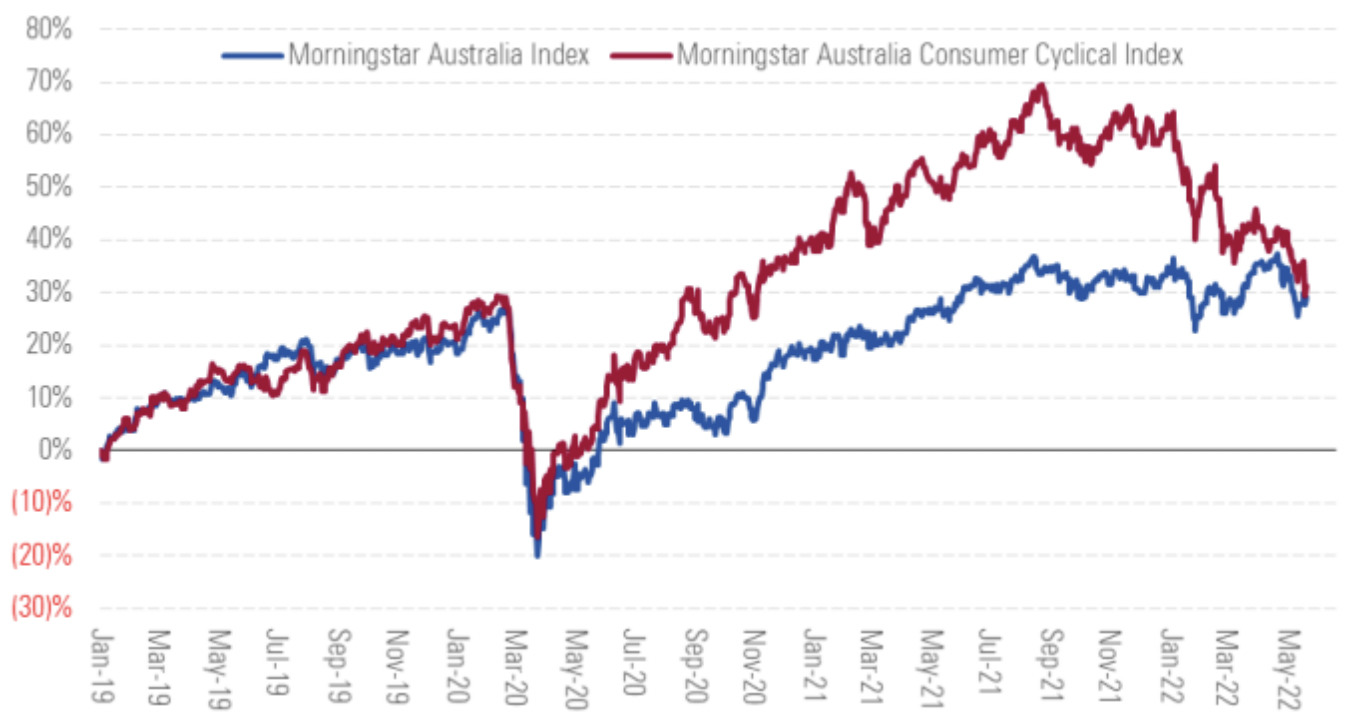

The Consumer Cyclical (or Discretionary) sector has – in the words of Morningstar analyst Angus Hewitt – endured a brutal second-quarter 2022, delivering a standout 21% fall, easily eclipsing the 14% fall of Morningstar’s Australia Index (below, which targets the top 97% of local stocks by market cap).

That slide’s wiped out whatever COVID-gains these consumer brands made over the rest of the market, as the sector jumped 26% since the first quarter of calendar 2020.

UBS: Finally fed up, with The Fed

Not afraid to kick a central banker when they’re down, analysts like UBS are this week saying the monetary brains trust at the Federal Open Market Committee (FOMC) have ‘significantly damaged’ their hitherto positive bias towards markets.

The US inflation rate hit 8.6% in May, its highest level since December 1981, putting pressure on employers to raise wages to keep pace, and the consequent shift higher in consumer inflation expectations have left the Fed suddenly looking rather comfortable with the negative growth they’ve been so focused on battling these last few years.

The World Bank has again cut its global growth rate for this year to 2.9% from its over 4% estimation made in January. Figures for the US are just about the same.

Now it seems central banks are more than happy to see the death of growth as a necessary cost of keeping inflation at bay.

Consequently, UBS this week said traders’ paranoia over the path of earnings have actually been justified.

The investment bank says it’s now likely that relief on the inflation side will be more than balanced by slower growth as the impact of accelerated hikes, Quantitative Tightening (QT) and Financial Conditions Index (FCI) tightening make themselves at home.

So the difficulty has ‘increased materially’ UBS says, as US markets gird for second quarter earnings – and perhaps most importantly, whatever second half guidance is proffered.

Fears around inflation give way to fears around growth

Although it’s been the whipping boy of the recent shift of focus from growth to quality, UBS remain of the view that the opportunities on the NASDAQ ‘remain the preferred upside trade,’ should inflation fears melt away over the next months and give way to economic growth fears.

Despite its headline falls, the NASDAQ has lost about 1.7% since the 24th May, easily outperforming the S&P 500, which is down about 5%.

The focus for the Fed is on easing inflation and not supporting the economy or the market through tough times; in fact the whole blunt instrument design of raising rates is to hamstring runaway prices and dampen economic activity. A plan UBS says will likely require a weak economy and some bon chance.

Betashares boss of numbers David Bassanese says US headline CPI could even edge lower without too much heavy lifting over at Fed Central, just due to the make up of segments outside of the demand for food and energy.

“Headline inflation potentially falls to 5% by year end, and core inflation to just over 3% – largely due to a slowing in energy and transport goods annual inflation.

“If so, it would suggest the Fed may not need to be as aggressive as markets fear in raising rates, and there could still be a chance the economy avoids recession.

But inflationary threats remain legion

Let us count the ways: further migraine-inducing supply chain problems, Russia’s invasion, blockade and bombardment of Ukraine, the further impact that has on the flow of energy and food around the world.

“To contain these risks, some element of demand destruction will likely be required – while already high food and energy prices will help in this regard, higher interest rates to slow demand more broadly will also be needed.”

That’s made life less fun for one sector in particular…

Ah. Consumer Discretionary. The sector which makes being a Capitalist Running Dog so damn marvellous.

This is a corner of the market made up of the businesses in the business of flogging the goods and services we really, really want, but don’t actually need.

Considering the various extraneous variables – i.e. the Fed now fighting to keep a lid on growth and not nurturing it – the environment for spending has ‘deteriorated dramatically’.

UBS says its wait and see outlook for these consumer stocks is no longer justified, and the analysts are repositioning for a fiercely bearish stance.

The math is pretty simple. When the cost of living goes up, the Walkmans, Star Wars action figures and colour TVs stay unbought.

Other than perhaps angst or cold shakes, the risk measure for the sector is: these are good goods to get, but only if the available income is on hand to afford them. That’s why these stocks are the first against the wall when the (rate cycle) revolution comes.

Structurally, it’s a sector that’s growth-oriented, so the share prices of these guys grow over a long time period.

And consequently, a higher market interest rate hurts, and hurts bad.

The average consumer is now facing a much fuller and higher interest rate life.

Just the tip of the iceberg

Ask a lettuce, visit the petrol station or just wait till that energy bill arrives.

Arthur Garipoli (Seneca Financial Solutions) told Stockhead consumers will feel the pain of higher interest rates going forward and this will have a huge impact on discretionary spending.

“Add higher living expenses to the equation such as increased grocery and utility bills and not to mention higher fuel prices and the consumer will definitely be tightening the reins when it comes to discretionary spending.”

Arthur says this will have ramifications that flow across the economy.

“In a tightening cycle, stocks like JB Hi Fi, Harvey Norman, Super Retail Group and ARB will feel the effects as consumers focus on staple spending.

“The market has already sold most of these stocks down to reflect lower earnings going forward. Consumers only have so much to spend and when things get tight non-essential spending is the first thing consumers trim.

“It may also mean consumers eat in house as opposed to the local café or restaurant,” he adds.

‘Interesting times ahead!’

As a result, UBS has slashed their consumer discretionary sector earnings estimates for FY23 and beyond by almost a full quarter (~23%) on average.

Investor appetite for consumer discretionary retail is extraordinarily low, with value investors yet to engage with the sector given further downside risk to earnings.

Preferred exposures in the sector according to UBS in a relative sense are:

- Youth and affluent consumers as they are less impacted by rising cost of living – they live at home, high income provides buffers examples would be LOV, UNI, TWE;

- Market share winners with a value focus, holding back price rises (e.g. DMP, WES);

- Those that have engaged in significant operational changes during COVID (e.g. PMV, SUL).

- Big ticket retailers are generally to be avoided (e.g. HVN, JBH)

UBS says inventory remains elevated for most listed consumer discretionary retailers, reflecting the disrupted supply chains which continue to drive the shift from just-in-time to just-in-case inventory.

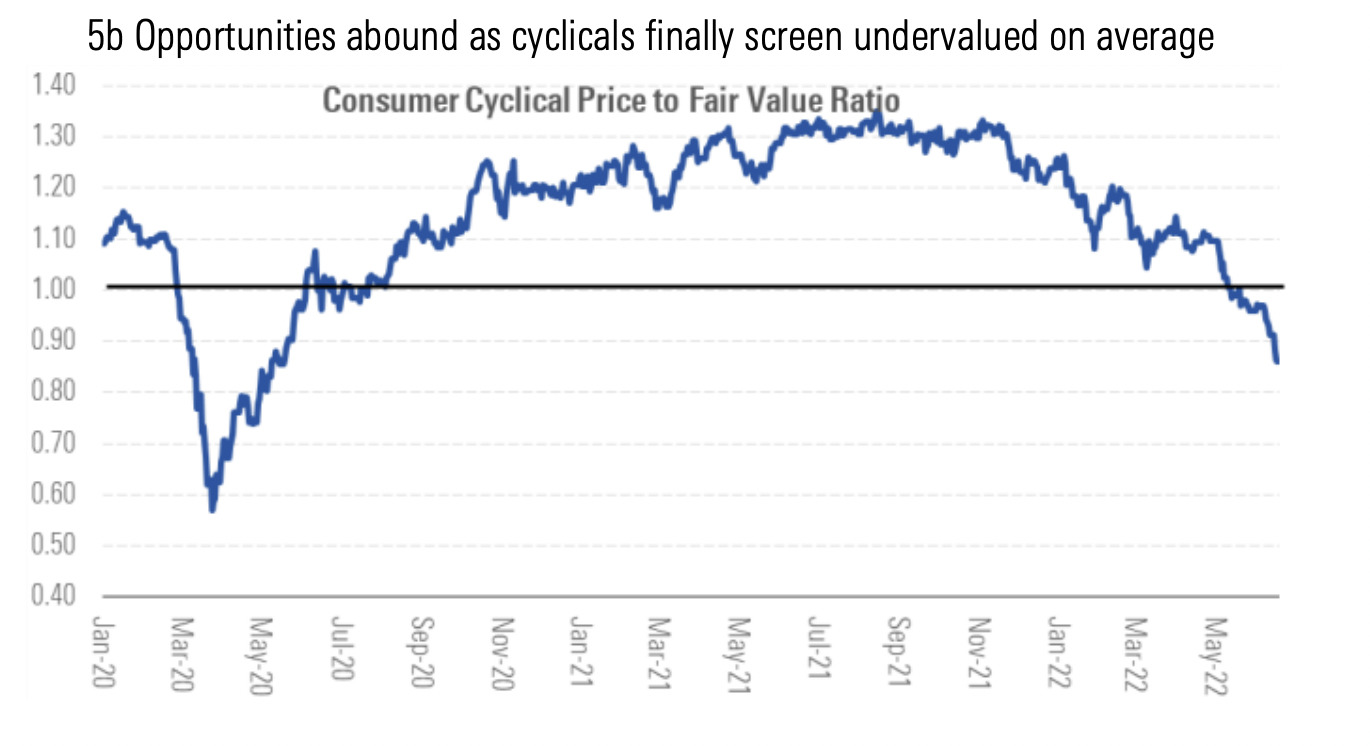

On the flipside from Morningstar, it now views the sector as undervalued with consumer discretionary companies trading at a discount to their fair value estimates on average:

Here’s three of Morningstar’s best:

Angus Hewitt says Kogan shares trade at a material discount to Morningstar’s fair value estimate.

“We ascribe the current share price weakness to a material moderation in sales growth and earnings declining from 2020 boom-time levels, as well the suspension of dividends.”

However, Hewitt adds Kogan should reinvest as further returns should add to shareholder value.

“We anticipate profit margins to expand as marketing expenses as a percentage of gross sales are scaled back and the top line growth reignites in fiscal 2023 after exceptionally strong COVID-19-induced sales growth is fully lapped.”

As an online pure-play, Morningstar believes Kogan is poised to benefit more than omnichannel retailers from the secular shift to ecommerce.

Despite its strong balance sheet, its position as Australia’s sixth-largest online retailer, and potential for significant profit margin expansion, shares in no-Morningstar-moat Myer trade at a significant discount to their fair value estimate.

“Over the next decade, we expect sales to remain virtually flat on fiscal 2022. However, we estimate underlying EPS to grow at a CAGR of 26% over the next five years, as margins improve.

“We see little reason for Myer’s shares to trade at a steep discount to our fair value estimate. Myer’s financial position is solid. Operationally, we expect the business to successfully transition online from its shrinking brick-and-mortar footprint,” Hewitt says.

Online sales increased almost 50% in the first half of fiscal 2022 and management plans to reduce its store space by up to 8% in the near term.

“We expect depressed pricing and volume from COVID-19 to be transitory and forecast earnings to recover in calendar 2022 — the first year with practically no funeral restrictions.

“With a wide economic moat underpinned by well-known, respected brands and cost advantages over the long tail of smaller competitors, we expect InvoCare to continue to dominate Australian death care.

“We expect a normalisation in the death rate, modest price increases, and incremental market share gains to drive our five-year revenue CAGR forecast of 7%,” Hewitt says.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.