UBS analysts flag 200pc earnings growth for ASX energy stocks as oil prices rise

Pic: Getty

We’re about two thirds of the way through February reporting season, and despite the prospects of a major global conflict and interest rate rises, UBS reckons things are going pretty well.

So far, a “skew towards strength” is showing through, with half-year profit beats outnumbering misses by a ratio of 4:3.

“This is an impressive showing given the Omicron hit the economy has taken over recent months,” UBS says.

However, markets may need to brace for impact on the earnings side over the next week, as more consumer-focused stocks get set to report (including Kogan and Afterpay-parent Block Inc on Thursday).

Energy boom

Markets are always forward-looking, and the December half-year is already in the past.

But the steady (if not strong) results flow has given analysts more confidence around the outlook.

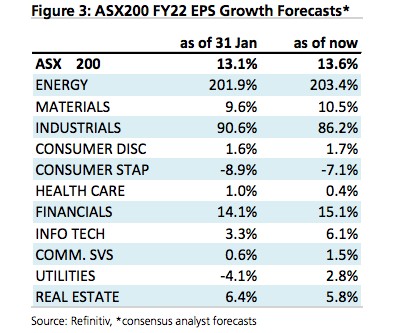

As a result, aggregate earnings per share (EPS) estimates for FY22 have been bumped up by 0.5% over the past three weeks, to 13.6%.

UBS provided a breakdown by sector in terms of EPS estimates, and through this table we can see one industry is clearly standing out:

From a torrid period in the wake of the pandemic when oil demand swan-dived, analysts now expect earnings per share in the ASX energy sector to more than triple.

That marks a notable contrast to the consumer discretionary sector which includes ecommerce stocks — post-COVID market darlings which are now lagging the market for projected earnings growth.

ASX financial stocks have also gotten a lift so far in reporting season, while the healthcare sector has seen “broad-based earnings downgrades”.

An ‘unusual’ reporting season

Taking out those extremes, February reporting season indicates that underlying ASX earnings are holding up relatively well.

And if the “hockey-stick” shaped uplift can hold in the coming weeks, it would prove to be “quite unusual versus the standard ‘mid-cycle’ experience, whereby earnings continue to grow, but at a decelerating pace”, UBS said.

Along with selloffs stemming from top-down macroeconomic risks, the bump in earnings has actually reduced the market’s aggregate Price/Earnings multiple to around 16.6x.

That now leaves it “a touch below its 5-year average”, UBS said.

The analysts concluded with an interesting tidbit on the inflation outlook, after 12+ months of supply chain bottlenecks that have contributed to broader pricing pressures in cases where companies are forced to pass on costs.

Many companies highlighted the issue in their half-year trading updates. However, they were also keen to highlight how their “strategic inventory build will allow them to get ahead of any future shortages”, UBS said.

And interesting, the bank’s global economics team now says there are “reasons to believe that inflation bottlenecks are now starting to ease”.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.