CLOSING BELL: $368bn AUKUS subs ‘worst deal in history’ says Paul ‘22% mortgage rates’ Keating

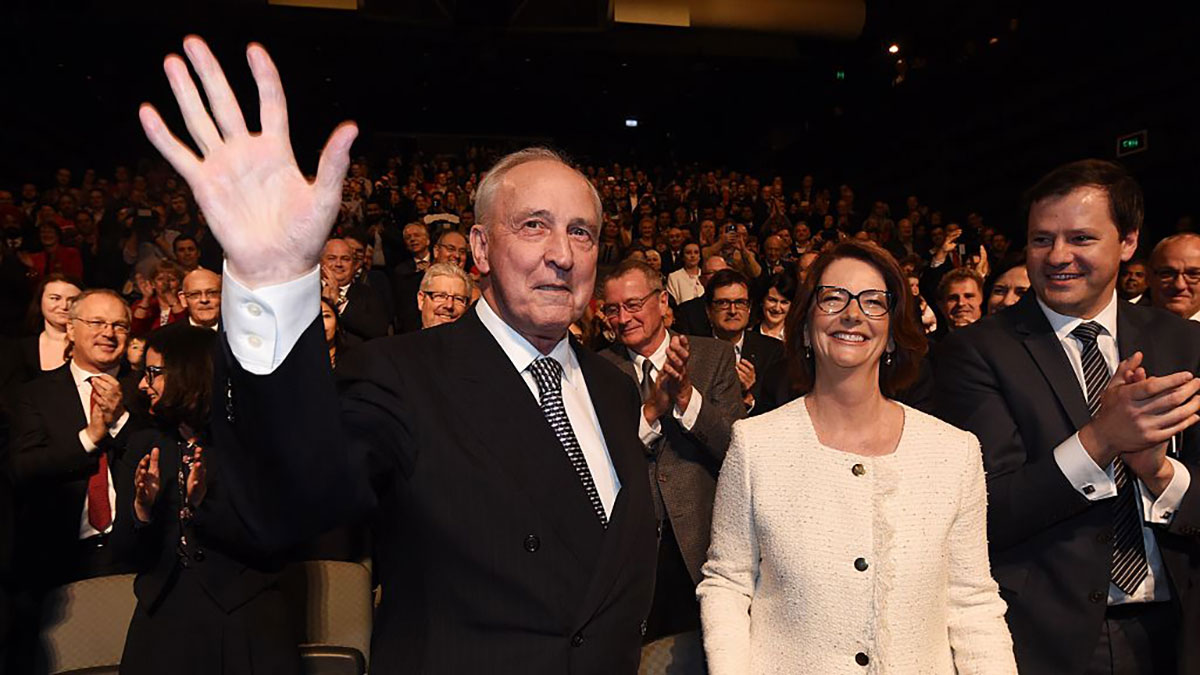

Former Prime Minister Paul Keating shows the devastating effects early 90s inflation had on his hands. Pic via Getty Images.

- The ASX bounced back from the week’s drama to close up by 0.86%

- The XEC Emerging Companies Index closed 1.26% higher because it’s young and needed the money

- Former PM Paul Keating kicks a glorious own goal at the Australian Press Club

Happy Hump Day to you all, and what a relief it’s been to see the market end the day on a positive note, after a string of very tense sessions which really did have the stench of death about them this week.

The benchmark had a strong start to the day, took a bit of a long lunch to celebrate, but came back strong again in the afternoon to wind up the session on +0.89%, with the benchmark outperformed by the XEC Emerging Companies Index on 1.26%.

InfoTech took the wheel today, cranking out a 2.42% lift and bringing Health Care (+1.56%) and Real Estate (+1.01%) along for the ride, while the heavily depressed Energy sector got some welcome news via China that saw it finish the day flat (trust me… that’s a win) while consumer Discretionary blotted its copybook to the tune of -0.19%.

Time for some headlines, then it’s nothing but random company names and a string of percentages designed dazzle your eyes, delight your senses and confound your enemies.

FROM THE HEADLINES

Administrators FTI Consulting say that there’s been “strong interest” from a number of interested parties looking to snap up recently-collapsed Sun Cable solar power play in the Northern Territory.

The company went into administration after its two largest investors, billionaire Twiggy Forrest and other billionaire Mike Cannon-Brookes, got into a spat over the direction of the company, and how whichever course of action came out on top would be funded.

FTI Consulting says it’s hopeful that, all things being equal, it could have binding proposals in place by the end of next month, and a possible buyout well underway by May.

Meanwhile, Woodside (ASX:WDS) is in the crosshairs of West Australia’s Environmental Protection Authority over concerns that the company isn’t moving fast enough on its plans to reduce emissions at its Pluto Liquid Natural Gas project.

According to the EPA, Woodside’s proposed emissions cuts slated for 2030 to 2050 aren’t nearly enough to bring the plant’s environmental footprint to within a reasonable level, while also voicing concerns that the pollution from the facility might be in danger of accelerating the weathering of World-Heritage-nominated rock art on the peninsula.

As the ABC explains, Pluto is one of WA’s five biggest carbon-emitting projects, emitting 1.9 million tonnes of carbon-dioxide equivalent emissions in 2020–21.

A Woodside spokesperson said that the company would be reducing emissions from the plant by up to 500,000 tonnes from its CO2 baseline of 4.1 million tonnes, when it brings a fancy new train online between now and 2026.

In more energy news, Bloomberg is reporting that China has officially lifted its ban on domestic companies importing Australian coal, helping to put some pep back in the step of a number of Aussie coal miners including Coronado (ASX:CRN) and TerraCom (ASX:TER), which are up 5.9% and 6.7% respectively.

The ban was lifted despite a fresh round of drama between Australia and Beijing, after Prime Minister Anthony Albanese unveiled a boat-shopping spree that will see taxpayers cough up a heart-stopping $368 billion (that we know of, because I guarantee that’s a conservative estimate that will blow out harder than a pensioner’s birthday candles) over 30 years for eight submarines.

$46 billion a pop for a tube full of dudes all breathing in each other’s gross farts for months at a time might sound a bit steep, but there are two very good indicators that while the price tag is hefty, we’re heading in the right direction.

The first inkling we got was that China went squealing to the UN about the deal within minutes of them pretending like they didn’t already know 100% of the specifics of the deal months ago.

China’s has a number of issues with the deal, including:

- It ‘risks escalating an arms race’ (at a time when China is frantically building the world’s largest navy ever);

- It ‘destabilises regional peace’ (at a time when China is laying claim to huge territories that clearly aren’t theirs); and

- Flies in the face of nuclear non-proliferation treaties (despite there being no nuclear weapons on board, and its own subs relying on nuclear power).

So far, the response from the wider international community to China’s protestations has been a resounding “lol”.

But the red-hot indicator that the deal could well be a cracker for Australia is former PM Paul Keating coming out in fierce opposition to AUKUS plan, labelling several of his former party colleagues “unwise ministers” for backing the plan.

Speaking at the Australian Press Club, Keating also slammed the deal as “the worst deal in all history”.

The generation of Australians Keating threw under the bus with mortgage rates of 22% would probably disagree.

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| G88 | Golden Mile Res Ltd | 0.003 | 200% | 432,500 | $81,836 |

| VTG | Vita Group Ltd | 0.14 | 75% | 8,396,788 | $14,069,747 |

| IEC | Intra Energy Corp | 0.006 | 50% | 5,023,333 | $2,823,126 |

| CCE | Carnegie Cln Energy | 0.002 | 33% | 270,121 | $23,463,861 |

| CLE | Cyclone Metals | 0.002 | 33% | 5,311,753 | $10,112,605 |

| GNM | Great Northern | 0.004 | 33% | 1,450,491 | $5,127,153 |

| REC | Rechargemetals | 0.145 | 32% | 2,353,137 | $4,377,450 |

| EEL | Enrg Elements Ltd | 0.026 | 30% | 6,850,352 | $18,584,685 |

| SIX | Sprintex Ltd | 0.039 | 30% | 53,794 | $7,630,630 |

| MMI | Metro Mining Ltd | 0.014 | 27% | 25,822,333 | $48,002,126 |

| EMU | EMU NL | 0.0025 | 25% | 6,113,382 | $2,900,043 |

| ICR | Intelicare Holdings | 0.02 | 25% | 943,194 | $3,342,647 |

| MCT | Metalicity Limited | 0.0025 | 25% | 50,000 | $7,009,079 |

| OLI | Oliver'S Real Food | 0.023 | 21% | 501,434 | $8,373,906 |

| VAR | Variscan Mines Ltd | 0.023 | 21% | 1,678,993 | $5,067,908 |

| DCL | Domacom Limited | 0.06 | 20% | 767,951 | $21,775,089 |

| PIL | Peppermint Inv Ltd | 0.006 | 20% | 3,723,378 | $10,189,284 |

| TKL | Traka Resources | 0.006 | 20% | 296,662 | $3,613,873 |

| BDX | Bcaldiagnostics | 0.061 | 20% | 100,000 | $6,940,830 |

| NEU | Neuren Pharmaceut. | 11.89 | 19% | 2,849,360 | $1,258,868,790 |

| AKN | Auking Mining Ltd | 0.07 | 19% | 313,587 | $10,526,462 |

| GWR | GWR Group Ltd | 0.1 | 18% | 368,780 | $27,303,416 |

| OPL | Opyl Limited | 0.034 | 17% | 100,015 | $2,201,419 |

| RBX | Resource B | 0.14 | 17% | 5,989 | $6,848,380 |

| WOA | Wide Open Agricultur | 0.175 | 17% | 388,253 | $19,317,266 |

In Small Caps Land, Vita Group (ASX:VTG) has blasted off to the tune of around 75%, after the company revealed that it has entered into a scheme implementation agreement with Practice Management, which would see the latter acquire 100% of VTG for a cash consideration of $0.06255 per share.

Under the terms of the deal, VTG will be permitted to pay a fully franked special dividend of up to $0.06425 per VTG share on or before the scheme implementation date, subject to the scheme being approved by shareholders and the Court.

If the dividend goes ahead, it would have up to approximately $0.02754 per VTG share in franking credits attached.

It’s a big win for VTG shareholders, who would be in line for a total value of up to $0.12680 per VTG share, before the benefit of any franking credits – and the news has sent VTG’s share price up past $0.14.

Recharge Metals (ASX:REC) is up 31.8% on news it has joined the growing list of Aussie explorers in Quebec’s rapidly expanding lithium rush, announcing that it is set to acquire 100% of the Express lithium project in the prolific James Bay region.

The Express lithium project is located in the heart of James Bay Region; 12km southeast of Allkem’s (ASX:AKE) James Bay deposit which currently boasts 37.2Mt @ 1.3% Li2O), and 15km northeast of Cygnus Metals’ (ASX:CY5) Pontax lithium project.

ENRG Elements (ASX:EEL) – formerly Kopore Metals – has had a chunky volume spike and climbed 25% today on news that its begun trading on the on the US-based OTCQB Market under the code OTCQB:EELFF.

Before you ask, no – I have no idea how to pronounce that.

Lastly, Metro Mining (ASX:MMI) has had a belated spike on the back of news it has entered into a facility agreement with Nebari Natural Resources Credit Fund I and Nebari Natural Resources Credit Fund II for a Financing facility of up to US$30 million.

MMI says the money is earmarked for funding of the expansion of the company’s 100%-owned and operating Bauxite Hills Mine in Western Cape York, Queensland.

ASX SMALL CAP LAGGARDS

Here are the least best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| KEY | KEY Petroleum | 0.001 | -33% | 5,073 | $2,951,892 |

| IRX | Inhalerx Limited | 0.031 | -31% | 7,058 | $8,539,513 |

| GTG | Genetic Technologies | 0.003 | -25% | 1,000,000 | $46,166,633 |

| MRD | Mount Ridley Mines | 0.003 | -25% | 2,032,975 | $31,139,531 |

| MTH | Mithril Resources | 0.0015 | -25% | 619,946 | $6,526,180 |

| LAW | Lawfinance Ltd | 0.01 | -23% | 19,429 | $830,280 |

| PVS | Pivotal Systems | 0.028 | -20% | 1,028,450 | $5,582,631 |

| SRJ | SRJ Technologies | 0.08 | -20% | 100,000 | $9,463,517 |

| TD1 | Tali Digital Limited | 0.002 | -20% | 130,000 | $6,937,889 |

| VAL | Valor Resources Ltd | 0.004 | -20% | 1,091,000 | $18,865,174 |

| POL | Polymetals Resources | 0.21 | -19% | 43,947 | $11,747,500 |

| MXO | Motio Ltd | 0.034 | -19% | 212,332 | $10,980,256 |

| TIA | Tian An Aust Limited | 0.27 | -18% | 26,363 | $28,580,914 |

| LCY | Legacy Iron Ore | 0.015 | -17% | 262,052 | $115,322,872 |

| BEX | Bikeexchange Ltd | 0.01 | -17% | 608,754 | $11,182,118 |

| PNX | PNX Metals Limited | 0.0025 | -17% | 1,611,605 | $16,141,874 |

| RLG | Roolife Group Ltd | 0.01 | -17% | 1,799,594 | $8,586,698 |

| XTC | Xantippe Res Ltd | 0.005 | -17% | 7,325,320 | $63,480,598 |

| X2M | X2M Connect Limited | 0.078 | -16% | 329,888 | $13,101,261 |

| MCM | Mc Mining Ltd | 0.16 | -16% | 18,400 | $75,559,502 |

| MBX | Myfoodieboxlimited | 0.017 | -15% | 19,230 | $738,364 |

| LAM | Laramide Res Ltd | 0.485 | -15% | 6,268 | $724,557 |

| HRZ | Horizon | 0.042 | -14% | 1,437,066 | $30,519,465 |

| ADD | Adavale Resource Ltd | 0.015 | -14% | 1,076,365 | $9,091,707 |

| CPT | Cipherpoint Limited | 0.006 | -14% | 624,705 | $8,005,717 |

LAST ORDERS

ACDC Metals (ASX:ADC) has announced that it has finalised the discovery drilling component of the aircore drilling program at its Goschen Central Heavy Mineral Sand and Rare Earth Element project in Victoria, with the company sinking 56 holes for 3,162m (in total, not each, obviously) with an eye on delivering a JORC compliant resource in the second half of this year.

“Our first post-IPO drilling program is progressing well at our tenements in western Victoria, as we work towards our maiden JORC resource,” legendary ACDC Metals frontman and CEO Tom Davidson said. “The aircore drilling method is fast, low impact and economical, and we are making excellent progress.”

“Furthermore, the mineral process test work underway at Mineral Technologies is validating that HMS mineralisation at Goschen Central is similar to that of peer companies. We are encouraged that a similar, well tested process plant design will be suitable.”

And in tech news, leading Australian B2B payments provider Monoova Global Payments has inked a deal with Identitii (ASX:ID8), for the latter to provide its cloud-hosted reporting platform to help further automate and improve auditability of their reporting obligations to AUSTRAC.

“Identitii is pleased to announce a new contract with Monoova, one of the fastest growing digital payments companies in Australia, who will adopt our cloud-based SaaS platform,” Identii boss John Rayment carefully practiced into the mirror.

“Identitii’s SaaS platform was built to accelerate revenue growth, by enabling us to better target and rapidly onboard multiple, faster-moving payments companies who are themselves experiencing strong growth and need to ensure they can meet regulatory obligations as they continue to scale.”

TRADING HALTS

Close the Loop (ASX:CLG) – Capital raising.

Australian Potash (ASX:APC) – Capital raising.

Enegex (ASX:ENX) – Equity placement.

Corella Resources (ASX:CR9) – Assay results from Whitecap and Whitehills prospects and capital raising.

Prospech (ASX:PRS) – Capital raising.

Neurotech International (ASX:NTI) – Final 54 week safety and efficacy data from its phase-1/2 clinical trial in autism spectrum disorder.

Magnis Energy Technologies (ASX:MNS) – Capital raising.

Payright (ASX:PYR) – Capital raising.

New Century Resources (ASX:NCZ) – announcement relating to the effect of recent weather events on its operations.

Volt Resources (ASX:VRC) – Offtake agreement announcement.

White Rock Minerals (ASX:WRM) – Material update of operations at the Woods Point gold project.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.