Trading with Focus – Making money and trouble in skinny markets

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

It’s Christmas time, and you know what that means… time for some skinny bump trades and cop-dodging!

In case you missed my past posts, mostly, my musings are those of a crazy person and should not be taken seriously. But that’s what makes the stock market so much fun, right? Yes. It’s the banter.

And winning, losing, thinking you’re smarter than the market and bragging about it, then finding out you aren’t and being suspiciously quiet about it. And using the snakes and ladders of the stock market to beat the risk-free rate of interest, which is such a low bar at the moment as to make the stock market the winning-est game in town!

Christmas is usually when a lot of market participants take a bit of time out. Brokers are the first out the door, especially this year – you try and reach a broker in Sydney right now. Retail punters cash a bit out of the market to buy worthless items of junk for their significants, even though we all know that nothing could possibly say ‘Merry Xmas and a Happy New Year’ more than some scrip in that junior explorer that is definitely going to hit gold with the next drillhole.

Sellers worry that maybe this year the Santa rally isn’t going to happen so they sell early, or it does and they sell into it at the last moment before jumping into the Griswold mobile. But mostly, very few active trading participants are likely to want to hold over the holidays after this dumpster fire of a year.

Each year we see stock market volumes dry up like the peak hour traffic into the CBD. This brings both opportunity and risk, but more so, as you could accidentally find yourself with a ‘please explain’ from the regulator, via your trading participant.

What’s the opportunity?

Little bounce trades in quality companies that have been sold off on light volume are amongst my all-time personal favorites. They feel somewhat more rewarding, as it’s often a quick 10% in and out without even having to care about the next piece of news, or whether the market will collapse. And it makes having to work over Xmas all that more rewarding. Like finding cash in an old shoe.

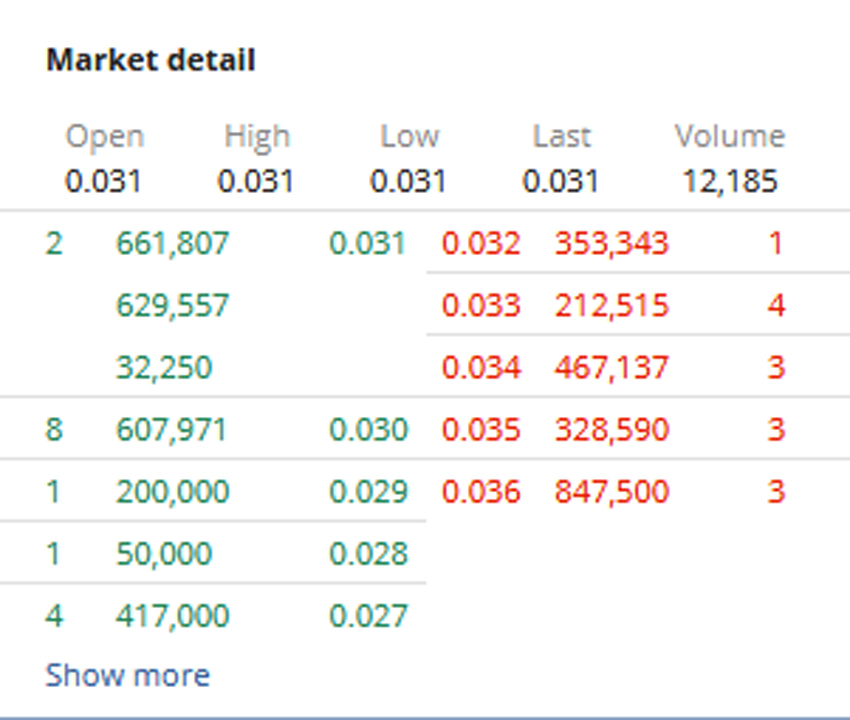

Have a look at this little beauty:

Doesn’t matter who it is, and yeah, I’m already set, and I already know it’s a company that I want to own. I just reckon there might be a chance to scalp a quick Xmas trade.

You probably don’t see it do you? You’re looking for a continuous rally, or a BNPL, or some gold explorer that’s already run hard.

Me? I love these thinly traded, unloved, unknown, fundamentally sound companies that rally hard on good news, then get sold off again in thin volumes.

Eventually they get a re-rate, or a takeover, but in the meantime it’s regular trading profits for the personal account, and a few stored away in the SMSF.

Their last bit of news for the year is out, and it was great news. Lots of ‘good stuff’ happened this year and next year sounds like a cracker, and what is crazy about this little fella is that they actually make money! Yeah – profit! Remember when that was a thing?

So I reckon my downside is limited, because I might be wrong for a little while but there’ll have to be some real black-swan sh*t for this company to go down the tube. They spiked to 3.7c on their last update because, as I said, it was a great update, but then the stock started to fade.

Now, with our brokerage rate at $5 I can straddle that gap and use the profits to pay for some new mags on the Passat come the post-Xmas sales in early 2021.

I think it faded because it is now, in all likelihood, the most amount of time before the next great update. Then Xmas came in, volumes dropped and the stock is back to its pre-profit upgrade levels.

“Great companies at cheap prices,” said every Buffett follower ever.

So I can wait for the pre-Xmas sellers to finish, as it looks like they did yesterday (maybe) scoop up a few and wait for the others to arrive, who are probably also thinking like I do, to maybe start pushing it up. Reflation, naturally tending upwards after all the sellers have sold. Or that’s what I’m hoping anyway!

What’s the risk?

Honestly, if I hadn’t been hunting thin volume bounce trades every Xmas since 2003 I’d be giving this sort of strategy 50/50, but it’s certainly worked for me more times than not. My confidence relies mostly on a couple of psychological and social factors and I’m not usually the sort to look purely at fundamentals, but they are a downside insurance policy, and just randomly throwing money at things is more for you Robinhood lot.

So, apart from the usual risk of losing money, you should also be very careful not to draw the ire of the regulator, who, with the ASX themselves, hate nothing more than people manipulating the market for personal gain. Even though, maybe, that’s sort of what the market is…

for…?

Or maybe it’s just for institutions to profit from hahaha…ha… C’mon I’m just kidding, officer!

A couple of things to know when aiming to avoid a massive fine and possible jail time in a thinly traded stock. (Again, this isn’t legal advice, or opinion, or anything that could be construed as any sort of advice; really, it’s just random words and letters jumbled together using monkeys and typewriters.)

- Don’t go storming in and push the share price up immediately. You need to give the market time for ‘price discovery’, so sit your bid in for a while, then move it up gently.

- Don’t stack the bid with multiple orders, and don’t then yank them off if you start getting filled.

- Don’t put a big fake sell in to try and hint that there is a large amount of selling volume, and try to push the price down.

- Don’t ring your mates up and tell them that you are looking to push up a stock price, and ask them to stack some bids as soon as you get filled.

What do you need?

Obviously, and I can’t even believe it’s something I need to point out, but obviously, you need live prices. Don’t even get me started.

You will also need a good chart. Look for the gaps, look for the volume, look for the supports and trends.

You also need news and company info, because you still need to know what the company are doing. Read all the reports, find out who the players are, look at the Annual Report, the major shareholders, look at the profit growth or revenue growth or just some indication that things are getting better overall.

You will need full market depth, with the full order book – or in other words, you’ll need to see all of the individual buyers and sellers lined up at all of the price levels.

Like this picture, where I’ve expanded the top line of buyers so you can see there’s a big line and a little baby one.

You’ll need cheap brokerage, and our starting price of $5 is the current winner in the ‘Australia’s cheapest brokerage on HIN’ stakes.

Then you don’t need the big payoff to make an earn. Each tick on a 3c stock adds roughly $160 to a $5,000 trade, so a few ticks and you’re making some nice little earns (equally, losing that amount on each down tick, but not adding insult to injury with high brokerage rates if you have to stop loss out).

And, surely, you have to be mobile. Sitting around the paddle pool, waiting in an Uber, or even just watching the cricket. You want to be able to see the buyers and sellers jostle throughout the day and get your price, news and volume alerts through an app – as this isn’t a set and forget strategy.

So, I can rent you all this for $45 a month, by the month.

And you know what? Maybe this year I won’t make a few grand between now and Jan 4 when people start dribbling back into the market, because this really is a degenerate strategy for the trade-aholic. But I had a cracking year of surprise gains in a bullmarket that could have been a new GFC, and giving back a bit to the punters that made me so much money feels like a charitable donation instead of a loss!

Good luck in the new year, hope you’ve learnt some stuff, hope you’ve had fun with it and look forward to battling you in the trenches again soon.

This article was developed in collaboration with Marketech Stockbroking Pty Ltd (AFSL 486148), a Stockhead advertiser at the time of publishing. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.