Trading with Focus – is BNPL finally a buy again?

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

As a disruptive financial services product ‘buy-now-pay-later’ is definitely a great marketing strategy.

Instead of paying cash (or waiting a bit) you can now just make four easy payments. Or the like.

But by BNPL-ing it, you are becoming part of a ‘movement’ sticking it to ‘the man’ somehow, disrupting banks and evil corporations.

And being convinced that you’re making a difference. By consuming more, now.

Hmmm, pretty sure I’ve heard of those sort of ‘movements’ before….

Anyway, as investments they’ve been doing very poorly indeed over the past few months. In all fairness, a lot of companies have been, as the ‘meme-stock’ boom ended earlier this year, and crypto took a pounding. Oh, and some actual economic things happened too that might have affected the overheated market.

Crypto and BNPL are the two highest profile new ‘disruptive’ forms of payment. Each with great marketing. Mostly based on their popularity and adding little current actual underlying value to the financial system, and certainly creating added risk. (Note that I said ‘current’, I don’t want to be picketed by the crypto cult again… maybe it’ll be good for something in the future other than speculating and moving money across the Russian border?)

So it’s no surprise that Mr Frydenberg has bundled them into his new payments reform ‘Announcement to Review in the future or at least consider forming a Working committee for community Engagement to table a Discussion around such Things’ proposal.

What I always find interesting in a market is that it should be viewed as very bad news indeed for all that dangerous new-debt/made-up-money crap, but there was a BNPL bounce.

Let’s walk it through, see if there’s anything to learn from it, maybe save you a few bucks in the future.

I’ll just use Zippy-Zip as my whipping boy for the examples – because the luckiest company in the world right now, aka Afterpay, is under a takeover cloud from another company that also only cares about disruption and revenue and not really about profits, so they aren’t really dancing to a normal drum at the moment.

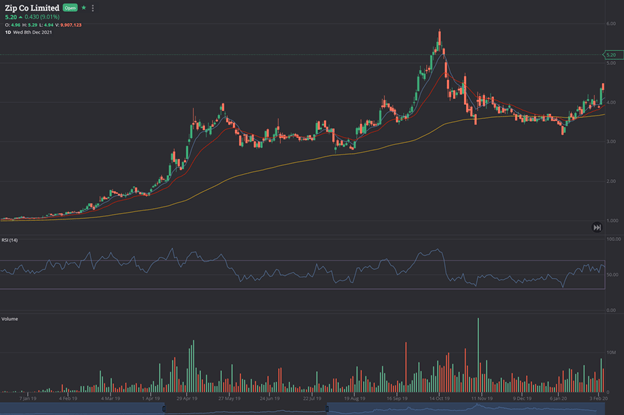

2019 to 2020 – the pre-COVID growth of BNPL

Initially no-one really supported BNPL from the big end of town, it just sounded like a big pile of BS. But it started to gain traction as Afterpay was making headlines as their stock price was going up a lot. (And anyone with large amounts of money to spend on advertising will always make big headlines!)

Remember, this was back before the government made everyone stay home, and turned off the sport. This is like that speculative ‘climbing a wall of worry’ stage, where no one really believes it, but it’s been going up, so it keeps going up…

The COVID crash-bounce

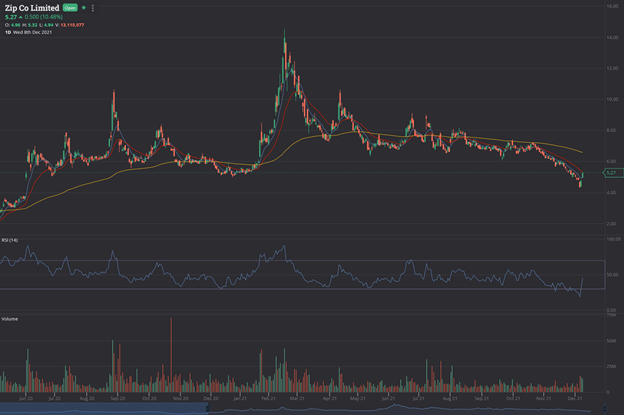

This following chart is the COVID sell-off, from $5 to $1, then bounce back to $5, with a breakout to new all-time highs. I can’t even remember what triggered the breakout, doesn’t really matter now… was probably a good meme.

But what does matter is that massive gaping hole – the dreaded gap that formed when it leapt from $4 to $5.

It wasn’t long after this that the directors of the BNPL companies funded a new online share trading company to help all the first time share investors that were desperate to get their slice of the new-found riches in the stockmarket, and their fill of meme stocks. And then the BNPL lot thought they’d better do the market a favour by selling them some of their founder shares. Probably unrelated…

The growth of the meme-stock trade, the peak, and the reality check.

So this next chart shows the time from that breakout of BNPL, to the peak in meme-stock mania (mid Feb 21) and then the collapse of all the meme-stocks (except DLC, who came late…), and then onto the last few months where reality set in.

And nothing was ‘meme-ier’ than BNPL.

APT was the darling, and Zippy and all the others were the ‘also-rans’ with their own online cheer-squad.

But there’s only so much space on a shop’s front-counter for all the BNPL installations, so APT and Zippy were the first two, but because of the alphabet, ‘Z’ comes after ‘A’ so it did worse. (Maybe the best way to have become a leading BNPL would have been to call yourself ‘AAA Aardvark sort-of Laybuy’?)

So, as with any great analysis, let’s try and justify the reasons why it got dumped.

Here’s my list – personal opinion only, no advice etc etc:

- Too many retail investors who are only here for a quick/good time, and bail at the last minute.

- Too many instos that didn’t believe in the long-term story but were taking advantage of retail.

- This is Australia, and in Australia a large majority of investors are probably SMSFs. And a typical SMSF will often invest in profitable companies with dividends. And no-one has proven yet that BNPL can be a profitable business.

- Regulation. There isn’t any. So when they started offering ‘BBNPL’ (buy beer now, pay later) it was always going to get looked at. And it won’t be pretty, because the government were all adults during the GFC, and the GFC was caused by poorly regulated debt.

- Afterpay had a takeover bid lobbed at it. So that meant that it may be less likely that Zippy would get one.

- Other shiny things came along, like lithium and uranium, so all these new retail shareholders probably wanted to sell out of the ones that were down, and into the ones that were up. That’s how you buy high sell low, and they love doing that.

- Directors’ selling is never a positive. They sell when they perceive it’s overvalued. You didn’t see Elon selling Tesla until recently, so that’s probably a sign for Tesla. They always blame tax and personal circumstances, when in reality no-one sells to pay a tax bill if they think the stock still has legs – and interest rates on overdue tax bills at the tax department aren’t that bad…

- The gap. Always. Mind. The. Gap…

And reasons why it bounced?

- Because the gap closed.

Now back on the 1/7/2020, I wrote an article for Stockhead bagging out BNPL. It was fun at the time, tearing down those tall poppies to remind myself that I’m a true blue Australian…

I pointed out that directors selling, and no profits, and too much hype – and that there was a gap below $5 meant that there was reason to be cautious – I even offered to take a side bet that it would close the gap!

Seemed foolhardy as time went by…

(Since that last chart we’ve made a large number of improvements to the platform, including dark mode, which I initially scoffed at, and now use religiously, which is why the chart looks different.)

And maybe it was the economy, or concern about Lurrr from the Planet Omicron, or maybe it was some other thing. It doesn’t matter.

All that matters is that the gap closed.

So if I was a trader, because of my fear of the gap, (and other useless things in a bullmarket, like fundamental analysis) I left a lot of money on the table, which is fine, because everything was going up. So as a trader, maybe now that the gap has closed, maybe the technical traders and short-sellers would be buying too.

If I was an investor I would not have bought this in the first place, as none of them are investment grade, and still wouldn’t.

But I am more of a ‘I told you so’ kind of guy, and certainly cannot say that I have done any better in any other stocks since the Feb peak…

BUT I’m obviously on a streak (with that one right call), so let me tell you one more thing – you can’t see gaps on a line chart. That’s why we have lines AND candlesticks AND a whole bunch of other chart tools.

And I don’t know why, and I don’t know if it will happen every time, or ever again, but in all of the time I have been following the market it just seems like there is one thing that happens more than any other… GAPS GET CLOSED!

At Marketech our platform is about technology, providing you the tools and technology to trade. We encourage our high-function trading platform to get you live pricing, live charts, live market depth to ensure you have the tools and trading capability at your fingertips, and on your mobile phone or PC.

You trade your own stock on your individual HIN. It is your cash in your own Macquarie account where you keep the competitive interest you earn.

Our subscribers get access to brokerage starting at $5, and then 0.02 per cent for trades over $25k. If you want to trade the market, you need immediate access wherever you are and the seamless Marketech mobile app means you are live anywhere anytime.

Marketech Focus subscribers also get 2-months free access to the ‘Marcus Today’ newsletter to help you with your investing and trading goals.

For more information, visit www.marketech.com.au. Any queries regarding Marketech should be directed to Marketech and not to Stockhead.

This article was developed in collaboration with Marketech Online Trading Pty Ltd (ACN 654 674 432), an Authorised Representative (1293528) of Sanlam Private Wealth Pty Ltd (AFSL 337927), and a Stockhead advertiser at the time of publishing.

All information and material contained herein is general in nature and does not consider your financial situation, investment needs or objectives.

The information does not constitute personal financial advice, nor a recommendation or opinion that a security or service is appropriate for you.

You should seek independent and professional tax and financial advice before making any decision based on this information.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.