Trading with Focus – How do you read this market?

Pic: Rommel Gonzalez / EyeEm / EyeEm via Getty Images

I think the best way to tell the story is by starting at the end, briefly, then going back to the beginning, and then periodically returning to the end, maybe giving different characters’ perspectives throughout.

Just to give it a bit of dynamism, otherwise it’s just sort of a linear story.

Before you cinephiles jump up and down, yes, that was a quote from the ‘The Other Guys’. And although it was said ironically by Steve Coogan/David Ershon to buy time at Lendl Global before it collapsed in a ponzi scheme, it makes a valid point if applied to a share market and the commentary surrounding it.

If you were only to look at a small part of the overall picture, you might be missing gains or leaving yourself exposed to losses. And the picture now is quite complex.

Part 1 – Starting at the End

The world is currently ‘investing mad’. Seemingly normal people are fighting about whether the recent selloff in crypto was a pullback or the beginning of the end for crypto dum-dums…on LinkedIn, a networking/self-promotion website. I don’t do my best work on LinkedIn, and you’d better believe my Silicon Valley quotes miss the mark by a wide margin, but I don’t want to argue about whether Dogecoin is legit on there, just like I never wanted to know that you did Crossfit.

It’s still a pandemic. Maybe it’s chilled out a little around here at the moment, but it’s still not normal.

There was a GFC and we still haven’t dealt with that. The proverbial can was just kicked down the road, hoping that time would fix all, but as we can see, the road is pretty rocky and all that debt that people were worried about has more than doubled since. Almost trebled!

Part 2 – Back to the beginning

I saw a typical post on reddit asking people how much they were ‘up’ overall, and that showed how short term all these little players are. Up from when? What was the beginning, last April? Is that what you think? Here, have a lolly.

I guess I’m a little jaded by years of trading, but this current fad will pass when it stops being easy to make money. Maybe that’s happened already. Soft baby faces can only get slapped so many times with things like APT down over 35%, Kogan/Digital Wines/Andromeda down more than half, etc etc…before the tears start and toys get thrown out of cribs. (Well ‘they’ can only handle so much, my face looks like one big callous from market slappings.)

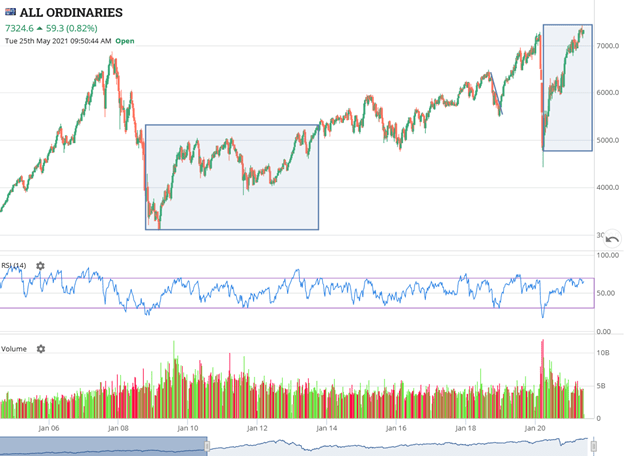

Check out the post GFC/mining boom volumes (below the boxed sections on the chart) in the All Ords and compare to now. Already looks to be slipping.

But also – the good news – if you weren’t a gamblin’ manchild from 2014 onwards the investment grade companies did very well, even though most speculative stocks went down the gurgler, or at the least, were circling the drain. Fast forward a few years and a lot of the stocks you were down 90% on (from the last time the speculative mania ended) don’t even do what they did at that time! (I wonder if some of the marginal BNPLs will end up backdooring in a gold explorer. Now that would be funny.)

Part 3 – A periodic return to the end

So what about right now – where to?

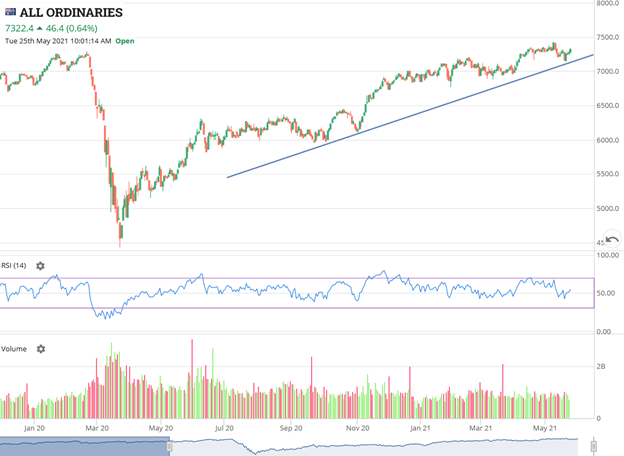

Well, it’s a bit hard to get too negative on the general direction of the market when the All Ordinaries keeps bouncing off a very obvious upward trend line. But that’s just the general market trend, not the speccy rubbish that you own.

And bull markets don’t typically last for only one year. But it doesn’t mean we can’t have a big pullback, and maybe that’s what the made-up coin and speccy markets are foretelling. Who knows?

All I know is that the All Ords was off a couple of per cent and specs were getting crushed.

Part 4 – Different characters’ perspectives

You might have noticed a bit of a change in tone in the commentary of the major media houses. I don’t blame them, they have to sell papers. But for a while there it was all ‘Millennial’ focused and ‘new investing paradigm that Boomers don’t understand’, and now it’s starting to loop around to ‘maybe there should be some protections for these poor defenseless kids who want to pump their super funds into Dogecoin’.

Won’t someone think of the children…

There are also a lot less people addicted to the share forums, more sad-emoji ‘loss-porn’ and less ‘diamond hands’ and more people getting angry on Hot Copper. The cold hard reality is that it isn’t always easy, and it looks to be starting to bite.

IPOs aren’t all going well. Capital raisings are not universally positively received.

‘Growth’ companies, especially those that don’t currently report any profits, are going to one day be held to account about whether they ever intend to. That includes you, Tesla!

Valuations always revert to profitability, and anything less is speculation. So if a stock is currently losing money, its potential downside is up to 100% if they can’t keep getting money from somewhere. Let that sink in.

So what’s my perspective as a somewhat ‘different character’?

Well, generally I think people are going to have to make a tough decision soon. Are you serious about being a sharemarket enthusiast for the longer term, or are you doing it because you thought it would be easy money and you won’t put the effort in to learn from your mistakes and get back on the horse?

Or at least a better horse, maybe even a little slower this time, so you don’t get bucked off?

One you can ride safely? With a better saddle?

I’ve seen a few cycles, and my bet is this. 70% of the new share market participants over the last 12 months will leave – over the next 12 months to two years. Most of them will leave with their tails firmly between their legs. Most of them will have turned up, and given half their money to wealthier individuals (who did take the time to learn how the market worked and used the right tools on a daily basis, reading about latest trends in the serious financial press, not following herds but stalking them).

So if you are planning to stick around this market for a bit longer then please consider this. There are websites that you can buy shares on that have been recently designed for the sharemarket tourist, and there are websites that were designed 20 years ago for the big banks.

We designed our brand new, six years in the making, trading platform to be the way it is, because that’s the way it should be, and we used technology to get the price down, not by slicing off important features. You’ll need the right tools in a tougher market.

Part 5 – A bit of dynamism (otherwise it’s just sort of a linear story)

When we were finalising the design for the platform we stuck with a ‘chart heavy’ layout, because nothing tells a story like a chart and even if you don’t use charts to trade, you have to know where the stock has been, and where it is now.

And you have to go back to the start from time to time to check whether it’s still doing what it promised when you first entered.

The ‘different characters’ include expandable depth – so you can see whether there are more buyers than sellers, but also so you can see if those buyers and sellers stick around to get hit, or if they are trying to headfake you. And live alerts on a mobile app with all the same features, so you can keep abreast of developments without having to be addicted to your screen. And now we even have automated stop-loss orders, to do things for you in your absence.

And in order to give it a bit of ‘dynamism’, we made it live-stream. You know, like the difference between refreshing a webpage for updates and watching a movie.

So if you’re not already a client of ours, how do you read this market?

At Marketech our platform is about technology, providing you the tools and technology to trade. We encourage our high-function trading platform to get you live pricing, live charts, live market depth to ensure you have the tools and trading capability at your fingertips, and on your mobile phone or PC.

You trade your own stock on your individual HIN. It is your cash in your own Macquarie account where you keep the competitive interest you earn.

Our subscribers get access to brokerage starting at $5, and then 0.02 per cent for trades over $25k. If you want to trade the market you need immediate access wherever you are and the seamless Marketech mobile app means you are live anywhere anytime.

For more information, visit www.marketech.com.au. Any queries regarding Marketech should be directed to Marketech and not to Stockhead.

This article was developed in collaboration with Marketech Stockbroking Pty Ltd (AFSL 486148), a Stockhead advertiser at the time of publishing. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.