Traders’ Diary: Son of a Fitch

Via Getty

The Economic Week That Was

The promising stock market rebound was skewered by the deeply significant and mean-spirited downgrading of US Government debt by Fitch Ratings, just as an event that will trigger the next boom – a cash mountain – moved into sight.

The S&P 500 declined by 1.4% after Fitch’s surprise decision to downgrade the US credit rating from the highest notch at AAA to the second highest at AA+. As Inspector Gadget would observe after shots of tequila between scenes, wowsers.

The agency notes that the financial deterioration in the next three years and the repeated negotiations on raising the debt ceiling, which threatens the ability of the United States to pay its obligations, are the main reasons for scuppering the rating.

“This decision to downgrade comes amid the general optimism prevailing in the stock markets about the ability of the US economy to avoid falling into recession in conjunction with expectations about the end of the cycle of raising interest rates after the last hike in last July, in addition to the strong quarterly results of companies for the second quarter, which widely exceed analyst expectations,” according to Samer Hasn, market analyst and part of the Research Team at XS.com.

But, although corporate earnings season is winding down Stateside, things are just starting here and with, thus far, circa 81% of S&P 500 companies already spilled the beans the results have been better than feared — buoying market sentiment and putting a little more pressure on our lot.

Meanwhile, a big week for central bank watchers.

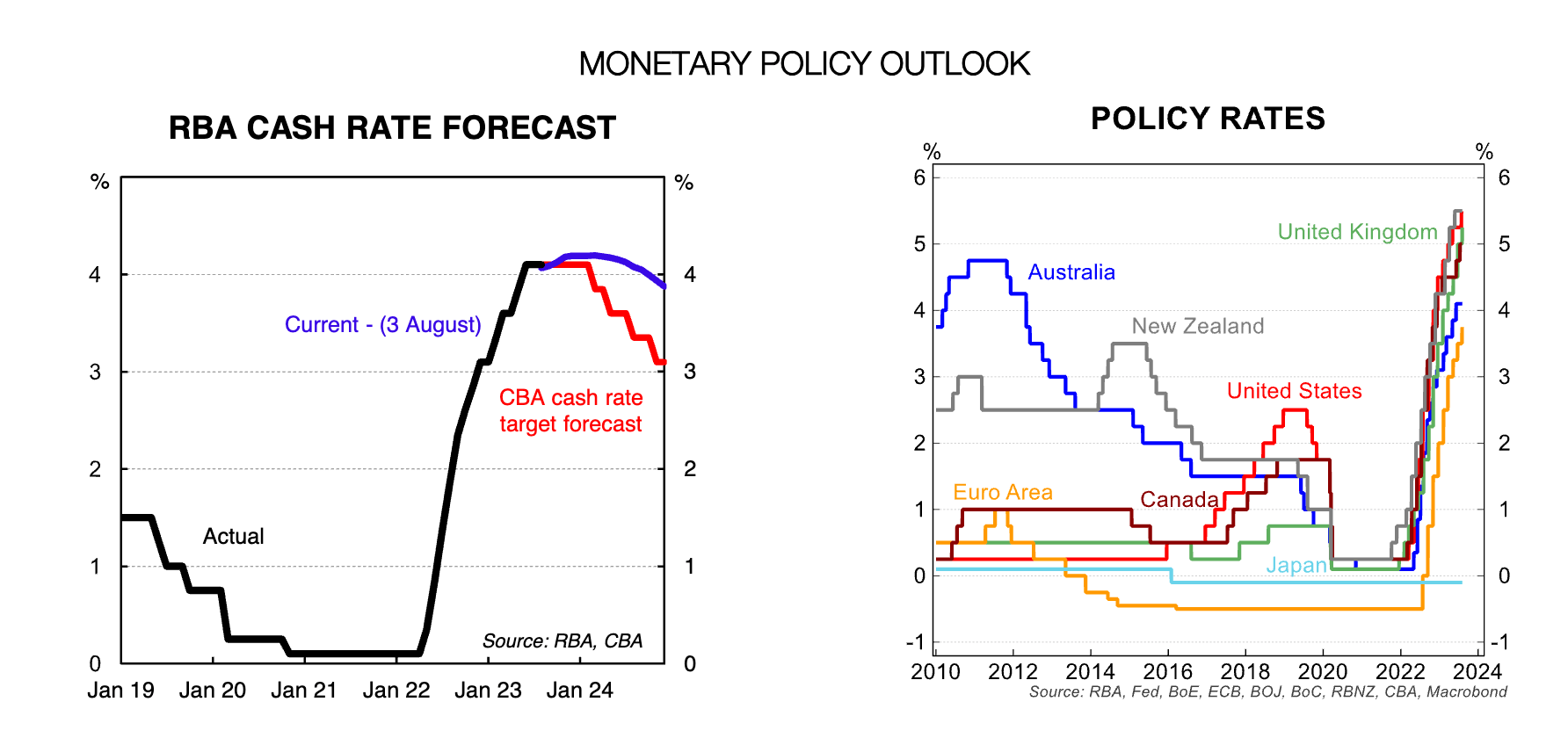

The RBA kept the cash rate target unchanged at 4.1% at their August board meeting, the second consecutive on‑hold decision.

The forward guidance was the same as for May:

“Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe”.

However, while the RBA retains a tightening bias CBA says they don’t expect any further hikes from here.

“We think the RBA is comfortable with the balance of risks to the inflation outlook, and is more alert to the potential downside risks to the outlook for economic activity.

“To that end, the RBA’s latest forecasts have downgraded the year‑end outlook for both growth and headline inflation. While CBA still see growth outcomes to be weaker and inflation to recede more quickly, the RBA’s forecasts are now more in line with our forecasts.

“We think that the onus will be on the economic data to surprise to the upside for the RBA to hike again.:

See the furious note on the August meeting from CBA here.

And from their senior economist Belinda Allen, go here for her mega write‑up of the RBA’s latest forecasts from their Statement on Monetary Policy. It’s pretty mega, TBH.

Meantime, the Bank of Poms (BoE) lifted by 25 basis points on Thursday and literally screamed that borrowing costs were going to stay high forever. Then, in Brussels, a non-Christine Le Garde European Central Bank (ECB) official flailed around making the case for holding ECB rates at Le Gardian highs for longer.

The Commods that were

Oil prices notched their sixth straight weekly gain, btfw, the longest winning streak in more than a year.

The gains have been aided largely by Saudi Arabia’s generous decision to continue curtailing its production into the US autumn.

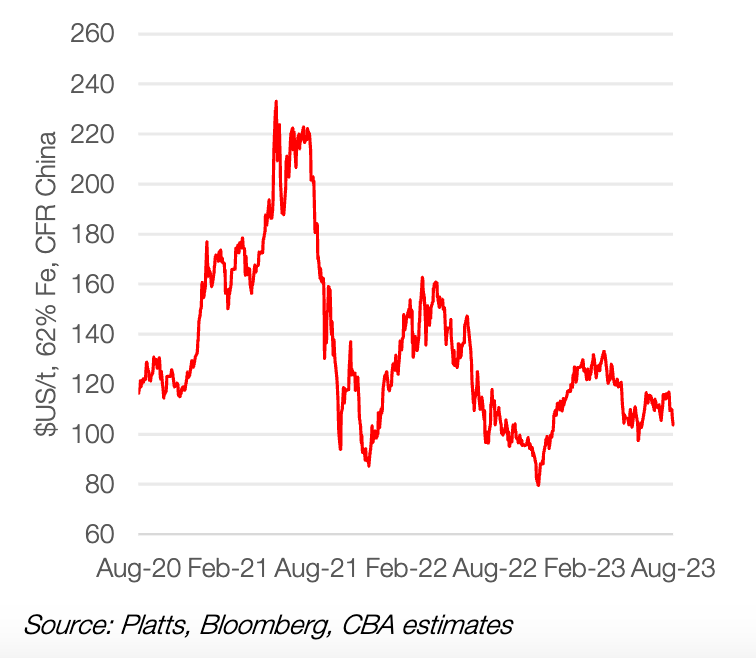

Iron ore spot prices fell below $US105/t (62% Fe, CFR China) on Friday as demand concerns in China continue to persist.

Spot prices have now lost ~11% since 25 July.

According to Vivek Dhar at CBA, the rapid decline in iron ore prices since late July suggests that markets are concerned that policymakers may not follow through with any meaningful support for China’s commodity-intensive economy following the semi-annual economic conference attended by China’s top leaders (‘Politburo’).

The conference, which took place in late July, saw China’s top leaders pledge to “strengthen counter-cyclical policies”, where an “adjustment” would be made to the restrictions on the property sector.

“Policymakers even reportedly talked of bringing forward infrastructure spending to help support the economy. These announcements though lacked details such as targets and timelines. And with more than a week since these high level announcements were made, markets are justifiably concerned that any policy support measures may disappoint expectations,” Vivek noted.

Iron ore spot prices – 62% Fe CER

The Economic Week Ahead

There isn’t too much too much to get excited about in market moving local economic data this week. But let’s try!

We’ve got the usual missable surveys and measures about how consumers and business feel about things ahead and behind (for August and July respectively).

The Westpac/Melbourne Institute consumer sentiment survey has been crap for ages. I should say, the survey itself appears fine, just the sentiment of late has been quite negative.

“With clearer signs of the inflationary pulse easing recently, another on‑hold rate decision by the RBA in August, and home prices rising further, consumers could begin to feel less pessimistic.”

That was what the CBA said, to no rational, actionable or empirical avail. Just shooting the sh*t on vague prognostications really.

Still on big bank talk, ha. ANZ and that Queensland bank aren’t getting to unify – ACCC said so on Friday.

Also, this week the NAB Business survey should still show subdued business confidence. Unless something’s afoot and it’s not.

The focus, my word, will probs be on what excitement is revealed in labour costs after the Fair Work Commission’s decision to bump the award wages by 5.75% from July. That’ll come through. Should be fun.

Going global, but thinking local, like a yokel

A busier global economic calendar this week, full of sound (inflation figures, most notably from both US and mainland China), as well as second quarter GDP data from the UK, Singapore, Indonesia, Philippines and Hong Kong SAR.

Rightio. I’m not going to muck about. Firstly, let’s unpack APAC.

Mainland China – as Josh Gilbert notes below in broken English – has the opposite problem of everyone else. No, not a nice government, it’s a big lack of inflation. That’s putting margin pressure on Chinese businesses big, small and centralised.

This has been obvious to anyone who read the July Caixin PMI figures.

Official comparisons against July’s CPI and producer price index (PPI) data should put a bit more of a 3D view on that situation.

GDP updates from several key APAC economies (and the Poms) will shed light on growth conditions over the second quarter.

The global expansion continued into Q2, driven mainly by service sectors, but the pace of growth seemed to be slowing in May-June.

S&P Global Intelligence says that “greater uncertainties have arisen surrounding the resilience of the global economy in the second half of 2023.” But – and this is me – if global growth went and peaked in late Q2, then QED: those uncertainties will be more certain. So pack that in your lunchbox, kids.

“Any surprises on the downside against consensus for these figures may still garner concerns over the full-year growth picture.” (That’s S&P again.)

“Additionally, insights into money managers’ views on the US equity market will be drawn with the August update of the S&P Global IMI survey while the GEP Global Supply Chain Volatility Index will shed light on another keenly watched subject.”

Three things, with Josh

We always ask Josh Gilbert, Friend of the Show and market analyst at eToro, to apply his relentless pursuit of returns by suggesting three key moments to look out for during the week ahead:

1. Reporting Season – Low expectations

The ASX200 has risen for the last two months, aided by the Reserve Bank of Australia seemingly winding down its tightening cycle as inflation falls and the expectation that the US can avoid a recession.

Josh says reporting season will be the next catalyst to tallying three months of gains for the local market, but given the low expectations, there are downside risks.

Looking ahead to next week, some of the more prominent names start to roll through, with ASX200 giant Commonwealth Bank reporting alongside Computershare (ASX:CPU), Newcrest Mining (ASX:NCM), AGL Energy (ASX:AGL) and REA Group (ASX:REA), to name a few more familiar types.

AGL Energy will be a name to watch this week after revising its FY23 and FY24 guidance last month. Although the good news is already likely baked in, Josh says keep an eye out for an upside to EBITDA and especially on guidance for FY24.

“For Commonwealth Bank (ASX:CBA), record earnings in its half-year results weren’t enough to stop shares from falling after warnings of a peak in net interest margins and slowing loan growth. That will be the focus this time around, and investors will be hoping for some optimism, with shares down 8% in the last six months. The good news is that low expectations can sometimes leave room for upside surprises.”

2. US CPI – Core the key to keeping the Fed on hold

US headline inflation has made significant progress in the last 12 months, falling from a peak of 8.5% to 3% in June, thanks to substantial declines in energy and food prices.

Josh says this has led markets to believe that the Federal Reserve is done hiking rates, with current pricing showing just a 17.5% chance of a September hike.

“The week’s CPI reading will be crucial in confirming this and further progress in core inflation will be the golden ticket investors are looking for to draw a line in the sand on the Fed’s hiking cycle.”

Current Bloomberg estimates are for headline inflation to rise slightly to 3.2% from 3%, while core is declining to 4.7% for 4.8%.

The Fed’s preferred measure of inflation has also shown further signs of receding, he adds, with June showing the smallest increase in more than two years.

“There may be some worry about a pickup in headline inflation, given the 15% jump in oil prices over the last three months, but investors may be more focused on any declines in core inflation.”

3. Chinese Inflation – Deflation nation

“Whilst most of the world is worried about high inflation, the world’s second-biggest economy is dealing with deflation fears. China is expected to experience deflation next week, with a projected CPI reading of -0.4%.

“Manufacturing activity last month fell for the fourth straight month, and cautious local consumers, anticipating better deals due to falling prices, have slowed down spending, reinforcing deflationary pressures,” Josh told Stockhead.

“The reading may be what the region needs to heap pressure on Beijing to hand down further measures to reignite growth and boost the economy. Officials have hinted at additional support in recent weeks but with no material action.”

The worry for everyone is that the effect of deflation in China has global repercussions. A Pterodactyl flaps its wings in Beijing, etc.

Closer to home, in fact at home, Australian miners could see some hardship if a period of deflation prolongs, given it would drive Chinese demand for raw materials down, amongst other areas such as energy, and even food.

“Unless more meaningful support is rolled out soon, fear is likely to grow amongst investors that the economy will continue to stagnate.”

The Australian Economic Calendar

Monday August 7 – Friday August 11

All sources from Commsec, Trading Economics, S&P Global Research, AMP, Westpac

Tuesday 8 Aug

Westpac/MI Consumer Sentiment Survey

NAB Business Survey

Australia Building Permits (Jun, final)

That’s pretty much it. We’ll deal with the reporting season calendar somewhere else.

The Everyone Else Economic Calendar

Monday August 7 – Friday August 11

All sources from Commsec, Trading Economics, S&P Global Research, AMP, Westpac

Monday 7 Aug

Canada Market Holiday

Japan BOJ Summary of Opinions (Jul)

Indonesia GDP (Q2)

Thailand Inflation (Jul)

Germany Industrial Production (Jun)

United Kingdom Halifax House Price Index* (Jul)

S&P Global Metal Users and Electronics PMI* (Jul)

Tuesday 8 Aug

South Korea Current Account (Jun)

Japan Household Spending (Jun)

Philippines Trade and Industrial Production (Jun)

China (Mainland) Trade (Jul)

Indonesia Consumer Confidence (Jul)

Malaysia Industrial Production (Jun)

Germany Inflation (Jul)

France Trade (Jun)

Taiwan Trade (Jul)

Canada Trade (Jun)

United States Trade and Wholesale Inventories (Jun)

S&P Global Investment Manager Index (Aug)

Wednesday 9 Aug

Singapore Market Holiday

South Korea Unemployment Rate (Jul)

Philippines Unemployment Rate (Jun)

China (Mainland) CPI, PPI (Jul)

Malaysia Retail Sales (Jun)

Japan Machine Tool Orders (Jul)

United States MBA Mortgage Rate

Canada Building Permits (Jun)

Thursday 10 Aug

Japan PPI (Jul)

Philippines GDP (Q2)

Malaysia Unemployment Rate (Jun)

India RBI Interest Rate Decision

Norway Inflation (Jul)

United States CPI (Jul)

United States Initial Jobless Claims

GEP Global Supply Chain Volatility Index* (Jul)

Friday 11 Aug

Japan Market Holiday

China (Mainland) M2, New Yuan Loans, Loan Growth (Jul)

Singapore GDP (Q2, final)

Malaysia GDP (Q2)

Hong Kong SAR GDP (Q2, final)

United Kingdom monthly GDP, incl. Manufacturing, Services

and Construction Output (Jun)

United Kingdom GDP (Q2)

United States PPI (Jul)

United States UoM Sentiment (Aug, prelim)

August ASX IPO listings

All dates are sourced from the ASX website. They could change without notice. Wait. They WILL change and only Eddy knows when or why.

Dragonfly Biosciences (ASX:DRF)

Expected listing: August 1

IPO: $5m at $0.20

No signs of life at DRF, I’m afraid. Just checked their website’s press page …

…so we’ll just have to join the growing punters waiting for this one.

Dragonfly in the meantime, is a cannabis based company popular in the UK for selling CBD-based everyday products such as toothpaste, suncare, balms and moisturisers.

The company sells to Boots, Tesco and Sainsbury, so pretty significant.

In the consumable category, Dragonfly has already received special access scheme approval for two of its products from our TGA.

Dragonfly expects the Asian market to see it as a fully accredited brand, which would enable the company access to those markets.

READ MORE: IPO Watch: UK-leading cannabis health and wellness house Dragonfly Biosciences set to list on ASX

Mining Green Metals (ASX:MG1)

Expected listing: August 21

IPO: $5m at $0.20

This explorer has a suite of green metal projects (either owned or optioned) including lithium, PGEs, nickel, vanadium and uranium in the attractive mining jurisdiction of Western Australia.

The Coats PGE, nickel, copper and vanadium project is 20km SSE of Chalice Mining’s (ASX:CHN) Julimar project.

MG1’s Lake Johnston lithium and nickel project is also close to Wesfarmers (ASX:WES) and SQM’s Mount Holland Lithium Mine, and the historic Maggie Hays/Emily Ann Nickel deposits held by Poseidon Nickel (ASX:POS).

Cleo Diagnostics (ASX:COV)

Expected listing: August 11

IPO: $5m at $0.20

Cleo is a medical diagnostics and devices development company.

The company’s product makes early diagnosis of ovarian cancer a reality with a simple and accurate blood test.

Its flagship is the CleoDX platform, a test kit designed to detect a novel protein biomaker CXCL10 in the blood which is present very early and through all stages of ovarian cancer.

After blood is collected, risk evaluation is performed and an assessment is made by Cleo’s proprietary algorithm.

Ashby Mining (ASX:AMG)

Expected listing: August 16

IPO: $15m at $0.20

AMG is developing a gold production business in the Charters Towers region in Northern Queensland and has secured rights to a land package covering over 600km2 containing historical mines, mineral resources, highly prospective exploration potential and a gold processing plant.

The 340Ktpa Blackjack Processing Plant is a conventional Carbon in Pulp (CIP) plant, located 15 minutes from Charters Towers.

The Far Fanning gold project lies on a permitted Mining Lease with historical production of 47,200oz gold from 664,000t of ore at average 2.2g/t gold.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.