Traders’ Diary: In about 5 days the US is going to blow up its own economy (and ours)

Via Getty

The Economic Week That Was

To markets first, because the Aussie benchmark staged a fightback for the ages during an action packed final session of last week. After stepping off into oblivion at the open on Friday morning, the ASX200 dusted itself, said no thanks to the lotion and the basket and began an unlikely climb out of the benchmark’s deepest pit since March.

Effectively starting the session six months behind where it had ended the night before (back under the 7000 level), the market put four days of losses and a Wall Street lead unhinged by Hawkish Fed chatter aside and with intense afternoon momentum hit the closing bell still -0.15% short, but slid over the line by settlement at 4.15pm, up by a handful of points.

The rally from about 10.30am amounted to about +115pts.

Worth a golf clap, although a brief one, since the Aussie benchmark index still lost a few hundred points over an awful, awful week, losing almost -3% and now sits barely +0.35% ahead of parity for the year to date.

As the last week of another volatile September unwinds, the ASX200 still has around -3.5% to find with just a few trading days left.

Last week the US Fed left the funds rate between 5.25% and 5.5%, although the latest dot plot – a summary of Fedspeakers’ economic and rate projections – signalled there’s at least one more round in the chamber this year along with fewer rate cuts in 2024.

Not making life any easier – and that’s half the purpose – Russian-led oil producers heaped further pressure on central banks across the world, as strategic supply cuts have accelerated rising oil prices. Hobbling your own economy at the knees is a thankless task when oil prices have leapt by a full third in the last quarter.

Brent is over US$93 a barrel and likely to keep climbing after Russia canned diesel and petrol exports in its latest bid to cause mayhem. West Texas Intermediate is at US$90. Find your 2% inflation target while this squeeze is happening.

An extremely wary, justifiably hawkish chair J. Powell’s post-match statement wasn’t received in the same calm and measured way it was delivered. Wall Street traders took it as threatening and dropped their loads.

Thus, US markets logged a fourth straight loss on Friday (Saturday morning in Sydenham) as benchmark US Treasuries surged to pre GFC highs.

The yield on the 10-year Treasury note climbed 12 basis points on the week to 4.44%, after surging Thursday to its highest level since October 2007, as the Fed projected interest rates would remain higher for longer.

“Fear of the Fed saw 10-year U.S. Treasury yields soar to their highest in 16 years on Thursday and the S&P500 hit its lowest levels since June,” wrote Mike Dolan, Reuters’ Editor-At-Large, Financial Industry and Financial Markets in an email on Sunday night.

“World stocks captured by MSCI’s all-country index recorded their worst day of the year so far – dropping 1.69%.”

For the week, the Dow Jones Industrial Average fell circa -2%. The tech-heavy Nasdaq Composite ended -3.6% and the benchmark S&P 500 had its worst week (down 3%) since the Ides of March – fans of getting stabbed in the back will recall this was around the time Silicon Valley Bank collapsed and a ‘here we go again’ sell-off threatened to go global.

In Londontown the Bank of England (BOE) surprised by leaving rates unchanged after 14 straight hikes, probably unjustifiably increasing British hopes of very unlikely English success in Le Rugby Coupe du Monde and that they’ve somehow also clocked the peak of the raising cycle. Recent UK inflation data has actually been pretty sterling.

Heaps of excitement in Japan last week, particularly on Friday. But in brief – the Bank of Japan (BOJ) kept interest rates unchanged and maintained its dovish appraisal of the benefits of an ultra-low interest rate policy.

The Week That Will Be

Shutdown.

In the US, expect a fall in consumer confidence and more rising home prices on Tuesday.

Shutdown.

Perhaps a dip in durable goods orders and maybe flat capital goods orders on Wednesday.

Shutdown.

Will there be a slowing in personal spending growth, probably not, (Friday).

The big question again is will the US be forced to shut itself down this weekend?

Republicans aren’t even united in their various lines of opposition to the Government spending plan and its gauntlet run through both chambers looks dire.

If there is no agreement by midnight Saturday in NY (Sunday morning in Sydenham), a whole conga line of federal workers will begin to be furloughed, grinding the arms and legs, if not the head of the US government to a sudden halt.

That would be bad. For a better idea of the economic consequences watch James Cameron’s 14-hour masterpiece Titanic – from the moment someone shouts ‘iceberg’.

Weakening economic confidence over September in the EU, by comparison, is peanuts. Their September CPI inflation (Friday) might not be if it doesn’t fall to 4.5%yoy from 5.2% with core inflation falling to 4.8%yoy from 5.3%, as economists expect.

Japanese industrial production and unemployment numbers are due Friday, while Chinese business conditions and PMIs for September (due Friday and Saturday) will likely drop with a thud.

In Australia, there’s a little more macro for the number munchers this week.

Markets and the RBA will focus on the August CPI indicator. The Consumer Price Inflation Indicator (Wednesday) is likely to show a rise to 5.3%yoy from 4.9% reflecting a 9% rise in petrol prices, according to AMP Capital.

CBA’s economic team is also expecting a large increase in petrol and diesel prices of between 8‑12%/mth in August drove up inflation to 5.1%/yr, up from 4.9%/yr.

The August figure will also provide important reads on market services inflation, including for categories like restaurant meals and various household services. The RBA is concerned about services inflation in the context of the Fair Work Commission’s 5.75% increase in award wages.

“We anticipate concession households in Melbourne receiving rebates to weigh on electricity inflation. Excise increases for some alcohols will likely see higher prices, and the higher excise for tobacco will add to inflation next month. But significantly lower child care prices from the expansion and increase in the Child Care Subsidy will not be measured until September,” CBA’s Stephen Wu wrote last week.

Retail sales are likely to rise again while job vacancies for the three months to August are expected to fall for a fourth straight read (both Thursday) and housing credit growth (Friday) is expected to remain moderate.

Your week on the ASX

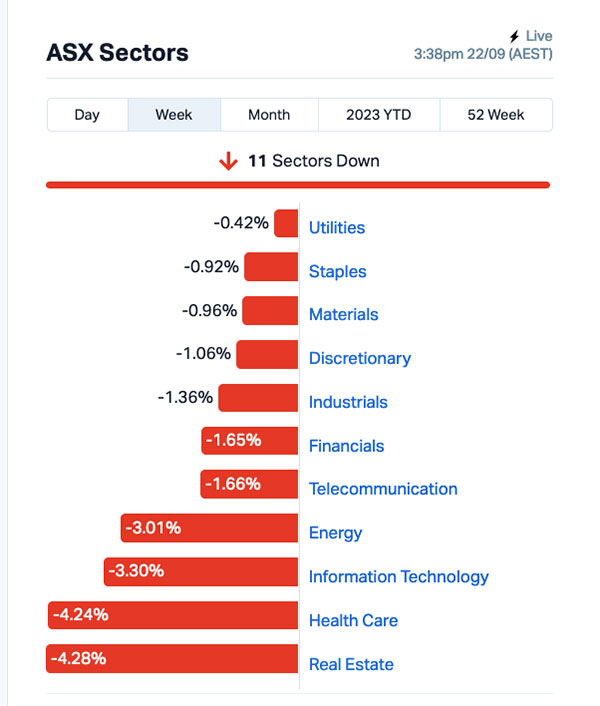

All 11 ASX sectors closed last week in the red. Energy and InfoTech broke the -3.0% barrier, and both Health Care and Real Estate lost more than 4.2% apiece.

Josh Gilbert’s 3 things to watch out for

eToro’s Sydney-based devilishly-handsome market analyst of Cornish heritage, Josh Gilbert tells Stockhead what three things he’s tracking this week:

1. Australian CPI on Michele Bullock’s radar

As Michele Bullock settles into her first few weeks as the new Governor of the Reserve Bank, she’ll be hoping next week’s monthly CPI reading doesn’t throw a curveball. Monthly inflation has continued to decline meaningfully since peaking in December 2022 at 8.4%, with July showing a decline to 4.9%.

However, that downtrend may stall next week with the expectation for inflation to pick back up marginally to over 5%. The RBA has maintained their hiking cycle pause for the last three consecutive meetings, and if that were to change, it would likely be due to an upside surprise in inflation.

The recent jump in oil prices may be a worry in the short term and poses a risk to the inflation outlook. This supports the RBA’s positioning on keeping the door ajar for further hikes if they deem necessary, should inflation pressures persist.

Markets however, still believe that inflation is moving in the right direction, with markets pricing just a 50% chance of another hike by the RBA by year-end. The good news is that we think the current oil rally self-corrects as higher prices stoke conservation efforts whilst triggering global macro-driven demand slowdown fears.

2. Will Retail Sales show the Aussie consumer is still holding up?

Next week, investors get a view of the state of the Australian consumer households with incoming monthly retail sales data. Consumer sentiment surveys have recently shown that consumers are still pessimistic despite the RBA keeping rates on hold for three consecutive months. Clearly, the lagging impact of rate hikes and cost of living pressures are impacting consumer habits. Consumers are shelving the idea of buying big-ticket items, and other discretionary spending is being dampened by the jump in petrol prices in recent months.

However, how consumers feel, and what they actually do, isn’t in sync. Last month, retail sales increased more than expected, jumping 0.5%, with spending continuing to remain near record levels. One factor impacting this figure is the strong jobs market with, consumers feeling confident in their job security, giving some freedom to spend. Next week’s reading is expected to show another increase of 0.2%, but interest rates at decade highs may keep chipping away at the resilient consumer.

3. Liontown Resources – Full Year Accounts

Reporting season has concluded, but some companies are still updating investors across the Australian market. Next week sees the ASX200’s best-performing stock, Liontown Resources, up more than 120% in 2023, announce its full-year accounts.

The lithium miner has been on a tear since US lithium giant Albermarle proposed a takeover at $2.50 a share back in March, which Liontown rejected. Albermarle has since sweetened the deal with a ‘best and final’ offer at $3.00 a share, with the door still open for the takeover to be completed and shareholders to be rewarded – particularly those that bought shares in the 2018 IPO at $0.03 a share.

Albermarle is looking to Liontown to expand its lithium production as the world’s appetite grows for electric vehicles, especially given Albermarle’s supply agreements with auto giants Ford and Tesla. Other lithium miners, Pilbara Minerals and IGO, announced record profits and mountains of cash in their full-year results, and Liontown investors will be hoping for the same positivity next week.

The Australian Economic Calendar

Monday September 25 – Friday September 29

Source: Commsec, Westpac, Trading Economics, S&P Global Research, AMP

TUESDAY

RBA 2023 Conference on Inflation

WEDNESDAY

Monthly CPI indicator, August

THURSDAY

Job vacancies, August

Retail trade, August

FRIDAY

Private sector credit, August

The Everyone Else Economic Calendar

Monday September 25 – Friday September 29

MONDAY

Chicago Fed National Activity Index (August)

Dallas Fed Index (September)

ECB President Lagarde Speech

TUESDAY US Building

US Permits final (August)

FHFA Home Price Index (July)

US S&P/Case-Shiller comp.20 HPI (July)

US Consumer Confidence (September)

US New Home Sales (August)

Richmond Fed Index (September)

KR Consumer Confidence Sept

WEDNESDAY

US Durable Orders (August)

KR Business Confidence Sept

ECB Non-Monetary Policy Meeting

US Earnings: Micron Technology

THURSDAY

US Continuing Jobless Claims (Q2)

GDP (Q2)

US Initial Claims (9/23)

US Pending Home Sales Index (August)

Kansas City Fed Manufacturing Index (September)

RU Unemployment Rate AUG

EU Economic Sentiment SE

US Earnings: Nike

FRIDAY

PCE Deflator (August)

US Personal Consumption Expenditure (August), Personal Income (August)

US Wholesale Inventories (August)

Chicago PMI (September)

Michigan Sentiment final (September)

GB Current Account,GDP Growth Rate YoY Final

GB Nationwide Housing Prices

GB Mortgage Lending Aug

GB BoE Consumer Credit

GB Mortgage Approvals

EU Inflation Rate Flash Sept

EU Core Inflation Rate Flash Sept

EU ECB President Lagarde Speech

IN Current Account Q2

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.