Traders’ Diary: Everything you need to know about the ASX and beyond for the rest of the week

Is it still inflating? Via Getty

What grabbed the headlines last week?

On the economic week just gone – it was refreshingly dull from a global perspective.

The pants-grabbing moment was the release of the RBA’s April Board meeting Minutes and the release of the RBA review, which should nicely reflect the numbingly familiar economic loop we’re all in.

RBA still has ‘a hiking bias’ according to Gareth Aird at CBA, but the minutes showed they ummed and ahhed a bit over lifting the cash rate by 25 basis points or just leaving things as they are ’till May and going to Tetsuya’s or possibly Aria and forgetting about the whole thing while this silly-ass independent review blows over.

The review didn’t change anything at all regarding the outlook for rates and monetary policy, so just hang on to your 2%‑3% inflation target and perhaps forget the ramblings of people like me.

Instead the review layered a bit more oversight over the oversight, upped the press conferences, downed the actual monetary policy meets and then said no one has to even worry about this until July 2024.

The ups and downs of the golden age

12 months ago…

Here we have Deputy Editor Reuben Adams (on this day last year) trying but failing to fly home after a particularly taxing editorial meet in the dastardly huge smoke of Sydney.

Similarly deflated, the price of gold 12 months to the day…

Today…

Last week, the US Treasury reported that the federal deficit hit US$1.1 trillion in 1H, about US$430 billion more than the same period a year earlier.

Reuben is a gold fiend and provides incredible detail here.

His conclusion, backed by J Felder, the former hedge fund manager and publisher of The Felder Report is that this could whack the US dollar in the near term, causing all hell to break loose.

“If history is any guide, the best protection against a deteriorating fiscal situation (mathematically guaranteed by rapidly growing social security and medicare spending) is gold,” Felder says.

A feeble USD is generally good. And also good for gold.

When the US deficit last blew out in the early 2000s it sparked a major bear market for the USD, Reubs and Jesse Felder say.

J Felder:

“This was one of the primary catalysts for a major bull market in the price of gold which rose from a low of $250 in 2001 to a high of nearly $2,000 a decade later.”

Meanwhile…

CBA says – in a roundabout fashion – that things we buy are costing less.

“The downtrend in inflation in many advanced economies reflects goods disinflation.”

The signals coming out of the way overworked Aussie Bureau of Numerals (ABS) via the new monthly CPI indicator suggest to CBA’s Stephen Wu that we’ll see a similar picture down here.

“There were broadly two key messages from the monthly inflation data says CBA,” Wu reckons. “The first is that goods inflation in Australia, like in most places, is abating. Some goods prices have in fact been falling. The second is that there look to be early signs that pockets of services inflation are moderating.”

OFC we won’t know till Wednesday, when the numbers bureau drops the Q1 23 CPI prints.

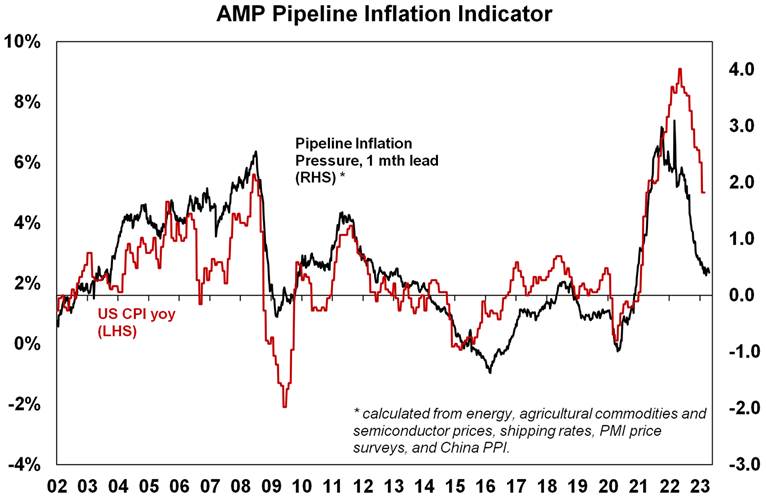

But AMP Capital’s US Pipeline Inflation toolkit continues to insist there’s a break in this extended and steamy US inflation season, although with OPEC playing silly buggers in the mix, higher gasoline prices are a likely impact during April.

On the ASX

In (delightful) summation (from the minds of James Gerrish and the crack team at Market Matters):

“In our opinion, the market feels fairly evenly balanced as we approach May with a lot of stocks trading around fair value as we approach the seasonally weak May & June period but investors’ sentiment is very bearish and cash levels are high suggesting that there will still be plenty of buyers into dips which by definition will probably be shallower than most people expect.”

MM still believes the best way to add value through 2023 will be through stock and sector rotation as opposed to picking the twists and turns of the ASX.

As for the blow by blow action on the ASX200, resources weighed as the benchmark backtracked about -0.4%.

“…the banks did their best to maintain the market’s upward trajectory e.g. ANZ & NAB both rallied over 1% while Woodside (WDS), BHP Group (BHP), and RIO Tinto (RIO) all fell by more than – 3%. On the stock level, we saw some standout reversion to a number of the earlier trends through 2023 with Whitehaven Coal (WHC) surging +7.4% whereas Domain Holdings (DHG) fell -7.1%.”

Josh Chiat unpacks some of BHP’s iron ore

The Big Australian’s (or whatever it is we fearfully and affectionately call our dual-listed monster) iron ore output rose by 11 per cent QoQ over Q1 2023. Largely thanks to China’s gradual reopening-stoked commodity demand.

Josh says in his quarterly BHP wrap-attack that BHP’s Pilbara mines remain on track to hit their guidance range of 278-290Mt after turning out 66.2Mt in the March quarter, down slightly on the March quarter last year but 11% down quarter on quarter.

The world’s biggest miner has shipped 1% more year to date than in FY22, exporting 212.6Mt through the first nine months of FY23 from WAIO, or 188.5Mt on an attributable basis.

The Samarco JV with Vale has shipped 3.3Mt year to date, up 7%, including a 5% lift March quarter YoY to 1Mt (4% down QoQ).

Lower volumes came after the shutdown in February following the death of railyard worker Jody Byrne in an on-site incident.

“Safety is paramount, and we are deeply saddened by the tragic death of Jody Byrne in an incident at Port Hedland in February. An investigation into the cause of the incident is underway, the findings of which will be shared widely,” Henry said.

BHP expects costs at WAIO to come in at the upper end of its guidance range of US$18-19/t.

It has also maintained copper guidance despite mine issues at Escondida in Chile, also flagged by JV partner Rio Tinto (ASX:RIO) last week, which have seen the world biggest copper mine’s guidance lowered from 1.08-1.18Mt to 1.05-1.08Mt.

But BHP’s general copper division will still produce 1.635-1.825Mt with overall year to date production (1.2403Mt) up 12% and March quarter output of 405,900t up 10% YoY.

Olympic Dam in particular is up 88% YoY to 155,800t, though March quarter production, while 33% higher YoY, was down 5% on the December quarter. BHP expects to hit the upper end of guidance at Pampa Norte (240-290,000t) and OD (195-215,000t).

The week ahead

Fed officials will be staying mum over the coming week as they enter the blackout period ahead of the May 2-3 policy meeting.

There’s plenty on the menu this week to suggest what flavour Fed officials will be serving us for the main dish at the end of their May 2 policy meet. For now officials will be staying mum as they enter the blackout period.

Starting things off is the consumer confidence index for April on Tuesday along with March new home sales. Durable goods orders will follow on Wednesday, but the first top tier release will land on Thursday with the advance estimate of Q1 GDP.

The go-get-’em US economy is expected to have expanded by an annualised pace of circa 2%, which kinda rules out a recession, one’d hazard.

What else for inflation watchers? Friday’s personal income and outlays report – with the all-important core PCE price index – as well as consumption data. Pending home sales are also due, while there’s some quarterly wages numbers and the Chicago PMI.

The Economic Calendar

Monday April 24 – Friday April 21

Sources: S&P Global, Commsec, Investing.com, Trading Economics

Australia

TUESDAY

Market closed

WEDNESDAY

Consumer Price Inflation (CPI), Q1

THURSDAY

Trade prices, Q1

FRIDAY

Private sector credit

Producer Price Index (PPI)

Global

TUESDAY

US Redbook, YoY

US S&P/Case-Shiller Home Price, MoM

US House Price Index

WEDNESDAY

CB Consumer Confidence

US New Home Sales

US Richmond Fed Services Index

THURSDAY

CN Industrial Profits (YTD)

US GDP Growth Rate QoQ

US Initial Jobless Claims AP

US Real Consumer Spending

FRIDAY

JP Bank of Japan 10-year bond yield

US Pending Home Sales

US Core PCE Price Index YoY

Wall Street Earnings

It’s still never-ending business time in New York with March quarter US earnings results and, well, nothing really broken yet, other than anything Elon touches.

According to the Man Who Refuses to Sleep, Tony Sycamore at IG Markets, at a stock level, Tesla extended its post-earnings slide in our time zone yesterday to close 9.75% lower at US$162.99, its lowest close in three months.

“AT&T (ATT) was also in the hurt locker, falling 10.41% after its earnings reports missed the spot,” Tony adds.

We can expect so much more earnings fireworks this week, with reports set to drop from (again looks at notes) some companies called Alphabet (GOOGL) , Meta (META), Microsoft (MSFT), and Amazon (AMZN), as well as Coca-Cola, PepsiCo, McDonald’s, Boeing, Exxon, and Chevron… and so on.

US$ 1.5 billion of Tesla’s (TSLA) heavy-hitting institutional shareholders wrote, cursed and then sent an open letter of corporate fury to the company’s board over the “over-committed” status of said CEO Elon Musk on Friday.

The missive – obviously not via Twitter – followed swiftly on the heels of that radical 30km in the air spiral detonation of Musk’s giant SpaceX Starship in its first test flight Thursday. I thought it was cool.

But then Tesla reported a net income crash of more than 20% from the prior year on narrowing margins. TSLA shares are not quite 30km up, but they did a good spiral themselves on the news.

Shares of Tesla (TSLA) crashed on Wednesday after cheap cars and high costs did what they do to margins. Elon says TSLA is all about sales growth and not profit for now, due to the EV price war and a shaky economy.

“This is an extremely important point,” Elon said after the numbers dropped. “We’re like laying the groundwork here, and it’s better to ship a large number of cars at a lower margin, and subsequently, harvest that margin in the future as we perfect autonomy.”

It’s not all about Musk… but, I may as well add since so very much of it is, that he also caused hooplah with his new toy Twitter (again), doing the switcheroo on those status things… and … honestly… I can’t remember exactly what he did and feel it’s not essential other than he caused a lot of hooplah.

Anyhoo.

Only 17% of S&P 500 companies have reported, (Friday, our time) but with 75% surprising on the upside (and in line with the long-term averages), this is way, way better than hoped for and smashed the December quarter. The average beat is running at 5.6%.

Coming up this week, we have all sorts of exciting quarterly updates.

Time being a factor, let’s do…

Microsoft – Azure – Athena – Bing!

The stock is up about 40% since it bottomed out in October and with the company reportedly ahead on helping artificial intelligence mess with our lives, traders are queuing up for these numbers as they drop on Tuesday after the bell in NY.

Will the numbers add more fuel to the share’s latest uptrend?

I say yes. Probably.

Wall St says earnings per share (EPS) should rise 0.5% from last year to US$2.23 from US$2.22.

Revenue to find +3.4% to US$51.025 billion – largely due to its rocking cloud services arm, amid a Q2 decline in personal computing.

I could do more, but let’s ask XM’s CEO Peter McGuire to do the heavy lifting:

Stockhead: Pete, spotlight to fall on Azure?

“Yep. Azure is Microsoft’s cloud computing platform, which provides up to 5000 services in 54 regions around the world and holds the second place in the public cloud adoption market. Just on Wednesday, it was announced that Azure’s Open AI service is planned to be integrated with Epic’s electronic health record software with technological advancements aimed at increasing productivity and ensuring long-term financial stability for the sector. Therefore, apart from Azure’s performance during the quarter, investors may watch closely the estimates for the platform’s growth in the coming quarters.”

Can you introduce “Athena”?

“Goddess of wisdom and military victory… until Tuesday last, when Microsoft revealed its developing its own artificial intelligence chip – you guessed it – named “Athena.” It’s a MSFT version of the tech behind AI chatbots like ChatGPT.

The news comes after the firm earlier this year launched its own AI-powered engine Bing AI in partnership with OpenAI, in an attempt to gain market share from Google.

Microsoft is hoping that the new chip will perform better than anything they currently buy from other vendors, which could prove cost and time saving…

So… combined with a potentially strong earnings report on Tuesday, a successful expansion in Microsoft’s AI business may encourage investors to keep the stock in their portfolios for long.”

Not much bad to say… or… possibly overvalued?

“With the 12-month forward price-to-earnings ratio of Microsoft decently above its long-term averages, some investors may be reluctant to buy at current levels as they may consider the stock to be overvalued.

Whatevs. The risks surrounding the bigger picture likely remain tilted to the upside, even if the stock corrects a bit lower in the short term.

Microsoft is considered a high-growth firm, usually valued by discounting expected cash flows for the quarters and years ahead. Therefore, with net income generally expected to grow at larger rates in future quarters and bets for rate cuts by the Fed later this year remaining firmly on the table, Microsoft’s present value may be destined to continue increasing.”

Let’s also go Meta!

Meta reports Q1 earnings after the market closes on Wednesday, the 26th of April, 2023.

IG Markets Tony Sycamore has an astonishingly nimble and precise preview:

“Last quarter, Meta reported a revenue beat of US$32.17 billion vs US$31.53 expected and announced a US$40bn share buyback sending its shares soaring, putting behind it a year to forget.

Meta said it expected Q1 2023 total revenue to be in the range of US$26-28.5 billion. Meta CEO Zucker-B said that 2023 would be the ‘Year of Efficiency’ and we’re focused on becoming a stronger and more nimble organization.”

The company also said that it expected total expenses in 2023 to be in a range of US$89-95 billion – less than previously forecast due to “slower anticipated growth in payroll expenses and cost of revenue”.

The forecast reduction in expenses alleviated concerns that the company’s massive investment in building the metaverse would continue to blow out costs. Its attention to costs saw the company announce another round of job cuts this week, estimated to be around 10,000 heads on top of 11,000 departures announced in November.

Restructuring charges for its Family of Apps (FoA) segment and Reality Labs (RL) unit of US$3.76 billion and US$440m, respectively, made for a difficult comparison at an EPS level.

However, excluding these charges, Meta’s operating margin would have been 13 percentage points higher, and its diluted EPS would have been US$1.24 higher for Q4.

While the company’s focus on controlling expenses has met with shareholder approval and will boost the company’s bottom line, there are concerns that softer advertiser demand, partly from the recent banking crisis, will weigh.

There will be interest to see if Meta’s improved targeting using first-party data will help improve ad pricing.

Comments on the Reality Labs segment will also attract attention as it so far has been immune from recent cost-cutting measures.”

Meta’s last quarter turnaround

- Facebook daily active users (DAUs) – DAUs were 2 billion on average for December 2022, an increase of 4% 1 year-over-year.

- Facebook monthly active users (MAUs) – MAUs were 2.96 billion as of December 31, 2022, an increase of 2% year-over-year

- Revenue – Revenue was US$32.17 billion and US$116.61 billion, a decrease of 4% and 1% year-over-year for the fourth quarter and full year 2022, respectively.

Dr Shane Oliver’s Playlist

Beach Boys, almost Fleetwood Mac and Barry Manilow:

“There is a great episode in Daisy Jones and the Six (which seems loosely inspired by Fleetwood Mac) where Daisy and Billy finally learn to write songs together. The Beach Boys classic In My Room gets a look (based on his Twitter feed, even Brian Wilson noticed) and in the next scene Barry Manilow’s I Write The Songs gets a go. The link is that the latter was actually written by Beach Boy Bruce Johnston…

Maybe it was too saccharine for The Beach Boys (and Bruce was having a break from them at the time) but it’s just right for Barry. It’s actually a great song. Speaking of Barry, his sped up super catchy version of Let’s Hang On is worth a look…

And of course, Daisy is played by Elvis’ granddaughter.”

The ASX IPO calendar for this week

According to the ASX, there are no new company listings this week. None that I saw anyway.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.