Traders’ Diary: Everything you need to know before the ASX opens

Via Getty

What grabbed the headlines last week?

Local markets endured a choppy week, although three technically consecutive days of gains from Wednesday helped limit the chaffing.

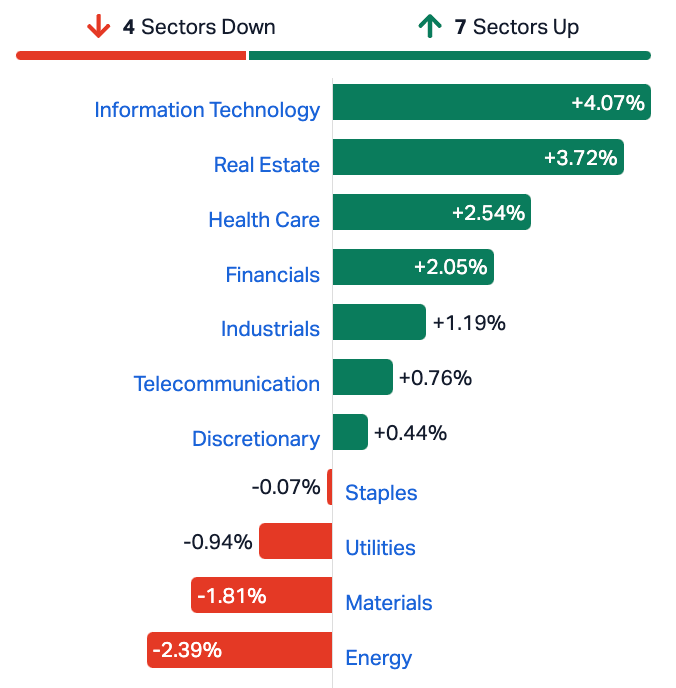

Resources stocks were just a blight last week. The Materials and Energy Sector saw all sorts of unlikely losses as companies detached from commodity prices and fell foul of their own limitations – (Santos (ASX:STO) and Whitehaven Coal (ASX:WHC) just two examples of what both dazed and confused local traders while the fireworks continued on Wall Street.

A little market melancholy after the RBA chief made it clear she’d be tightening her grip on tightening. Governor Michele Bullock offered some blunt advice during the week – saying “An inflation rate with a ‘4’ in front of it is not good enough and still some way from the midpoint of our target.”

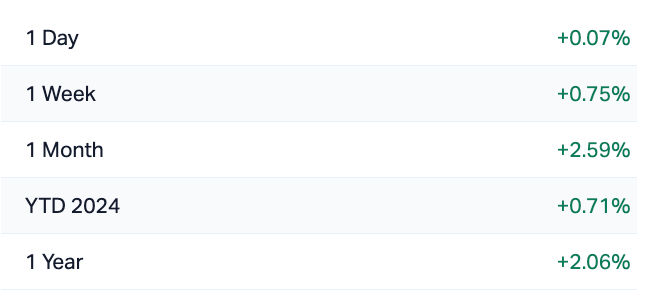

The ASX200 (XJO) index

In the States, December’s revised inflation reading came in lower than first reported just adding further smoke signals out of the US of inflation in remission.

A plucky and resilient American economy and some more solid corporate earnings are behind 2024’s Wall Street rally, which last week witnessed the three major US averages notch their fifth straight weekly gain.

In the week just gone, the S&P added 1.4% and the Nasdaq Composite jumped 2.3%, while the Dow Jones finished flat.

The surge in megacap tech stocks helped lift the S&P 500 and Nasdaq on Friday, with the S&P holding above the crazy 5,000 level and just pushing its record high ever higher.

Chinese shares gained around 5.8% on some more convincing signals that the officialdom is serious about wheeling out market support measures and stimulus.

However, China’s disappointing CPI last week only serves to highlight Beijing’s rising risk of a debt deflation spiral, in sharp contrast to Japan, where rising wages could finally end negative rates.

The economic situation facing Chinese households has worsened amid plummeting asset values, a deteriorating labour market, significant debt-service burdens and the state embarking on belt-tightening in 2024.

Barclay’s have lowered their full-year CPI forecast to 0.3%.

ASX Sectors Last Week

In the US…

The last session in New York saw more of the Magnificent Majors drive gains.

This time Nvidia (NVDA) surged 3.65% to a new intraday record high, while nearby market monsters inclouding Messrs Microsoft (MSFT), Amazon (AMZN) and Alphabet (GOOG) also drive upwards.

On Friday, Wall Street got a free swing after thre Bureau of Labor Stats released some favourable revisions to the consumer price index (CPI), likely gifting the US Federal Reserve more wriggle room on cuts, while confirming bets around easing inflation.

The revisions made for a fascinating contrast to last year’s, when the CPI was revised outrageously higher, sparking much of the pervading doom of 2023 around rate hikes.

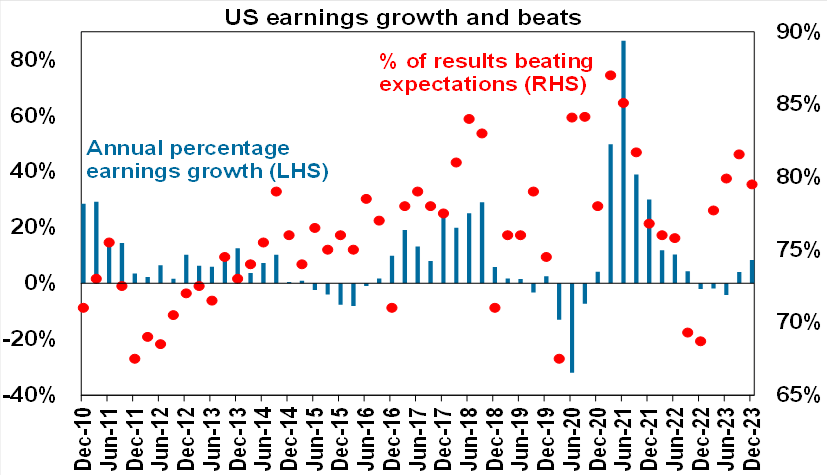

67% of US S&P 500 companies have now reported December quarter earnings with 79.3% coming in better than expected, which is above the norm of 76%, as per AMP:

So far earnings growth for the quarter is running around +8%yoy, which is well up from consensus expectations for 4.3% growth at the start of the reporting season.

The Week Ahead

First up, in the climax of silly footy with helmets, the reigning Kansas Chiefs and the San Francisco 49ers will stand around high-fiving in a sure to be tedious repeat of Super Bowl LIV.

More exciting will be the viewing data as per the Swift Effect, with Taylor dating someone from one of the teams leading punters to punt more and other punters to forecast the total viewership could be circa 118mn.

Wagering companies will be happy. Legal betting is expected to top $US1.35bn across America’s 39 regulated markets.

US Earnings season continues with reports from companies including Coca-Cola, Airbnb, Lyft, Cisco, Robin Hood, AMD, Dropbox, and Coinbase.

This week’s key US economic moment will be closely watched inflation data for January.

Headline CPI is expected to rise by 0.2%MoM, allowing the annual rate to fall to 2.9% YoY from 3.4% prior. Core inflation is expected to increase by 0.3%MoM, which would see the annual rate of core inflation ease to 3.7% from 3.9%YoY.

The New York and Philadelphia regional manufacturing surveys for February are expected to improve a bit but remain weak, with January retail sales expected to fall 0.2%mom and industrial production growth picking up to 0.4% (all Thursday).

Housing starts are expected to be flat and January producer price inflation is likely to remain around 1%yoy.

Japanese December quarter GDP growth (Thursday) is expected to be 0.3%qoq with flat consumer spending but contributions from capex and trade.

At home, consumer confidence vies with business confidence from the January NAB survey for least exciting data drops.

Jobs data for January on Thursday is expected to show employment up by 35,000 after a slump of 65,000 in December with unemployment rising to 4%.

ASX December half earnings reporting season will ramp up with nearly 50 major companies reporting starting with JB HiFi (ASX:JBH) on Monday, Commonwealth Bank (ASX:CBA) on Wednesday, Treasury Wine Estates (ASX:TWE) and Wesfarmers (ASX:WES) (Thursday) and the ASX (ASX:ASX), Friday.

Consensus expectations are for a 5.4% fall in earnings for 2023-24 reflecting the slowdown in the economy and a sharp fall in energy profits but with strong gains in profits for utilities, health care and industrials.

Guidance is the give away again this season – not just for corporates but also for hints on how the Aussie consumer really is holding up amid the high rates and cost of living crunch.

And one final word on Swiftonomics from Shane Oliver head of investment strategy and chief economist at AMP:

With Taylor Swift’s concert tour in Australia kicking off later this month interest in its economic impact will rebound again. Sure all the associated spending (on tickets, food, merchandise, flights, hotels, etc) will see consumers inject money into the economy but I reckon as Governor Bullock implied in relation to her own kids it will come at the expense of other things and of course much of the concert is an import.

So maybe a brief spike in some activity around the concerts then back down such that the net impact on GDP will be hard to detect.

Or maybe I am just still upset that I stuffed up getting the tickets which makes it a bit of a cruel summer…

The Aussie Economic Calendar

Monday February 12 – Friday February 16

All sources: IG Markets, S&P Global Market Intelligence, CommSec

MONDAY

Nope

TUESDAY

Australia Westpac Consumer Confidence (Feb)

Australia NAB Business Confidence (Jan)

WEDNESDAY

Australia Employment Change (Jan)

THURSDAY

Nada

FRIDAY

没有

The Everyone Else Economic Calendar

Monday February 12 – Friday February 16

MONDAY

China (mainland), Hong Kong SAR, South Korea, Taiwan

and Singapore Market Holiday

India Industrial Production (Dec)

India Inflation (Jan)

United States Consumer Inflation Expectations (Jan)

TUESDAY

China (mainland), Hong Kong SAR, Taiwan Market Holiday

Japan PPI (Jan)

Singapore GDP (Q4, final)

France Unemployment (Q4)

United Kingdom Labour Market Report (Dec)

Switzerland Inflation (Jan)

United States CPI (Jan)

S&P Global Investment Manager Index (Feb)

WEDNESDAY

China (mainland), Taiwan Market Holiday

United Kingdom Inflation (Jan)

Eurozone Employment (Q4, prelim)

Eurozone Industrial Production (Dec)

Indonesia Presidential Election

THURSDAY

China (mainland) Market Holiday

Japan GDP (Q4, prelim)

Indonesia Trade (Jan)

Japan Industrial Production and Capacity Utilization (Dec)

Eurozone Balance of Trade (Dec)

United States Retail Sales (Jan)

United States Industrial Production (Jan)

United States Business Inventories (Dec)

FRIDAY

China (mainland) Market Holiday

South Korea Unemployment Rate (Jan)

Singapore Non-oil Domestic Exports (Jan)

Thailand GDP (Q4)

Malaysia GDP (Q4)

United Kingdom Retail Sales (Jan)

Switzerland Industrial Production (Q4)

France Inflation (Jan, final)

United States Building Permits (Jan, prelim)

United States PPI (Jan)

United States Housing Starts (Jan)

United States UoM Sentiment (Feb, prelim)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.