Traders’ Diary: Everything you need to know before the ASX opens

Via Getty

What grabbed the headlines last week?

Offshore, resilient economic data in the US was a key theme. Strong retail trade and low initial jobless claims marginally pushed out market expectations for 2024 rate cuts from the Fed.

Market pricing for a March cut has eased with a probability of ~80% last week coming down to ~50% as we go to press.

CBA’s international economics team has been of the view for some time that March seems too early and favour May for the first Fed rate cut.

Wall St rallied good on Friday, as the S&P 500 closed at all-time high of 4,839, adding 1.2%, the Dow Jones surged 395 points and the Nasdaq advanced 1.7%.

The el loco US Tech Sector led the players off the park on Friday as microchip makers extended their rally, led by Taiwan Semiconductor’s better-than-expected forecast the previous day and optimism around AI.

Nvidia reached a new record high of $594.91 with a brutal 4.2% rise, Advanced Micro Devices leapt by 7.1%, and Texas Instruments soared by 4%.

On the Wall St earnings front, Travelers Co. took off 6.7% after the insurer’s Q4 profit more than doubled.

Finally, the Michigan consumer sentiment unexpectedly reached 2021 highs, and inflation expectations for the year ahead fell to the lowest in three years.

For the week, the S&P 500 rose 1.1%, the Nasdaq jumped by 2%, and the Dow Jones ended 0.5% higher.

Chinese markets remain under intense pressure.

The Hang Seng lost circa 0.55% on Friday, reversing from modest gains in the morning session and coming closer to its lowest level in almost 15 months with all sectors feeling the pinch.

The Hong Kong index logged a third straight weekly decline, although this one was more of a collapse – down almost 6%.

Chinese Premier Li Qiang told Davos participants that Beijing won’t go in for the old bag of stimulus tricks to spur a turnaround in the economy this year due to fears of long-term risk – adding to fears for local traders already nervous about the fragile state of China’s economic recovery.

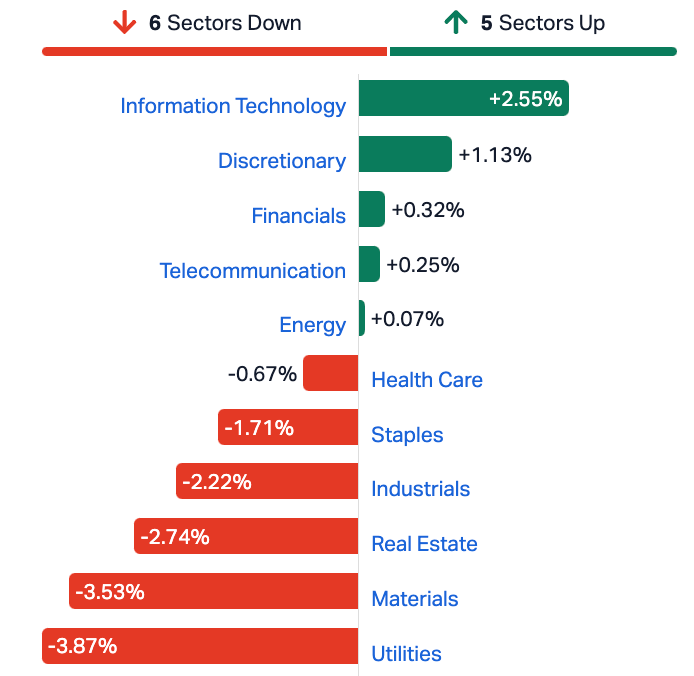

ASX Sectors Last Week

Koonenberry Gold (ASX:KNB) took line honours for the week, banging out an 86% gain, made all the more impressive considering its entire segment, on carefully weighted average numbers and a lot of complex mathematics, was utter gobshite.

The goldies, if you missed the memo, shanked a 5.6% loss for the week as a whole. Brutal.

White Cliff Minerals (ASX:WCN) took the silver medal for the week, up 80% on news that it popped down to the shops for milk, bread and a pack of smokes – and came back with The Radium Point uranium licences, fresh from the Northwest Territories in Canada.

The pick-up for White Cliff covers an area in excess of 3,300km2 and includes significant historical mining operations, such as the Eldorado, Echo Bay and Contact Lake mines.

And the bronze gong this week went toENRG Elements (ASX:EEL), but the reason why remains a mystery.

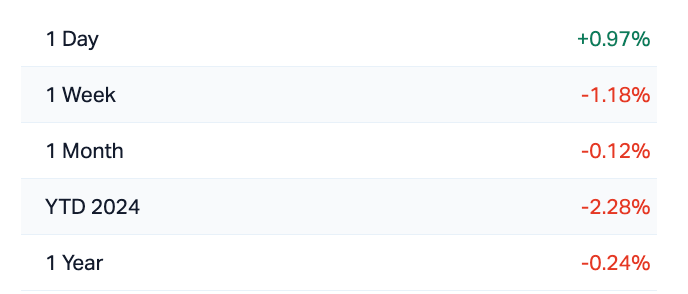

At home, at least the ASX benchmark was slightly less depressing:

ASX200 last week

The Week Ahead

Which brings us to business this week, another slow one for local data, while it’ll be a little loopier in the US, with Wall St closely eyeing the US Q4 GDP growth rate, on Friday as well as the PCE Price Indexes, and personal income and spending.

When the economic highlight for the Aussie Day week is NAB’s December Business Survey, you can prep for an early break.

Business confidence remains soft and conditions are also easing. Weak household consumption is impacting on trading and profitability, according to CBA’s Harry Ottley.

“As the economy continues to slow, we expect business conditions to contract further… The surveyed cost and price measures within the survey will also be closely watched after picking up in November,” says CBA.

Central bank meetings in the EU, Canada and Japan will be the global highlights as anxious markets scan the horizon for any further hints of monetary policy changes.

The European Central Bank (ECB) and Bank of Canada (BoC) meetings will be economic events to watch closely after market optimism about lower rates has started to waver into the new year.

The first set of flash PMI surveys for 2024 will also be released on Wednesday, providing insights into economic conditions across major developed economies. Additional economic data will be in abundance, including the release of US Q4 GDP, core personal consumption expenditures (PCE) figures and various inflation updates across the globe.

US earnings will also add to some zing to movements on US markets.

US Q4 GDP is also due on Friday.

The Aussie Economic Calendar

Monday January 22 – Friday January 26

All sources: Trading Economics, IG Markets, S&P Global Market Intelligence

MONDAY

Nope

TUESDAY

Australia NAB Business Confidence (Dec)

WEDNESDAY

Nada

THURSDAY

Australia RBA Bulletin

FRIDAY

Markets closed

The Everyone Else Economic Calendar

Monday January 22 – Friday January 26

MONDAY

China (Mainland) Loan Prime Rate (Jan)

Malaysia Inflation (Dec)

Taiwan Export Orders (Dec)

Hong Kong SAR Inflation (Dec)

United States CB Leading Index (Dec)

TUESDAY

South Korea PPI (Dec)

Australia NAB Business Confidence (Dec)

Japan BoJ Interest Rate Decision

Japan BoJ Quarterly Outlook Report

Singapore CPI (Dec)

Taiwan Industrial Production (Dec)

Eurozone Consumer Confidence (Jan, flash)

WEDNESDAY

Japan au Jibun Bank Flash Manufacturing PMI*

UK S&P Global/CIPS Flash PMI, Manufacturing & Services*

Germany HCOB Flash PMI, Manufacturing & Services*

France HCOB Flash PMI, Manufacturing & Services*

Eurozone HCOB Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

New Zealand Inflation (Q4)

Japan Trade (Dec)

Thailand Trade (Dec)

Malaysia BNM Interest Rate Decision

South Africa Inflation (Dec)

Canada BoC Interest Rate Decision

THURSDAY

South Korea GDP (Q4, adv)

Hong Kong SAR Trade (Dec)

Germany Ifo Business Climate (Jan)

South Africa PPI (Dec)

Turkey TCMB Interest Rate Decision

Eurozone ECB Interest Rate Decision

United States Durable Goods Orders (Dec)

United States GDP (Q4, adv)

United States Wholesale Inventories (Dec)

United States New Home Sales (Dec)

FRIDAY

Australia, India Market Holidays

Japan BoJ Meeting Minutes (Dec)

United Kingdom Gfk Consumer Confidence (Jan)

Germany Gfk Consumer Confidence (Feb)

United States Core PCE Price Index (Dec)

United States Personal Income and Spending (Dec)

United States Pending Home Sales (Dec)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.