Traders’ Diary: Everything you need to know before the ASX opens

Via Getty

What grabbed the headlines last week?

If the ASX All Ordinaries (XAO) index was a Hollywood actor today, it’d be, let’s say… Giancarlo Esposito.

I’m not going to add a pic, and that’s the point.

Omnipresent, with the capacity to excel.

But without a memorable enough recent performance to be imprinted in the hippocampus.

After five days of toil last week, the XAO was exactly where it was a week ago, and still looking decidedly undecided on which path to take into 2024.

XAO: Much Ado About Nuthin’

And there was a lot happening.

Microsoft ended Friday back on top as the universe’s most valuable publicly traded company, surpassing Apple after momentarily doing the same a few days earlier.

Microsoft rose circa 3.2% for the week, bringing its market cap to $2.89 trillion, while Apple’s stock dropped by almost the same, giving it a modest $2.87 trillion valuation.

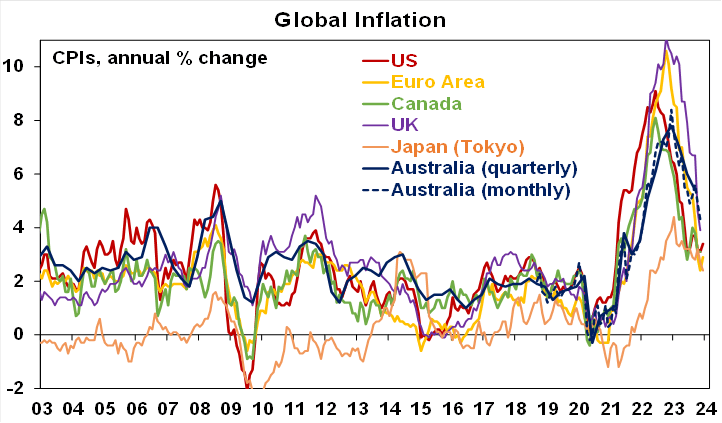

Inflation was everywhere. Surprising on the downside from Taiwan and The Philippines, to Poland and Norway.

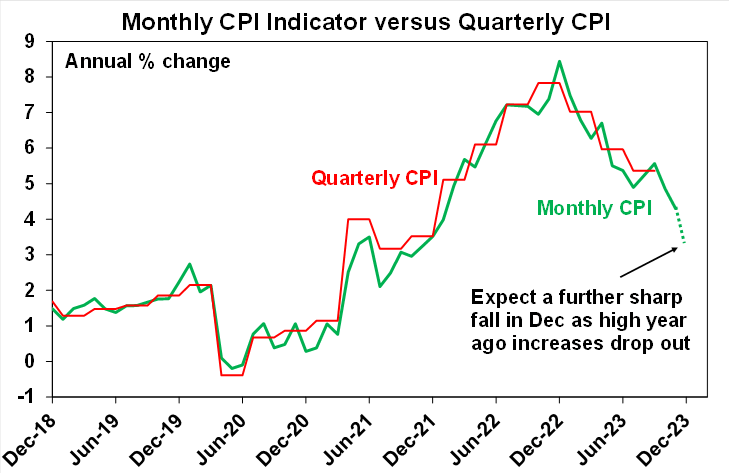

Aussie inflation came in lower then expected for a second consecutive month.

According to the Bureau of Stats, inflation fell to 4.3%yoy in November, against the spike in prices endured in November last across food, transport, petrol and travel which all came in lower and slower.

While Aussie prices are still rising at pace across rents, energy and insurance, they’re slower or falling for petrol, travel, food, clothing and the rest.

Last week, AMP chief economist Dr Shane Oliver told Stockhead that while there’s been a bit of angst that Australian inflation’s been higher than in the US and Europe, he says this mainly reflects the fact that it lagged on the way up by around 3 to 6 months.

“And so it’s lagging on the way down… and if it has fallen to around 3.3%yoy in December as we expect, then that will take it down close to US and European levels.”

“We expect December 2023 monthly inflation to fall to around 3.3%yoy as the 1.5% monthly surge in December 2022 (which was largely due to a 27% rise in travel costs) drops out of the annual calculation.”

In the US wholesale prices unexpectedly fell by 0.1% in December, a day after the US CPI which came in a wee bit hotter than economists were forecasting and investors betting.

Still Wall Street’s three major indices all ended the week higher.

The Dow added 0.35%, while the S&P 500 claimed 1.85%.

The tech heavy Nasdaq, driven by Nvidia, Microsoft and Meta ended the week more than 3% ahead.

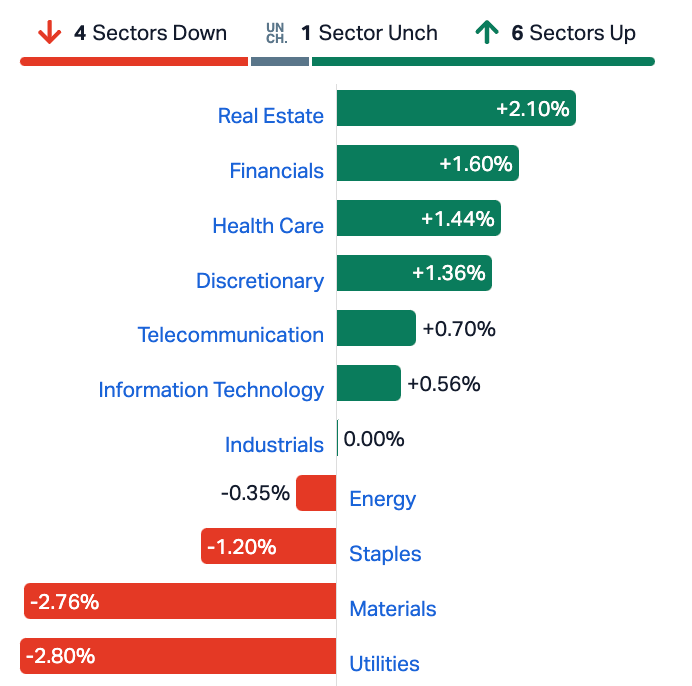

ASX Sectors Last Week

As the numbers for the XAO suggests, local markets weren’t set on fire last week. The Materials and Utilities Sectors weighed heavily.

Small caps on the ASX Small Ordinaries (XSO) have been overdue a decent run for some time now.

Room to Grow:

ASX Small Ordinaries (XSO) vs ASX200 (XJO)

The Week Ahead

Which brings us to business this week.

Economically, the week’s focus is in APAC, where an economic data dump of Chinese proportions is forecast for Wednesday.

It starts with GDP numbers for the mainland, followed swiftly by official reads on retail sales, industrial production and unemployment.

Recent Caixin PMI data showed that mainland China ended 2023 on a positive note as composite output growth rose to a seven-month high. This was with manufacturing output growing for a second straight month in December as new orders rose.

Japan’s December inflation read comes out on Friday.

The Americans kick off the week with a holiday. Wall Street will be shuttered on Monday for Martin Luther King Day.

After that they’ve got a date with December’s retail sales, some industrial production and the Michigan consumer sentiment report.

There’s Fed talk, US housing data NAHB foreign trade, the NY Empire State Manufacturing Index and the Philly Fed version of the same.

It’s the first full week of Q4 earnings season in the States. Stepping up early are more major banks – Morgan Stanley, Goldman Sachs, US Bancorp and Charles Schwab.

At home, we’ll get a look at December’s labour force report due out on Thursday.

According to the CBA, November’s release was a surprise result with an odd combo of strong employment growth, a record high participation rate and a lift in the unemployment rate to 3.9%.

For December the bank’s economics team expects a more modest lift in employment of 20k, the participation rate to remain at a record high of 67.2% and the unemployment rate to remain steady at 3.9%.

“We expect the labour market to loosen more materially in 2024.”

The Aussie Economic Calendar

Monday January 15 – Friday January 19

All sources: Trading Economics, IG Markets, S&P Global Market Intelligence

MONDAY

CommBank Household Spending (Dec)

TUESDAY

Australia Westpac Consumer Confidence (Jan)

WEDNESDAY

Nada

THURSDAY

Australia Employment Change (Dec)

Australia Unemployment Rate (Dec)

FRIDAY

Zip

The Everyone Else Economic Calendar

Monday January 15 – Friday January 19

MONDAY

United States Market Holiday

South Korea Trade (Dec)

Indonesia Trade (Dec)

India WPI (Dec)

Germany Wholesale Prices (Dec)

Germany Full Year GDP Growth (2023)

Eurozone Balance of Trade (Nov)

Eurozone Industrial Production (Nov)

Brazil Business Confidence (Jan)

Canada Manufacturing Sales (Nov)

TUESDAY

Japan PPI (Dec)

Germany Inflation (Dec, final)

United Kingdom Labour Market Report (Dec)

Germany ZEW Economic Sentiment Index (Jan)

Canada Inflation (Dec)

WEDNESDAY

Singapore Non-oil Domestic Exports (Dec)

China GDP (Q4)

China Industrial Production (Dec)

China Retail Sales (Dec)

China Fixed Asset Investment (Dec)

China Unemployment Rate (Dec)

United Kingdom Inflation (Dec)

Indonesia BI Interest Rate Decision

Eurozone Inflation (Dec, final)

Brazil Retail Sales (Nov)

United States Retail Sales (Dec)

United States Industrial Production (Dec)

United States Business Inventories (Nov)

THURSDAY

Eurozone Current Account (Nov)

United States Building Permits (Dec)

United States Housing Starts (Dec)

FRIDAY

Japan Inflation (Dec)

Malaysia Trade (Dec)

Germany PPI (Dec)

United Kingdom Retail Sales (Dec)

Canada Retail Sales (Nov)

United States UoM Sentiment (Jan, prelim)

United States Existing Home Sales (Dec)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.