Traders’ Diary: Everything you need to know before the ASX opens

Via Getty

What grabbed the headlines last week?

When we last left our erstwhile hero, the ASX200 (XJO) index, things were (aside from the Friday session last week) largely looking up…

On Monday morning in Sydney, the situation is not so green.

As you may recall, things got pretty real pretty quickly last week, both here and in the States…

ASX Sectors Last Week

Stocks in New York ended a volatile session flat on Friday, as US traders reassess their reassessments of the new, new path of US monetary policy. All three major indexes ended near the flatline, halting a nine-week win streak, with the Nasdaq 100 booking its sixth straight day of losses.

Basically, capping off last year with one of Santa’s particularly great rallies, guilty looking US markets smacked into a big old wall of doubt last week to usher in a new year of trade in an old way.

First, perhaps, the mission was just to lock in some of the meaty profits made on (largely) Mega-Tech Magnificent 7 trades after the Fed’s early December dovish pivot. But nine weeks of straight wins began to weigh heavily on the mood as the economic data into the end of last week proved enough of a mixed bag/poisoned chalice to put an early end to the fairy tale.

But the fairy tale was real, people.

It was certainly a corker of a year for Wall Street.

All three major indices ended December (and the year) on the kind of positive note Mariah Carey’s been flogging for the last 20 Christmases, with the S&P500 back near its best ever Information Technology, Communication Services, and Consumer Discretionary were the three biggest winners in 2023, all of them up more than 40% for the year.

Here’s a detailed look at how they all did in 2023.

2024: Game Off!

But that was then and this is 2024.

Last week, the new year’s first, the tech-heavy Nasdaq fell over 3%, while the S&P500 and the Dow Jones fell 1.59% and 0.60% respectively.

On the economic front, some decent US jobs growth, familiarly anxious US FOMC minutes and the pistons of a still pumping US economy churned up the old doubts about some of the overtly aggressive trading on the promise of rate cuts, while the euro area inflation profile should allow for ECB cuts in April, and China’s weakness could well trigger PBoC cuts later this month.

US economic data of a mixed variety put the brakes on any remaining Santa-berries. A larger than expected lift in non-farm payrolls (216k vs 170k exp), better than expected average hourly earnings (0.4% vs 0.3% exp) and an unchanged unemployment rate at 3.7% were offset by heaps of downward revisions on previous months and a larger than expected fall in private payrolls.

Providing further doubt, a slumpy-surprise in the December Services ISM.

The wash up, according to Tony Sycamore at IG Markets, being the probability of a 25bp Fed rate cut in March.

Chances there lengthening by the day, from 90% around Christmas, to 62% over the weekend.

Six 25bp cuts are priced for 2024, but if we learned anything last year – it’s that inflation’s a bitch.

Finally, Bitcoin gets a mention.

The crypto-king is back into jerky-volatile trading mode, currently higher at US$43,971.

Tony told Stockhead it’s still a bit too soupy to get a clear read on BTC and its brethren ahead of the SEC’s January 10 deadline for possible spot Bitcoin ETF approval.

“While we believe that SEC approval will support the Bitcoin price in the long run, we remain wary of a ‘buy the rumour sell the fact’ type reaction in the short term.”

The Week Ahead

Which brings us to business this week.

Economically, the week’s focus is on CPI in the US, Japan and in China.

Expectations for the US inflation data is for headline to bump higher to 3.3% YoY from 3.1% in November.

Core US CPI is expected to have eased during December, to 3.8% YoY from 4.0% in November 2023.

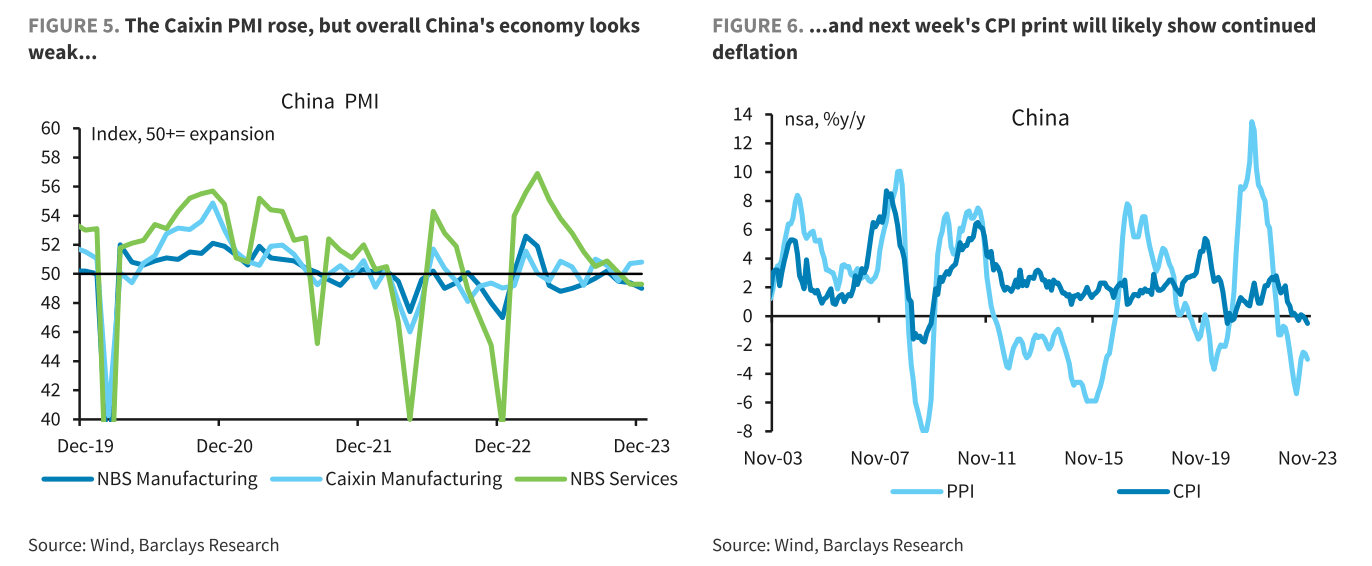

China’s uninspiring economic progress should trigger People’s Bank of China (PBoC) cuts this month, according to Barclays Research.

“We expect weaker growth momentum and persistent deflation to prompt a 10bp policy rate cut as soon as January.”

“The Q4 PBoC MPC meeting vowed to stimulate prices and that the exchange rate is less a constraint. A likely DPP election win in Taiwan implies heightened tension, but we see limited risk of a more serious turn.”

At home, the market moving economic events will be November’s retail sales and CPI read.

“The consensus expectation is for the Monthly CPI indicator to fall to 4.7% YoY from 4.9%. Should the trimmed mean (core) fall below 5%, it would confirm the rates market is on the right track looking for two RBA rate cuts in 2024,” Tony says.

The Aussie Economic Calendar

Tuesday January 8 – Friday January 12

All sources: Trading Economics, IG Markets, S&P Global Market Intelligence

MONDAY

Nada

TUESDAY

Building Permits Nov (Preliminary)

Retail Sales Nov (Preliminary)

Private House Approvals Nov (Preliminary)

WEDNESDAY

Monthly CPI Indicator Nov

THURSDAY

Balance of Trade Nov

FRIDAY

Home Loans Nov

Investment Lending for Homes Nov

The Everyone Else Economic Calendar

Monday January 8 – Friday January 12

MONDAY

Monday 8 Jan

Germany Trade (Nov)

Switzerland Inflation (Dec)

Eurozone Economic Sentiment (Dec)

Eurozone Retail Sales (Nov)

United States Consumer Inflation Expectations (Dec)

United Kingdom KPMG/REC Report on Jobs* (Dec)

Global Metal Users and Electronics PMI* (Dec)

TUESDAY

Japan Household Spending (Nov)

Japan Tokyo CPI (Dec)

Australia Building Permits (Nov, prelim)

Switzerland Unemployment (Dec)

Germany Industrial Production (Nov)

France Balance of Trade (Nov)

Taiwan Trade (Dec)

Italy Unemployment Rate (Nov)

Eurozone Unemployment Rate (Nov)

Mexico Inflation (Dec)

Canada Trade (Nov)

United States Trade (Nov)

S&P Global Investment Manager Index (Jan)

WEDNESDAY

South Korea Unemployment (Dec)

China (Mainland) M2, New Yuan Loans, Loan Growth (Dec)

Philippines Trade (Nov)

Turkey Industrial Production (Nov)

France Industrial Production (Nov)

THURSDAY

South Korea BoK Interest Rate Decision

Malaysia Industrial Production (Nov)

South Africa Manufacturing Production (Nov)

Brazil Inflation (Dec)

Mexico Industrial Production (Nov)

United States CPI (Dec)

United States Initial Jobless Claims

United States Monthly Budget Statement (Dec)

FRIDAY

Japan Current Account (Nov)

China (Mainland) CPI, PPI (Dec)

United Kingdom monthly GDP, incl. Manufacturing, Services

and Construction Output (Nov)

France Inflation (Dec, final)

India Industrial Production (Nov)

United States PPI (Dec)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.