Traders’ Diary: Everything you need to know before the ASX opens

Via Getty

What grabbed the headlines last week?

On Friday, the ASX ended trading for 2023 on an entirely unsurprising low note, down by -0.3%.

- Via MarketIndex

Unspectacular, even in failure.

It’s not criticism, just a little whingeing as the benchmark ASX200 did in fact put in a rally Santa could be proud of over December, up by +8.21% which added heaps of icing to 2023’s final rise.

Basically, up +8.13 for the year, it’s December and Santa which got us well over the line.

ASX Sectors Last Week

On Friday, local shares tracked gains on Wall Street, as they have all year but without any of the American gusto which has lifted the S&P500 to within cooee of its record best.

Me mate Edward Scissorbrains Sunarto reports that a fair few analysts now believe next year could be even better in the states for epic equity as the ‘Magnificent Seven’ — Apple, Amazon, Alphabet, Meta, Tesla, Nvdia, Microsoft — are expected to post over 20% earnings growth in 2024.

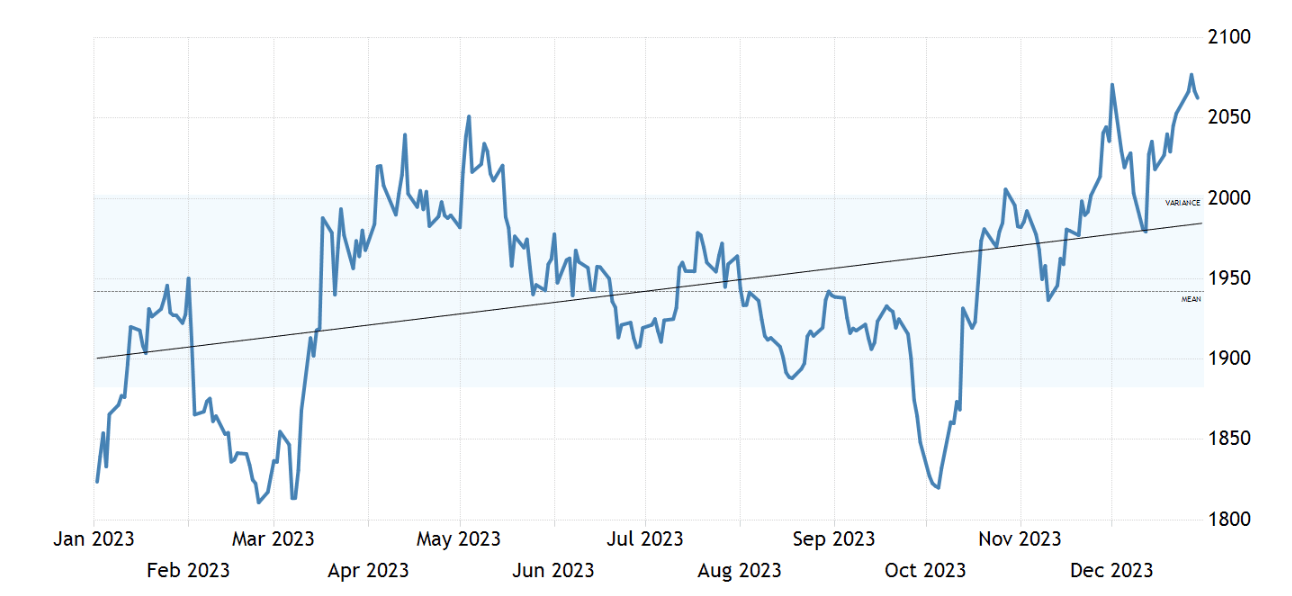

Gold finished the year at US$2,063 an ounce, clambering about +13% higher in 2023 on the blood of its enemies (safety, security, certainty, lower rates and a decent USD) for its first yearly gain in 3.

Gold cracked a new record high last year, mostly supported by hopes central banks will begin stomping on interest rates.

The US Federal Reserve is now thought to kick off an easing cycle for cash as soon as March after end-year signals inflation has topped out.

Geopolitical tensions and the levelling of the Gaza Strip in the Middle East added furl to the safe-haven’s fire buying.

A Golden Year for Gold

The Week Ahead

Very quiet at home as the year begins with a wee pop, rather than at DefCon 5. The NFP report and Eurozone CPI will be the week’s focal point for global markets.

CoreLogic are out and about early with home prices, while the RBA mails in an always useful chart pack. Full of charts from December and the previous quarter. Me likee.

In the States, equity and bond markets get back into business tonight, (Sydenham time, Tuesday in New York) after taking Monday for the New Year.

Calendar 2024 trading on Wall Street kicks off for real with the latest slew of US jobs data, the absolute highlight of a holiday-quashed week, once the trickle of investors turns into a flood.

The US Bureau of Labor Stats drops Job Openings on Wednesday, the market expecting a slight monthly rise.

On Friday the number crunchers roll out December employment data. US unemployment is expected to come in at 3.8%, up from 3.7%.

Also on Wednesday, the Federal Open Market Committee will release the minutes from its mid-December monetary-policy meeting.

Canadian employment and Chinese PMIs might attract attention too.

The Aussie Economic Calendar

Tuesday January 2 – Friday January 5

All sources: Trading Economics, IG Markets

MONDAY

Done

TUESDAY

Nope

WEDNESDAY

RBA Chart Pack

CoreLogic Dwelling Prices MoM

THURSDAY

Judo Bank Services PMI / Composite PMI Final DEC

FRIDAY

Nope

The Everyone Else Economic Calendar

Tuesday January 2 – Friday January 5

MONDAY

Done

TUESDAY

China Caixin Manufacturing PMI DEC

EU HCOB Manufacturing PMI Final DEC

EU Loans to Companies / Households YoY NOV

UK S&P Global/CIPS Manufacturing PMI Final DEC

WEDNESDAY

CA S&P Global Manufacturing PMI DEC

US S&P Global Manufacturing PMI Final DEC

US Construction Spending MoM NOV

US 3-Month / 6-Month / Bill Auction / MBA 30-Year Mortgage Rate DEC

US MBA Purchase Index DEC

THURSDAY

US Redbook YoY DEC

US ISM Manufacturing PMI DEC

US JOLTs Job Openings NOV

USnISM Manufacturing Employment DEC 45.8 46

US FOMC Minutes

CN Caixin Services PMI DEC

CN Caixin Composite PMI DEC

UK BoE Consumer Credit NOV

UK Mortgage Lending NOV

GB S&P Global/CIPS Services PMI Final

FRIDAY

US Jobless Claims DEC

CA S&P Global Composite PMI DEC

CA S&P Global Services PMI DEC

US S&P Global Composite / Global Services PMI Final DEC

GB Halifax House Price Index MoM DEC 0.5% 0.1%

GB New Car Sales YoY DEC

GB S&P Global/CIPS Construction PMI DEC

EU HCOB Construction PMI DEC

EU Inflation Rate YoY Flash DEC

EU PPI NOV

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.