Traders’ Diary: Everything you need to know before the ASX opens

All the hard truths for the week ahead. Via Getty

What grabbed the headlines last week?

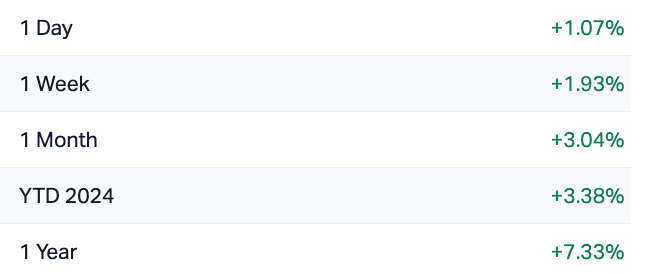

The Aussie benchmark ended above and beyond 7,800 points for the very first time on Friday.

The ASX200 called it a day on 7,847.0, ahead 1.1% for the session and 1.9% for the week.

The broader All Ords found 1% but is tracking the benchmark almost blow for blow.

From whence came these gains?

Headstrong and volatile, the European Central Bank president Christine Lagarde has been a rock upon which the complaints of higher interest rates have been ceaselessly breaking all this cycle. Never mind the Sex Pistols, nor the US Federal Reserve chair Jerome Powell – if you want to see a hawk be hawkish, then Christine is your central banker.

Until sometime Thursday in Brussels when she held rates steady and struck a far more dovish pose.

Here’s a picture:

Then it was congressional testimony by J Powell which has seen a distinct repricing in market expectations with regards to the Fed’s future interest rate path.

US investors now see a June cut as surely a shoe-in.

There’s also something for China to feel less morose about – on Friday consumer prices actually rose by 0.7% yoy in February, well above market forecasts of 0.3% and a seriously good turnaround from the most calamitous drop in over 14 years of 0.8% from just a month before.

It was the first CPI increase since last August due to robust spending during the Lunar New Year holiday. Food prices fell the least in eight months while non-food inflation sharply accelerated.

That said, China’s producer prices fell a few hours later by 2.7% yoy for the same period. It was the 17th straight month of contraction in factory gate prices.

Anyway, the Chinese National People’s Congress (NPC) was the main act in Beijing last week and there was some acting and only modest signs of some useful macro stimulus.

Premier Li Qiang announced China’s annual economic growth target for this year would be “around 5%” with inflation “around 3%” which were unchanged from last year and may well be fudged to greater degree than usual these days.

Not cryptic lately…

I suppose we should also acknowledge that it’s been a landmark for weeks for Bitcoin and the crypto market in general.

Tuesday last, saw BTC mount a successful incursion above $US69k, planting a flag at $69,202. That’s one of many records to tumble last week.

Peter McGuire told Stockhead the US regulator’s tacit approval of spot-Bitcoin ETFs has delivered some backbone again to crypto.

“In less than two months after Wall Street’s embracement of digital currencies, Bitcoin stormed to a fresh record high even though most analysts were expecting this to occur after the halving event in April.”

Meanwhile, rate cut bets have been drastically scaled back compared to the beginning of the year, but Bitcoin investors look unhindered.

“Right now, it seems that the institutional money that found its way into the volatile crypto space is here to stay. Considering that Bitcoin is trading near all-time highs, the majority of those who have invested in it are currently in gains, which could open the door for a huge wave of profit taking.

“However, we saw that this has not been the case so far as the price recovered immediately from its post-record-high slump, indicating investor trust in longer-term prospects.

Pete says the adoption by big Wall Street names has helped with “transparency, legitimacy and liquidity.”

“What remains to be seen though is whether cryptos can exhibit any form of intrinsic value.”

At home…

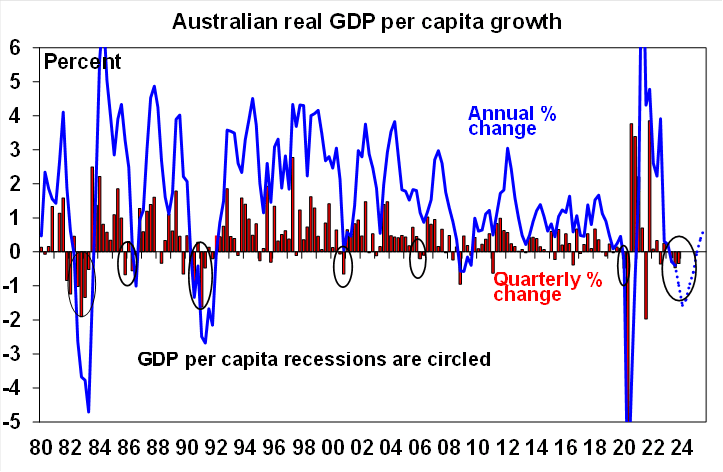

So December quarter GDP came in roughly in line with market expectations. But consider this – were it not for the record burst of immigration and thusly population growth the Aussie economy would have gone backwards.

Consumer spending is up just 0.1% over the last year, which is below RBA forecasts for a 0.4% rise.

Good time for a rate cut, one would reckon the experts would reckon.

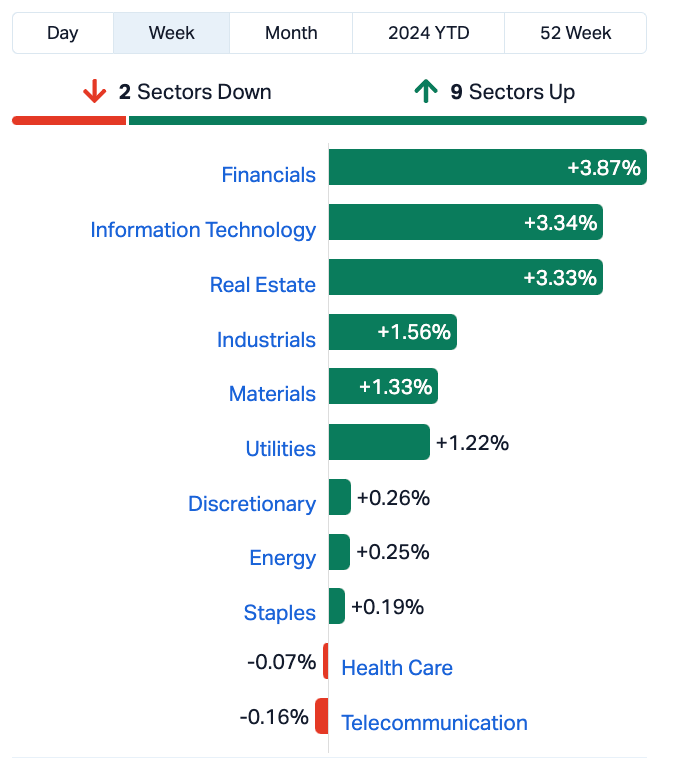

Gains on the local benchmark last week were led by IT and Financial stocks. The Property Sector also added 3.33%

How the Sectors fared last week

On Wall Street last week

Wall Street finished lower after a choppy session on Friday, as prickly US investors reacted to a mixed jobs report by booking some rather rotund profits in the AI/tech/Nvidia (NVDA) universe where the latest supernova-ing of US market first began and will likely end.

The American economy added a casual 275K jobs in February, smahing analyst estimates of 190K. At the same time, the unemployment rate moved up to 3.9% vs. the expected 3.7% figure.

For the week, the Nasdaq slipped 1.2%, while the Dow Jones and S&P500 fell 0.9% and 0.3%, respectively.

The 30-stock Dow is still the laggard, down 0.11%.

The Week Ahead

The upcoming week on the US is headlined by the February CPI report, alongside retail trade, industrial production, and the preliminary reading of Michigan consumer sentiment for March.

Headline inflation is poised to remain unchanged at 3.1% in February, while the core rate is expected to dip to 3.7%, its lowest level since April 2021, according to eToro market analyst Josh Gilbert.

“As we approach the March 12 release of the US February CPI data, markets are on edge, anticipating another possible surge in inflation figures.”

This data proceeds the much-awaited March 20 US Federal Reserve meeting and these numbers could set the tone for the Fed’s monetary policy decisions. Inflation trends have been quite volatile, peaking mid-2022 before dipping, and now potentially on the rise again.

“Should recent data be indicative, we may see annual rates hovering near – or surpassing – 3%, diverging from the Fed’s 2% target.”

On a month-over-month basis, both headline and core rates are anticipated to advance by 0.4% and 0.3%, respectively.

Some focus will also be given to US producer and foreign trade prices, business inventories, the government’s monthly budget statement, and the NY Empire State Manufacturing Index.

In China, the focus will be on the People’s Bank of China’s 1-year medium-term lending facility rate call, and there’s growing anticipation of a possible rate cut.

Also, we get to enjoy the full impact of the Lunar New Year holidays on new loans. Additionally, the house price index could be curious to painful.

In Tokyo, the final estimate drops for GDP growth in Q4. Then round the ‘hood, we’ve got trade data from the Philippines and Indonesia.

In the UK, they’ll be trying to fix their cricket team and watching for monthly GDP data, industrial production, trade figures, and a jobs report – all except the first will speak to Britain’s wrestle with inflation.

Germany, France, and Italy have inflation data.

Oh. Wait. Industrial activity in the EU is expected to decline following two straight months of growth.

At home, we’ve got NAB to thank for its mesmerising business confidence index which will say something asbout business confidence. And sentiment.

The Aussie Economic Calendar

Monday March 11 – Friday March 15

All sources: IG Markets, S&P Global Market Intelligence, CommSec

MONDAY

Nope

TUESDAY

NAB Business indewx

WEDNESDAY

Nothing

THURSDAY

Niente

FRIDAY

Nada

The Everyone Else Economic Calendar

Monday March 11 – Friday March 15

MONDAY

Jpn Q4 GDP

Chn Feb new loans, CNY

TUESDAY

BoE speak

WEDNESDAY

EU Jan industrial production

UK Jan monthly GDP

THURSDAY

US Feb retail sales

US Feb PPI

US Initial jobless claims

FRIDAY

US Feb industrial production

Fed Empire state index

Feb import price index

Mar Uni. of Michigan sentiment

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.