Traders’ Diary: Everything you need to know before the ASX opens

Via Getty

What grabbed the headlines last week?

Largely happy US inflation data last week – the US PCE came in as expected – has pretty much left everyone including The Chaps at The Fed on track to cut rates from around mid-year. There is relief and a rally.

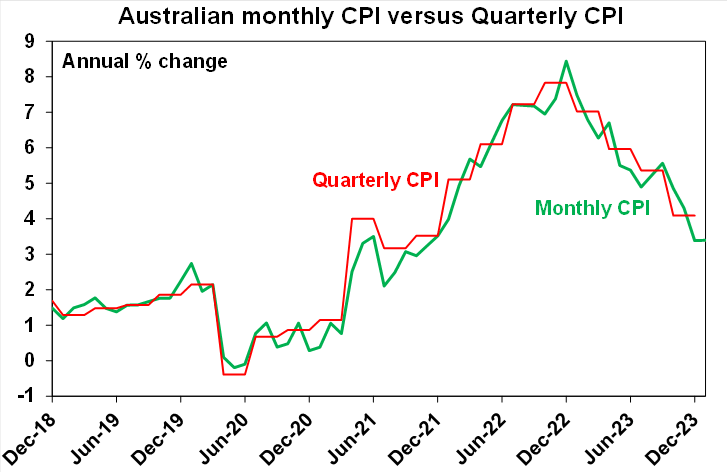

At home, Australian inflation actually looks like it’s falling faster than Team RBA have been hoping for.

Soft retail sales last week provided “further reason to ignore the RBA’s hawkish bias” in their latest statement, says City Index market analyst Matt Simpson.

The January monthly CPI came in weaker than expected, holding at 3.4% year-on-year and the underlying measures also falling slightly.

Here’s a picture:

So the only thing inflating at a surprise rate last week were global equity markets.

Wall Street, the Eurozone and Japanese shares all clocked new record highs during the week, while the ASX200 stomped in for some of that action on Friday.

For the week US shares rose 0.9%, Eurozone shares rose 0.4% and Japanese shares rose 2.1%. Chinese shares rose 1.4% on hopes for more policy stimulus.

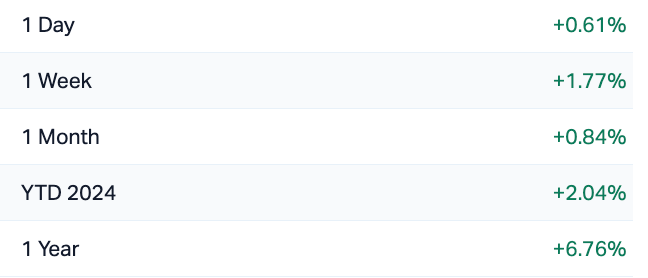

The local benchmark index added a Stormin’ Norman sized 1.8% for the week, with impetus drawn from the giddy and upbeat global sentiment, a surprisingly-not-terrible earnings season laden with future promise.

The dormant local resources sector also peered above the parapets of lower commodity prices after a pretty quiet 2024.

James Gerrish of Shaw and Partners and Market Matters notes the manufacturing data from China was slightly better than expected on Friday and that also helped the local miners rally, with iron ore majors rising despite the itchy and scratchy nature of iron ore futures. BHP added 2.25% on Friday.

And the ASX usually comes home with a wet sail when that happens.

“We’ve spoken about the resources needing to join the move, and if they did, the ASX200 could quickly be at 8000,” Gerrish says.

“So far so good – with the market only ~3% away.”

On the whole, the broader All Ords (XAO) earnings estimates have been revised lower, but being a resources heavy market, the main cause of that is weaker global commodity prices.

Everything else seems to be working pretty good, and TBFH, I read somewhere something about… past performance being no guarantee of future results…

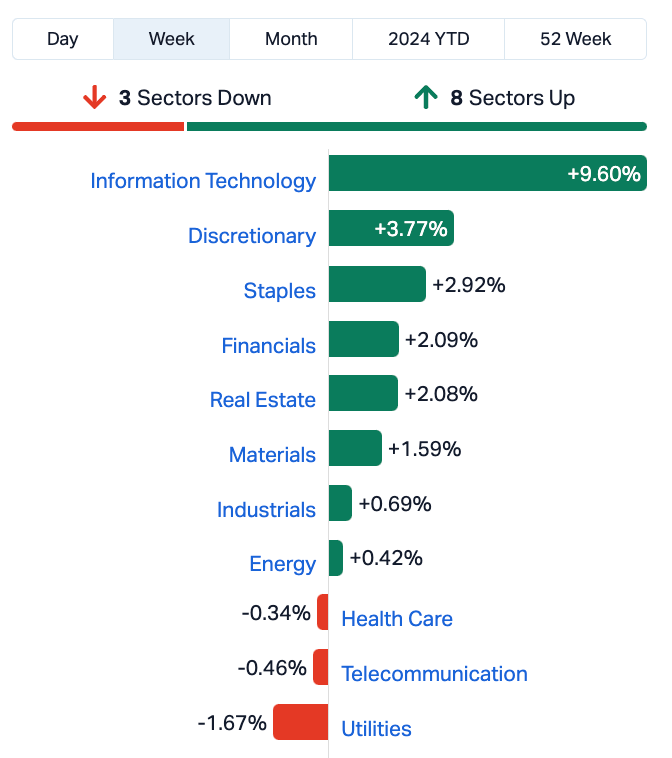

The strong Friday session which led to the new record highs – and the sixth weekly gain from seven attempts – was in large part a domestic driven event with Materials adding 2% and Energy finding 1% by the end of the session. The combo outstripped another fabulous run for local IT – an ongoing solo standout – up 1.9% on Friday, to end the week a lazy 9.6% higher.

What the (ASX200) benchmark’s been doing lately

Gains on the benchmark were led by IT, consumer stocks, property and the banks and insurers.

While oil and gold prices rose, copper and iron ore fell, but Materials made something of a comeback aided and abetted by the return of hope in lithium stocks.

How the Sectors fared last week

Bond yields rose in Europe, were flat in Japan but fell in the US and here in Aussie.

According to CoreLogic, February’s 0.6% gain in Australian house prices is the fastest pace of growth since October. While CoreLogic’s head of numbers Tim Lawless is cautious on the outlook, the boffins at UBS reckon house prices should rise somewhere between 3% and 5% this year.

With stretched valuations and positive investor sentiment share markets remain at risk of a short term pullback but are still managing to grind higher helped by a combination of mostly OK economic and earnings news, ongoing expectations for rate cuts and enthusiasm for AI.

While Australian shares are lagging partly because of their little exposure to AI they are still managing to benefit from stronger global markets, prospects for RBA rate cuts later this year and the earnings reporting season being out of the way without major mishaps.

On Wall Street last week

The Nasdaq Composite swooned to an all-time high Friday, surpassing its 2021 record, as investors bet that megacap technology stocks were the best way to play slowing inflation and a coming artificial intelligence boom.

The tech-heavy advanced 1.14% to 16,274.94, clocking a new high of 16,302.24 during the session.

A day earlier, the index closed at its first record since November 2021.

The fatter S&P 500 added 0.80% to 5,137.08 for its first close above the 5,100 threshold. The Dow Jones Industrial Average gained 90.99 points, or 0.23%, to 39,087.38.

Everyone’s fave chipmaking monster Nvidia, which has led the tech rally by surging more than 260% over the last 12 months, was up another easy 4% Friday.

Meta also jumped more than 2% for the day.

For the week, the Nasdaq added 1.74%, while the S&P 500, which also popped to a record close on Thursday, advanced 0.95%. Both indexes notched their seventh positive week over the last eight.

The 30-stock Dow is the laggard, down 0.11%.

Can BTC keep its head?

Bitcoin went on a roll last week, surging toward its all-time high and racking up its biggest monthly gain since December 2020, Josh Gilbert, market analyst at eToro told Stockhead.

“The reigning star of the crypto market recently touched a new peak, reaching AU$98,000 as the crypto asset surged as high as US$64,000, just shy of the record-high $69,000 it hit in 2021,” says Josh.

The latest bull run, which saw its market cap jump to a staggering $1.2T, was fueled by several factors, including the spot Bitcoin ETF boom that opened the door for mainstream investors and an upcoming halving event.

“Bitcoin ETFs have piqued interest on a massive scale, with their substantial trading volumes and billions of dollars of inflows highlighting the increasing trend of institutional investors wanting exposure to Bitcoin.

“A supply squeeze accompanies the increase in demand, too. Investors continue to hold their Bitcoin rather than spend, with 70% of all Bitcoin in circulation currently not having moved in over a year, and the amount readily available for purchase on exchanges is at the lowest level since early 2018. The biggest financial institutions in the world, such as BlackRock and Fidelity, are not just observing this trend, but also actively participating, purchasing Bitcoin in significant volumes.”

Upcoming events like the Bitcoin halving and mid-year rate cuts, continued inflows into ETFs, and revived retail interest could potentially propel the bull market into six-figure territory.

“In this scenario, it’s easy for investors to feel FOMO,” Josh warns.

“However, it’s important to remember your risk profile and understand that Bitcoin is still a volatile asset class that has a history of wild price fluctuations.”

The Week Ahead

The highlight in Australia this week will be the December quarter National Accounts, with Business Indicators and the Balance of Payments data both dropping beforehand.

The Reserve Bank meets across the 18-19th March to determine rates and investors will watch Q4 GDP for smoke signals.

Predictions from the RBA indicate it’s likely to remain subdued, reflecting the continuing concerns around cost of living and interest rates and CBA expects the release on Wednesday to confirm this.

“Our preliminary estimate is for GDP growth of 0.2%/qtr and 1.4%/yr. We will firm up our estimate after the remainder of the partial data released on Monday and Tuesday,” says Belinda Allen.

Over at Westpac, senior economist Andrew Hanlan expects a ‘flattish quarter’ for national output.

“A view informed by significant weakness in hours worked and likely declines in both goods imports and goods exports, as well as a softening of private business surveys.

“We assess that the domestic demand growth pulse is likely weakly positive for the quarter,” he adds.

In the states, the Americans have a January labor report and a whole bunch of Fed-speaking officials, including Chair J. Powell’s half yearly monetary policy chat with Congress.

There’s US indicators like the ISM Services PMI, JOLTS job openings, factory orders.

Aside from ours, there’s trade data for other major global exporters such as Germany, Brazil, France, China, and Canada to be watched closely, along with services PMIs for China, Spain, Italy, and Brazil.

This week in China is all about the key National People’s Congress, in the shadow of a services PMI which delivered a big rebound – albeit courtesy of the Lunar New Year spending boost.

Unemployment still looks shot and China’s generally subdued outlook makes a sustained rebound muchos unlikely.

The continued drop in construction PMI means property remains a key risk. The NBS manufacturing PMI remained stuck in contraction.

Chinese inflation data is due and – considering the spotlight will be on the political circus this week – one can almost bet the apartment in Shanghai that deflation miraculously eased in February when compared to January.

And the timing of the Lunar New Year excitement can happily explain whatever decent number comes up.

The European Central Bank (ECB) get together on Thursday and Ms Lagarde and her lackeys are widely expected to leave interest rates unchanged. I would. She’s the boss.

Her assessment that the EU economy is weak and that EU inflation is decelerating aligns with Christine’s instruction that more evidence is needed on slower wages before rates are cut.

CBA’s senior economist Belinda Allen says this is likely to occur in June.

The Bank of Canada is also expected to leave rates unchanged. The statement will be important to watch for how much longer the restrictive stance will be maintained. Both the US and Canada release labour market data at the end of next week.

The Aussie Economic Calendar

Monday March 4 – Friday March 8

All sources: IG Markets, S&P Global Market Intelligence, CommSec

MONDAY

Building Approvals, Jan

Business Indicators, Q4 23

Company profits

Inventories

Melbourne Institute Inflation YoY

TUESDAY

Balance of Payments, Q4 23

Current account balance

Net exports contribution

Judo Bank PMIs

WEDNESDAY

GDP drops

THURSDAY

Lending indicators, Jan

Goods, trade balance

FRIDAY

Nada

The Everyone Else Economic Calendar

Monday March 4 – Friday March 8

MONDAY

KR S&P Global Manufacturing PMI FEB

Turkey Inflation Rate FEB

TUESDAY

US Fedspeak (Harker)

KR GDP Growth Rate Final Q4

GB BRC Retail Sales Monitor FEB

JP Jibun Bank Services PMI Final FEB

CN Caixin Services PMI FEB

CN National People’s Congress begins

WEDNESDAY

KR Inflation rate

US S&P Global Composite PMI Final FEB

US S&P Global Services PMI Final FEB

US ISM Services PMI FEB

US Factory Orders MoM JAN

US RCM/TIPP Economic Optimism Index MAR

US Fedspeak (Barr)

US API Crude Oil Stock Change

Germany Balance of trade

GB Spring Budget 2024

CN National People’s Congress

THURSDAY

US ADP Employment Change FEB

CA BoC Interest Rate Decision

US Fed Chair Powell Testimony to Congree

US JOLTs Job Openings JAN

US EIA Crude Oil Stocks Change MAR

US EIA Gasoline Stocks Change MAR

US Fedspeak (Daly)

CN Balance of Trade JAN-FEB

Germany Factory Orders JAN

FRIDAY

EU ECB Interest Rate Decision

CA Balance of Trade JAN

US Balance of Trade JAN

US Initial Jobless Claims MAR

US Fed Chair Powell Testimony

US Fedspeak Mester

JP Current Account JAN

DE Industrial Production JAN

Germany PPI Jan

FR Balance of Trade JAN

EU Employment Change Q4

GDP Growth Rate

US Fedspeak (Williams)

CN National People’s Congress

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.