Traders’ Diary: Everything you need to know before the ASX opens

Last week was weird. Best not dwell. Via Getty

What grabbed the headlines last week?

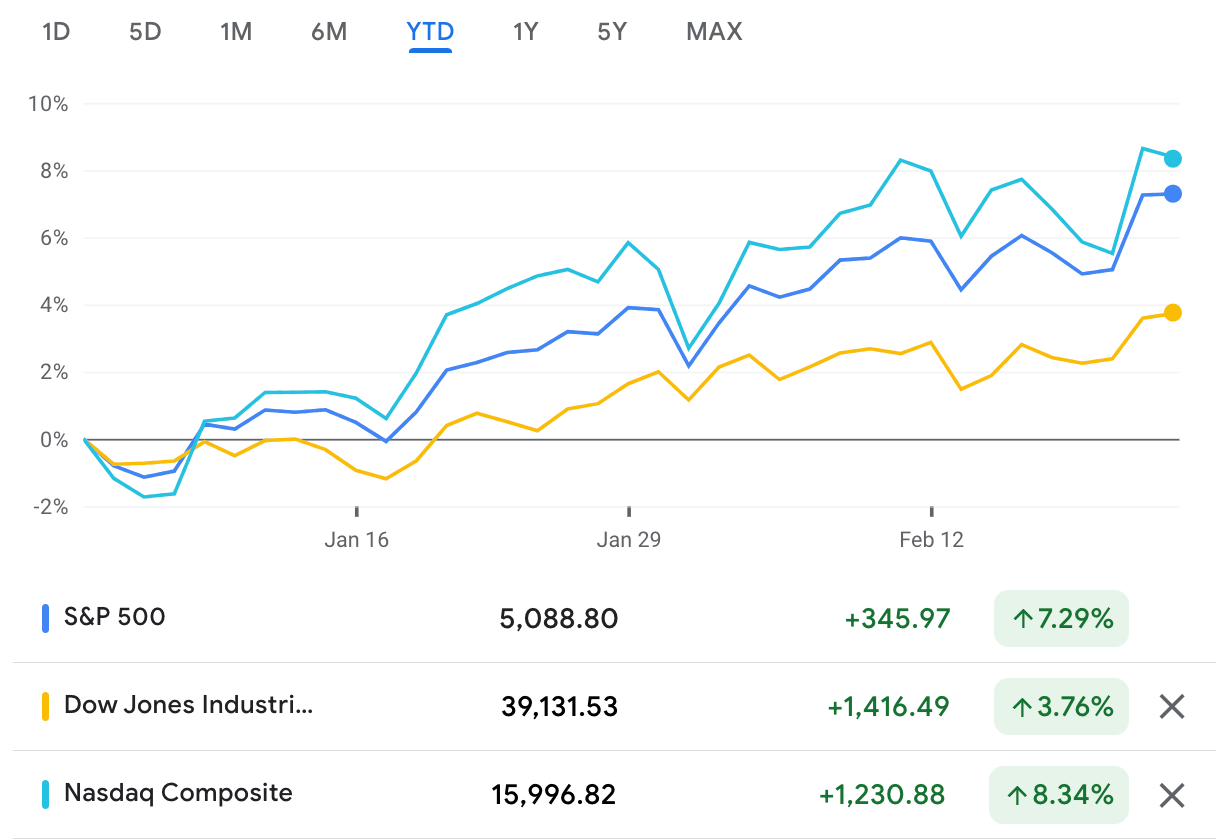

Some anxious notes on the Fedspeak song sheet and guilty euphoria around Nvidia (NVDA) earnings drove global markets last week.

Without much actual guidance on the data front, US stocks ended the shortened – but memorable – week muddled.

In the middle somewhere, Nvidia’s cracking earnings report spawned fresh records on Wall Street.

There were more gains for the Dow Jones but some jittery big tech profit-taking and another flat tyre for Tesla (TSLA) punctured the Nasdaq

The S&P500 hit 5100 for the first time, but woke the next morning looking pale and sickly at what it’d done the day before.

Unbridled enthusiasm for AI (Artificial Intelligence) remains the driver and the anxiety for the Us majors, thrown into sharp relief by the moneybags on display last at AI chip making monster NVDA, offsetting the bummer about the US Fed being unlikely to cut interest rates apace..

For the week US shares rose 1.7%. EU stocks were up too Japanese shares rose 1.6% and finally made it past their 29 December 1989 bubble years’ high. They also went into recession.

Still. Evwn the Chinese traders managed to pause the slow-mo train wreck long enough for the CSI 300 to rise by an unfamiliar 3.5% for the week as easing measures gained traction.

Despite the positive global lead Australian shares fell 0.2% for the week.

The IT and Utilities rose nicely, not quite offsetting losses for Resources, and Consumer Staples.

The minutes from the last Fed meeting reiterated that it is seeing progress in reducing inflation but wants more evidence that it will be sustained and is wary about moving too quickly to cut rates with stronger economic activity data lately providing them with flexibility.

The planned deluge of Fedspeak last week hammered this home (to anyone listening).

The RBA minutes from February repeated the old RBA adage that the Board could’ve hiked (but didn’t) and kinda now sees the risks to the outlook easing supporting the forecast that inflation will return to target but ’till then retains a mild tightening bias whereas the Fed and ECB are more neutral.

There is nothing new in any of this, says Shane Oliver Head of Investment Strategy and Chief Economist at AMP, but it does serve as a reminder that we still have a way to go in terms of actually seeing rate cuts and market expectations have consequently become more tempered as a result.

”And reflecting the lag in inflation in Australia compared to other countries, the RBA is not surprisingly still lagging the Fed and will likely do so when it comes to starting to cut rates.

”While the road to lower inflation is likely to remain bumpy, we continue to see sufficient progress such that the Fed and ECB will cut rates around five times this year starting in the June quarter and the RBA will cut by around three times starting mid-year,” Dr Oliver says.

Last week also saw local annual wages growth (that read was in the December quarter) rise at its fastest pace since 2009, resulting in the first rise in real wages since 2021. That was less helpful for the RBA, although Dr Oliver reckons that might already be peak wage growth for the moment.

”We would concede that the risk in Australia is that the cuts could start a bit later around August/September.”

Aussie 1H Earnings in 20 seconds

Local earnings wrap it all up this week – yet there’s still about 40 or so blur chips yet to show their cards.

In the Financial Sector – there’s major insurer NIB Holdings (ASX:NHF) and Suncorp Group (ASX:SUN) ; Retailers it’s Coles Group (ASX:COL) and and Harvey Norman Holdings (ASX:HVN) ; Healthcare has Ramsay Health Care (ASX:RHC) while Woodside Energy Group (ASX:WDS) and Worley (ASX:WOR) lead out the resources and industrial clans.

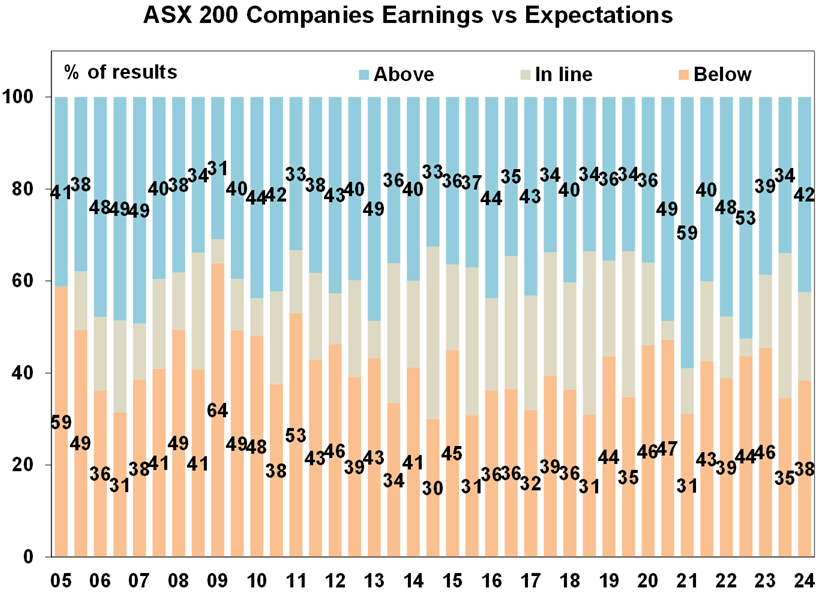

So with 1H reporting season circa 80% done, the scoreboard is less pleasing to the eye…

The fiery start has cooled right off off a bit with the level of companies beating earnings expectations now just a smidge better than average.

According to research at AMP, beats so far have beaten misses – but that ratio’s tightened with 42% of results surprising on the upside with 38% startling on the downside, which is only just a bit better than the long-term average for both of around 41%.

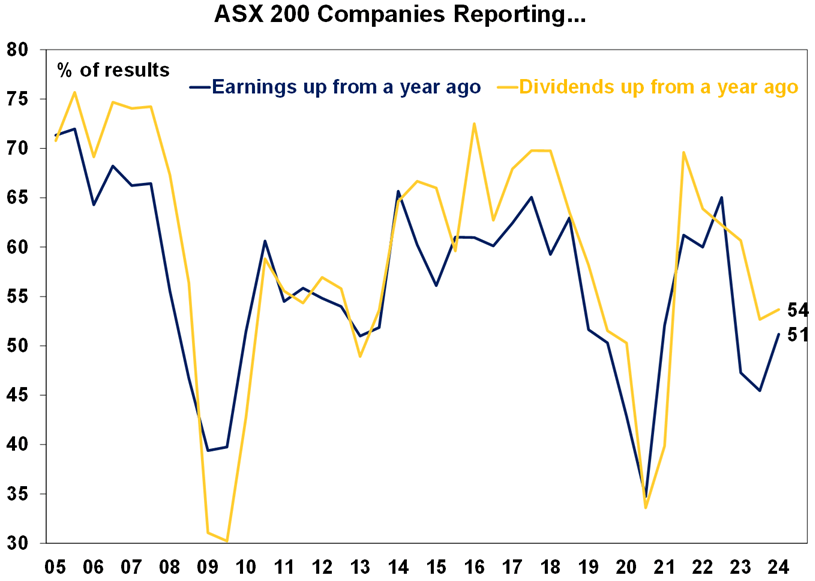

54% of companies have increased their dividends on a year ago which is up a bit from last week but it’s below the norm of 59% and a greater than usual 32% have cut their dividends, which overall suggests a degree of caution.

The Week Ahead

So in the states, with Wall Street’s own interminable earnings season finally winding down, attention this week returns to the battle that matters most – economic growth vs inflation.

The focus this week falls on US January core PCE, personal spending, consumer confidence and home prices.

As of the weekend the US rates market is pricing in a 68bp of rate cuts for 2024 – from 167bp in early January.

I’ll be wathing for signs of sense from the baffling US Congress this week, which among many other simple tasks needs to SORT out the now usual spending package problems – they’ll need to drop some sort of resolution to authorise spending and avoid the now familiar partial government shutdown – this one’s from 1 March.

The EU drops inflation data for February. Japan drops inflation for January.

China probably very reluctantly will share business conditions PMIs for February.

January is already up for its CPI post-mortem on Wednesday. We also have December quarter construction spending, business investment iand January retail sales.

Shane says CoreLogic data for February which drops this week will likely show a 0.6% gain in Australian home prices, up from 0.4% in January, as the prospect of rate cuts ahead and the shortage of supply continue to offset the negative impact of high mortgage rates.

The Reserve Bank of New Zealand (Wednesday) is expected to leave its cash rate on hold at 5.5%. I am not expecting to be engaged.

The Aussie Economic Calendar

Monday February 26 – Friday March 1

All sources: IG Markets, S&P Global Market Intelligence, CommSec

MONDAY

Nope

TUESDAY

Nada

WEDNESDAY

Construction done

Monthly CPI Indicator, Jan

THURSDAY

Retail Sales (Jan, prelim)

Capex, Q4 23

RBA Private Sector Credit, Jan

FRIDAY

CoreLogic House prices

The Everyone Else Economic Calendar

Monday February 26 – Friday March 1

MONDAY

Thailand Market Holiday

Singapore Industrial Production (Jan)

United States New Home Sales (Jan)

TUESDAY

Japan Inflation (Jan)

Germany GfK Consumer Confidence (Feb)

France Consumer Confidence (Feb)

Taiwan Export Orders (Jan)

Hong Kong SAR Trade (Jan)

United States Durable Goods Orders (Jan)

United States S&P/Case-Shiller Home Price (Dec)

United States CB Consumer Confidence (Feb)

WEDNESDAY

Taiwan Market Holiday

New Zealand RBNZ Interest Rate decision

Thailand Industrial Production (Jan)

Hong Kong SAR GDP (Q4, final)

Eurozone Economic Sentiment (Feb)

United States GDP (Q4, 2nd est.)

United States Wholesale Inventories (Jan)

THURSDAY

Japan Industrial Production (Jan, prelim)

Japan Retail Sales (Jan)

Germany Retail Sales (Jan)

United Kingdom Nationwide Housing Prices (Feb)

Turkey GDP (Q4)

France Inflation (Feb, prelim)

France GDP (Q4, final)

Switzerland GDP (Q4)

Taiwan GDP (Q4, final)

Germany Unemployment Rate (Feb)

United Kingdom Mortgage Lending and Approvals (Feb)

India GDP (Q4)

Germany Inflation (Feb, prelim)

Canada GDP (Q4)

United States Core PCE Price Index (Jan)

United States Personal Income and Spending (Jan)

FRIDAY

South Korea Market Holiday

Worldwide Manufacturing PMIs, incl. global PMI (Feb)

South Korea Trade (Feb)

China (mainland) NBS PMI (Feb)

Indonesia Inflation (Feb)

Japan Consumer Confidence (Feb)

Eurozone Inflation (Feb, flash)

Italy GDP (Q4)

Italy Inflation (Feb, prelim)

Brazil GDP (Q4)

United States ISM Manufacturing PMI (Feb)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.