Traders’ Diary: Everything you need to know about the week ahead

Picture: Getty Images

What grabbed the headlines last week?

All three major US averages kept marching in July, powered by strong mega-cap earnings and attractive inflation numbers. We even saw a 13-day winning streak for the 30-stock Dow average, a stretch not seen since 1987.

Solid US earnings reports abound, but coming off low expectations which haven’t provided the concomitant bump in values. I think the analyst beat rate so far this season stands at about 75%, according to Refinitiv.

The Nasdaq led with a 2% gain, while the S&P 500 increased about 1% and the Dow rose 0.6%.

There was a wee setback when the Bank of Japan surprised by moving to loosen its yield curve control, but for the markets en masse it was damn the torpedoes as per.

Wall Street shares shares rose 1%, EU and Japanese shares both found about 1.5% and the slumbering giants wriggled in their Chinese chains with mainland and HK shares surging 4.5% on Chinese stimulus hopes.

And speaking of randomly disappearing high-placed officials, Beijing relieved its idea of a foreign minister ( Qín Gāng 秦刚) last week, after relieving him of being around (or at least from public view). That’s already been a month.

While that was the headline news out of China last week, China’s more under-the-heel than ever various forms of state media, censored press and brain-wiped social media barely coughed up a Qin.

Heaps on the 70th anniversary of the end of the Korean War, though. Mind you, that’s not even officially ended.

In this regard South Korea didn’t get a single nod either – ALL the print is on the unfortunately awful Americans. The true enemy.

It’s good to be home

Australian shares were boosted by some unspoken desire to buy which we’re largely putting down to news of lower-than-expected inflation – which fell to 6% in the June quarter, down from 7% in the March quarter.

These eclipsed reasons not to buy, which involve a June quarter Export Price Index down 8.5%, and now11.2% on an annual basis, the largest quarterly fall since the September quarter 2009 and June retail trade figures showed a 0.8% drop, the inverse of May’s 0.8% rise.

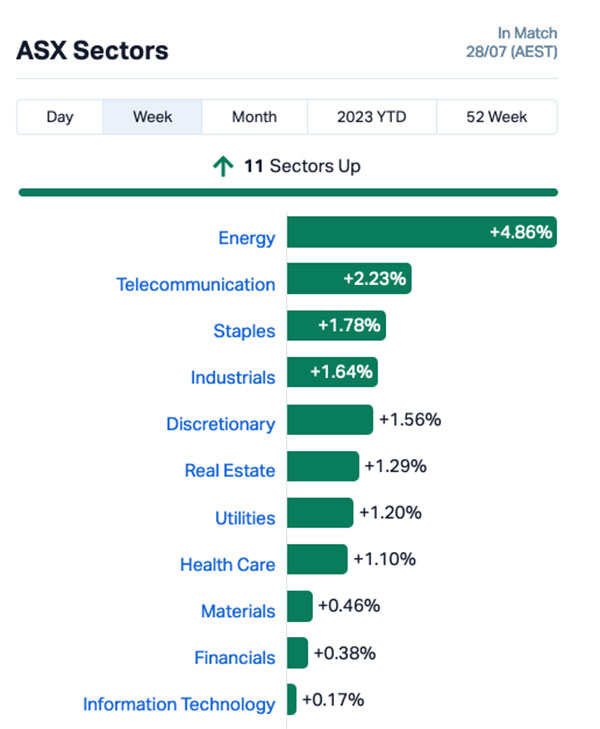

Gains for the week were led by the Energy, Telco, IT and Consumer Staples sectors.

All 11 ASX/200 sectors climbed last week.

Bond yields generally rose on the back of stronger economic data in the US and the BoJ move.

Oil prices continued to rise with tight supplies and metal prices also rose, but the iron ore price fell slightly.

Dr Shane Oliver at AMP Capital says the risk of a short-term correction in shares is still high.

“Recession risks remain high, China growth worries (persist), central banks still at risk of hiking further, the BoJ now edging towards tightening and the seasonal rough patch often seen from August to October.”

“But the ongoing fall in inflation consistent with interest rates being at or near the top and indications that any recession may be mild is consistent with our positive 12-month view on shares and appears to be dominating.”

So, any pullback may be shallow, the doc suggests.

Sold on gold

Gold is poised at US$1950/oz ($2908/oz).

June’s US personal consumer expenditure price index (PCE) only served to reinforce the market’s expectations about the end of the Fed’s interest rate hike cycle, according to Samer Hasn, market analyst and part of the research team at XS.com

“After the recent hike by 25 basis points and Jerome Powell’s less hawkish … talk about the continued decline in inflation, albeit not as quickly as expected… This would weaken the US dollar, which would support the rise in dollar-denominated gold prices.”

Markets now expect that the Fed will keep interest rates unchanged at its meeting next September, with a probability of 80%, compared to a probability of 20% that the Fed will raise again by 25 basis points.

Despite the rises in gold price, it may face pressure due to rising bond yields.

Following the PCE figures last week, US Treasury yields for 2-year bonds reversed their downward trend during Friday’s session, achieving gains of 1.5%.

After rising in the wake of this week’s US Fed decision (+0.25%) – which was expected – the precious metal then pared those gains as markets began pricing in small chances of an additional rate hike.

While not historically always the case, interest rates and gold have recently had an inverse relationship. Gold, and silver, could explode higher once the market is confident interest rate increases are done for.

“The Fed is most likely done raising rates,” OANDA’s Ed Moya reckons.

“The Fed will probably see no change with rates in September and when the market is confident that November will be a pause, then gold might break out higher.”

What to watch over the next week?

In the US, the focus will be on July jobs data (Friday) which are expected to show a further deceleration in payroll growth to 200,000, unemployment flat at 3.6% and a slight further slowing in wages growth.

In other data, the manufacturing conditions ISM (Monday) is expected to improve slightly but to a still weak 46.9 but the services conditions ISM (Thursday) is expected to soften slightly to 53.

The Fed’s latest lending standards survey will be released Monday with job openings data for June on Tuesday. The US June quarter profit reporting season will continue.

EU June quarter GDP growth (Monday) is expected to be 0.1%qoq with annual growth slowing to just 0.4%yoy. July CPI inflation (also Monday) is expected to have slowed further to 5.2%yoy with core inflation falling to 5.3%yoy (with both at 5.5% in June) and June unemployment (Tuesday) is expected to be unchanged at 6.5%.

The Bank of England (Thursday) is expected to raise its key policy rate by another 0.25% taking it to 5.25% with strong wages growth offsetting the recent downside surprise to inflation.

In APAC, country and sector PMI will be due next week while the attention will also be on central bank meetings in Australia and Thailand.

The RBA meeting is likely to be particularly interesting as analysts are divided on the likely decision, albeit with the odds leaning towards a further hike, says S&P Global Research.

Japanese industrial production in June (Monday) is likely to rise but unemployment (Tuesday) is likely to be unchanged at 2.6%.

Chinese business conditions PMIs for July are likely to be little changed with the composite likely to remain around 52.3.

In Australia, as noted earlier in this artful report, the RBA is expected to leave rates on hold on Tuesday.

UBS expects another 25 basis point hike, taking the cash rate to a peak of 4.35 per cent.

“Other notables have swung into that camp in the past day or so, including analysts at CBA, although they’re generally of the belief that if the RBA does hike again next month, it’ll likely be the last one for this cycle,” says our own Robert A Badman.

Doc Oliver is less determined – saying it’s a close call and if they do hike it will likely be the last in this cycle. The RBA’s Statement on Monetary Policy (Friday) is expected to revise the RBA’s wages forecasts for this financial year up slightly following the stronger than expected increase in award and minimum wages, but it’s unlikely to change its inflation forecasts much and its growth forecasts may be revised down slightly.

On the data front expect modest June credit growth (Monday) with an acceleration in housing credit, an 8% fall in building approvals after a 20.6% gain in May, a 1% fall in housing finance and CoreLogic data for July to show some loss of momentum in home price growth to 0.9%mom from 1.1% in June (all due Tuesday), trade data to show a slight rise in the trade surplus to $12.2bn and June quarter real retail sales to show a 0.5% fall (both due Thursday).

Three things to watch out for, with Joshua

We asked Josh Gilbert, Mild Mannered Market Analyst at eToro, to apply his relentless pursuit of returns by suggesting three key moments to look out for during the week ahead.

1. RBA Rate Decision

When the RBA meets next week, they will have a tough debate on whether to hike or keep rates on hold. Q2 CPI released this week showed that inflation is declining in Australia thanks in part to Philip Lowe and the Reserve Bank’s 12 hikes in 15 months. There is still a long way to go in order to bring inflation, which still sits at 6%, back to a target of 2–3% – and Australia’s labour market continues to show resilience, which means rates may stay higher for longer. Looking ahead to the decision, the market believes there is only a 13% chance of a hike next week after the lower-than-expected inflation data, but we’ve seen this year that the board can surprise markets. Although another pause seems to be on the cards next week, markets still believe that the Reserve Bank has another hike in the tank, pricing in a 75% chance they will hike before year-end. The good news for investors is a pause from the RBA next week could be the catalyst to propel the ASX200 within touching distance of record highs, and may readjust market pricing to see 4.1% as the peak.

2. Reporting season is just around the corner

The Australian reporting season is unofficially underway as of this week, with Rio Tinto’s half-year results, and next week sees two more names reporting in Credit Corp Group and BWP Trust. Investors will soon gain insight into the Australian companies that are effectively manoeuvring through an undoubtedly difficult macroeconomic landscape. Some companies, like CSL, have already forewarned investors about underwhelming full-year results by revising profit guidance. Given the challenging environment mentioned, investors’ focus should be on cost control measures and then on margins given that over the past year, inflation has been at a 30-year high. Unfortunately for dividend-loving investors, some corporates may decide to trim dividends in a bid to preserve balance sheets. Finally, watch for FY24 outlooks, which will likely hold the key to who comes out of reporting season as a winner.

3. Apple Earnings

Apple shares have had a strong start to 2023, gaining almost 50% year-to-date and tipping over the historic $3 trillion mark in June. With Microsoft and Tesla showing recently anything but perfect results will be punished, its FQ3 earnings next week will have no margin for error. China’s faltering economic recovery will be a worry for investors, particularly with consumers in the region not spending at the levels Apple is used to. The bright spot is likely to be services revenue, one of the only segments set to post revenue growth for the quarter, thanks to the success of the App Store, ApplePay and AppleTV, to name a few. This segment of the business is a powerhouse and is set to be a major contributor to Apple’s growth over the next decade, making it an area of the business investors should watch. Further updates regarding the release of the iPhone15 should lift investor optimism as the upgrade cycle swings into full force. Market consensus is for earnings of $1.20 on revenue of $81.5 billion. If revenue consensus is met, it would signify the third quarter of declining revenue for Apple.

The Australian Economic Calendar

Monday July 31 – Friday August 4

All sources from Commsec, Trading Economics, S&P Global Research, AMP, Westpac

MONDAY

RBA Private Sector Credit, June

TUESDAY

Australia RBA Interest Rate Decision

Australia Building Approvals and Home Loans (Jun)

CoreLogic dwelling prices, July

WEDNESDAY

Nope

THURSDAY

Australia Trade (Jun)

Australia Retail Sales (Jun, final)

FRIDAY

Retail trade volumes Q2 23

Australia RBA Monetary Policy Statement

The Everyone Else Economic Calendar

Monday July 31 – Friday August 4

MONDAY

Japan Industrial Production and Retail Sales (Jun)

Japan Consumer Confidence (Jun)

China (Mainland) NBS PMI (Jul)

Germany Retail Sales (Jun)

Hong Kong SAR GDP (Q2, advance)

Germany GDP (Q2, flash)

Italy GDP (Q2, flash)

Eurozone GDP (Q2, flash)

United Kingdom Mortgage Lending and Approvals (Jun)

United Kingdom Nationwide Housing Prices (Jul)

TUESDAY

Switzerland, Thailand Market Holiday

Worldwide Manufacturing PMIs, incl. global PMI* (Jul)

Japan Unemployment Rate (Jun)

South Korea Trade (Jul)

Philippines PPI (Jun)

Indonesia Inflation Rate (Jul)

Hong Kong SAR Retail Sales (Jun)

Eurozone Unemployment Rate (Jun)

United States JOLTs Job Openings (Jun)

United States ISM Manufacturing PMI (Jul)

WEDNESDAY

New Zealand Employment (Q2)

South Korea Inflation (Jul)

Japan BOJ Meeting Minutes (Jun)

Thailand BOT Interest Rate Decision

United States ADP Employment Change (Jul)

THURSDAY

Worldwide Services, Composite PMIs, inc. global PMI* (Dec)

Germany Trade (Jun)

Switzerland Inflation (Jul)

United Kingdom BOE Interest Rate Decision

United States ISM Services PMI (Jul)

FRIDAY

Philippines CPI (Jul)

Singapore Retail Sales (Jun)

Germany Factory Orders (Jun)

Eurozone Retail Sales (Jun)

Canada Employment (Jul)

United States Non-farm Payrolls, Unemployment Rate,

Average Hourly Earnings (Jul)

S&P Global Sector PMI (Jul)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.