Traders Diary: Everything you need to know about the abridged – and final – trading week of 2022

Via Getty

The week that was across markets

At home markets fizzled, dropping almost 0.8% on Friday, ending the last full week of business with a right fizzle.

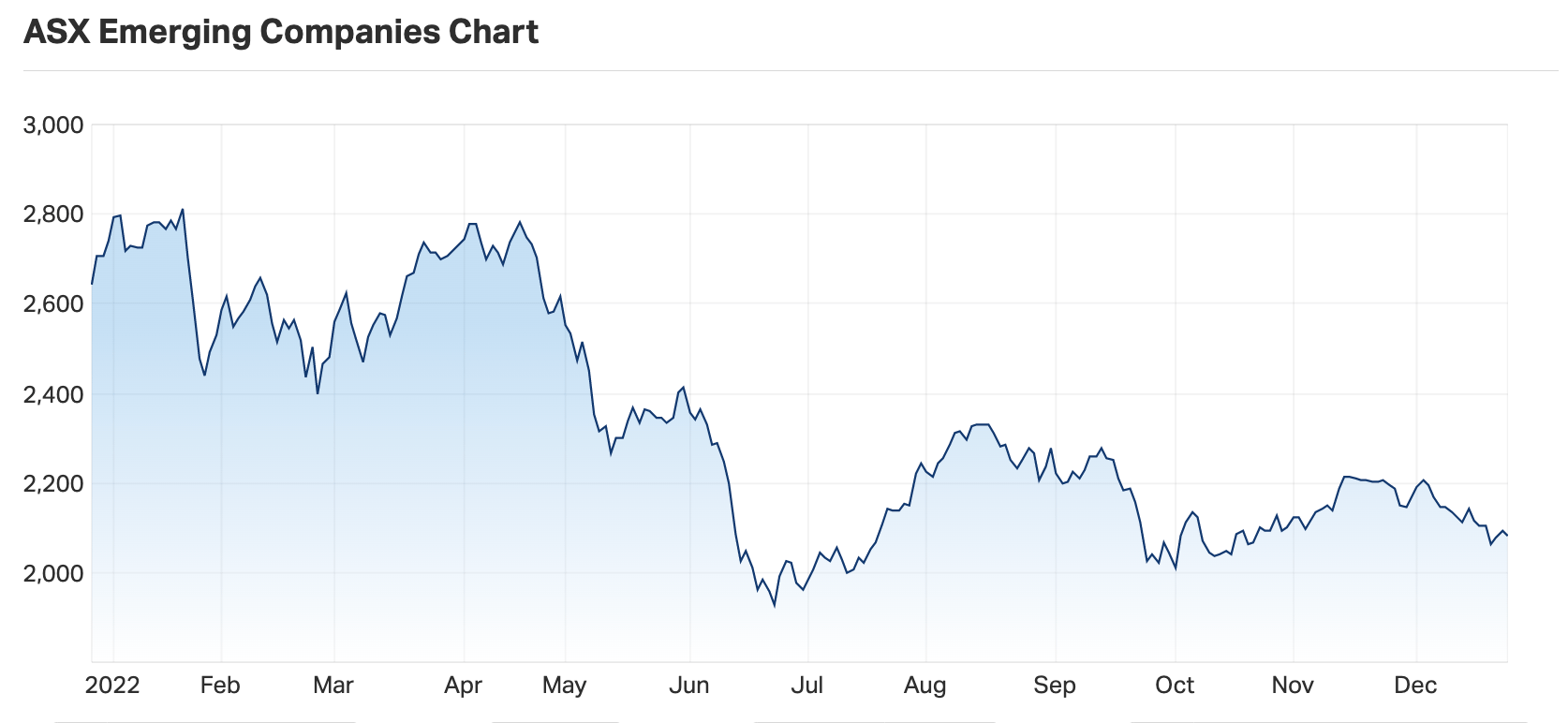

Below is where we’re leaving the S&P/ASX Emerging Companies (XEC) from a dull finish into Xmas.

This was the 12 months to Santa:

It’s not been an easy run, down 1.5% this week, adding to a bad month and a 2022 worth cremating.

Could be worse. This is what the Nasdaq looked like in 2022:

The week ahead

With Wall Street literally frozen over, global markets can expect a quiet week into the new year.

Although it does seem very 2022 to end the year with at least 4 or 5 major trademark shocks.

For now, the world’s watching New York State disappear under a giant snow drift.

There’s a dim spotlight lingering on the Bank of Japan and it’s summary of opinions released Wednesday (AEDT).

That should add some colour around the BoJ’s bust-a-move raising of the yield ceiling.

That blindside run which caught 100% of the 35 or so economists Bloomberg says it surveyed on the subject totally offside, might’ve moved markets more profoundly if we’d not already totally checked out and if not that parched markets will be gagging for a bit of liquidity which’ll be in short supply this week.

The final, abridged week of 2022 brings about a series of data releases before the new year ushers in worldwide manufacturing and services PMI data for the month of December.

The US jobs report due the first Friday will also be closely glanced as a few handy insights into labour market conditions might give someone an edge in FX as The feisty Fed is also s’posed to be closely monitoring wage inflation.

Hold the phone, there are a few CPI data reads across the EU and one or tow closer to home in the AsiaPacific, they’ll shake the tree on inflation reads into the end of of 2022, but I’ve already booked a ticket out of that.

Stay distracted I say. Read a book, hit the tables, make some moonshine. Any big bumps are just a scarcity of both liquidity and attention… minus OFC the usual 2022-out-of-the-blue, show-stopping news catalyst which could anyone for six at any moment.

Slumped

Meanwhile (sigh) as the US freezes and markets remain closed, the rest of the trading week from Tuesday for a few other markets is sufficiently calm.

The only decent set of numbers are released Wednesday with pending home sales and a variety of little followed regional business surveys punctuating a week, traders won’t lose too much sleep over.

S&P Global market Intelligence reckon the US jobs report for December this Friday could get some attention.

“Amid the growing attention on wages, the employment conditions will be scrutinised though flash PMI indications have so far given early indications of slowing jobs growth as demand slumped.”

The only word here that makes sense to me right now is slumped.

And as mentioned: in a slow week, the summary of opinions from the BoJ’s December meeting will be closely watched on Wednesday. This release is similar to the meeting minutes. It contains less detail, but it’s released much sooner, elevating its importance. Traders will look for any hints around future policy tweaks – was this really a one-off move – like Governor Kuroda says – (he downplayed the action as simply ‘fine-tuning’ last week) … or the first step in a new Tokyo tightening process?

The main story might be the scarcity of liquidity. With many investors closing their books for the year and many traders away from their desks, liquidity will be thinner than usual. This means that markets can move sharply without any news, and that any actual headlines could have a much greater impact.

As such, Pete McGuire CEO of XM Australia, says any moves in the coming week “might be more noise than signal“.

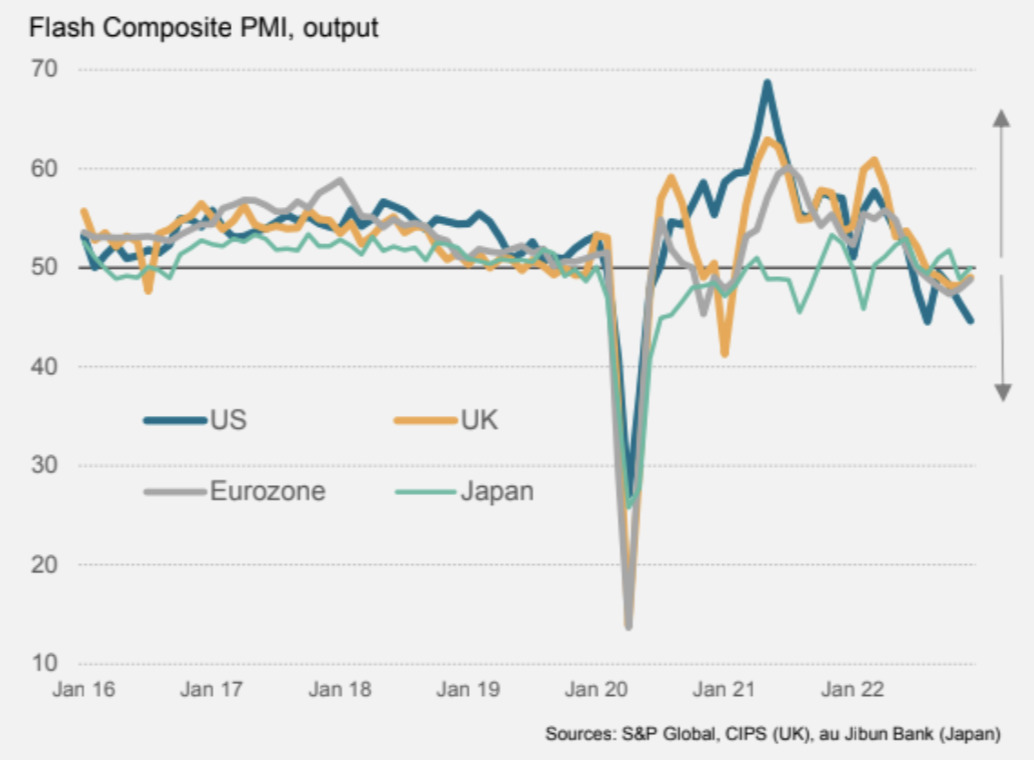

S&P: Year-end G4 developed market PMI output

Flash PMIs reflected “worsening developed market economic growth in December,” says S&P, with the downturn especially sharp in the US .

“Other ‘G4’ economies showed tentative signs of moderation in decline. Final numbers from the G4 economies and more widely across the globe will therefore be eagerly anticipated at the start of 2023 for the earliest snapshot of conditions at the end of 2022.”

Global Economic Calendar

Shortened holiday week: 27th December – 30th December

Tuesday 27

UK, Canada, Australia, New Zealand, China, Hong Kong

Market Holiday

Japan Unemployment Rate (Nov)

Japan Retail Sales (Nov)

Japan Housing Starts (Nov)

Norway Retail Sales (Nov)

United States S&P Global/Case Shiller Home Price (Oct)

Wednesday 28

Japan Industrial Output (Nov, prelim)

US Pending Sales Change (Nov)

Thursday 29

South Korea Industrial Output (Nov)

South Korea Retail Sales (Nov)

Eurozone M3 (Nov)

US Initial Jobless Claims

Friday 30 December

US, UK (Partial), New Zealand (Partial), South Korea,

Philippines Market Holiday

South Korea CPI Growth (Dec)

Thailand Current Account (Nov)

Switzerland Official Reserves Assets (Nov)

UK Nationwide House Price (Dec)

Hong Kong Retail Sale (Nov)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.