Traders’ Diary: Everything you need to get ready for the week ahead

News

News

Not a ball-tinglingly terrific week for investors, let’s be honest.

Pretty much everyone was hoping to see a fat’n happy near-term rate cut by the US Fed at least – if not the EBC, RBA, BoE et al.

Alas, such expectations were nudged further out to sea, thanks to an array of hawkish Fedspeak out of Florida last week.

Then came the FOMC minutes on Wednesday and on Thursday in the States some quite better-than-expected PMIs suggesting some virile American business activity (and prices) during May.

On Wall Street, the S&P500 managed to close slightly higher, clinching a sliver-then fifth straight week of gains, the US benchmark’s longest winning run since just after ‘Straya Day.

That was mainly thanks to Nvidia’s (NVDA) 7% after hours surge on Wednesday, where the chipmaker busted through the $1,000 level for the first time on the back of stunning quarterly results and even better guidance.

Yet, truth be told, after clocking its latest fresh record high on Tuesday in New York, US stocks have largely sat back on their haunches sucking in the big ones as that growing cloud of interest cut mystery continues to gather round Mount Federal Reserve.

T’were those FOMC minutes, the hawky-talky coupled with the unwelcome good economic data, which dented US sentiment.

Of course, the Nasdaq Comp got a revivifying shot in the arm when NVDA smashed them haughty Wall Street expectations.

Adding sugar to the icing, the Napolean of AI – after more than doubling its quarterly dividend – also revealed cunning plans for an ambitious 10-1 stock split.

CEO Jensen Huang was appropriately stentorious on the day:

“The next industrial revolution has begun. Companies and countries are partnering with Nvidia to shift the trillion-dollar traditional data centers to accelerated computing to produce a new commodity: Artificial Intelligence.”

The S&P (SP500) added +0.03% for the week, while the Nasdaq (COMP:IND) climbed +1.4%. Conversely, the blue-chip Dow (DJI) fell -2.3%.

The ASX200 done bad, down 1.11% over the last week, after crossing below its 50-day moving average on Friday.

The weak US lead, the hawkish RBA chat, a pullback in oil and metal prices saw the Materials and Energy sectors fall as did the Comms sector, while the rate sensitive ASS Retail and Property stocks also suffered.

There’s a possibility that OPEC+ will push for steeper production cuts when it meets at the beginning of June amid the less optimistic demand outlook, but it’s hard to see an agreement beyond a cobbled together extension of the existing quotas.

But.

The iron ore price rose.

Aussie bond yields reversed some of their recent decline on renewed uncertainty about rate cuts.

The benchmark is currently 2.31% below its 52-week high and has looked more convincing.

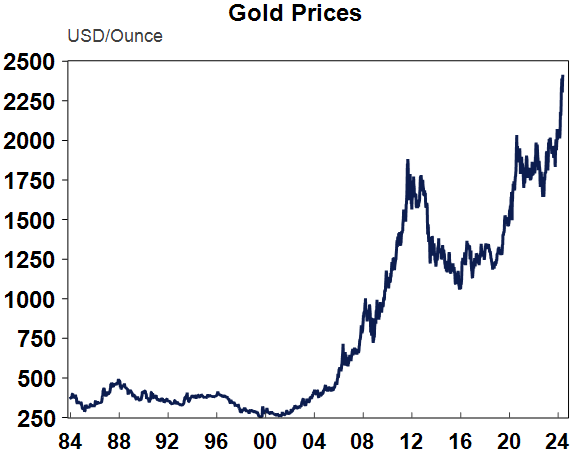

Last week’s diminishing expectations for US rate cuts have also been a right drag on gold prices too.

Gold’s slide, meanwhile, has likely been exacerbated by profit taking and the fulsome outlook for the greenback, although a further rebound in US Treasury yields could turn into a bigger headache.

Here’s the cost of some gold over the last 40 years. That bottoming out moment in 2000 is when a mate of mine told me to go buy a lot.

Of course, I was a stage actor back then, so I didn’t understand. And I had no money.

Nvidia. Lowe’s did good too, but that made people think how strong the US consumer is and so…

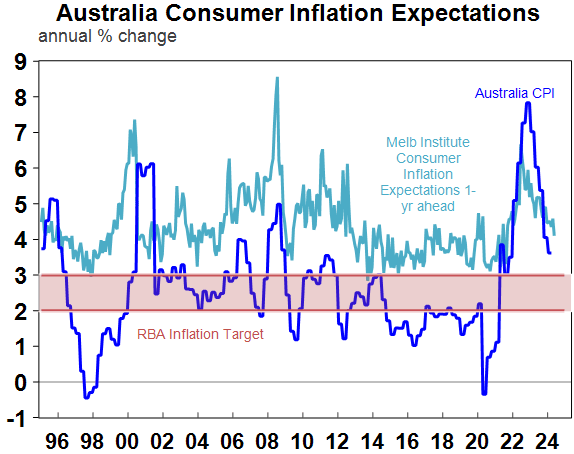

At home the bureau of numbers will drop the Aussie monthly CPI rates on Wednesday.

Last week Aussies thought Aussie inflation was easing, as per Westpac and the Melbourne Institute’s thingy:

At the May meeting, the Reserve Bankers of Aussie pretty much held onto their dull, neutral stance, disappointing everyone banking on either a dovish tilt or a hawkish shift due to a wobbling economy and still-sticky local inflation.

Chinese business conditions PMIs for May (Friday) are expected to be little changed. The Aussie dollar, not at its best already, could be hit by befuddled Chinese PMIs as well.

Japanese data for jobs, industrial production and retail sales will be released Friday.

The April PMIs showed that growth in both the manufacturing and services sectors slowed, but China’s exports and imports improved, pointing to a potential return of the Chinese consumer.

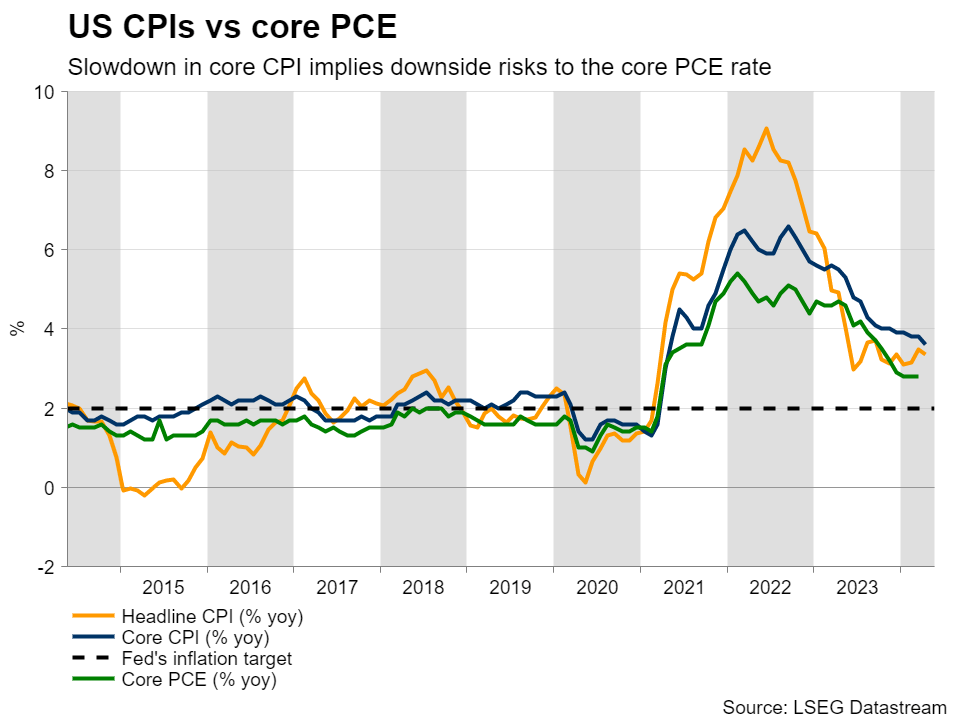

In the US, the focus will be on inflation again with core private final consumption inflation for April due Friday.

Meanwhile, home price growth (Tuesday) is expected to have slowed in March and consumer confidence (also Tuesday) is likely to have fallen slightly.

In the EU there’s inflation data for May (Friday) and unemployment for April (Thursday).

MONDAY

BOJ Gov Ueda Speech

CN Industrial Profits (YTD)

JP BOJ Uchida Speech

JP Coincident Index Final MAR

JP Leading Economic Index Final MAR

DE Ifo Business Conditions MAY

EU 20-Year, 3-Year Bond Auction

ECB Lane Speech

TUESDAY

AU Retail Sales MoM Prel APR

ECB Schnabel Speech

US Fed Mester Speech

Germany Wholesale Prices YoY

Germany 10-Year Bund/g Auction

WEDNESDAY

US Money Supply APR

US Fed Cook Speech

12:00 PM

AU Westpac Leading Index

AU Construction Work Done

AU Monthly CPI Indicator APR

JP BOJ Adachi Speech

JP Consumer Confidence MAY

Ger GfK Consumer Confidence JUN

Inflation Rate YoY Prel MAY

FR Consumer Confidence MAY

FR Retail Sales MoM APR -0.5% 1.0%

EU Loans APR

EU M3 Money Supply YoY APR

US MBA 30-Year Mortgage Rate MAY

US Mortgage Market Index MAY

IN M3 Money Supply YoY MAY/17 11.1% 10.9%

US Redbook YoY MAY

THURSDAY

US Richmond Fed Manufacturing Index MAY

US Dallas Fed Services Index MAY

US 2-Year FRN Auction

RU Industrial Production YoY APR

US Fed Williams Speech

US Fed Beige Book

US API Crude Oil Stock Change MAY

AU RBA Hunter Speech

US Fed Bostic Speech

GB Car Production

JP Foreign Bond/ Stock Investment by Foreigners MAY

AU Building Permits MoM Prel APR

AU Building Capital Expenditure

AU Plant Machinery Capital Expenditure

AU Private Capital Expenditure

AU Private House Approvals MoM Prel APR

JP 2-Year JGB Auction

Unemployment Rate APR 7.2% 7.3% 7.3%

08:00 PM

EU Economic Sentiment MAY

Unemployment Rate APR

Consumer Confidence Final MAY

Consumer Inflation Expectations MAY

Industrial Sentiment MAYSelling Price Expectations MAY

Mex Unemployment Rate APR

US GDP Growth Rate

US Corporate Profit

US Goods Trade Balance Adv APR $-91.83B $-91.8B $-93.0B

11:30 PM

US Initial Jobless Claims MAY

US Retail Inventories Ex Autos

US Wholesale Inventories MoM

US Continuing Jobless Claims MAY

US Core PCE Prices

US GDP Sales

FRIDAY

US Pending Home Sales

US EIA Crude Oil Stocks Change

US Fed Williams Speech

US Fed Logan Speech

KOR Industrial Production

KOR Retail Sales MoM APR

JP Unemployment Rate

JP Tokyo Core CPI

AU Housing Credit

AU Private Sector Credit

CN NBS Manufacturing PMI MAY

CN NBS Non Manufacturing PMI MAY

CN NBS General PMI MAY

JP Housing Starts YoY APR

JP Construction Orders

FR Non Farm Payrolls

AU Commodity Prices YoY MAY

FR Inflation Rate YoY Prel MA

FR GDP Growth Rate QoQ Final

FR PPI MoM APR

GB BoE Consumer Credit

EU Inflation Rate

US Core PCE Price Index

US Core PCE Price Index YoY APR 2.8% 2.7%