Traders’ Diary: Everything you need to get ready for the week ahead

Via Getty

What grabbed the headlines last week?

Dovish noises from European central banks, a dovish note from the US Fed and some warmly welcomed weak-ass US labour market data gave Wall Street a pretty tailwind last week, the benchmark S&P500 making it a hat trick of weekly wins.

Defying the fears of May, the benchmark US equity index has now erased nearly all of its April losses.

Next door, and playing some sterling catch-up footy was the Dow Jones which logged a fourth straight week of wins.

All three US indices were sell-backed by a robust earnings season and the weaker jobs read which boosted optimism around rate cuts.

On that issue – last week was a busy one for central bankers. The Bank of England turned heads, when the Poms seriously signalled looming rate cuts, while others have already begun (Sweden), or continued (Brazil) or held (like US and Mexico).

The lasses and lads at the RBA held at 4.35%, sounding hawkish, but retaining what amounts to a formal neutral bias.

This is the last par of the post-match statement on Tuesday:

Recent data indicate that, while inflation is easing, it is doing so more slowly than previously expected and it remains high. The Board expects that it will be some time yet before inflation is sustainably in the target range and will remain vigilant to upside risks. The path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe remains uncertain and the Board is not ruling anything in or out. The Board will rely upon the data and the evolving assessment of risks. In doing so, it will continue to pay close attention to developments in the global economy, trends in domestic demand, and the outlook for inflation and the labour market. The Board remains resolute in its determination to return inflation to target.

In the States, meanwhile, for the week the S&P500 added 1.9%, the blue-chip Dow Jones rose 2.2%, and the tech-heavy Nasdaq Composite climbed 1.1%.

The S&P (SP500) is also now just about 0.5% away from another record high.

On the US corporate front Walt Disney (DIS) delivered a surprise profit in its streaming operation for the first time ever.

The Star Wars owners reported a profit for its slightly entertainment streaming division (Disney+ and Hulu), and forecast full combined streaming business profitability in FQ4 (including ESPN+).

Yet, no-one likes straight out good storytelling these days. Dropping nearer to 10% on Tuesday in New York, DIS pulled out its worst trading day in 18 months.

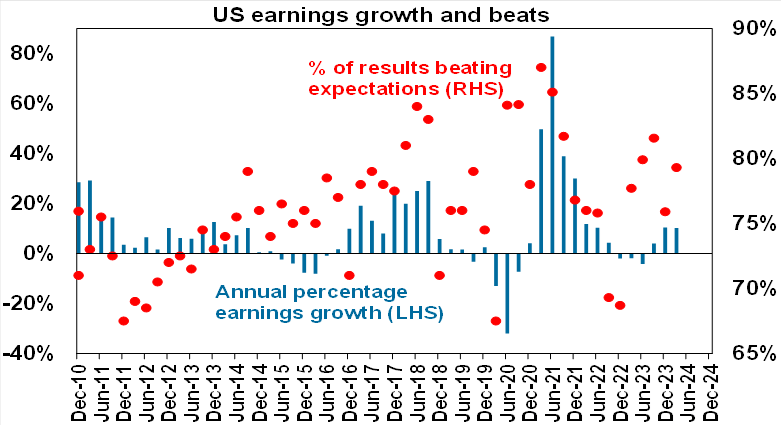

Otherwise, we can probably say Wall Street March quarter earnings were strong.

According to AMP, 92% of S&P 500 companies have reported with 79% beating, against a norm of 76% and earnings growth expectations now at 10%y-o-y, up from 4.1% on four weeks ago.

Growth is easing, they say, yet the US Tech sector’s earnings are up 38%y-o-y.

US earnings ex-tech stocks are up a whole 1% with that growth actually accelerating.

On the stoopid front

The madly popular, yet also rich with stoopidity short-video app TikTok and its Chinese dad, ByteDance (BDNCE), sued the US government in an attempt to save TikTok from a bill which will force its sale, or otherwise flat out ban it in the States.

Last month, US President Joe Biden signed legislation which could see TikTok no longer seen in the States with either a firesale to some politically reliable local punter or a straight nationwide ban within a year.

Because irony can be so ironic sometimes… and because the Chinese Communist Party legal team were all trained in New York, ByteDance will be heading to court this week wielding the shameless ‘First Amendment violation’ argument.

Basically America’s persecuting a social media app on national security grounds, while their Chinese overlords argue what a violation that is of the free speech they don’t recognise.

Even by the insensate fever-dream standards of everyday US justice in 2024, the whole show should result in a wonderfully stoopid win for the free press which will be all over it.

More problematic – Pres Joe is set to announce more, nastier China tariffs targeting strategic sectors, including a major hike in levies on electric vehicles (EVs), while also the White House last week revoked export licenses for Qualcomm (QCOM) and Intel (INTC) to supply Chinese telco-of-evil Huawei.

At home

Your S&P/ASX200 closed Friday higher, gaining about 27 points or 0.35% to close at 7,749, after the RBA kept rates on hold.

The benchmark’s top performers were Helia Group (ASX:HLI) and Beach Energy (ASX:BPT), up 5.95% and 4.00% respectively.

T’were in fact a very good week for the ASX investors in the wake of April’s surprise slap in the face.

Over the last five days, the benchmark index gained 1.57% and is currently 2.04% off of its 52-week high.

ASX SMALL CAP LEADERS LAST WEEK

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| ICL | Iceni Gold | 0.089 | 207% | $21,943,934 |

| ADY | Admiralty Resources. | 0.014 | 133% | $19,553,687 |

| ERL | Empire Resources | 0.004 | 100% | $5,935,653 |

| PEC | Perpetual Resources | 0.016 | 100% | $8,960,412 |

| M4M | Macro Metals Limited | 0.04 | 100% | $100,194,069 |

| FGL | Frugl Group Limited | 0.11 | 83% | $10,925,015 |

| CGO | CPT Global Limited | 0.16 | 80% | $5,446,657 |

| CRS | Caprice Resources | 0.034 | 79% | $6,702,608 |

| OZZ | OZZ Resources | 0.05 | 67% | $4,626,506 |

| AXN | Alliance Nickel Ltd | 0.059 | 64% | $45,727,896 |

| IRI | Integrated Research | 0.655 | 60% | $107,384,307 |

| ANX | Anax Metals Ltd | 0.043 | 59% | $24,835,318 |

| BUR | Burley Minerals | 0.086 | 51% | $11,578,563 |

| ADS | Adslot Ltd. | 0.003 | 50% | $9,673,487 |

| CCO | The Calmer Co International | 0.006 | 50% | $6,804,398 |

| CNJ | Conico Ltd | 0.0015 | 50% | $2,707,643 |

| EMU | EMU NL | 0.03 | 50% | $2,159,775 |

| FAU | First Au Ltd | 0.003 | 50% | $3,323,987 |

| GTI | Gratifii | 0.012 | 50% | $16,120,450 |

| MCT | Metalicity Limited | 0.003 | 50% | $11,212,737 |

| SGC | Sacgasco Ltd | 0.009 | 50% | $7,017,184 |

| ERW | Errawarra Resources | 0.06 | 46% | $5,755,240 |

| RR1 | Reach Resources Ltd | 0.013 | 44% | $13,116,460 |

| TG1 | Techgen Metals Ltd | 0.04 | 43% | $4,612,772 |

| SXG | Southern Cross Gold | 3.28 | 41% | $260,087,686 |

| AQX | Alice Queen Ltd | 0.007 | 40% | $4,145,940 |

| DXN | DXN Limited | 0.035 | 40% | $5,916,459 |

| ICG | Inca Minerals Ltd | 0.007 | 40% | $5,633,172 |

| KLI | Killi Resources | 0.042 | 40% | $2,418,002 |

| ION | Iondrive Limited | 0.011 | 38% | $3,403,997 |

| SYA | Sayona Mining Ltd | 0.044 | 38% | $411,731,841 |

| AQD | Ausquest Limited | 0.015 | 36% | $10,726,940 |

| FTL | Firetail Resources | 0.05 | 35% | $7,445,278 |

| DAL | Dalaroo Metals | 0.027 | 35% | $2,234,250 |

| WA8 | Warriedar Resources | 0.062 | 35% | $41,077,283 |

| AGC | AGC Ltd | 0.125 | 34% | $22,000,000 |

| ARD | Argent Minerals | 0.02 | 33% | $24,596,199 |

| EDE | Eden Innovation | 0.002 | 33% | $7,356,542 |

| JAV | Javelin Minerals Ltd | 0.002 | 33% | $3,264,346 |

| M2R | Miramar | 0.012 | 33% | $1,674,782 |

| SP8 | Streamplay Studio | 0.008 | 33% | $8,629,678 |

| SRY | Story-I Limited | 0.004 | 33% | $1,505,619 |

| TX3 | Trinex Minerals Ltd | 0.004 | 33% | $7,254,609 |

| GHY | Gold Hydrogen | 1.82 | 33% | $127,260,618 |

| TTT | Titomic Limited | 0.079 | 32% | $81,861,504 |

| SCN | Scorpion Minerals | 0.025 | 32% | $11,055,317 |

| MGT | Magnetite Mines | 0.355 | 31% | $34,944,256 |

| HTA | Hutchison | 0.038 | 31% | $515,755,326 |

| BEO | Beonic Ltd | 0.03 | 30% | $12,734,848 |

| HOR | Horseshoe Metals Ltd | 0.013 | 30% | $10,364,459 |

Little shout out to Macro Metals (ASX:M4M) which certainly maintained its upward trend on Friday adding another +25% to take its tally for the week to +245%, and push it well through the +1,100% mark for the 2024 so far…

Thanks also, btfw, to my colleague, the legend that is Nadine McGrath for compiling much of this week’s ASX data.

Elsewhere, some of the bigger names like DroneShield (ASX:DRO) (+15.06%), Liontown Resources (ASX:LTR) (+14.29%), Nuix (ASX:NXL) (+10.38%) all did well out of last week.

ASX SMALL CAP LAGGARDS LAST WEEK

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| OSX | Osteopore Limited | 0.07 | -77% | $8,389,522 |

| APC | Aust Potash Ltd | 0.001 | -75% | $4,000,189 |

| WOA | Wide Open Agriculture | 0.029 | -68% | $5,191,679 |

| MPP | Metro Perf.Glass Ltd | 0.07 | -58% | $12,976,466 |

| AXP | AXP Energy Ltd | 0.001 | -50% | $5,824,681 |

| DTI | DTI Group Ltd | 0.011 | -39% | $4,934,066 |

| ME1 | Melodiol Glb Health | 0.0025 | -38% | $2,140,462 |

| LV1 | Live Verdure Ltd | 0.44 | -37% | $56,123,233 |

| MOV | Move Logistics Group | 0.32 | -36% | $37,243,241 |

| EXL | Elixinol Wellness | 0.004 | -33% | $6,505,370 |

| NRZ | Neurizer Ltd | 0.002 | -33% | $4,132,948 |

| SIT | Site Group Int Ltd | 0.002 | -33% | $5,204,980 |

| VPR | Volt Power Group | 0.001 | -33% | $10,716,208 |

| RTR | Rumble Res Limited | 0.041 | -33% | $33,035,935 |

| THL | Tourismholdings | 1.795 | -31% | $388,439,448 |

| FIN | FIN Resources Ltd | 0.012 | -29% | $8,440,493 |

| AIV | Activex Limited | 0.005 | -29% | $1,077,513 |

| GLL | Galilee Energy Ltd | 0.04 | -29% | $14,948,764 |

| TRJ | Trajan Group Holding | 0.74 | -27% | $111,117,742 |

| SNS | Sensen Networks Ltd | 0.022 | -27% | $17,066,156 |

| EOF | Ecofibre Limited | 0.05 | -26% | $18,564,821 |

| BEX | Bikeexchange Ltd | 0.27 | -26% | $5,149,877 |

| NME | Nex Metals Explorat | 0.02 | -26% | $7,050,651 |

| CT1 | Constellation Tech | 0.0015 | -25% | $2,212,101 |

| ENT | Enterprise Metals | 0.003 | -25% | $2,654,163 |

| FZR | Fitzroy River Corp | 0.12 | -25% | $12,954,510 |

| GCM | Green Critical Min | 0.003 | -25% | $3,409,755 |

| IEC | Intra Energy Corp | 0.0015 | -25% | $2,536,172 |

| JPR | Jupiter Energy | 0.018 | -25% | $25,473,044 |

| KOR | Korab Resources | 0.006 | -25% | $2,569,350 |

| KPO | Kalina Power Limited | 0.003 | -25% | $9,945,576 |

| RDS | Redstone Resources | 0.003 | -25% | $3,238,825 |

| RIE | Riedel Resources Ltd | 0.003 | -25% | $6,671,507 |

| STM | Sunstone Metals Ltd | 0.0105 | -25% | $35,006,515 |

| TKL | Traka Resources | 0.0015 | -25% | $2,625,988 |

| TMX | Terrain Minerals | 0.003 | -25% | $4,295,012 |

| WFL | Wellfully Limited | 0.003 | -25% | $1,478,832 |

| TZL | TZ Limited | 0.019 | -24% | $4,618,496 |

| RNT | Rent.Com.Au Limited | 0.026 | -24% | $16,370,889 |

| MDX | Mindax Limited | 0.026 | -24% | $53,268,378 |

| NYR | Nyrada Inc. | 0.072 | -23% | $12,558,609 |

| ASP | Aspermont Limited | 0.01 | -23% | $24,556,347 |

| XGL | Xamble Group Limited | 0.03 | -23% | $10,049,884 |

| PAA | PharmAust Limited | 0.17 | -23% | $71,264,022 |

| GIB | Gibb River Diamonds | 0.024 | -23% | $5,076,227 |

| PNM | Pacific Nickel Mines | 0.025 | -22% | $10,456,328 |

| PSL | Paterson Resources | 0.0125 | -22% | $5,928,492 |

| RRR | Revolver Resources | 0.075 | -22% | $19,731,444 |

| VIT | Vitura Health Ltd | 0.098 | -22% | $53,556,262 |

| AAU | Antilles Gold Ltd | 0.011 | -21% | $10,356,885 |

Consumer-facing stocks like Baby Bunting (ASX:BBN) (-19.55%), Adairs (ASX:ADH) (-10.56%), The Reject Shop (ASX:TRS) (-7.55%) and JB HiFi (ASX:JBH) (-6.71%), all got smacked on the weak retail read.

However, a very decent 10 of the 11 ASX200 sectors ended higher last week.

Standouts were the Utilities (4.79%), Energy (+4.34%), Real Estate (+2.41%), and IT (+2.40%) Sector.

The fluff side, was people with the Consumer Discretionary (-0.52%), Health Care (+0.79%), Consumer Staples (+0.86%) and Industrial (+1.35%).

ASX Sectors last week

Encouraging thought for the week ahead

“We’re not at home to Mr Cock-up.”

We’re back in the indicative data business this week with a heavy economic calendar ahead with fresh US CPI data as the centrepiece.

US inflation figures for April may well determine if it really is go-away May or hey-stay it’s May… etc

The higher-than-expected March CPI dampened rate cut hopes ahead of the May Fed meeting.

US activity data such as retail sales and industrial production numbers are anticipated through the week. Early insights from PMI data showed US manufacturing production growth decelerated amidst lower new business.

That said, retail sales may well reflect the improvements in consumer sectors that were observed in the US sector PMI data.

At home the excitement starts on Monday at can’t wait o’clock when NAB’s latest Business Confidence thingy drops.

Then we swallow a new Federal Budget on Tuesday, before Wages and Labour Force numbers for April later in the week.

Nearby China will undoubtedly serve up positively flavoured retail sales and industrial production figures, while surprisingly punchy Caixin PMIs will show a Chinese economy on the mend for Q2, allowing mainland and Hong Kong stocks to start building for a real climb.

Japan’s Q1 GDP is also dropping.

US Futures overnight:

The Economic Calendar

Monday May 13 – Friday May 17

MONDAY

Australia NAB Business Confidence (Apr)

India Inflation (Apr)

Germany Current Account (Mar)

Germany HCOB Export Conditions Index (Apr)

Canada Building Permits (Mar)

Brazil Business Confidence (May)

GEP Global Supply Chain Volatility Index (May)

TUESDAY

Japan PPI (Apr)

Germany Inflation (Apr, final)

United Kingdom Labour Market Report (Mar)

India WPI (Apr)

Eurozone ZEW Economic Sentiment Index (May)

Germany ZEW Economic Sentiment Index (May)

United States PPI (Apr)

S&P Global Investment Manager Index* (May)

WEDNESDAY

Hong Kong SAR, South Korea Market Holiday

Australia Wage Price Index (Q1)

China (Mainland) 1-Year MLF Announcement

Thailand GDP (Q1)

Indonesia Trade (Apr)

France Inflation (Apr, final)

Eurozone Employment Change (Q1)

Eurozone GDP (Q1, 2nd est.)

Eurozone Industrial Production (Mar)

United States CPI (Apr)

United States Retail Sales (Apr)

United States Business Inventories (Apr)

THURSDAY

Japan GDP (Q1, prelim)

Australia Employment (Apr)

Philippines BSP Interest Rate Decision

Italy Inflation (Apr, final)

United States Building Permits (Apr, prelim)

United States Housing Starts (Apr)

United States Industrial Production (Apr)

FRIDAY

Norway Market Holiday

South Korea Unemployment (Apr)

Singapore Non-oil Domestic Exports (Apr)

China (Mainland) House Price Index (Apr)

China (Mainland) Industrial Production, Retail Sales, Fixed

Asset Investment, FDI (Apr)

Malaysia GDP (Q1)

Japan Industrial Production (Mar, final)

France Unemployment (Q1)

Hong Kong SAR GDP (Q1, final)

Eurozone Inflation (Apr, final)

Canada New Housing Price Index (Apr)

United States CB Leading Index (Apr)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.