Traders’ Diary: Everything you need to get ready for the week ahead

Via Getty

What grabbed the headlines last week?

We’ll likely find out what the bulls are made of in the days ahead, after US equity markets took a bit of a dive last week, wetting the rest of us in the process.

Reflecting the poor global lead Aussie markets fell 2.8% for the week with broad based declines.

First US Lemming off the block was the Mega Tech-heavy index, the Nasdaq tottering idly in the face of reanimated US interest rates.

US Fed officials fuelled fears of a higher-for-longer pivot in the rate cut front pushing bond yields solidly higher in the US and Europe

With several Fedspeakers, including Chair J. Powell, insisting there’s no urgency to ease monetary policy soon, and with US retail sales coming in much stronger than expected on Monday, Wall St took off the table more basis points worth of rate cuts for this year.

The street is now expecting interest rates to be lowered by only 42bps, far fewer than the Fed’s own projections of 75.

New York Fed Chief John Williams became the second FOMC member in as many days to entertain the possibility of a rate hike, while regional presidents Bostic and Kashkari doubted if rates would have to be cut at all in 2024.

Moreover, earnings announcements from chipmakers have raised concerns about the demand outlook, casting a shadow over tech earnings just as the Q1 reporting season gets underway.

Even Netflix’s surprisingly strong subscriber numbers couldn’t lift spirits as investors were less than impressed by the company’s revenue guidance for the second quarter.

The S&P 500 closed lower for the 5th straight session on Thursday, while the Nasdaq was shorn of a full 5%.

Reinvigorated geopolitical tensions didn’t make life any easier nor did growing doubts around some of the big name US tech earnings.

At home, local indices fell again following the escalation of events in the Middle East. Although the ASX 200 closed well off some scary intraday lows, the benchmark had its worst week since September, falling 220 points or 2.83%.

While regional hostilities took on a more Israel vs. Iran shape, Friday’s limited Israeli response to Iran’s attack couldn’t stop both markets in the US and over in Europe from losing heavy ground.

Wall Street fell circa 3% for the week and Eurozone shares lost 1%. Japanese shares fell 6.2% for the week having gone up a lot more than other markets. But Chinese shares managed a 1.9% gain helped by better-than-expected economic data.

Greenback: the new gold

It’s been a corker of a 2024 for the US dollar.

The greenback has gained more than 4% against a basket of currencies, turbocharged by a series of solid economic readings which, eventually, have forced the hand of Wall Street traders to pull in their heads a bit after splurging heavily on bets around imminent Fed rate cuts.

Heavy US government spending and a surging population, driven by an influx of migrants have done a goodmjob of propping up the US economy, bolstering the labor market as well as consumer demand.

Also last week…

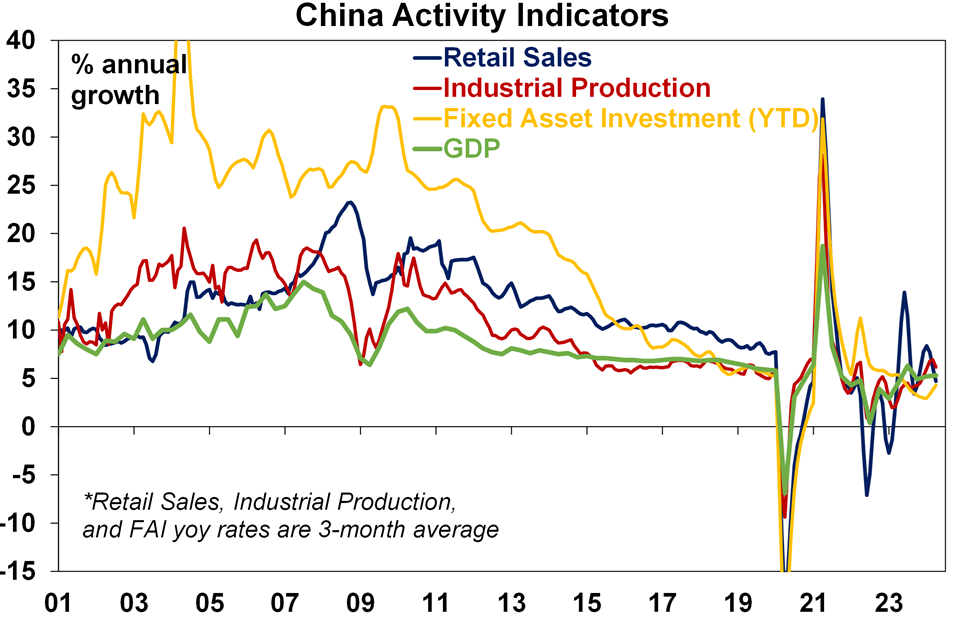

China’s economy reportedly picked up more than the expectations of simple reason over the March quarter.

Whether the numbers are accurate or not, there’s certainly no question Chinese property data remains shonky with more falls in property prices, sales and investment.

But so far the rest of the economy is still growing at a mostly okay pace says Dr Shane Oliver at AMP Capital.

“March quarter GDP rose a stronger than expected 5.3%yoy, March retail sales and industrial production rose less than expected but investment rose more than expected. And a pick up in PMIs is a positive sign.”

Overall the Chinese economy looks on track for growth this year of around 4.5-5%.

That said, Dr Shane agrees that more policy stimulus would be the surest fix.

The Week Ahead

The main focus on the macro calendar this week will be Q1 2024 GDP and the Fed’s preferred measure of inflation, Core PCE.

At home, the March quarter CPI (Wednesday) is expected to rise 0.7%qoq taking annual inflation down to 3.4%yoy, from 4.1%yoy in the December quarter, which is slightly below the RBA’s implied 3.5%yoy forecast.

The monthly CPI for March is also likely to be 3.4%yoy.

It’s PMI week again with March business conditions indices (or PMIs) due Tuesday for the US, Japan, Europe and Australia and likely to show that the global economy is continuing to grow at an okay pace.

Interest will be on the cost and price components which for the G3 have stopped improving recently, mainly reflecting the US.

In the US the focus is on March quarter GDP growth (Thursday) and core private final consumption (PCE) inflation (Friday).

Another bust week on the US data front is likely to recalibrate the latest Fed rate cut expectations, and the question could well change from how many basis points could the Fed cut to whether it will cut at all this year.

The GDP data is likely to show another quarter of solid growth albeit at 2.3% annualised a bit slower than the 3.4% pace seen in the December quarter. Meanwhile, core PCE inflation is expected to come in around 0.26%mom with a fall to 2.7%yoy from 2.8%. While lower than the CPI this is likely to still be too high for the Fed’s comfort. Meanwhile, expect a rise in durable goods orders (Wednesday).

Finally on Friday, the core PCE price index for March will hit the markets, alongside personal consumption and income figures. Forecasts suggest core PCE inflation, the Fed’s favourite inflation metric, held steady at 2.8% in annual terms. The stickiness in consumer prices for the month likely tilts the risks to the upside.

The preliminary S&P Global PMIs for April are also coming out on Tuesday and market participants will get a glimpse of how the US economy has entered Q2.

The Bank of Japan (Friday) is likely to leave monetary policy on hold after its rate hike at its March meeting. However, it may move its forward guidance to sound more neutral and data dependent, as part of the transition to more normal monetary policy and given the surprising further fall in the Yen.

When they last met, Japanese officials decided to end years of negative interest rates, raising them by 10bps, and entirely abolished its yield curve control policy.

That said, with the Bank saying that they will continue buying bonds with broadly the same amounts as before, and with Governor Ueda noting that they will maintain accommodative policy conditions, investors continued to believe that any subsequent hikes will be very gradual and slow.

March quarter profit reporting season will reveal where the smartest of the recent flood of money landed as tech earnings enter the equation.

Aside from war and inflation, US earnings season is going to be a major influence over the next few weeks.

On Tuesday, the spotlight will fall on Alphabet and Tesla, while on Wednesday, it will be Meta’s turn. On Thursday, Microsoft and Amazon.

The Economic Calendar

Monday April 22 – Friday April 26

MONDAY

China (Mainland) Loan Prime Rate (Apr)

Indonesia Trade (Mar)

Taiwan Export Orders (Mar)

Canada New Housing Price Index (Mar)

Eurozone Consumer Confidence (Apr)

MONDAY

Australia Judo Bank Flash PMI, Manufacturing & Services

Japan au Jibun Bank Flash PMI, Manufacturing & Services

India HSBC Flash PMI, Manufacturing & Services

UK S&P Global Flash PMI, Manufacturing & Services

Germany HCOB Flash PMI, Manufacturing & Services

France HCOB Flash PMI, Manufacturing & Services

Eurozone HCOB Flash PMI, Manufacturing & Services

US S&P Global Flash PMI, Manufacturing & Services

Singapore Inflation (Mar)

Taiwan Industrial Production (Mar)

Hong Kong SAR Inflation (Mar)

United States New Home Sales (Mar)

WEDNESDAY

South Korea Consumer Confidence (Apr)

New Zealand Trade (Mar)

Australia Inflation (Q1)

Indonesia BI Interest Rate Decision

Germany Ifo Business Climate (Apr)

Canada Retail Sales (Feb)

United States Durable Goods (Mar)

THURSDAY

Australia, New Zealand Market Holiday

South Korea GDP (Q1, adv)

Malaysia Inflation (Mar)

Germany GfK Consumer Confidence (May)

Turkey TCMB Interest Rate Decision

United States GDP (Q1, adv)

United States Wholesale Inventories (Mar, adv)

United States Pending Home Sales (Mar)

FRIDAY

Australia PPI (Q1)

Japan Tokyo CPI (Apr)

Japan BoJ Interest Rate Decision and Quarterly Outlook

Singapore Industrial Production (Mar)

Mexico Trade (Mar)

United States Core PCE Index (Mar)

United States Personal Income and Spending (Mar)

United States UoM Sentiment (Apr, final)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.