Trader’s Diary: Everything you need to get ready for the week ahead

Picture:Getty Image

International headline last week was all about the US inflation data.

Prices in the US jumped 0.9% in October, and 6.2% from a year ago, the highest jump in three decades.

Some American corporate executives are calling on the government to fight inflation.

“I don’t think the administration is on top of it at all,” said the CEO of one of the US’ largest companies who spoke to Politico on condition of anonymity.

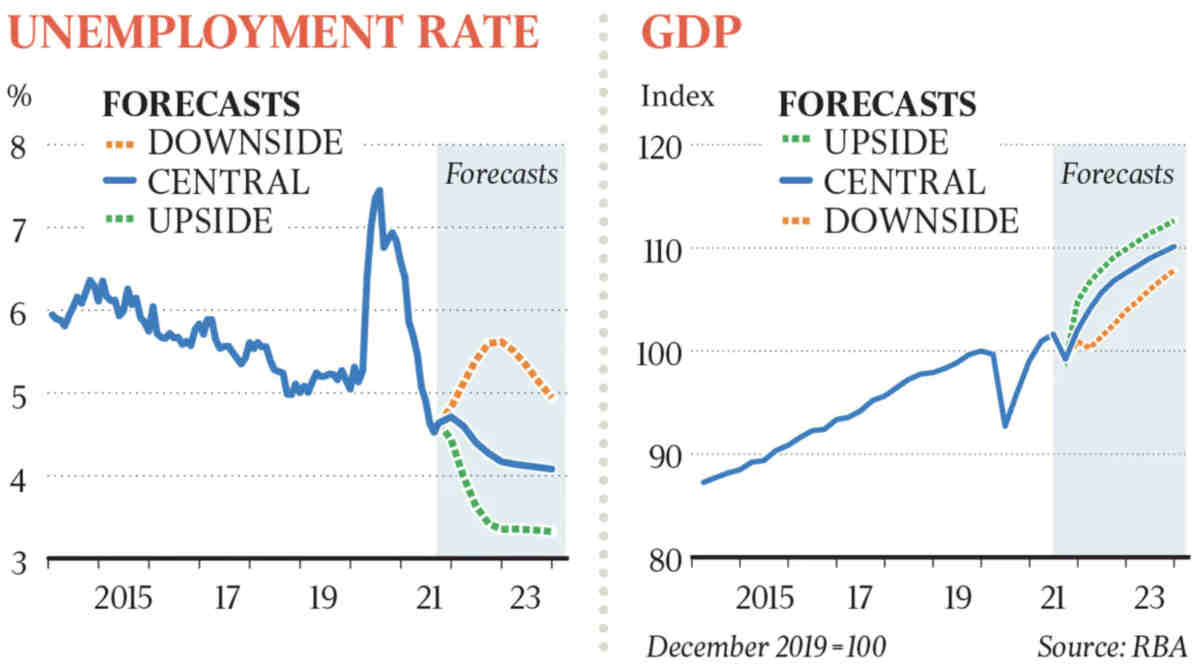

In Australia, the unemployment rate surged to 5.2% in October, compared to 4.6% in September.

The ABS says this is the first time the labour force participation rate (the proportion of working age population that is either in work or actively seeking work) has increased since June 2021.

Bjorn Jarvis, head of labour statistics at the ABS, said it showed people were preparing to get back to work.

“It may seem counterintuitive for unemployment to rise as conditions are about to improve,” he said.

“However, this shows how unusual lockdowns are, compared with other economic shocks, in how they limit being able to work and look for work.”

Economic calendar for this week

Australia

The focus this week is on the speech by RBA Governor, Philip Lowe, on Tuesday.

TUESDAY:

Reserve Bank (RBA) board minutes of the November 2nd meeting.

Speech by RB Governor, Dr Philip Lowe. The title of the speech will be “Recent trends in inflation.”

Weekly consumer confidence.

WEDNESDAY:

Wage price index for the September quarter.

THURSDAY:

Speeches by RBA board officials – Tony Richards who is the Head of Payments policy, and Luci Ellis who is the assistant Governor for Economic policies.

International calendar

US (US time)

Most of the key data will be released on Tuesday.

TUESDAY:

US retail sales for the month of October. In September, retail sales rose by 14% on the year.

US industrial production for October.

US housing market index.

Europe (European time)

A big in the economic calendar for Eurozone. Key data will be employment, GDP and CPI.

TUESDAY:

Eurozone employment data. It rose by 0.7% in the last quarter.

Eurozone GDP.

WEDNESDAY:

Eurzone CPI for October. In September, CPI was 2.1% YoY, and the market expects no change.

FRIDAY:

Eurozone current account.

China

MONDAY:

Chinese unemployment rate.

Chinese retail sales.

Chinese industrial production.

ASX IPO calendar for this week

MONDAY:

Resilience Mining Mongolia (ASX:RM1), a gold and copper explorer in Mongolia that raised $6m at 20c a share.

TUESDAY:

Evolution Energy Minerals (ASX:EV1), a mineral explorer that raised $22m at 20c.

WEDNESDAY:

Kalgoorlie Gold Mining (ASX:KAL), a mineral explorer that raised $172m at 20c.

Lycaon Resources (ASX:LYN), a mineral explorer that raised $20m at 20c.

My Rewards International (ASX:MRI). This is an employee and consumer rewards, loyalty and engagement program provider. It raised $7m at 20c.

THURSDAY:

Parabellum Resources (ASX:PBL), a mineral explorer that raised $172m at 20c.

Tissue Repair (ASX:TRP). This is a clinical stage biotech developing an advanced wound healing technology targeting the chronic wound and cosmetic procedure markets. It raised $22m at $1.15.

FRIDAY:

Cadence Opportunities Fund (ASX:CDO), an investment company that raised $25m at $2.77.

Cooper Metals (ASX:CPM). The company explores copper and gold deposits in Queensland and Western Australia. It raised $.4.8m at 20c.

Ventia Services (ASX:VNT). This is one of the largest essential services providers in Australia and New Zealand. Ventia was created in 2015 following the merger three companies. It raised $30m at $2.75.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.