Traders’ Diary: Everything you need to get ready for the week ahead

Via Getty

- Aussie inflation came in lower than expected last week

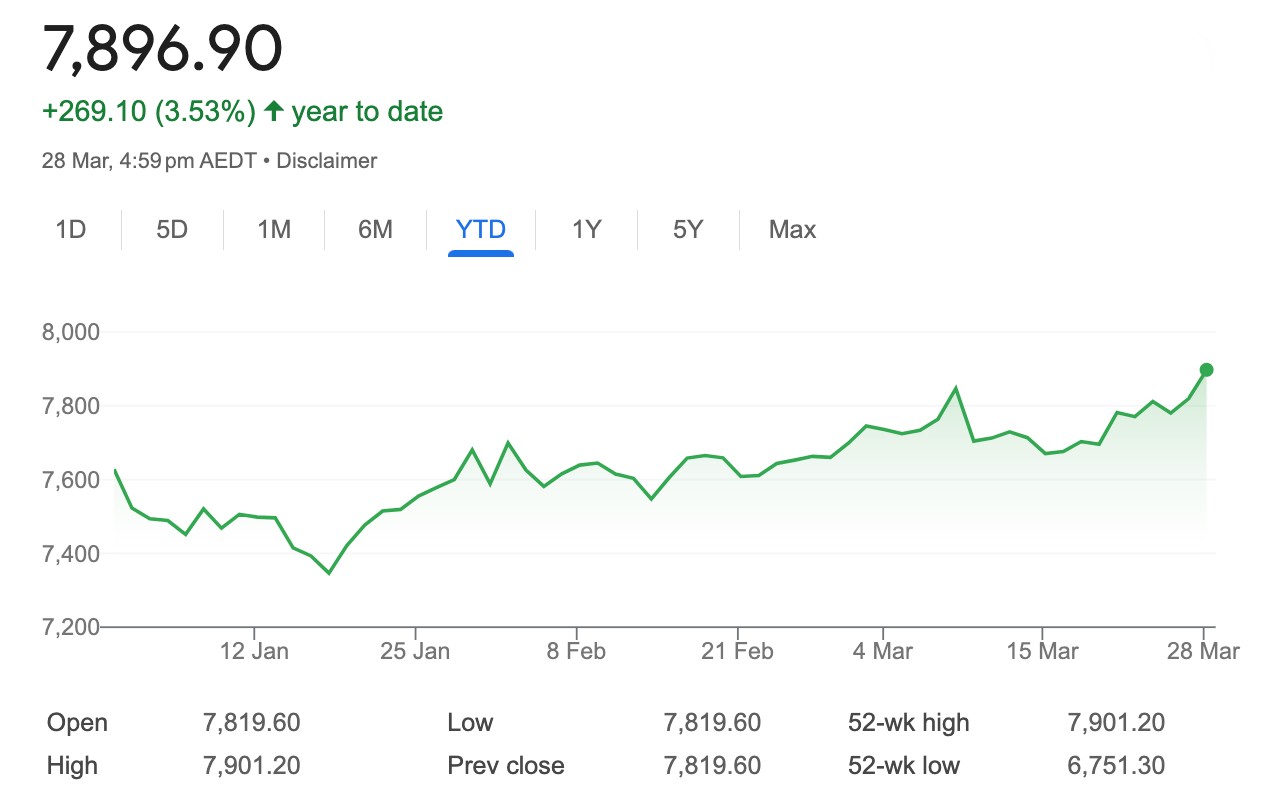

- The ASX200 up 3.5pc YTD, now at all-time highs

- The week ahead: Busy for local data

What grabbed the headlines last week?

T’was a bullish Friday session in Sydney which closed out a positive quarter for Aussie equities.

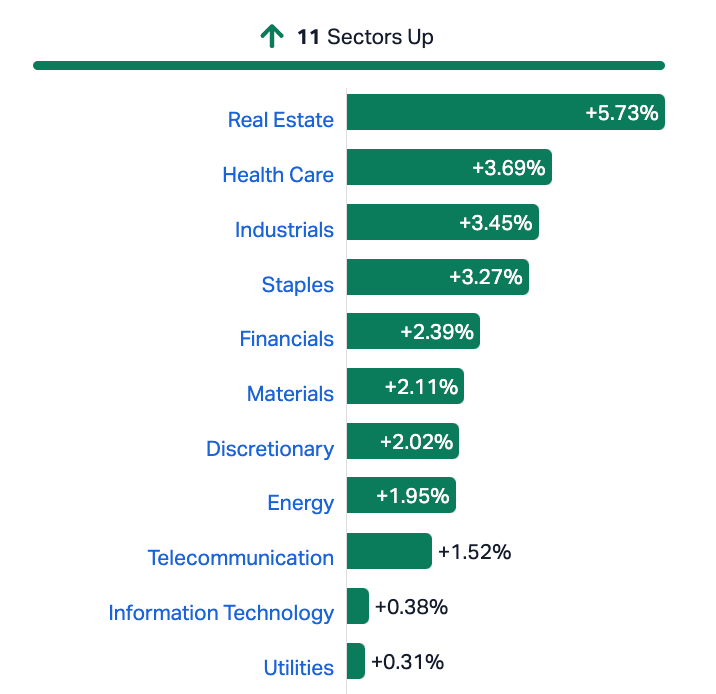

Aided by upbeat trading in New York and some further evidence of easing local inflation, Australian shares rose 1.6% last week with the Energy, Real Estate, Healthcare and Consumer Staples driving gains.

The local market rallied 3.5% in the last month, propelling the ASX200 to fresh all-time highs.

Around the traps, commodity prices were mixed with oil and copper up but iron ore down sharply.

Gold climbed above US$2,250 an ounce on Monday, extending its rally to record levels as softer-than-expected US inflation data cemented bets that the Federal Reserve would start cutting interest rates in June.

That was the takeaway of mixed news from the world’s more familiar central bankers, with US Fed Governor Waller leaning a bit more hawkish but Fed Chair Powell sounding pretty cool and calm and welcoming lower February core private final consumption inflation as “definitely more along the lines of what we want to see”.

Powell suggested the strong US economy and jobs market might “give us the chance to be a little more confident about inflation coming down” before heading downwards.

Last week, J. Powell stood by the Fed’s base case of three Fed rate cuts this year but is data dependent and still waiting for more confidence.

Meanwhile, in loopyland, ECB officials sounded dovish and the Swedish central bank flagged possible rate cuts in May or June.

On Wall Street, all three of its main indices closed in the green, with the Dow Jones gaining the most and the S&P 500 securing a new closing record. The Nasdaq gained the least, perhaps dragged down by Nvidia, which closed in the red for a second straight session.

More data suggesting that inflation in the US is proving stickier than expected could weigh on Wall Street.

Data released on Friday showed that the Fed-preferred PCE price index rose 0.3% month-on-month in February, slowing from an upwardly revised 0.4% gain in January which was also the consensus forecast.

Even if delayed, the next move on US interest rates is likely to be lower, which is positive for firms that are valued by discounting free cash flows for the quarters and years ahead, while recent activity has shown that investors are willing to price more future growth opportunities related to artificial intelligence.

US markets now see a nearly 70% chance that the Fed would start cutting rates in June, pricing in 75 basis points in total reductions this year.

The Aussie fell slightly and the greenback rose slightly.

On the ASX…

On Friday, the ASX200 ended the first quarter of 2024 at fresh record highs and lock in a fifth consecutive month of gains.

For the first quarter of 2024, the ASX200 stormed in a gain of 3.53%, while the ASX200 Accumulation index, which includes dividends, is set to end the quarter up 4.3% — about the same as the RBA’s official cash rate (OCR).

Of course, after last week’s softer-than-expected inflation print and Friday’s mundane 0.3% MoM rise in retail sales in February, IG Markets’ Tony Sycamore says the OCR at such highs won’t last.

“The RBA’s cash rate looks set to end the year closer to 3.85%, which adds to the comparative lure of the Australian stock market.”

The XJO has now gained 3.5% year-to-date…

Via Google

How the Sectors fared last week

The Week Ahead

The week ahead brings the Minutes of the RBA Board’s March meeting. The post‑meeting Statement shifted to a neutral tone, and we would expect that to come through as well in the Minutes.

Second‑tier economic data, including home prices, building approvals and the goods trade balance will be released.

Offshore, a quiet week is ahead, with euro area inflation and US non‑farm payrolls in focus.

Investors will be closely watching a Chinese business confidence survey for indications that depressed sentiment is beginning to lift.

Caixin is scheduled to release its March services purchasing managers’ index reading on Wednesday.

The Aussie Economic Calendar

Tuesday April 2 – Friday April 5

TUESDAY

Judo Bank Manufacturing PMI Final

RBA Kent Speech

RBA Meeting Minutes

ANZ-Indeed Job Ads MoM MAR

TD-MI Inflation Gauge MoM MAR

Reserve Bank of Australia’s Index of Commodity Prices

CoreLogic Dwelling Prices MoM MAR

WEDNESDAY

Ai Group Industry Index MAR

Ai Group Construction Index

Ai Group Manufacturing Index

THURSDAY

Australia Retail Sales (Feb, prelim)

Feb private sector credit (Feb)

Job vacancies Q1

MI inflation expectations (Mar)

Judo Bank Services PMI Final

RBA Jones Speech

Building Permits MoM Prel FEB

Private House Approvals MoM Prel FEB

Retail Sales MoM Final

FRIDAY

Aussie Balance of Trade FEB

Exports MoM FEB

Imports MoM FE

The Everyone Else Economic Calendar

Monday April 1 – Friday April 5

MONDAY

Monday 1 Apr

UK, Eurozone, Switzerland, Norway, Australia, New Zealand, Hong Kong SAR, South Africa Market Holiday

Japan Tankan Survey (Q1)

South Korea Trade (Mar)

China (Mainland) Caixin Manufacturing PMI* (Mar)

Indonesia Inflation (Mar)

United Kingdom Nationwide Housing Prices (Mar)

United States S&P Global Manufacturing PMI* (Mar)

United States ISM Manufacturing PMI (Mar)

Tuesday 2 Apr

Worldwide Manufacturing PMIs, incl. global PMI* released

across April 1-2 (Mar)

South Korea CPI (Mar)

Australia RBA Meeting Minutes (Mar)

Switzerland Retail Sales (Feb)

United Kingdom Mortgage Lending and Approvals (Feb)

Germany Inflation (Mar, prelim)

United States JOLTs Job Openings (Feb)

United States Factory Orders (Feb)

Wednesday 3 Apr

China (Mainland) Services, Composite PMI* (Mar)

Turkey Inflation (Mar)

Eurozone Inflation (Mar, flash)

Brazil Industrial Production (Feb)

United States ADP Employment Change (Mar)

United States S&P Global Services, Composite PMI* (Mar)

United States ISM Services PMI* (Mar)

Thursday 4 Apr

China (Mainland), Hong Kong SAR, Taiwan Market Holiday

Worldwide Services, Composite PMIs, inc. global PMI*

released across April 3-4 (Mar)

Australia Building Permits (Feb, prelim)

Switzerland Inflation (Mar)

Canada Trade (Feb)

United States Trade (Feb)

Friday 5 Apr

China (Mainland) Taiwan Market Holiday

Australia Trade (Feb)

Philippines Inflation (Mar)

India RBI Interest Rate Decision

Singapore Retail Sales (Feb)

Germany Factory Orders (Feb)

United Kingdom Halifax House Price Index* (Mar)

France Industrial Production (Feb)

Eurozone Construction PMI* (Mar)

United Kingdom Construction PMI* (Mar)

Eurozone Retail Sales (Feb)

Canada Unemployment Rate (Mar)

United States Non-farm Payrolls, Unemployment Rate,

Average Hourly Earnings (Mar)

S&P Global Sector PMI* (Mar)

All sources: IG Markets, S&P Global Market Intelligence, CommSec

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.