Traders’ Diary: Everything you need to get ready for the week ahead

Ahh. She must read Stockhead. Via Getty

- Central banks looked done with rate hikes last week

- Swiss cut by 25bps

- The week ahead: Monthly CPI and markets closed on Friday, courtesy the big guy upstairs

What grabbed the headlines last week?

It was a week to remember for the limelight absorbent central banks with the Reserve Bank of Australia (RBA), the Bank of Japan (BoJ), the US Federal Reserve, the boring olde Bank of England (BoE) and the Swiss National Bank (SNB) all choosing a fresh path for monetary policy.

In Martin Place, the RBA left the cash rate on hold at 4.35%, as was widely expected.

Belinda Allen, senior economist at CBA, said given the flow of data in the past month or so – particularly the Q4 23 GDP numbers and monthly CPI – there was a chance the Guv’nah would nix the bank’s long held “hiking bias.”

“In the end,” Belinda says, “the mild tightening bias was removed and replaced with a neutral one “the Board is not ruling anything in or out””

“This reflects the language the Governor used at the post meeting press conference in February and acknowledges that the RBA is now more convinced the last rate hike is done.”

The RBA next meet on 7 May.

The Bank of Japan on Tuesday overhauled its policy regime, exiting its negative interest policy and yield curve control. The BoJ reintroduced the unsecured overnight call at a range of 0.0%‑0.1%.

In contrast, the exuberant bunch at the Swiss National Bank made a gallant and unexpected 25 basis point cut.

And there was much rejoicing.

At the Bank of England the top boffins voted 8‑1 to keep the Bank rate unchanged at 5.25%.

Forward guidance was maintained that rates need to stay sufficiently restrictive for an extended period of time. Nevertheless, the BoE noted that “policy could remain restrictive even if Bank Rate were to be reduced”.

CBA expect the first British rate cut in August.

On the ASX…

Traders had a rollercoaster, running the full gamut of trading emotions: shitscared and euphoric. Often at once.

Gold casually smashed though record highs above US$2200/oz before paring some gains late in the week.

US markets hit frivolous new highs. Iron ore disappointed. Oil surged.

And then there’s Bitcoin.

After punching though US$70k last week, BTC gave up about 13% to land at US$60k and was heading back to record territory again on Friday, when Reuben last saw it heading to Vegas at US$66.5k circa COB Friday.

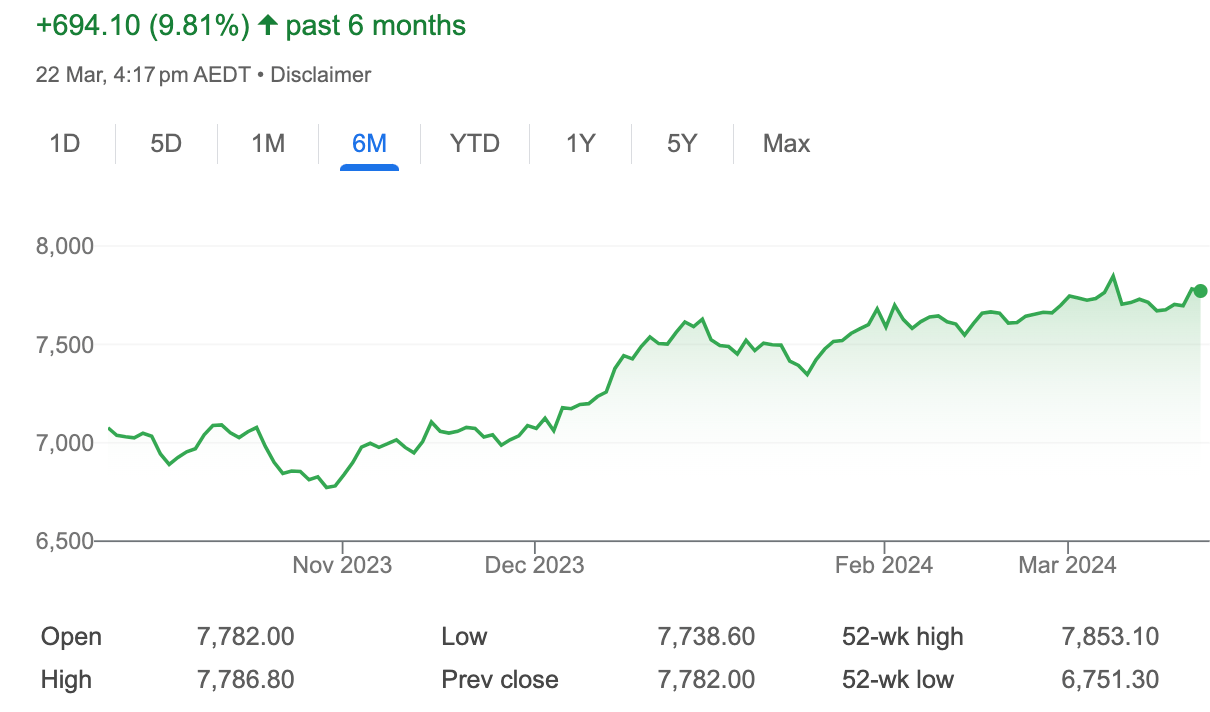

The benchmark ASX200 ended the week ahead some 1.3%, thanks to a particularly robust day of trade on Thursday. A nice recovery from last week’s depressing effort.

The XJO has now gained almost 10% over the last half year of trade…

Via Google

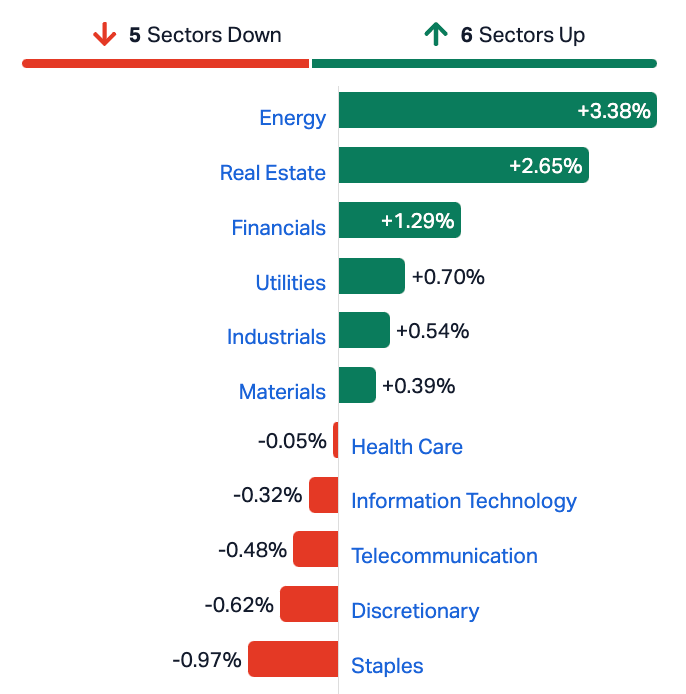

How the Sectors fared last week

The Week Ahead

It’ll be a shortened week on the ASX, with the very badly named Good Friday holiday. Good for everyone but the guy it’s commemorating – he’s getting nailed to a tree.

This week the focus will be on said man, chocolate eggs via a rabbit and the local monthly CPI indicator.

There’s also some retail trade data for February.

CBA expects a bounce back in the monthly CPI to 3.8%/yr and a flat outcome for retail trade in February after a lift of 1.1% in January.

Job vacancy, credit growth and consumer sentiment data are also due.

Offshore, it’s spooky quiet which will make everyone particularly sensitive to anything loony, unexpected or just not perfect enough about US PCE data.

Around our neck of the woods, there’s inflation data dropping for Singapore and Malaysia, while some interesting meeting minutes from the Bank of Japan (BoJ) are also due.

It should really be Very Bad Friday and then Just Terrific Sunday.

With a punchier lead in, like…

Jesus: He cannot be stopped.

That’s how you get the kids interested.

The Aussie Economic Calendar

Monday March 25 – Thursday March 28

MONDAY

ACCI–Westpac business survey Q1

TUESDAY

Australia Westpac Consumer Confidence (Mar)

Westpac–MI Consumer Sentiment (Mar)

RBA Head of Payments Policy speaks in Sydney

WEDNESDAY

Westpac–MI Leading Index (Feb)

Monthly CPI Indicator (Feb)

THURSDAY

Australia Retail Sales (Feb, prelim)

Feb private sector credit (Feb)

Gob vacancies Q1

MI inflation expectations (Mar)

FRIDAY

ASX holiday

The Everyone Else Economic Calendar

Monday March 25 – Friday March 28

MONDAY

India Market Holiday

Japan BoJ Meeting Minutes (Jan)

Thailand Trade (Feb)

Malaysia Inflation (Feb)

Singapore Inflation (Feb)

Taiwan Industrial Production (Feb)

United States New Home Sales (Feb)

TUESDAY

Japan Consumer Confidence (Mar)

Singapore Industrial Production (Feb)

Germany GfK Consumer Confidence (Apr)

Spain GDP (Q4, final)

Hong Kong SAR Trade (Feb)

United States Durable Goods Orders (Feb)

United States S&P/Case-Shiller Home Price (Jan)

United States CB Consumer Confidence (Mar)

WEDNESDAY

South Korea Business Confidence (Mar)

China (Mainland) Industrial Profits (Feb)

Spain Inflation (Mar, prelim)

France Consumer Confidence (Mar)

Eurozone Economic Sentiment (Mar)

Mexico Trade (Feb)

Spain Business Confidence (Mar)

South Africa SARB Interest Rate Decision

THURSDAY

Japan BoJ Summary of Opinions (Mar)

United Kingdom GDP (Q4, final)

Germany Retail Sales (Feb)

Germany Unemployment Rate (Mar)

Italy Business Confidence (Mar)

Brazil Unemployment Rate (Feb)

India Current Account (Q4)

Canada GDP (Jan)

United States GDP (Q4, final)

United States UoM Sentiment (Mar, final)

United States Pending Home Sales (Feb)

Friday 29 Mar

US, UK, Eurozone, Switzerland, Norway,

Singapore, Hong Kong SAR, South Africa, India, Brazil,

Canada, New Zealand Market Holiday

South Korea Industrial Production (Feb)

Japan Unemployment Rate (Feb)

Japan Industrial Production (Feb)

Japan Retail Sales (Feb)

France Inflation (Mar, prelim)

Italy Inflation (Mar, prelim)

United States Core PCE (Feb)

All sources: IG Markets, S&P Global Market Intelligence, CommSec

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.