Traders’ Diary: Everything you need to get ready for the week ahead

Can these Americans sort their debt ceiling differences? Via Getty

The economic week that was

The ASX200 pulled out another wee gain last week, ending +0.25% ahead. The blame here really lies at the feet of interminably optimistic Wall Street traders.

The general theme running through Wall Street is the obstinate belief that the Fed’s totally done with hiking rates clearing the way for good economic news – aside from lower unemployment which is still bad – to finally be accepted by equity traders as actually good news.

The obvious rider to that is all bets are off if the the US blindly argues its way into an unprecedented and catastrophic default on its debt.

That hint of positivity saw growth back o the menu, but it’s not a dish I’d be confident in gorging myself on. But best ignore me, they major tech names are rolling on.

“The sector rotation from value into growth continued unabated even as local 3-year bond yields rallied to their highest close in 10 weeks – we question if the likes of tech can continue to ignore the move in bonds for much longer, especially if it gathers momentum,” noted James Gerrish of Market Matters.

The S&P ASX 200 index closed up 0.6% on Friday. The local Emerging Companies index (S&P/ASX:XEC) – a benchmark for Australia’s micro-cap companies – was also higher by 0.86%.

Late into the week, local markets followed Wall Street higher, traders in New York really clinging onto any leg of hope in the sorting of the debt ceiling crisis.

The tech-heavy Nasdaq looks set to jump on the slightest of not-bad-news. It ended the week 3.3% higher.

On Thursday, those mega tech’s, among which we can now include Nvidia (alongside the FAANG fraternity of Netflix, Apple, Alphabet, Meta, Microsoft all signed off up around their highest levels for the year to date.

Tesla hit a 4-week high of US$177.40

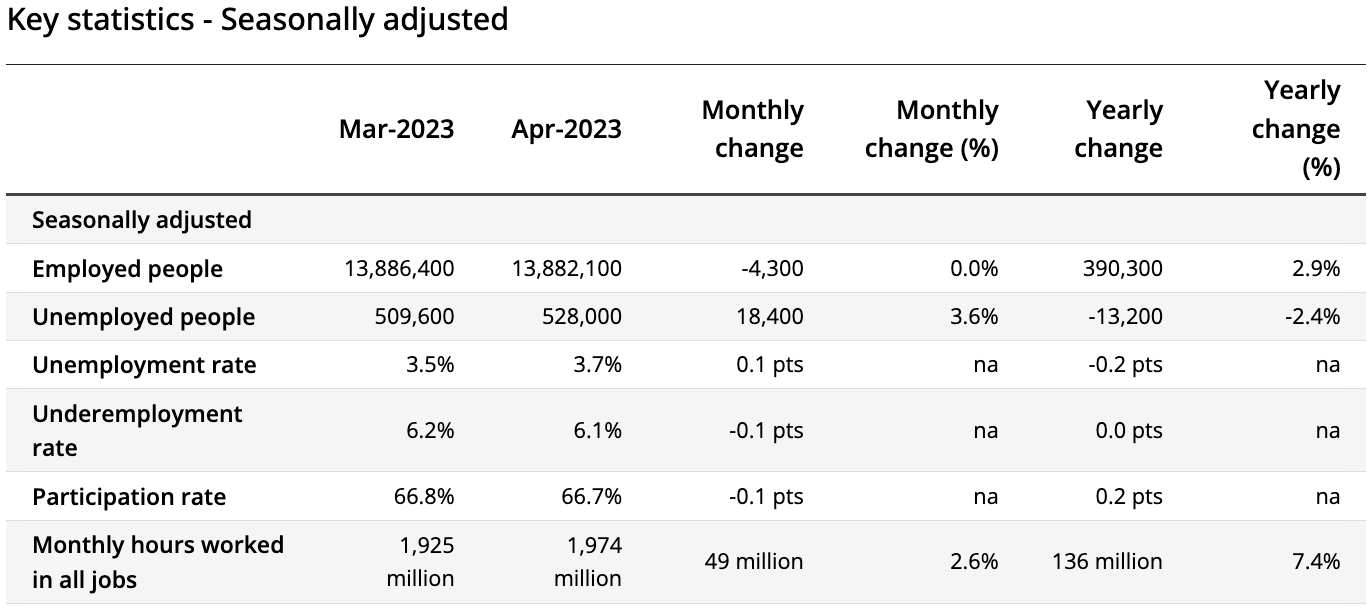

At home, last week jobs data for April was soft with employment down slightly and unemployment rising to 3.7%, up from a low of 3.4%.

Labour market underutilisation edged up to 9.8%.

While the jobs market is still tight with unemployment still around its lowest in nearly 49 years, it does appear to be slowing, according to AMP’s Dr Shane Oliver.

The Reserve Bank of Australia is holding rates at 3.85% at its June meeting, says , but he also warns further rate hikes ‘remain a high risk.’

“The minutes from the last RBA board meeting reiterated that further rate hikes may still be required depending on economic activity and inflation data.

“Looking at the data since the last meeting: business conditions remain solid but are slowing; retail sales have been soft; wages growth has increased a bit further but is in line with RBA forecasts and there are no signs of a wages breakout; and April jobs data came in weaker than expected with an emerging rising trend in unemployment,” Dr Oliver says.

“Of course, there is still retail sales data (26 May) and inflation data (31 May) to come but so far the data flow since the last meeting suggests that the RBA should leave rates on hold at its June meeting in order to better assess the impact of past rate hikes and avoid unnecessarily plunging the economy into recession.

“We think that further tightening would be overkill, but with the RBA minutes reiterating the Bank’s concerns about sticky services inflation, the tight labour market, the risk of rising inflation expectations, weak productivity growth and the increase in home prices the risk of further rate hikes is very high.”

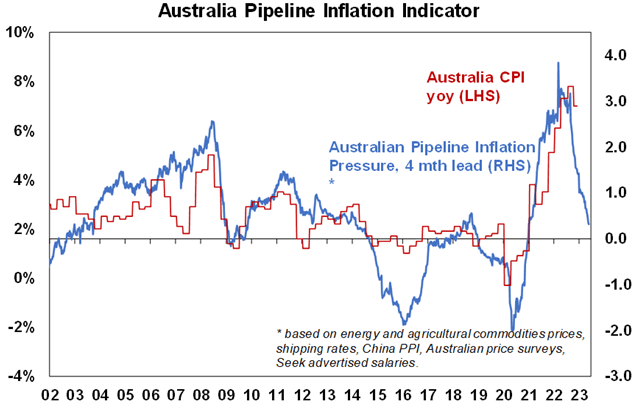

Having said that Dr Oliver’s palpitating Australian Pipeline Inflation Indicator is continuing to fall pointing to sharp fall in inflation ahead.

“Its now coming down as quickly as it went up suggesting that inflation could surprise the RBA on the downside.”

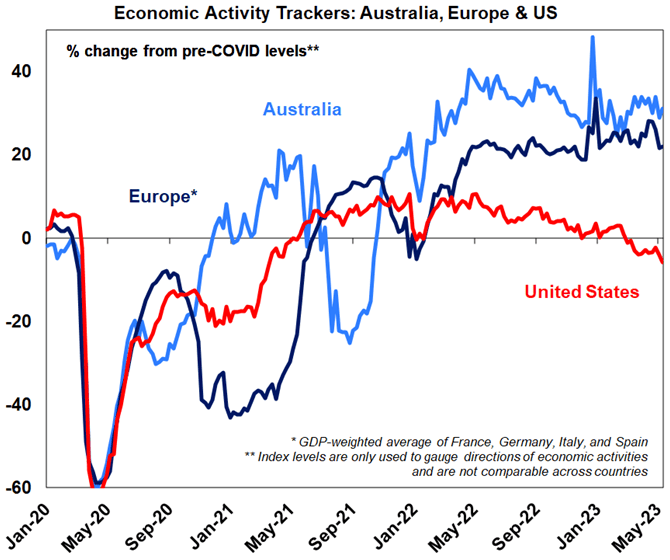

On the broader economic front AMP’s Economic Activity Trackers rose slightly here at home and in Europe, but the US fell further.

It’s a messy old chart and looks alike my impending heart attack, but does a good job of describing volatile times and Americans behaving badly.

“Overall,” Doc Oliver says, (the above chart) (is) “suggesting flat-to-only-slightly positive economic growth year to date in Australia and Europe, but possibly an emerging contraction in the US.”

Japanese markets highest in 33 years

In Tokyo the funny old bourse is back, thanks to some stronger-than-expected growth. It’s taken the entire life span of some of the world’s greatest comedians (ie: 33 years) – like Chris Farley, Jon Belushi, Bon Scott, Eva Braun and Jesus H Christ to hit the highs it did late last week just as the often equally amusing G7 leaders gathered in Hiroshima for the latest of the ‘Gees-even: I’m-over-this-summit, summit’.

At 4.30pm Friday (AEST) The Nikkei 225 was up 0.8%, clocking the highest levels since 1990. The Topix scored its sixth straight winning session.

The rise in Japanese markets comes despite the country’s accelrating inflation (3.5% in April) with core (ex food and energy) inflation rising to 2.5% from 2.3%.

Japanese March quarter GDP came in stronger at 0.4%qoq or 1.3%yoy driven by strength in consumer spending, business investment and public investment.

By comparison, the Fair-to-Middling Kingdom’s recovery looks pretty ho-hum right now.

Chinese markets have fallen with the Hong Kong’s Hang Seng index down 1.05% and the Shanghai Composite sliding 0.4% in mainland China.

Doc Oliver says it’s ‘losing some momentum.’

Soft, I believe, is how he described China’s economic activity data for April.

Obviously retail sales growth jumped – up over 18 %yoy, but that’s compared to the pancaking effect of lockdowns a year ago with sales actually down 7.8% in April.

Industrial production was up but less than hoped and investment growth slowed, because the signals out of Beijing are a bit scary. Residential investment remains weak.

Youth unemployment hit a new record high of 20.4%. That’s a worry.

“Overall, it appears momentum from the reopening may have faded quicker than in other countries (partly due to less support for the household sector and so less pent up saving) and further policy easing may be required,” Dr Oliver said.

Chinese markets have fallen with the Hong Kong’s Hang Seng index down 1.05% and the Shanghai Composite sliding 0.40% in mainland China.

The next 12 months are likely to see easing inflation pressures, central banks moving to get off the brakes. This along with improved valuations should make for reasonable share market returns in contrast to 2022. But the next few months may be rough given high recession and earnings risks, uncertainty around US banks and raising its debt ceiling, geopolitical risks and poor seasonality out to around September/October. This is likely to impact both global and Australian shares.

– Dr Shane Oliver

Gold and less interesting metals

Here’s Pete McGuire on CNBC talking gold…

And here’s James Gerrish talking ASX 2nd Tier goldies:

The 2nd tier gold stocks tend to have a higher cost of production making them higher beta plays on the gold price i.e. they’re more volatile.

“At MM we are bullish towards the gold sector medium & long term hence we like the “2nd tier” gold stocks into pullbacks with RMS & GOR our preferred 2 at current levels – we already hold St Barbara (SBM) in our Emerging Companies Portfolio, which has been a challenge!,” MM’s James Gerrish told clients over the weekend.

“So far in 2023 we’ve seen gold rally hard and then fall hence ytd.”

Gerrish the moves look fairly muted:

Ramelius (ASXRMS) +48%

Newcrest Mining (ASX:NCM) +34%

Evolution Mining (ASX:EVN) +27%

Gold Road Resources (ASX:GOR) +8%

Regis Resources (ASX:RRL) +1%.

The economic week ahead

Looking ahead, a lacklustre session on Wall Street, Friday could drag the local index back into morose territory as Monday kicks off in Sydney.

On the Aussie economic front, it’s a pretty quiet one.

My pasty Cornish Sydney-based but English-as-Stilton analyst from eToro, Mr Josh Gilbert says the the monetary policy conspirators of Macquarie Street got good news last week when the jobless rate rose to 3.7%. But bad news for the 528,000 Australians who can’t find one, nevertheless we’re taking whatever a win looks like Vs inflation.

Josh says its another key data point that could see the Central Bank leaves rates on pause next month.

“Another focal point in the data puzzle impacting the RBA’s next move is handed down this week with monthly retail sales,” he reckons.

Retail trade on Friday is the sole first‑tier release and is always an important data point.

CBA says recent spending data has been generally soft: nominal growth has proven sluggish and real retail trade volumes contracted in Q4 2022 and Q1 2023. Consumer spending has been slowing especially for goods.

“March’s read on retail sales showed sales rose by 0.4% month-on-month as retail spending begins to subdue. As the full effect of the RBA’s rate hikes passes through to households, consumers are becoming more cautious over their spending habits – something the RBA wants,” Josh told Stockhead over the weekend from his Northern Sydney tower of solitude.

“As a result, this period will see more consumers ‘down trade’, which should benefit consumer staple names such as Coles (ASX:COL), with retail sales being driven by food sales.

“The everyday consumer has been fairly resilient over the last 12 months, but confidence is near record lows, and households are now really starting to feel the pinch.”

In the states, the market stupefying moments will be dominated by blow-by-blows on the debt ceiling negotiations. The latest on this (Sunday morning Sydney time), is that President Joe and House Speaker Kev ate to meet face to face Monday (New York time) to get back to name calling under the debt ceiling.

The McPresident is jumping straight back onto Air Force One from the G7 Summit in Hiroshima to try and get the screwball Republicans to yield on the US deficit ceiling impasse. It’s totally bollocksed his Pacific geopolitical agenda, nixing to scheduled meetings with Pacific Island nations and Asian partners like us in the Quad.

There’s more to sift through for FMOC fans with the meeting minutes, fresh May PMIs for the US, UK, the EU, Japan, France, and Germany. Personal income and spending data, PCE prices, the the 2nd estimate of US GDP growth, corporate profits, and durable goods orders.

And what we could really overdose on is the slew of inflation numbers due from the UK and monetary policy calls in China, South Korea, Indonesia, Turkey, and South Africa.

The week in $$: USD gets big on June Fed hike bets

At least we smacked the NZD last week.

Factors at play, via XM:

- Debt-ceiling headlines stay encouraging

- Initial jobless claims surprise to the downside

- Fed officials continue to appear in hawkish suits

- USD gains as June hike probability increases

- Loopy Wall Street celebrates data and debt-ceiling optimism

On the geopolitical front, the elections in Turkey need an eye kept trained on Istanbul.

Incumbent and ever cranky Recep Tayyip Erdoğan now has favourite status going into the presidential run-off, but one must recall experts, pollsters and various commentators said exactly the reverse last week.

On Wall Street JPMorgan has an investor day in New York on Monday, with presentations by chief executive Jamie Dimon and various members of his executive management team.

Earnings to watch

At home, the online travel rustlers WebJet (ASX:WEB) release FY 2023 on Wednesday morning.

These chaps haven’t made a FY profit since 2019, although excitement has been brewing since before Christmas when Webjet surprised markets with a 1H $32.1m take home profit. They reported a massive 217% increase in revenue and a 557% jump in EBITDA, but importantly said that profitability should climb above pre-pandemic levels.

Goldman Sachs reckons WEB could smash even those expectations, churning through as much as $338 million of revenue and $124 million of EBITDA– tripling the first and doubling the second on FY22.

Josh Gilbert notes that travel stocks have been some of the top performers on the ASX200 so far this year as investors bet that the surge in travel demand won’t taper anytime soon.

“Earnings from travel compatriots globally in the last month have been stellar, with Expedia, Booking.com, Singapore Airlines and Emirates all reporting better-than-expected results.

“Webjet investors will be hoping to see the same result from its full-year numbers…. Given that travel has come back in a big way, Webjet’s full-year results could spell more good news for shareholders this year, but its guidance may be in focus with headwinds such as labour costs, weakening consumers and recession risks.”

The Economic Calendar

Monday May 22 – Friday May 26

Sources: S&P Global, Commsec, Trading Economics

Australia

MONDAY

Nope

TUESDAY

Nope

WEDNESDAY

Westpac Leading Index MoM

AU RBA Jacobs Speech

THURSDAY

Nope

FRIDAY

Retail sales, MoM (Yay)

Everyone else

MONDAY

US Fedspeak Bullard speech

China Loan Prime Rate 1Y/5Y

TUESDAY

US Fedspeak Bostic Speech

US Fedspeak Logan Speech

US Redbook YoY

US S&P Global Services PMI Flash MAY

US S&P Global Composite PMI Flash MAY

US S&P Global Manufacturing PMI Flash MAY

US Building Permits Final

WEDNESDAY

EU PMI

UK PMI

US New Home Sales APR

US Richmond Fed Manufacturing Index MAY

US Richmond Fed Services Index MAY

THURSDAY

US FOMC Minutes

US Chicago Fed National Activity Index APR

US GDP Price Index QoQ

US Corporate Profits QoQ Prel Q1

US GDP Growth Rate QoQ 2nd Est Q1

US Initial Jobless Claims MAY

FRIDAY

US Durable Goods Orders MoM APR

US Core PCE Price Index MoM APR

US Personal Spending MoM APR

US Personal Income MoM APR

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.