Traders’ Diary: Everything you need to get ready for the week ahead

Picture: Getty Images

The economic week that was

The US Federal Reserve, the European Central Bank (ECB) and our own punchy RBA all lifted their respective cash rates by 25bp.

The moves by the ECB and US Fed were expected.

Even though the governor made it clear that the RBA has retained its tightening bias, the bank’s decision to lift rates by 25bp ;ast week was met with disappointment bordering derision.

According to Bloomberg’s survey of 21 economic punters there was to be no change to the cash rate in May. Money markets had priced a negligible ~12% chance of a 25bp rate hike.

The ASX 200 finished 1.1% lower for the week, which in the words of my genius colleague and friend of the show Gregor Stronach, isn’t surprising considering the knocks it’s been taking since Monday.

Looking at the Official Sector list, the best performer was Real Estate, which climbed 2.57% followed by Utilities on +1.37%.

According to Stronach, the situation wasn’t helped by the surprise RBA rate hike, weak global leads and the exit of another US bank.

“The banking woes in the US really too their toll on local Financials stocks, which closed out the week down 2.81% – and given how bloated and corpulent that sector is, it’s a huge burden for the rest of the market to try to carry.

“Energy fell by 1.7%, Health Care by 1.3%, Staples by 1.1% and that’s where I’m going to cap that list because at this point it’s like gawping mindlessly at a road accident.”

I’ll continue for him: Bond yields fell, as did oil, metal and iron ore prices. The $A rose though as the $US fell.

“The weeks volatile proceedings inspired another stellar performance by local gold stocks, with the XGD All Ords Gold index climbing 3.25%.”

The precious metal booming into an all-time high above AUD$3,000 an ounce this week as well.

You should see what Josh Chiat has to say about that.

Elsewhere

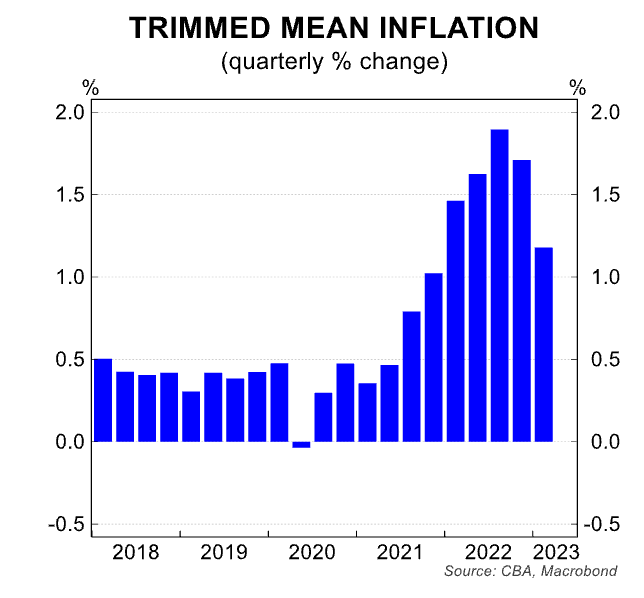

With the Reserve Bank’s latest SOMP in his hands late last week, CBA’s Gareth Aird noted that at least from a monetary policy perspective CBA doesn’t think that the RBA will hike the cash rate again in this cycle.

“This is simply based on our take of the Board’s reaction function from here. That is, the economic data will need to print stronger than the RBA’s updated forecasts for them to increase the cash rate again. And that is not our base case.”

But, as Mr Aird rightly points out: “no economist has a crystal ball and the data could surprise to the upside, particularly given the housing market is showing signs of renewed strength.”

As such, the near term risk sits with another rate increase and “markets should be aware of this.”

“Looking further ahead our base case sees the RBA commence an easing cycle in late 2023.

Because the art of monetary policy works with a lag in both directions. Aird says the bank’s base case sees the RBA commence an easing cycle in late 2023.And we think that with inflation receding more quickly than the RBA expects and unemployment rising more quickly the Board will want to take the cash rate down from a deeply restrictive setting to keep the economy ‘on an even keel’ in 2024.

The economic week ahead

The focus in the week ahead will be the Aussie Federal Budget, handed down on Tuesday evening (7.30pm AEST).

CBA also sees the deficit estimate getting “revised down substantially.”

To ~$A5bn (0.2% of GDP) AND well below theIR previous estimate of $A36.9bn (1.5% of GDP), thanks largely to stronger‑than‑expected nominal GDP growth this year is boosting revenue and lowering spending.

Consumer and business sentiment is also released this week, as is the CommBank Household Spending Intentions series for April.

For fans of US inflation, we wouldn’t leave you out.

The US April CPI report due out on May 10 – economists guessing at a 0.3% month-over-month increase in inflation for the month and 5.5% year-over-year gain, as higher gasoline prices bite, but the core (CPI) inflation read is expected to slow a bit to 5.4% YoY from 5.6%.

Following up the CPI print, the latest update on producer prices will be released on May 11 to also give inflation watchers another useful peek into the machinery.

Producer prices are also thought to have eased a little, to 2.4% YoY. The Fed’s Senior Loan Officer Opinion Survey (Monday) is likely to show a further tightening in already tight bank lending standards. The NFIB small business survey comes out Tuesday.

The Bank of England (BoE) (Thursday) is expected to hike rates by another 0.25% to 4.5% and provide neutral guidance.

Chinese April trade data (Tuesday) is expected to show slower export growth of 11% yoy and an improvement in imports to flat year on year. CPI inflation (Thursday) is expected to slow further to just 0.2% yoy with producer price inflation falling to -3.1% yoy.

In Australia, the focus will be on the 2023-24 Australian Budget (9 May) which is likely to be mainly about modest cost of living relief, and measures to fund a further ramp up in structural spending pressures (on defence, NDIS, health and aged care).

What else?

The earnings adventures continue in the US.

A few media companies under the Wall Street microscope:

MONDAY

PayPal Holdings (PYPL), KKR (KKR), Lucid Group (NASDAQ:LCID)

TUESDAY

Airbnb (ABNB), Fox (FOX), Coupang (CPNG), Nikola (NKLA).

WEDNESDAY:

Disney (DIS), Trade Desk (TTD), Roblox (RBLX), Unity Software (U).

THURSDAY

JD.com (JD), US Foods (USFD), News Corporation (NWS).

FRIDAY

Spectrum Brands (SPB), Soho House (SHCO).

The Economic Calendar

Monday May 8 – Friday May 12

Sources: S&P Global, Commsec, Trading Economics

Australia

MONDAY

Australia NAB business confidence index (April): index to rise to 1 from -1.

Building approvals for March +3% according to CBA

TUESDAY

Westpac / MI Consumer Sentiment, May

CommBank Household Spending Intentions, April

Federal Budget 2023/24

Australia consumer confidence index (May): expected to fall to 82.1 from 85.8.

FRIDAY

Everyone else

MONDAY

UK Coronation bank holiday – UK markets closed

US FED Senior Loan Officer Opinion Survey

TUESDAY

China trade data (April): exports to rise by 11% compared to 14.8% in March.

WEDNESDAY

US CPI (April): prices expected to have risen 4.9% YoY from 5%, and fall 0.2% from a 0.4% rise MoM. Core CPI to be 5.6% YoY and 0.5% MoM, from 5.6% and 0.4% respectively.

US EIA crude oil inventories (w/e 5 May): stockpiles fell by 1.3 million barrels in the preceding week.

THURSDAY

China CPI (April): prices to rise 0.9% YoY and 0.1% MoM, from 0.7% and -0.3%.

BoE rate decision: rates expected to rise to 4.5%, though signs of dissent could indicate a resistance to further rate increases.

US initial jobless claims (w/e 6 May), PPI (April): prices expected to have fallen 0.1% MoM, claims to rise to 248K.

FRIDAY

GDP (Q1, preliminary): growth expected to have been 0.1% QoQ and -0.5% YoY.

US Michigan consumer sentiment (May): expected to fall to 63.

The ASX IPO calendar for this week

According to the ASX and Emma, these are the new company listings on the ASX this week, and a few thereafter in May:

Expected listing date: 10 May, 2023

IPO: $5m at $0.20

This explorer has a suite of green metal projects (either owned or optioned) including lithium, PGEs, nickel, vanadium and uranium in the attractive mining jurisdiction of Western Australia.

The Coats PGE, nickel, copper and vanadium project is 20km SSE of Chalice Mining’s (ASX:CHN) Julimar project.

The Lake Johnston lithium and nickel project is close to Wesfarmers’ (ASX:WES) and SQM’s Mount Holland Lithium Mine, as well as the historic Maggie Hays/Emily Ann Nickel deposits held by Poseidon Nickel (ASX:POS).

Then there’s the Nowthanna uranium-vandium project, which is adjacent to Toro Energy’s (ASX:TOE) Nowthanna project.

Expected listing date: 17 May, 2023

IPO: Around $9.56m at $0.20 per share

NGX is Sovereign Metals’ spin-out of its Malawi graphite assets, which Sovereign said would allow it to focus on its Kasiya rutile project – “the largest natural rutile deposit in the world”.

Under the spinoff deal, Sovereign shareholders are entitled to one NGX share for every 11 Sovereign shares they hold, with the IPO allowing them to participate in purchasing one new NGX share for each NGX share held.

Graphite itself is having its day in the sun due to increasing demand driven by electric vehicle battery makers.

While graphite prices have not moved to the same extent as other battery metals so far in the electric vehicle boom, a major gap is emerging between supply of battery graphite and demand.

That is only set to rise with EV penetration, given graphite anode material makes up significantly more of the metal content of the battery than lithium.

Upon listing, NGX holders will take full ownership of the advanced Malingunde project, which already boasts a measured, indicated and inferred resource of 65Mt at 7.2% total graphitic carbon for 4.68Mt of contained graphite, more than half of that in the higher measured and indicated categories.

They’ll also pick up the Duwi project, just 15km east of the Malawian capital of Lilongwe.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.