Traders’ Diary: Everything you need to get ready for the week ahead

Olde England. Via Getty

The last few weeks have provided us with critical updates on inflation and the labour market while in the coming week we get an update on wages, which Westpac’s senior economist Justin Smirk reckons is “both an outcome of, and interplay between, these two factors”.

What grabbed the headlines last week?

Inflation and interest rates.

Inflation.

And interest rates.

In the States, we saw that the monthly inflation picked up in January, many traders are now struck numb by the breadth of high inflation reads right across CPI items, because at the same time the broader trend towards lower inflation appeared to continue with annual US inflation falling to 6.4% year on year. Core inflation dropped to 5.6% YoY.

In the nittiest grittiest bits, three-month annualised goods price inflation stayed negative, three-month annualised core services inflation began to slow and even rental growth chilled a little (AMP Capital’s Diana Mousina and Dr Shane Oliver see further falls ahead given the sharp slowing in market rents).

In London, the Office for National Statistics published CPI data on Wednesday which showed January inflation down for the third straight month to 10.1% YoY, under the expected 10.3%.

Bond yields rose in the US as Fed rate hike expectations pushed higher. Oil prices fell but iron ore and copper prices rose.

Across global markets over the last week we enjoyed some real, genuine divergence with the biggies well mixed.

Because inflation.

And interest rates.

In Europe, shares jumped almost 2% while in the US they dropped 0.3%.

The Brits pushed the FTSE 100 to a fresh record high, breaching the 8,000 point threshold for the first time on Big Wednesday.

Most of the big FTSE 100 companies do their business outside the UK with banks, energy, and commodity majors like our dual listed BHP winning favours.

This is entirely in the face of common sense, of course.

All the economic forecasts point to a horrible reckoning for the UK economy and its shattered people. To say nothing of its broken institutions and self-immolating royal family.

As Stephen Fry’s General Melchett says:

If nothing else works, a total pig-headed unwillingness to look facts in the face will see us through.

The major Euro trash bourses were even stronger, with the CAC 40 in Paris up 1.2% and Berlin’s DAX up 0.8%.

At home, Bevis reported on the scramble to secure critical minerals needed for the energy transition – highlighted by global governments getting in on the act, like the US Inflation Reduction Act.

He noted a big move for Piedmont Lithium (ASX:PLL) which just landed a $75m investment from South Korean chemical giant LG Chem – the parent of the world’s second largest battery cell maker, which included a binding commitment for the offtake of 200,000t of spodumene concentrate from its jointly-owned North American Lithium project over four years from the third quarter of 2023.

On the bourse, Aussie shares lost 1.2% for the week led by weakness in financials and across resources stocks.

The cause? Inflation and rates.

A more aggressive RBA brought on a new sense of dread over what impact such hikes might have on life, the economy and more recently what they might do to company earnings as reports point to signs of weakening demand.

On the same theme, the latest CoreLogic data so far for February shows home price falls slowing sharply (although not for you Byron Bay) with Sydney prices even up slightly. This begs the question whether the violent downswing has done its worse.

The AUD fell below $US0.69 as the spunky USD rose again. BA pities the Aussie fool on some kind of European sabbatical.

Elsewhere, Japanese shares fell 0.6% and Chinese shares collapsed 1.7% as doubts about the future trajectory of the Chinese economy and the return of the Chinese tech giants were inflamed by doubts about how China’s leadership sees the reopening playing out.

Worth repeating from Eddy On Monday Sunarto:

Officially, China recorded 2% GDP growth for 2022, its second-lowest pace since the 1970s. And for the first time since 1976, the US has pipped China after reporting a 2.1% growth last year.

The question now is whether a China rebound this year could lift the global economy out of a recession…

The Economic Calendar

Monday February 20 – Friday February 24

All sources from Commsec, Westpac and Trading Economics

Australia and New Zealand

In Australia, we have the RBA Minutes and some RBA speak to look forward to. Wages drop on Wednesday.

TUESDAY

RBA minutes

WEDNESDAY

Wage Price Index

Westpac Jan Leading Index

Construction Work Done

THURSDAY

ABS Capital Investment / Expenditure

RBA Speak – Bullock, Cagliarini

Global

Overseas, the focus this week will be on global PMIs, China’s central bank, US Fed minutes, and inflation reads in Europe and Japan.

MONDAY

US Markets closed for President’s Day

EU Feb consumer confidence

UK Feb house prices

China PBoC Loan Prime Rate

TUESDAY

US Feb S&P Global manufacturing PMIs

US Feb S&P Global services PMIs

US Jan existing home sales

Japan Feb Nikkei manufacturing PMIs

Japan Feb Nikkei services PMIs

EU Feb S&P Global manufacturing PMIs

EU Feb S&P Global services PMIs

UK Feb S&P Global manufacturing PMIs

UK Feb S&P Global services PMIs

WEDNESDAY

US FOMC Feb meeting minutes

THURSDAY

US Jan Chicago Fed activity index

US Q4 GDP, annualised

US Initial jobless claims

US Fedspeak Bostic and Daly

US Feb Kansas City Fed index

EU Jan CPI

Korea Interest Rate Decision

FRIDAY

US Jan personal income / personal spending

US Jan PCE deflator

US Jan core PCE deflator

Jan new home sales

Feb Uni. of Michigan sentiment

US Fedspeak – Jefferson, Collins and Waller.

Japan Jan CPI

UK Feb consumer sentiment

The ASX IPO calendar for this week

The listing date shown is from the ASX, and they could change at short or without notice.

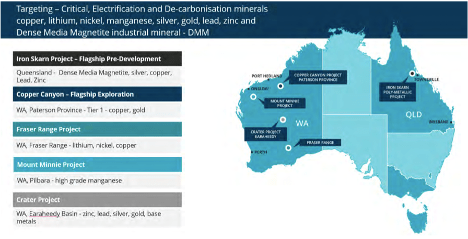

TIGER TASMAN MINERALS (ASX:T1G)

Listing: 24 February

IPO: $8m at $0.20

Tiger Tasman Minerals has projects in WA and QLD focused on copper, lithium, nickel, manganese, silver, gold, base metals and industrial minerals (DMM) essential to the global clean energy transition, decarbonisation and a more sustainable future.

The projects are in proven and prospective jurisdictions including Paterson Province, Fraser Range, Earaheedy Basin, Ashburton and the Townsville region.

They are the Iron Skarn silver-copper-lead-zinc project (QLD), the Copper Canyon copper-gold project (WA), the Fraser Range lithium-nickel-copper project (WA), the Mt Minnie manganese project (WA), and the Crater copper-zinc-lead-silver-gold project (WA).

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.