Trader’s Diary: Everything you need to get ready for the week ahead

Picture: Getty Image

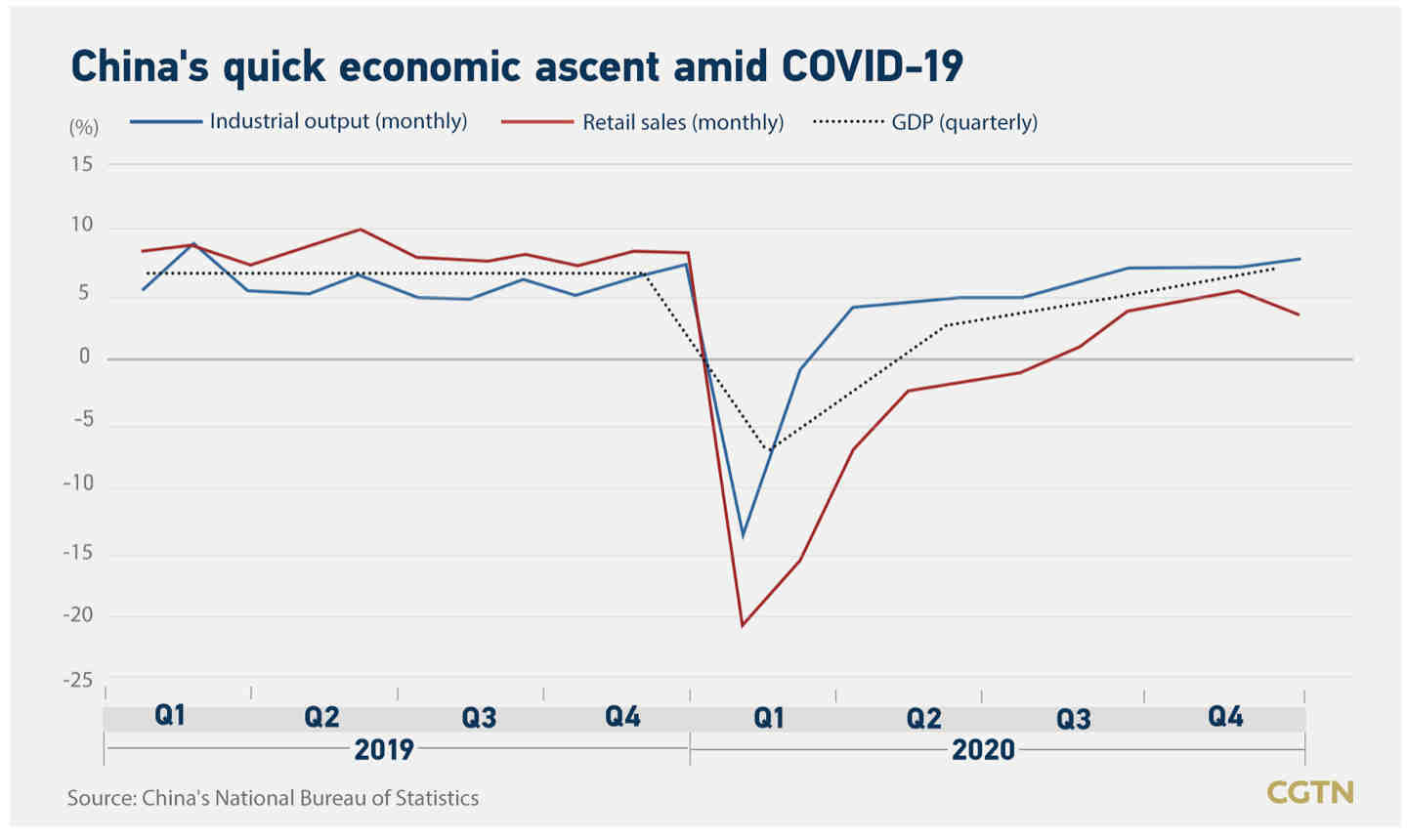

Last week was headlined by the weak Chinese GDP data, which grew by only 4.9% annually in the last quarter compared to analysts’ forecast of 5.1%.

The Chinese economy has been hit by power outages and supply disruptions that have adversely impacted industrial production.

And there’s Evergrande, a crisis that has shrunk the country’s output in the real estate and construction industries by 1.6% and 1.8% respectively.

In the US, the number of new Americans filing for jobless claims fell by 6,000 to a 19-month low of 290,000.

The data supports the market’s expectations of an imminent rate hike in the US, with the 10-year Treasury now at its highest level since June.

Fixed income traders are pricing in a 60% chance of a US rate hike by June next year.

Back home, the Australian Bureau of Statistics (ABS) said that payroll jobs rose modestly by 0.2% in the fortnight to September 25, up from a 0.6% drop in the previous two weeks.

The ANZ-Roy Morgan Consumer Confidence was up for the sixth straight week in October, following the end of Sydney’s 106-day lockdown.

Economic calendar for this week

Australia

Australia’s inflation report on Wednesday will dominate this week’s calendar.

TUESDAY:

ANZ weekly consumer confidence. It fell by 7.2 points last week.

WEDNESDAY:

CPI for the September quarter. The last reading was 0.8%, and the market is expecting that to fall to 0.7% in the September ending quarter.

THURSDAY:

International (export and import prices). Last quarter showed an increase of 13.2% for exports, and 1.9% for imports.

FRIDAY:

Producer price index for the September quarter. It rose by 0.7% in the last quarter.

Retail trade for the September quarter.

International calendar

US (US time)

TUESDAY:

US homes prices for August. In the previous month, it rose by 1.4%.

US new home sales for September. It rose by 1.5% in August.

US consumer confidence for October. The market is expecting consumer sentiment to rise.

THURSDAY:

US GDP for the September quarter. In the last quarter, US GDP rose by 6.7% QoQ, but the market is expecting that to drop to 3.2% this quarter.

FRIDAY:

US personal income and spending for September.

Europe (European time)

The headline for the week will be dominated by Friday’s CPI report.

THURSDAY:

Business and Consumer survey. The market expects it to drop slightly.

ECB interest rates decision.

FRIDAY:

Eurozone CPI report. The last reading was 3.4%, and the market is expecting Eurozone inflation rate to rise to 3.7%

ASX IPO calendar for this week

MONDAY:

Eastern Metals (ASX:EMS), a junior base and precious metals explorer with initial interests in three projects located in the NT and NSW. The company raised $4.5m at 20c a share.

TUESDAY:

GQG Partners Inc (ASX:GQG), a global boutique asset management firm that raised $1.306 billion at $2.20 a share.

RemSense Technologies (ASX:REM), an engineering services company that has partnered with Woodside Petroleum and raised $5m at 20c a share to fund the global rollout of its ‘digital twin’ technology.

C29 Metals (ASX:C29), a mineral explorer with a focus on developing prospective copper, gold and base metal assets throughout Australia. The company raised $5m at 20c a share.

WEDNESDAY:

Star Minerals (ASX:SMS), a mineral explorer that has raised $4m at 20c.

THURSDAY:

Aurum Resources (ASX:AUE), a junior explorer that has raised $5m at 20c.

FRIDAY:

Cooper Metals (ASX:CPM), a mineral explorer with a focus on developing copper and gold deposits in Queensland and Western Australia. The company raised $4.8m at 20c a share.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.