Traders’ Diary: Everything you need to get ready for the week ahead

The US Fed will hand down its interest rates decision this week. Picture Getty

What grabbed the headlines last week?

Recession predictions

Wall Street bank chiefs were unanimous in their assessment of recession chances in 2023.

JP Morgan CEO Jamie Dimon told CNBC that a mix of headwinds were likely to tip both the US and global economy into a “mild to hard” recession by middle of next year.

Goldman Sachs head David Solomon declared that we are facing uncertain times, that markets clients are reducing their risk, and that the rebound in “capital markets activity hasn’t happened yet.”

“There is more uncertainty right now on the economic trajectory for the next 12 to 24 months than we have seen in quite some time. Hope for the best but prepare for a bumpier environment,” Solomon said.

Citigroup CEO Jane Fraser said countries around the world will slip into a recession with the US to follow in the the second half of 2023.

“Obviously, things are softening. But still, when you go to the States, compared to elsewhere in the world, it is good to be American,” Fraser said.

Morgan Stanley went a step further, cutting 1,600 people from its global workforce after citing a looming US recession.

Earlier, Scion hedge fund manager and ‘Big Short’ author Michael Burry warned about a “real recession” that will last multiple years.

Meanwhile, Elon Musk said he expected a severe recession if the Fed did not cut rates immediately.

Blackrock joining the chorus

In its much anticipated annual market outlook report, Blackrock has also tipped a recession in 2023.

“Recession is foretold as central banks race to try to tame inflation,” Blackrock analysts wrote in the report titled 2023 Global Outlook.

“It’s the opposite of past recessions.

“Central bankers won’t ride to the rescue when growth slows in this new regime, contrary to what investors have come to expect. Equity valuations don’t yet reflect the damage ahead.”

The report continued to paint a bleak picture.

“What worked in the past won’t work now. The old playbook of simply ‘buying the dip’ doesn’t apply in this regime of sharper trade-offs and greater macro volatility.

“We don’t see a return to conditions that will sustain a joint bull market in stocks and bonds of the kind we experienced in the prior decade.”

“We don’t think equities are fully priced for recession,” the report concluded.

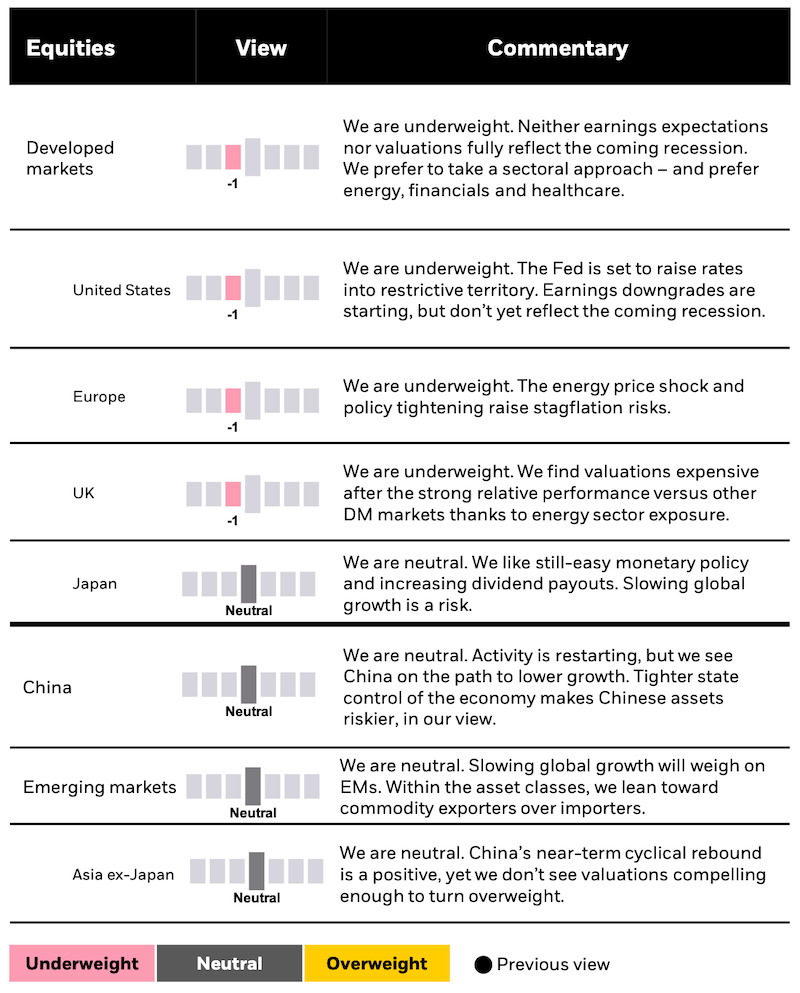

Below is Blackrock’s view of global equity markets over the next 6-12 months.

RBA’s interest rates decision

The RBA board increased its overnight cash rate (OCR) for the eighth consecutive month last Tuesday, hiking it another 25bp to 3.1%.

Despite being at the highest level in a decade, the OCR is nowhere near the inflation rate which is at 6.9%.

“The size and timing of future interest rate increases will continue to be determined by the incoming data,” said RBA boss Philip Lowe in the post-meeting press conference.

“Given the importance of avoiding a prices-wages spiral, the board will continue to pay close attention to labor costs and price setting by firms,” he added.

Experts have analysed Lowe’s words and believe the key takeaway from the RBA meeting was flexibility.

The post meeting statement revealed no pre-set path for rates, and while policymakers are expected to raise rates at upcoming meetings, economic data will dictate if so and by how much.

The RBA won’t meet again until February, so technically January will be kind of a pause.

“As it stands, no change or 25 basis points in February is a coin toss, while 3.35% in March (25bps above the current rate) is seen as being 50% likely with 25bps either side around 25% each. Clearly the RBA’s communication strategy is going to plan,” said OANDA analyst Craig Erlam.

The Economic Calendar

Monday December 12 – Friday December 16

All sources from Commsec

Australia and New Zealand

TUESDAY

Westpac and Melbourne Institute Monthly consumer confidence for December

Overseas arrivals and departures for October

WEDNESDAY

RBA Governor Phil Lowe makes a speech at the 2022 AustPayNet Annual Summit

THURSDAY

Labour force for November

Household wealth for the September quarter

FRIDAY

S&P Global purchasing managers’ index (PMI)

Global

The US Federal Reserve Open Market Committee (FOMC) will convene for a two-day meeting commencing on Tuesday, with Jerome Powell expected to hand down a 50bp hike on Wednesday (US time).

On Thursday, the European Central Bank (ECB) will also hand down its rates decision.

MONDAY

EU wages and labour costs

TUESDAY

US FOMC meeting

US CPI for November

US small business optimism for November

WEDNESDAY

US import/export prices for November

US Fed interest rates decision

EU industrial production for October

THURSDAY

China retail spending for November

US retail sales for November

ECB interest rates decision

FRIDAY

US S&P global purchasing managers’ index

EU CPI for November

The ASX IPO calendar for this week

Listing dates sourced from the ASX. Could change at short notice.

As reported by Stockhead’s Josh Chiat earlier:

Richmond Vanadium Technology (ASX:RVT)

Listing: December 13

IPO: $35m at $0.40

Formerly part of gold explorer Horizon Minerals (ASX:HRZ), Richmond Vanadium wants to bring its project of the same name to market with plans to start a BFS after listing.

The largest non-titanomagnetite vanadium deposit of its kind in the world, the company says it can produce a significant supply of vanadium for the steel and emerging energy storage markets over a 25-year initial life of mine.

Located 500km west of Townsville and 400km east of Mt Isa between the towns of Julia Creek and Richmond, the 1.8Bt deposit is located near the proposed Copper String 2.0 high voltage network line and Great Northern rail line to the Townsville Port.

It could also be the beneficiary of a commitment from the Queensland Government to lob at least $10m towards constructing a common user facility to process vanadium from the State’s deposits and kickstart a local battery storage industry.

Desoto Resources (ASX:DES)

Listing: December 16

IPO: $12m at $0.20

For those who like to invest based on the people, Desoto Resources is an interesting proposition given the involvement of executive chairman Paul Roberts.

As founder and CEO of prospect generator Predictive Discovery (ASX:PDI) from 2007 to 2021, Roberts closed his stint with the discovery of the world class 4.2Moz Bankan gold project in Guinea.

He and non-executive director Barry Murphy are aiming to recapture the success they have converting their senior role experience at the Predictive Mineral Discovery Cooperative Research Centre into success in the real world with PDI.

Former PDI corporate development officer and BPM Minerals (ASX:BPM) CEO Chris Swallow is also on board as managing director.

Desoto is turning those talents to the 345km2 Fenix lithium and gold project in the Pine Creek pegmatite field — down the road from Core Lithium’s (ASX:CXO) 110,000tpa spodumene mine Finniss — which boasts historic holes that have intersected pegmatite and +800ppb gold soil samples.

The explorer also owns the Fenton gold project, which sits in the 17Moz Pine Creek field near the Cosmo Howley deposit, with wide gold hits from limited drilling of 55m at 0.88g/t gold from 418m including 20m at 1.74g/t gold from 423m.

Mackerel Metals (ASX:MKM)

Listing: December 16

IPO: $10m at $0.30

Raising $10m, Mackerel is a spin-out from Zenith Minerals (ASX:ZNC), which includes its prized 25% share of the Earaheedy lead-zinc discovery in WA primarily owned by Rumble Resources (ASX:RTR).

Other gold and base metal prospects including the gold tenements at Split Rocks, Red Mountain and Cowarra with the base metal assets of Develin Creek (copper/zinc), will be transferred to the Mackerel portfolio as its parent company becomes, like many others, increasingly enamoured with lithium.

Zenith is up 26% year to date, largely on lithium discoveries in pegmatites at the Split Rocks project in WA.

Previously regarded as taboo in the UK due to an old wives’ tale that they fed on the corpses of dead soldiers, mackerel are now a common delicacy known for their punctuality during the migration, an attribute we can only hope will be transferred to its exploration namesake.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.