Traders’ Diary: Everything you need to get ready for the week ahead

Traders diary for the week beginning 17 October 2022. Picture Getty

What moved the markets last week?

US inflation and job reports

The US CPI report was the main market mover for the markets last week.

US inflation reached a 40-year high of 8.2% in September, versus consensus forecast of 8.1%. Core CPI, which excludes the volatile food and fuel prices, gained 6.6% versus consensus of 6.5%.

The red hot inflation is likely to keep the Fed in a tightening mode for a few more meetings starting from the next FOMC meeting in November.

“The Fed will likely need to remain in tightening mode for a few more meetings, which would indicate rates will have to reach 5% or go even higher,” said OANDA analyst Edward Moya.

The US September workforce figures also raised fears US interest rates would continue higher for longer. The unemployment rate in the US fell by 0.2% to 3.5%, and average hourly earnings were up 0.3% for the month.

The Fed’s September policy meeting minutes revealed some concern at not doing enough to tame inflation, with Fed officials agreeing in the meeting that rates should remain high until prices came down.

Geopolitics

Geopolitical tensions were in focus as Russia launched attacks on cities in Ukraine across regions it does not control.

Russia said it was payback for an ealier attack by Ukraine on a bridge linking Russia and Crimea.

Separately, US President Biden reportedly asked Saudi Arabia (the de facto leader of OPEC+), to delay its decision on reducing oil output by a month which the Saudis rejected.

OPEC+, which includes Russia, had earlier announced its largest supply cut since 2020 of 2 million barrels per day starting from November.

All this should have pushed oil prices higher, but benchmark Brent crude was down 7% for the week apparently due to reports that Russia was willing to sell oil at a discount.

“Last month, Russia was threatening they would stop selling oil to countries that would agree to use a price cap, but now it seems like that was just a bluff,” said Moya.

The S&P/ASX 200 Energy [XEJ] was down 1.5% for the week.

Truss U-turn

UK PM Liz Truss performed a humiliating U-turn over her flagship plan to cut corporation tax after sacking her chancellor Kwasi Kwarteng.

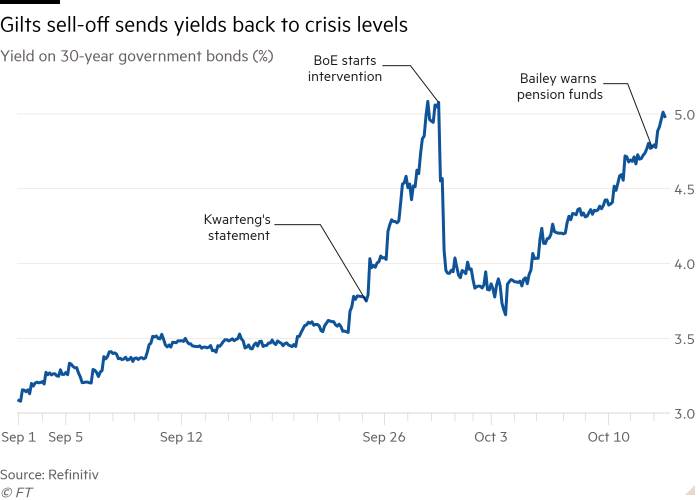

Three weeks ago, Kwarteng announced a controversial mini-budget that included unfunded tax-cut measures that sent financial markets into a meltdown.

His decision sent UK bond yields to spike to their highest level ever as the Bank of England (BoE) said it would intervene in the bond markets in a buyback program.

Yields eventually came down when the BoE moved to reassure markets that it would end its bond buying measure, a plan that was apparently scrapped.

The saga continues.

The Economic Calendar

Monday October 17 – Friday October 21

Australia and New Zealand

TUESDAY

ANZ Roy Morgan weekly consumer confidence

RBA board meeting minutes for October 4

Speech by RBA Deputy Governor Bullock

NZ quarterly CPI

WEDNESDAY

Detailed skilled job vacancies for September

Building activity for June quarter

THURSDAY

Labour force for September

Global

MONDAY

US Empire State manufacturing index for October

TUESDAY

China GDP for September quarter

US industrial production for September

US NAHB housing market index

WEDNESDAY

EU monthly CPI for September

China new home prices

US housing starts and building permits

US Fed Reserve Beige Book (update on regional US economic activity)

THURSDAY

China loan prime rates

US Philadelphia Fed manufacturing index for October

US exisiting home sales

EU current account for August

EU leaders’ summit

FRIDAY

EU consumer confidence

The ASX IPO calendar for this week

Omega Oil & Gas (ASX:OMA)

Listing: 11 October

IPO: $15m at $0.20

This O&G junior has two exploration permits in the Surat Basin in South East Queensland, ATP 2037 and ATP 2038.

The two permits represent an area of over 250,000 acres and are located approximately 50km away from critical gas transmission infrastructure.

The exploration program will explore the Permian Deep Gas play which, if successful, represents a potential multi-TCF gas resource.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.