Traders’ Diary: Everything you need to get ready for the week ahead

Via Getty

The economic week that was

The benchmark ASX 200 had already won before it went and surrendered meekly on Friday, slipping ~0.8%. Thanks to the surprise burst of confidence on Wall Street earlier in the week and a more dovish tilt at raising the cash rate by the RBA, this puppy was ahead already in the bullish month of October, and by some 5%.

On Tuesday the Aussie Reserve Bankers choose the 0.25% door, instead of the more favoured 0.5% door. The consequent celebratory rally was led by some of the blue chip majors and a genuine run from them businesses we reckon are interest rate sensitive – names like Wisetech (ASX:WTC) up +7.5%, Newcrest Mining (ASX:NCM) +7% and jobs platform Seek (ASX:SEK) +8.1%.

Lithium continued to assert its potential with lithium chemical pricing across China’s domestic market surging on the back of strong downstream demand from cathode manufacturers and constrained supply, according to Benchmark Mineral Intelligence’s latest price assessment.

Emma says China’s burgeoning EV investment is leaving a supply chain short on supply.

“Prices throughout September increased by 0.6% m-o-m in the Benchmark Lithium Price Index while spot prices for both lithium carbonate and hydroxide remained relatively stable in international markets – reflecting a hesitation to purchase material under current high prices and macroeconomic concerns by consumers,” the little legend wrote last week.

Strong Chinese EV sales figures in August, which clocked an evil 666K units, up 12.3% m-o-m which is a record high.

But with this kind of demand, Benchmark MI says, Chinese players have been declaring heaps of new investment into building domestic lithium projects in the face of a widening deficit which hasn’t been able to keep any kind of lid on prices.

Wall St: capricious and ephemeral

Still not the indices to take home and meet your mother.

The brief flash of optimism earlier in the week was well and truly doused by Friday night our time – some hefty US employment data put the momentum squarely back in the rising Fed playbook – higher interest rate = recession = gloom and doom.

A hot labour market begets a higher wage spiral which begets further Fed aggression which begets fears of a recession. We know the drill by now.

In a Friday note, Market Matters‘ James Gerrish remarked that the slightly stronger than expected jobs data was enough to lift US 10-year bond yields back towards 3.9% which in turn sent almost every corner of the S&P500 lower. This, just days after the market enjoyed its largest back-to-back returns since March 2020.

“US stocks are looking for a low but probably still haven’t reached their inflection point,” he said.

The Doctor from AMP Capital says:

That after falling back to around the June lows, shares were due for a bit of a bounce, Dr Shane Oliver notes.

“And having seen a double bottom it’s possible that we have seen the low.”

(In the mysterious language of technical analysis, a double bottom has a ‘W’ shape and is taken as a signal for bullish price movement.)

Then again the tech wreck and the GFC bear markets saw several similar big 5% plus rallies (like last week) without a happy ending.

“That proved short-lived only to see the bear market resume as we maybe started to see on Friday in the US.”

“And from a macro perspective the risks for shares are likely still on the downside in the short-term as central banks remain hawkish, recession risks are high and still rising, the conflict in Ukraine looks likely to escalate, oil prices could move higher on OPEC’s move to cut oil production and earnings expectations are still being revised down,” he added.

Stuff you probably didn’t know

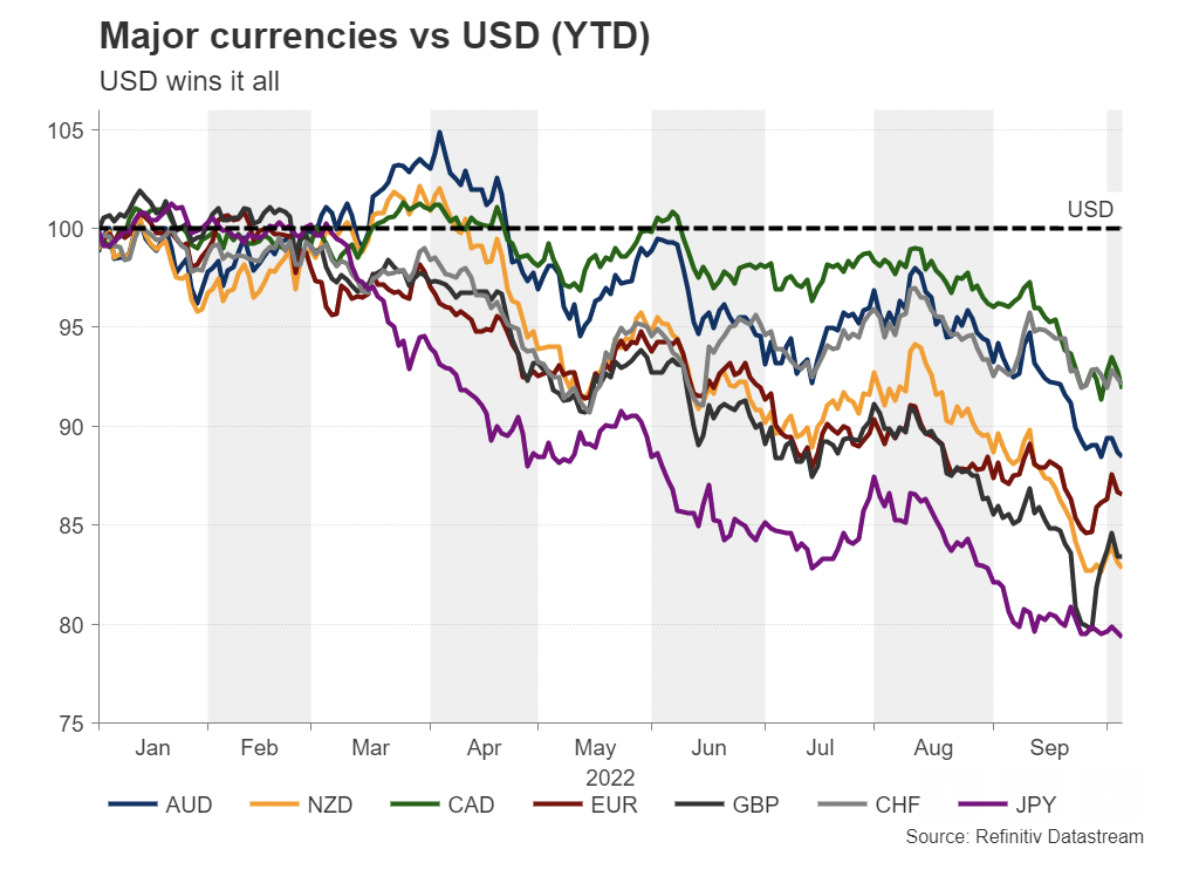

- In 2022 thus far the US Dollar is up circa 15% – 20% vs. a basket of the usual major currencies. I would call BS, but it’s already happened:

2. The former artist formerly known as Prince wrote this little ditty which really does make Monday’s fun:

The Week Ahead

SPI Futures imply a weaker open on Monday, down ~1%.

We’re agonising over inflation again this week.

In the US, we’ve got September CPI data (Thursday) – expected to decline to 8.1% year-on-year from 8.3% and hopefully in the monthly core read as well.

Producer price inflation (Wednesday) is also expected to slow a bit, but that’s usually when it pops.

Just sayin’.

Minutes from the Fed’s last meeting (Wednesday) are likely to be hawkish, then we’re Fedspeaking all over, first with Vice Chair Brainard (Monday) who has dovish potential and later in the week we’ve got the raptors en masse – Bowman, Carr and Evans.

Retail sales growth (Friday) is expected to be slightly negative in real terms.

In China we’ve also some CPI inflation to check out (Friday), but really they’re killing it on that front. Reuters’ group of mysterious and eternally incorrect economists reckons it’s risen to 2.8% year on year, 0.8% at a core level and the PPI (producer price inflation) slipping to 1%.

Chinese trade data should be ordinary, with a likely further slowing in export and import growth. We’re also in Beijing on 20th Party Congress watch.

At home, the touchy-feelies are due – that’s the Westpac/MI consumer sentiment index (Tuesday) and the NAB business survey (also Tuesday) the former weak the later likely to show an encore of solid confidence.

RBA Assistant Governor Lucy Ellis (Wednesday) will also be watched for them’s that’s keen on monetary whisperings.

The Economic Calendar

Monday October 10 – Friday October 14

Source: Westpac, Trading Economics.com, ThinkMarkets and Investing.com

Australia and New Zealand

TUESDAY

Aus Oct WBC–MI Consumer Sentiment

NAB Sept business survey

ABS Sep overseas arrivals, preliminary

NZ Sep retail card spending

WEDNESDAY

Aus RBA Assistant Governor Economic Lucy Ellis

NZ Aug net migration

THURSDAY

Aus Oct MI inflation expectations

NZ Sep REINZ house sales

NZ Sep food price index

FRIDAY

NZ Sep manufacturing PMI

Global

MONDAY

China Sept new loans

EU Sentix investor confidence

US Holiday – Columbus Day

Fedspeak – Brainard and Evans

TUESDAY

Japan Aug current account balance

UK Aug ILO unemployment rate

US Sep NFIB small business optimism

WEDNESDAY

Japan Aug machinery orders

EU Aug industrial production

UK Aug trade balance

US Sep PPI

US FOMC September meeting minutes

Fedspeak – Kashkari and Barr

THURSDAY

US Sep CPI

US Initial jobless claims

Fedspeak – Bowman

FRIDAY

China Sep PPI

China Sep CPI

China Sep trade balance

EU Aug trade balance

US Sep retail sales

US Sep import price index

US Aug business inventories

US Oct Uni. of Michigan sentiment

Fedspeak – Cook

Looking ahead: The ASX IPO calendar for coming few weeks

This list, courtesy of the ASX is, I find, rather speculative. Please do check with the exchange and an adult if keen to follow up.

Listing: October

IPO: $25m at $1.50

This company is focused on solving gas emission issues for landfill sites while generating dispatchable, distributed and renewable electricity and creating Australian Carbon Credit Units (ACCUs).

LGI has a current portfolio of 26 projects with long-term contracts, across the Australian eastern seaboard and says it has a strong pipeline of growth opportunities, investing capital to optimise the conversion of biogas to revenue.

The plan after listing is to increase biogas revenue through additional ACCU projects and landfill biogas-to-power stations, and expanding existing biogas-to-power stations; increase exposure to high quality landfill gas sites; and strengthen the premium electricity offering deploying hybrid battery systems that increase LGI’s ability to optimise the price it receives for electricity.

Listing: 11 October

IPO: $15m at $0.20

This O&G junior has two exploration permits in the Surat Basin in South East Queensland, ATP 2037 and ATP 2038. The two permits represent an area of over 250,000 acres and are located approximately 50km away from critical gas transmission infrastructure.

The exploration program will explore the Permian Deep Gas play which, if successful, represents a potential multi-TCF gas resource.

Listing: 13 October

IPO: $5m at $0.20

This explorer is focused on the exploration and development of manganese and rare earths projects in the NT and WA.

Projects include the Amadeus Project (prospective for manganese), the Coomarie Project (prospective for heavy rare earths), the Nolans East Project (prospective for light rare earths) and the Pargee Project (prospective for heavy rare earths).

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.