Traders’ Diary: Everything you need to get ready for the week ahead

Here I come Monday! Via Getty

It’s late enough on Sunday night the 11th September 2022 for this writer to feel something akin to an emotion for Stockhead’s editor, who, no matter how late we work, must, by rank and function always work that much more later.

So let’s try to quickly go through the important moments of last week under less than 10,000 words.

The Queen is dead, long live the King.

The ASX 200 and ASX Emerging Companies (XEC) indices lifted last week, the benchmark by 0.7% and the small caps by 1.7%.

In New York the All Ords gained 2.5%. In the EU markets found 0.7%.

Closer to home, the Japanese Nikkei found 2% and mainland Chinese markets 1.6%.

A Stockhead exclusive

“While always welcome, last week’s gains across global equity markets made for some good skating on some pretty rotten ice,” I told Stockhead in an exclusive self-interview in what is probably a first for global journalism.

“If there’s a hint of calm in these volatile markets, investors take the opportunity,” I said to myself, exclusively.

“And last week’s little bump came from a seed planted the previous week when a bunch of nervous nellies did some nervous over-selling on Wall Street, across the EU and in Asia,” I added.

And since I only invest in comic books, friendship and looking great, I’m happy to share my unencumbered thoughts on the outlook for equity markets:

Although Wall Street remains between 15% – 20% below YTD highs and our local markets are 10% below – nearly all the global central bankers that matter are putting on their stern and hawkish faces – to whit – only last week the RBA, ECB and BoC all lifted sharply – and none of them seem happier about where inflation is headed or even if there’s a peak hereabouts. So, I’m calling short-term outlook for equities ‘a bit iffy.’

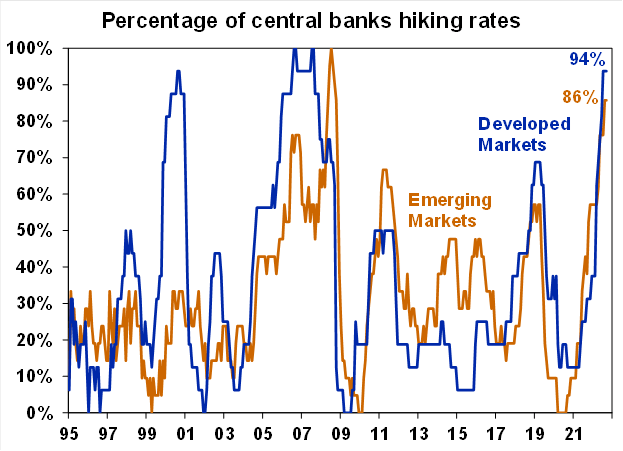

According to AMP Capital, 94% of central banks in developed markets have started lifting interest rates (the other 6% is Japan).

The European Central Bank raised the white flag and its interest rates by a brutal 75 basis points on Thursday and the fabulous EU boss Christine Lagarde suggested more hiking was in the post.

Considering the union’s diabolic state of affairs on the war, energy, inflation energy and working together or even agreeing on energy stuff front – I’m just going to call Winter Recession here and now.

Diana Mousina at AMP Capital, an actual highly trained senior economist, says this:

“With inflation at a half-century high and approaching double-digit territory, (ECB) policymakers are worried that rapid price growth could become entrenched, eroding the value of household savings and setting off a wage-price spiral.”

Translation: Winter Recession.

A soothing unguent after urgent raising

At home, RBA Governor Dr P Lowe followed up our 50 bps hike on Tuesday with some soothing and softer words on Wednesday at the Australian Business Economists annual Anika charity lunch, basically saying it’s great not to be in the EU.

Diana noted a “new” comment from Dr Lowe:

“He said, ‘the case for a slower pace of increase in interest rates becomes stronger as the level of the cash rate rises,’ which is the first signal of a less hawkish approach from the RBA. We expect the cash rate to peak at around 2.85%, with the pace of rate rises to start slowing from next month (we expect a 0.25% rise in October and November). This remains below market and consensus expectations.”

Westpac economists observed that it now appears the consequences for growth of an abrupt tightening cycle and the hit to discretionary spending capacity from inflation are very much on the mind of the RBA and its boss.

On the other side of macro life in Aussie last week, June quarter GDP rose by 0.9% taking annual growth to 3.6%.

July trade data was weaker than expected – the trade balance falling to $8.7bn – against consensus closer to $15bn.

Amazeballs iron ore and coal prices went off the boil, so exports crashed by almost 10%. Imports were up by 5.2% with surging consumables (which Diana Mousina takes as a sign consumer demand is holding up but also that a lot of stuff is costing a lot more!)

Stuff you probably didn’t know

Myanmar’s central bank (aka the generals’ bankers) are adding some US$200 million worth of foreign currency into the forex market to try and take the sting out of inflation.

The Junta’s central bank has a happy track record of flogging dollars to defend its currency, but this marks the first intervention of over $100 million since the military took control last year. Myanmar – among other challenges – is getting wracked by the soaring price of fuel.

The local currency, the Kyat, has lost nearly 40% of its value in just six weeks.

Staying in the ‘hood…

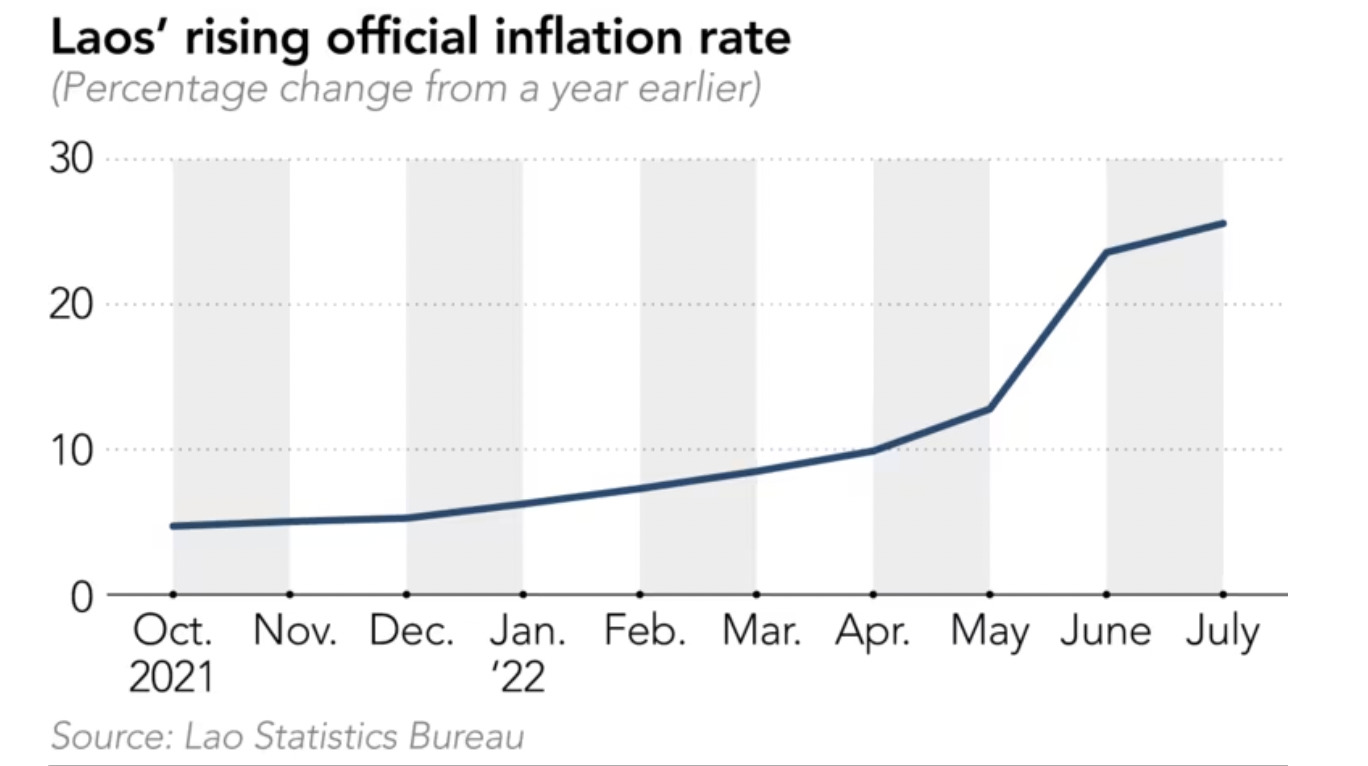

No far away, a similarly obtuse oligarchy of tough guys over in Laos – at the Lao People’s Revolutionary Party – are also staring down ‘multiple economic land mines in their midst,’ according to a very unpromising but absorbing bit of reporting at Nikkei Asia.

The first is a touch of inflation.

The second a terribly large amount of debt.

Laos’ US$18 billion economy has chewed its foreign reserves down to the quick while carrying a totally unsustainable amount of foreign debt – or Chinese debt is perhaps more accurate, the Nikkei says.

Laos owes China big-time for large-scale infrastructure projects, reminding many of that beautiful but very bankrupt South Asian island of Sri Lanka which ran out of dollars to service its largely Chinese foreign obligations in April.

AidData, a research lab at William & Mary college in the states, told Nikkei Asia Laos’ total “debt exposure to China is worth approximately $12.2 billion, or 64.8% of GDP.”

The Week Ahead

First up, the EU’s energy ministers are finally going to actually get together on Friday and – I don’t know – maybe spitball a few ways to deal with their totally at-crisis-point energy crisis.

Bon chance everyone and get it done.

July industrial production is due for the EU, as is the monthly trade balance data and June quarter labour figures.

In the States, Congress is back in session, Americans appear as divided as ever. No quick fix there.

For me it’s all about the August CPI read on Tuesday. That’s expected to fall by 0.1% over the month with annual growth slowing to 8.1% (from 8.5% last month). But now is a good time to point out these reads or the readers reading them are all over the shop.

Core CPI is expected to slightly increase in annual terms – to 6.1% from 5.9% last month – but again, who knows anything in this crazy messed up hill of beans.

Also up in the US – the Empire manufacturing index, August advance retail sales, the Philly Fed business outlook, August industrial production and Uni of Michigan consumer sentiment and inflation expectations.

China has August home prices, property sales, August industrial production, August retail sales and fixed asset investment. They also seem to have a bunch of COVID-19 and a heap of zero-COVID tolerance. So, again, not ideal.

And at home, jobs data on Thursday.

The Economic Calendar

Monday 12 – Friday 16 September

Source: Westpac and Investing.com

Australia and New Zealand

TUESDAY

September Westpac-MI Consumer Sentiment

NAB business survey

August overseas arrivals

WEDNESDAY

NZ Q2 current account balance

THURSDAY

Australia MI inflation expectations

August employment data

NZ Q2 GDP

Global

MONDAY

UK July trade balance

TUESDAY

EU ZEW survey of expectations

UK Jul ILO unemployment rate

US August NFIB small business optimism

US August CPI read

WEDNESDAY

Japan July machinery orders

Japan July industrial production

EU JUly industrial production

UK August CPI

US August PPI

THURSDAY

EU July trade balance

UK BoE policy decision

US Initial jobless claims

US Fed Empire state index

US Philly Fed index

US Aug retail sales

US Aug import price index

US Aug industrial production

US July business inventories

FRIDAY

China Aug retail sales

China Aug fixed asset investment

China Aug industrial production

EU Aug CPI

UK Aug retail sales

US Sep Uni. of Michigan sentiment

The ASX IPO calendar for this week

According to the ASX, these stocks will make their debut this week (could change without notice).

Octava Minerals (ASX:OCT)

Listing: 14 September

IPO: $6m at $0.20

This lithium, Platinum Group Metals (PGMs), nickel sulphide and gold explorer has tenements in the Pilbara, with its flagship project the East Pilbara Talga lithium and gold project.

The recent successes by other exploration companies, like Global Lithium Resources (ASX:GL1), has shown that significant lithium bearing pegmatites are prevalent in the region.

Previous exploration at Talga has identified pegmatite within the southern area of Octava’s extensive farm-in and JV Talga lease, with a rock chip sample returning an elevated lithium assay of 0.22%.

This area is approximately 10km northeast of GL1’s Archer lithium deposit where they reported an inferred resource of 10.5mt at 1.0% Li20 in a similar geological setting.

The company also has the Panton North and Copernicus North nickel and PGMs projects as well as the Yallalong PGEs, gold and nickel sulphides project.

Nightingale Intelligent Systems (ASX:NGL)

Listing: 16 September

IPO: $10m at $0.35

This company develops and sells Unmanned Aerial Vehicles (UAVs) or drones for commercial applications – and there’s a bunch of them.

NGL says its tech has applications across solar farms, ports, O&G facilities, critical infrastructure like dams and power stations, in construction, border patrol, securing pipelines, fire and oil spills along with search and rescue, crowd control and for prisons.

Basically, the drones can respond to a threat; when a security alarm is triggered the system automatically dispatches a drone to the alarm location and streams live video to the security team.

They can also be scheduled for autonomous patrol missions based on day, time, path, altitude, hover duration, camera direction, and other mission details.

During a major event like an oil spill, chemical leak, or fire, you can manually dispatch a drone to monitor events as they unfold on the ground.

Plus, they can autonomously patrol areas of interest around the facility and send out alerts only when human and vehicle intruders are detected.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.