Traders’ Diary: Everything you need to get ready for the week ahead

Via Getty

- ASX Emerging Companies (XEC) index is 5.3% higher

- ASX 200 up 2.2% last week, global markets did pretty good too. Global PMIs lower

- All eyes on the Fed, Thursday morning Sydney time

The economic week that was

Global equity markets rallied last week – led by the wee ASX Emerging Companies (XEC) index which jumped about 5.3% higher.

Elsewhere, the Dow Jones Industrial Average was up 6% and the Nasdaq 7%. Japanese indices rallied about 4%.

So last things first:

Late on Friday night our time, the Global PMIs fell like dominos.

Most notably in the US and in Europe. Our July read on the composite PMI fell to 50.6, from 52.6, with a larger drop in services while manufacturing fell only slightly.

The US composite PMI crashed to 47.5 in July, from 52.3 last month – expectations were a decline to 52.4 with services activity accounting for the bummer number while manufacturing activity maintained.

The Eurozone composite PMI dropped to 49.4 in July, from 52 in June – expectations were for a reading of 51.

EU manufacturing activity is having a very tough run, and was down to 49.6 in July.

While we’re taking out the Euro trash, their central bank lifted rates by more than expected last week – and still the euro couldn’t find the legs to rally. Fair enough though, the Italians have found a way to add a little political turmoil into the mix, with the name Silvio Berlusconi making headlines again.

At home, the Reserve Bank of Australia’s July minutes were a great read and the consequent speeches from RBA Governor Lowe and his Deputy Bullock spluttered on about the much work to be done to contain inflation and its various risks.

The minutes took but a minute to show the debate between a 25bp or 50bp hike was no debate at all. The big one getting the nod because, “the level of interest rates was still very low for an economy with a tight labour market and facing a period of higher inflation.”

The economic week that will be

Heaps happening this week, with a real focus Stateside with the Federal Reserve’s midweek meet. But on top of a slew of market moving economic reports, and certain to attract a fair bit of agonising over whether the US economy is having, heading to or actually in an economic recession.

XM Australia CEO Pete McGuire reckons US market participants have a “triple-barrelled rate increase” all but locked in.

“So traders will put more emphasis on Powell’s commentary and the upcoming GDP report that will reveal whether America is in a technical recession.”

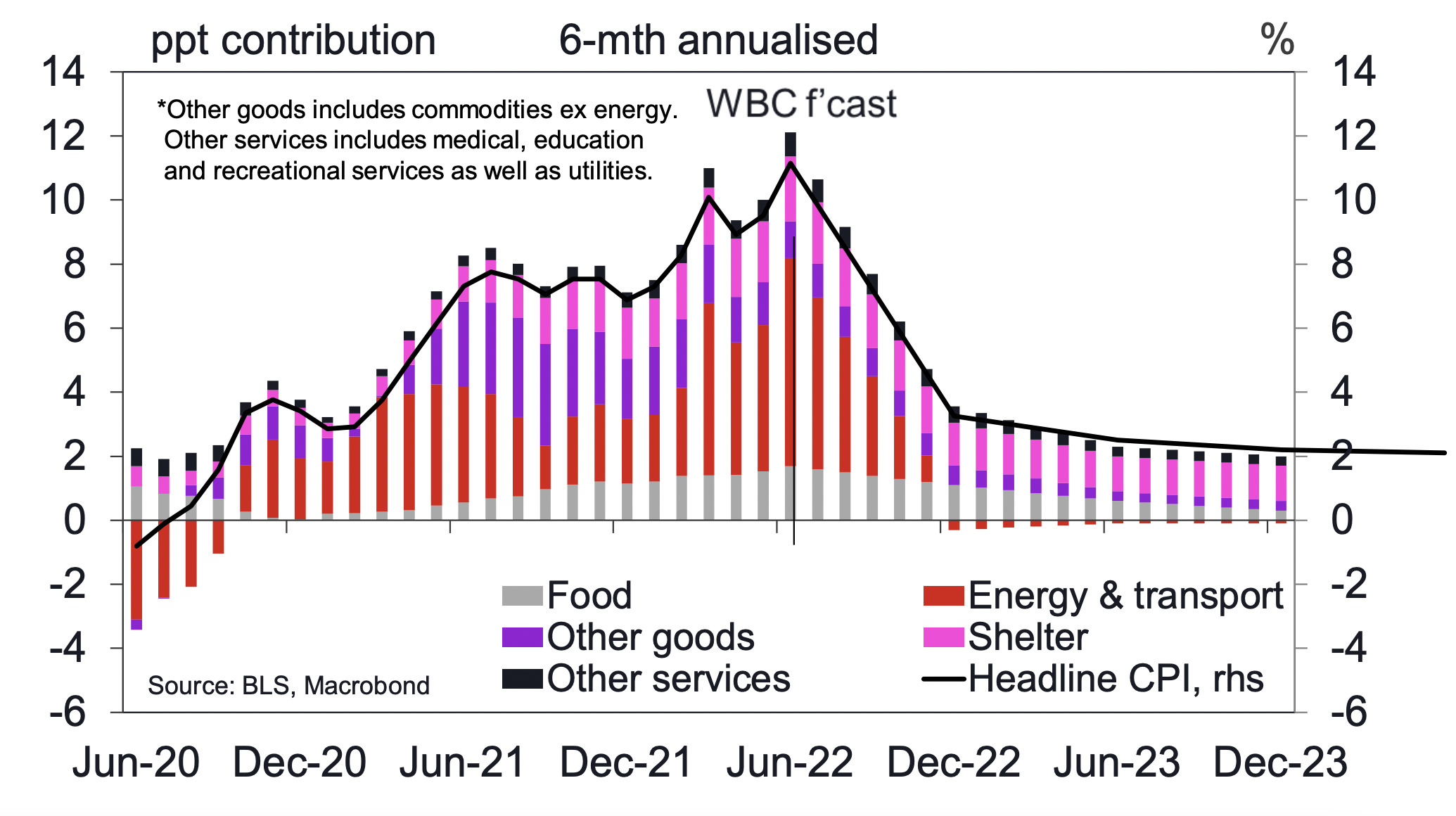

Westpac meanwhile, says “US inflation will abate, slowly.”

They made a chart, (below) but when the argument is that rising inflation will “abate, slowly” you know they’ll be right at some stage.

There has been a tremendous shift in global markets recently, Pete says.

“Inflation worries have taken a back seat, replaced by concerns around economic growth. While incoming data has been resilient, business surveys increasingly suggest demand is losing power as consumers tighten their belts.

“This has been mirrored in commodity prices, with everything from metals to food to energy cooling off. And with shipping costs declining as supply disruptions finally ease, inflation expectations have started to roll over,” McGuire adds.

The pay off for a cure for inflation, he says, is that demand must suffer.

Across the Atlantic, the EU’s inflation stats for July hit the markets on Friday, alongside the first estimate of GDP for Q2.

It’s reporting season too.

America’s meta-monster companies are dropping key earnings.

Facebook, which has transitioned to Meta Platforms, reports Wednesday.

Microsoft and Alphabet, (who begat Google) report Tuesday. Apple and Amazon report Thursday

In all, more than a third of the S&P 500 companies are reporting.

The Economic Calendar for this week

Australia and New Zealand

WEDNESDAY

Australia Q2 CPI

THURSDAY

June retail sales

Q2 export price index

Q2 import price index

Federal Treasurer Jim Chalmers to speak

NZ July ANZ business confidence

FRIDAY

Australia Producer Price Index (PPI)

Australia June Private Sector Credit

NZ July ANZ consumer confidence

Global

MONDAY

Germany IFO business climate survey

US June Chicago Fed activity index

US July Dallas Fed index

TUESDAY

China (possible) Foreign Direct Investment

Japan Corporate Services Price Index (CSPI)

Japan Monetary Policy Meeting Minutes

Japan BoJ Core CPI (YoY)

US July Dallas Fed index

US May S&P/CS home price index

US July Consumer Confidence

US July Richmond Fed index

US June new home sales

WEDNESDAY

China June industrial profits

US June wholesale inventories

US June durable goods orders

US June pending home sales

French Consumer Confidence

Italian Business Confidence

Italian Consumer Confidence

THURSDAY

EU July Economic Confidence

EU July Consumer Confidence

UK July Nationwide house prices

US Q2 GDP, annualised

US Initial jobless claims

US July Kansas City Fed index

4AM Sydney time US Fed Interest Rate Decision

4AM Sydney time US FOMC Statement

4AM Sydney time FOMC Press Conference

Friday

Japan June industrial production

Japan Tokyo Core Price Inflation (CPI)

EU July Core Price Inflation (CPI)

EU Q2 GDP

UK June net mortgage lending

US Q2 employment cost index

US June PCE deflator

US June core PCE deflator

US July Chicago PMI

US July Uni of Michigan sentiment

Source: CBA, investingdotcom, Westpac

The ASX IPO calendar for this week

According to the ASX these stocks will make their debut listing this month (subject to change without notice)

Australia Sunny Glass Group (ASX:AG1)

Listing: 26 July

IPO: $7.5m at $0.35

This Australian-based holding company, through its subsidiaries, operates a glass production and supply business for structural building facades.

The group has a fully automated processing plant which it says is highly efficient, accurate and scalable and an R&D focus on the development of cyclone resistant glass using new laminating and bonding techniques.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.