Trader’s Diary: Everything you need to get ready for the week ahead

US President Joe Biden met with the President of Poland, Andrzej Duda on March 25, 2022 in Rzeszow, Poland. (Photo by Jeff J Mitchell/Getty Images)

- ASX200 is back nudging record highs, despite lower prices for metals, oil and iron ore

- Inflation and interest rates still front of mind for investors

- Three new names expected to make their ASX debut this week

Major economic headlines last week

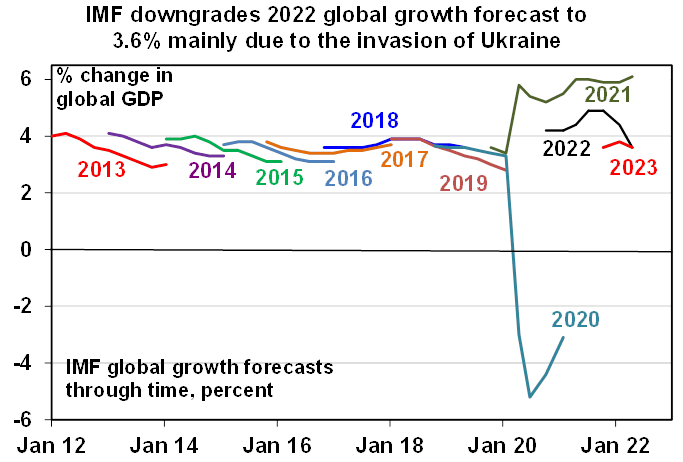

While I don’t care much for the International Monetary Fund and its largely unhelpful and ill-timed downgrades on the state of life, the universe and everything, it is probably worth reflecting the fund from last week now sees global growth at 3.6% for 2022, down pretty sharply from 4.4%.

Inflation, war, disruption and disaster – not helping.

The French presidential race was run and won comfortably by Macron, a decision which could have far reaching consequences for US President Joe Biden as he continues to coordinate reaction to Russia’s invasion of Ukraine.

On the plus side, the IMF sees Russia’s growth forecast plummeting to -8.5%, while ours was revised up to 4.2% – one of the few economies to cop an upgrade – thanks to you again metals, iron ore and energy prices. They shook us all week long, before closing out the week lower and taking the Aussie dollar-buck with them.

Yet, even as bond yields continued to rise Aussie shares almost snuck in a new record high – ridiculous but true – before they stumbled on Friday after stateside inflationary data and interest rate anxieties got the better of local investors after some quality, cut-through fear-mongering from the Fed’s scariest officials.

Across both the Emerging Companies (XEC) and benchmark ASX200 (XJO), resources and tech names weighed heavily, offsetting some positive signs for the industrial, real estate and utilities sectors, as well as some excitement for a few healthcare majors like Ramsay.

This Aussie effort is contrasting stoutly with market peers across the US, European and North Asian bourses, which, while we threaten fresh highs, are all down year to date. Despite some robust US earnings, global markets have crept back to revisit last month’s lowest troughs. US shares fell 2.8% and Chinese shares were staggered – giving away well over 4%.

Looking ahead, our March quarter inflation data comes in from the ABS on Wednesday and AMP Capital’s Dr Shane Oliver reckons it will likely further pressure the RBA to start raising rates.

“Our base case remains that the first RBA rate hike will be 0.15%, taking the cash rate to 0.25% and come in June as the RBA will prefer to avoid hiking in the election campaign and wants to see March quarter wages data due on 18th May before moving,” Dr Oliver said.

This week the good doctor is listening to Vance Joy. Let’s not read into that.

Economic calendar for this week

Sources: ANZ, Commsec.

Australia / Asia Pacific

MONDAY

AU/NZ public holiday

TUESDAY

Reserve Bank board meeting minutes (held on 1 April).

WEDNESDAY

Australian CPI data

ANZ Roy Morgan Weekly Consumer Confidence Index

THURSDAY

NZ: Trade bal (Mar), ANZ bus conf (Apr)

Japan: Retail sales (Mar), IP (Mar P), BoJ policy rate

FRIDAY

AU: Private sector credit March (1Q)

China: purchasing manager’s index (PMI) for April.

International calendar

US (AEDT)

TUESDAY

US Durable goods (Mar)

Richmond Fed (Apr)

New home sales (Mar)

WEDNESDAY

US wholesale index (Mar)

THURSDAY

US GDP (1Q), Personal Cons, (1Q)

FRIDAY

ECI (1Q),

Personal income/spending (Mar)

PCE (Mar)

PMI (Apr)

Uni of Michigan sentiment (Apr)

Europe (AEDT)

MONDAY

Germany: IFO Business Index (Apr)

FRIDAY

Eurozone manufacturing PMI.

And these companies are listing after Anzac Day:

Lithium Plus Minerals (ASX:LPM)

Listing: 26 April

IPO: $10m at $0.25

Stockhead’s Emma Davies says this lithium play is focused on exploring its 19 granted exploration licences and three exploration licences under application in the Northern Territory.

The tenements are in the Bynoe and Arunta regions, and assuming that the three pending tenement applications are granted, the total area held will exceed 1,690 km2.

The company says the tenements show significant early exploration success through soil sampling, mapping, field work and RC drilling programs carried out in 2017.

Koba Resources (ASX:KOB)

Listing: 27 April

IPO: $8m at $0.20

The company was incorporated to demerge New World Resources’ portfolio of cobalt assets into a new standalone ASX-listed entity.

The assets include the Blackpine cobalt-copper, Colson cobalt-copper and Panther cobalt-copper projects, which are all located in the Idaho cobalt Belt in the USA – one of the Western world’s premier cobalt districts.

While most of the world’s cobalt production is from copper and/or nickel mines where cobalt is recovered as a secondary by-product, the Idaho Cobalt Belt is unusual in that it hosts multiple mineral deposits in which cobalt is the element of primary value.

Maronan Metals (ASX:MMA)

Listing: 29 April

IPO: $5.5m at $0.20

The explorer is focused on the Maronan lead-silver copper-gold project in Northwest Queensland.

A maiden, JORC 2012 compliant, Mineral Resource Estimate for the project was reported by Red Metal (ASX:RDM) in 2015 – who the company is a wholly owned subsidiary of.

The spin-out and initial public offering will enable the company to test the significant exploration potential of the Project, including drilling for additional shallow, high value copper-gold and lead-silver mineralisation as well as the potentially larger, higher-grade copper-gold and lead-zinc-silver extensions at depth.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.