Trader’s Diary: Everything you need to get ready for the week ahead

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Major economic headlines last week

The ASX All-Ords index rose by 2.2% last week after a 1.6% rise the previous week. It’s now been moving upwards in fits and spurts for most of March in some pretty volatile business. But for now, the All-Ords still started April around 5.5% higher than it ended February.

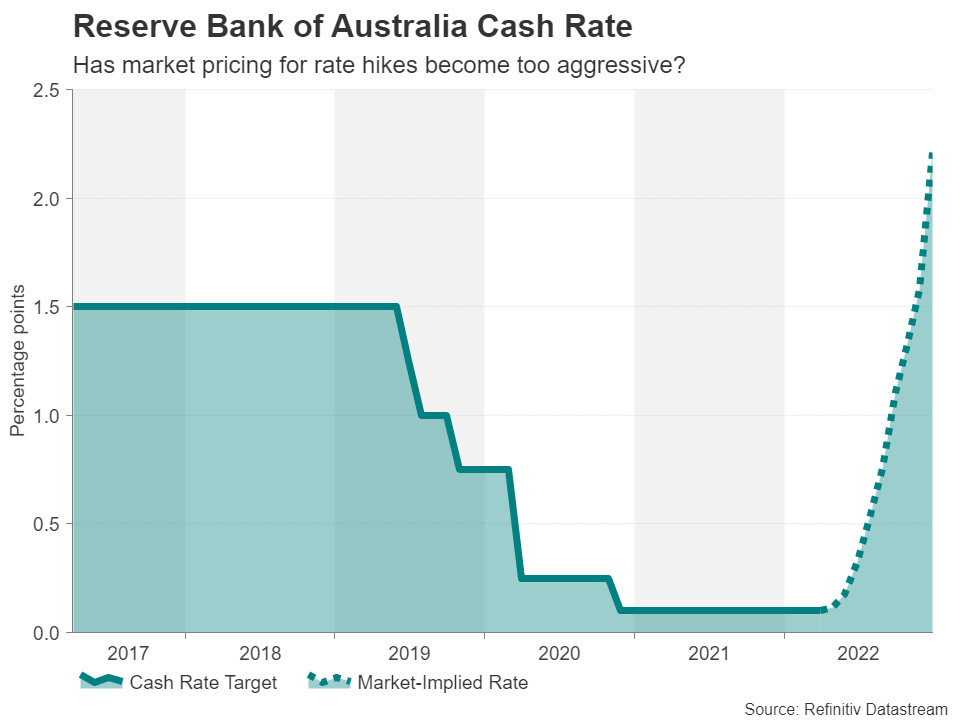

Equities are seemingly supported by a vague confidence that things will turn out alright, although the only short terms calmative might be that the Ukraine war will stop central banks from raising interest rates too aggressively (see drawing below) and that oil prices won’t go nuts anymore thanks to China demand-dimming Zero COVID Strategy (ZCS) and the US government’s decision to splash global markets in the riches of its strategic oil reserves.

At home, while the Federal Budget and the war played starring roles last week, another round of softer global PMIs had a few highlights.

The lower Caixin read in China was laid at the feet of zero-COVID lockdown.

On one hand, feel bad for the dire job policy makers have of trying to control the pandemic and sustain activity. But on the other hand, they’re also discovering on live subjects just how wonderfully easy it is to lock everything and everyone down, down, down. If it works for COVID (which it doesn’t), then it can work for anything dressed up as a threat.

At home, Australia’s more robust IHS Markit PMI edged firmer. On the whole, the budget was broadly stimulatory and pleasing to the eye of the voter, without changing too much of the maths for economists and central bank watchers.

However, the week did end with some shifting property data, showing that here in Sydney home values fell for the second straight month and the consensus is that the national market bears all the hallmarks of a looming cyclical about face.

On Friday night Sydney time, US non-farm payrolls came out at 431k in March, below the 490k consensus but the unemployment rate fell 0.2pp to 3.6% and average hourly earnings bounced back enough to not mess with the pointy-heads’ calculations for the Federal Reserve’s forthcoming interest rate decisions.

In fact, the Fed minutes and those of the ECB’s (European Central Bank) last policy meetings will draw most of the investor limelight during a quieter economic agenda next week.

The Fed’s March minutes, published Wednesday, may not reveal anything new on the members’ voting intentions for coming rate rises, but the lot of them must have free-styled at length at the March get together about what to do with the Fed’s excitingly wrong-side-of-$9 trillion balance sheet. The verbose governors have enjoyed jawboning on their preferred approach to raising cash rates but seem to be sidestepping any decisions about the balance sheet until the May meeting.

On the data front in the US, the ISM non-manufacturing PMI due Tuesday will be the main market moving data release.

The RBA (Reserve Bank of Australia), meanwhile, is not expected to announce any policy shifts at its meet on Tuesday, but that’s usually the best time to do something annoying.

In our kind of press release – brief – the RBA announced Michele Bullock (from Assistant Gov. covering Financial Systems) will replace Guy Debelle as Dep. Governor with immediate effect.

Here’s a drawing of what the market is pricing in for the RBA’s rate action, accompanied by an apparently rhetorical question.

Economic calendar for this week

AUSTRALIA

MONDAY

MI Inflation for March (11am Syd)

ANZ Job Ads for March

TUESDAY

RBA Board Meeting (2:30pm) Cash Rate Target consensus expected: 0.10%, previous: 0.10%

THURSDAY

Trade Balance Feb exp prev $12.9b (11:30am, Syd)

FRIDAY

RBA Financial Stability Review (11:30am, Syd)

International calendar

ASIA

TUESDAY

Nikkei Japan Services PMI for March (10:30am, Syd)

WEDNESDAY

China Caixin Services PMI for March (11:45am, Syd)

FRIDAY

Japan Current Account for Feb (9:50am, Syd)

EURO ZONE

MONDAY

Sentix Investor Conf. Apr (6:30pm, Syd)

TUESDAY

Markit Services PMI

UK Markit Services PMI

WEDNESDAY

Germany Feb Factory Orders (4pm, Syd)

PPI for Feb (7pm, Syd)

THURSDAY

Ger. Industrial Production Feb (4pm, Syd)

EU Retail Sales Feb (7pm, Syd)

UNITED STATES

MONDAY

Factory Orders for Feb (12am, Syd)

Durable Goods Orders for Feb Final (12am, Syd)

TUESDAY

Trade Balance for Feb (10.30pm, Syd)

WEDNESDAY

FOMC Meeting Minutes March (released 4am, Syd – set your alarm Sam Jacobs!)

THURSDAY

Consumer Credit Feb (5am, Syd)

ASX IPO calendar for this week:

According to the ASX, these companies will – in all likelihood, but let’s not set our Fitbits to it – make their ASX debut this week.

Listing: 4 April

IPO: $8.12m at $0.25

The explorer holds tenements in Queensland and Western Australia and lithium rights to certain tenements in the Yalgoo Lithium province.

The portfolio contains lithium, rubidium, nickel, cobalt, copper and gold, which the company says placed them in an ideal position as the battery metals industry develops into the future.

Listing: 4 April

IPO: $6.4m at $0.20

The company is exploring for oil, gas and other associated product streams (including helium and hydrogen) and aims to be a net zero emissions energy producer.

The company will hold a 100% interest in a granted hydrocarbon permit in Queensland, where it plans to undertake geological, geophysical and engineering studies, aeromag and gravity surveys, seismic acquisition as well as the plug and abandon of the Barwinock 2 well.

In the Northern Territory, the company will hold a 50% interest in 30 hydrocarbon exploration permit applications totalling ~160,000km2.

The company aims to secure application grants, seismic acquisition and to undertake seismic interpretation and drilling prospect generation.

International Graphite (ASX:IG6)

Listing: 5 April

IPO: $10m at $0.20

The explorer and developer is aiming to develop the first fully integrated graphite production facility in Western Australia.

It holds mining tenements at Springdale and says its downstream processing facility brings together the best of international manufacturing technology and Australian process engineering knowhow.

The plan is to supply anode material to meet growing international demand for lithium batteries – and strengthen Australia’s sovereign capability in the critical minerals space.

Microba Life Sciences (ASX:MAP)

Listing: 5 April

IPO: $30m at $0.45

Microba has developed a technology for measuring the human gut microbiome.

It’s focused on delivering gut microbiome testing services globally to consumers, clinicians, and researchers; and driving the discovery and development of novel therapeutics for major chronic diseases.

Listing: 6 April

IPO: $8.5m at $0.20

The explorer’s namesake Sarytogan deposit is in the Karaganda region of Central Kazakhstan.

There are two large zones of graphitised sediments in the Sarytogan area: the Central and North graphite zones and the project has a mineral resource estimate of 209mt at 28.4% total graphitic carbon with 60,000t of contained graphite.

Finder Energy Holdings (ASX:FDR)

Listing: 8 April

IPO: $15m at $0.20

This oil and gas explorer has a substantial acreage portfolio of highly prospective exploration permits in two of the world’s premier hydrocarbon basins – the Northwest Shelf of Australia and the United Kingdom North Sea.

In the Northwest Shelf, the company holds an interest in five exploration permits, with the Kanga-1 exploration well scheduled to spud in May this year.

Kanga-1 is targeting significant resource potential in the heart of the Northern Carnarvon Basin, and the company says if it’s successful, offers investors exposure to near term upside.

Finder also holds a strategic position along trend from the Dorado oil discovery, while in the North Sea, the company currently holds five seaward production licences.

Listing: 8 April

IPO: $10m at $0.20

Noble is all about identifying, exploring and developing helium assets in United Republic of Tanzania.

It says that its independent certification of a mid-case 101 Bcf Prospective Resource in the first of four of its licensed Tanzanian basins gives it the potential to become a Tier One project at proof in 2023.

NHE also says its current projections show that Tanzania will be one of the largest helium resources in the world.

Listing: 8 April

IPO: $5m at $0.20

The explorer and developer is targeting gold and base metals.

In SA, Osmond has the Yumbarra Project (nickel and mineral sands), along with the Fowler, Coorabie Shear Zone, and Tallacootra projects (nickel/copper and gold).

The Sandford Project in Victoria is prospective for gold and base metals (copper, lead, silver, and zinc), as well as ionic REE clays and heavy mineral sands.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.