Trader’s Diary: Everything you need to get ready for the week ahead

Pic: Getty

Major economic headlines last week

War returned to Europe on Thursday afternoon, Sydney time.

At home, the ASX 200 (XJO) slumped to its heaviest loss since September 2020 after Russia invaded Ukraine. The All-Ordinaries index (XAO) fell by well over 3% over the last five trading days, following a 0.2% fall the week before.

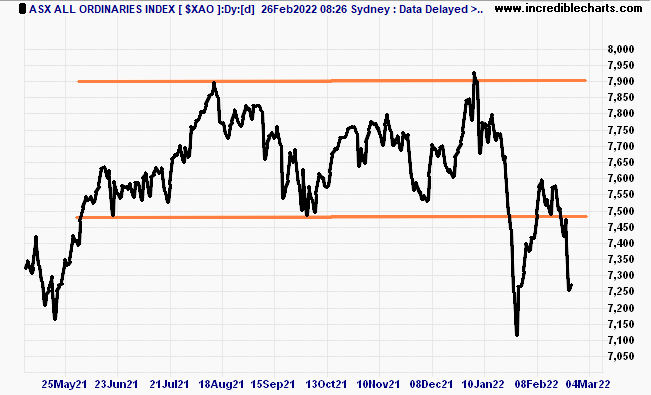

Public policy economist Professor Percy Allan says after briefly returning to the price channel established last June, the broader Aussie index has now collapsed below that threshold and entered uncharted waters.

“Russia’s invasion of Ukraine is the main reason, though worries about higher inflation and interest rates and slowing world growth also dampened investor sentiment,” Professor Allan says.

The price of conflict

It’s worth noting that between 9/11 and the time Donald Trump was shoehorned out of the White House – a month or two before the pandemic-inspired market collapse of the March 2020 – the US had poured an estimated $6.4 trillion into its various wars.

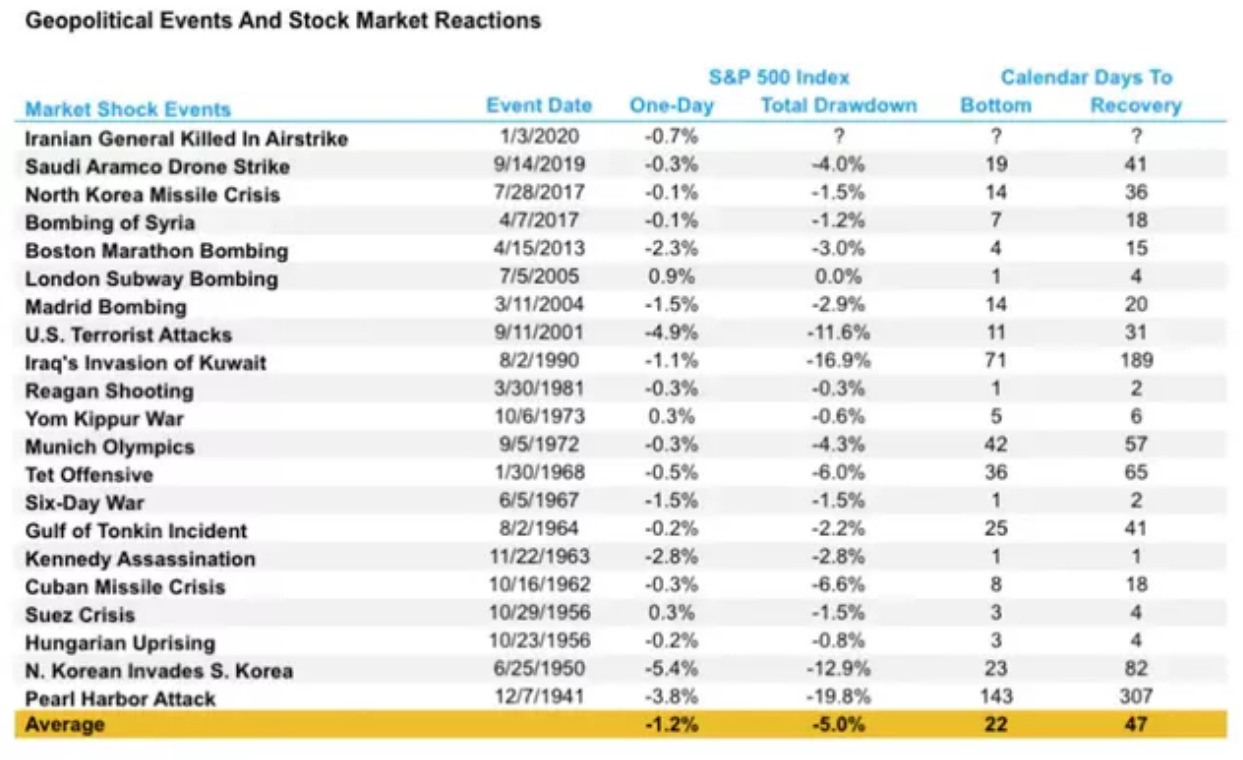

And while that’s a sizeable chunk of US gross domestic product, LPL Financial chief investment strategist John Lynch notes US equities have all but shrugged off past geopolitical tempests, saying stocks have largely, “weathered heightened geopolitical tensions in the past.”

War we know always comes with an appalling cost. However, Percy Allan, a former secretary and chair of the NSW Treasury, adds how history has shown the geopolitical threat can be more damaging to stocks than the geopolitical act.

“In other words when a war starts – investors are relieved because the uncertainty is over – and experts can better assess the outcome,” Allan said, before quickly adding with a smile, “it’s all very macabre.

Of course, that’s not to say war in the Ukraine isn’t going to mess with markets, especially critical commodity prices at a critical commodity price time.

Russia’s relative economic scale and its role in the global economy is pretty similar to that of Australia’s… well, aside from being a crap neighbour and getting a free pass from China – Russia is also a major exporter of key commodities – particularly for Europe – with significant natural reserves of oil, gas, coal, some usefully obscure but critical metals like aluminium and palladium, and like Ukraine as well, a significant player in agri-commodities.

Meanwhile on the local economic scene the ABS provided interesting investment-related numbers ahead of this week’s fourth quarter GDP report card for 2021.

Construction work done, surprised to the downside (-0.4%) against market expectations of a 2.5% gain (that one’s on Delta mainly). Also under the fog of war was a bad miss in the Q4 CAPEX survey, rising just 1.1% and well lagging market expectations of a gain between 2.5% to 3%.

Economic calendar for this week

Australia

MONDAY:

MI Inflation Gauge for Feb

ABS Company Profits Q4 (11:30am)

ABS Inventories Q4 (11:30am)

ABS Retail Sales Jan (11:30am)

ABS Private Sector Credit Jan (11:30am)

TUESDAY

CoreLogic Dwelling Prices Feb

Balance of Payments Q4 (11:30am)

Current Account (exp $13.5bn – previous $23.9bn)

Net Exports Contribution

Housing Finance for Jan (11:30am)

Owner–occupier

Investor housing

RBA Board Meeting Cash Rate Target expected 0.10%, previous 0.10% (2:30pm)

The Q4’21 wages report, crap as it was, largely fell in line with the RBA’s forecast.

So add that to the many easter eggs the central bank has been dropping since med-Feb, when it burst back onto the national stage with an exciting wait and see posture on the cash rate: the clear word at the top of the reiteration count for 2022 remains ‘patient’.

As in -“the Board is prepared to be patient…” – which is easier than explaining: We’re as uncertain as everyone about how persistent or even predictable the pick-up in inflation will be and it depends a lot on the (cuss word) supply-side problems which we suppose will eventually get resolved. Wages growth – let’s not shit one another – is modest at best and it’ll be some time yet before it’s any good, or we get paid more at least in-line with inflation.

In a note late Sunday, TD Securities analysts reckon the RBA could add a few thoughts on Ukraine in its statement – but its shuttering of supportive OMO operations – its heroic buying program of treasuries et al in the open market to fix the open market – will rate a mention, signalling another step away from pandemic monetary policy settings.

WEDNESDAY

GDP Q4 q/q exp 2.8%, previous –1.9%; y/y exp 3.4%, previous 3.9% (11:30am)

TD Securities again: Strong consumer spending, “evident from the surge in real retail sales,” probably boosted Q4 GDP growth.

“However, this is unlikely to hit the (Reserve) Bank’s bullish forecast of +4.4% q/q due to the drag from net exports and softer business investments.

Nonetheless, the economic outlook is robust as high vaccination rates should keep lockdowns at bay and limit the impact on economic activity,” researchers from the Canadian investment bank said.

The conflict in Ukraine is lifting commodity prices. That will boost inflation in Australia as oil and gas prices rise. And we estimate that a sharp rise in energy prices will actually boost Australia’s export earnings more than its import bill. While the economic boost from higher export earnings would be small, the further rise in inflation would only make the RBA more eager to hike rates. We’ve pencilled in a 3% m/m fall in retail sales in January (due Mon.) and a 3.4% q/q rebound in Q4 GDP (due on Wed.)

THURSDAY

Building Approvals for Jan (11:30am)

Trade Balance for Jan exp $10.4bn, previous $8.4bn (11:30am)

International calendar

US (AEDT)

MONDAY

Chicago PMI Feb (1:45am)

Dallas Fed Index Feb (2:30am)

TUESDAY

Const. Spending Jan (2am)

ISM Manufacturing Index for Feb exp 58.0, previous 57.6 (2am)

WEDNESDAY

ADP Employment Change Feb (12:15am)

Federal Reserve’s Beige Book (6am – early start for Sam Jacobs)

THURSDAY

ISM Non–Manufacturing Feb (2am)

Factory Orders Jan (2am)

Durable Goods Orders Jan Final (2am)

FRIDAY

Non–Farm Payrolls Chg Feb (12:30am)

Unemployment Rate Feb exp 3.9% previous 4.0% (12:30am)

Avg Hourly Earnings Feb (12:30am)

China / Japan

MONDAY

Japan Industrial Production Jan Preliminary (10:50am)

TUESDAY

CHINA

Manufacturing PMI Feb exp 49.9, previous 50.1 (12:30pm)

Non–Manufacturing PMI Feb exp 50.8, previous 51.1 (12:30pm)

Caixin Manufacturing PMI Feb exp 49.1, previous 49.1 (12:45pm)

THURSDAY

CHINA

Caixin Services PMI Feb exp 50.8, prev 51.4 (12:45pm)

FRIDAY

JAPAN

Job to Applicant Ratio Jan (10:30am)

Europe (AEDT)

WEDNESDAY

EURO ZONE CPI for Feb (9pm)

THURSDAY

EURO ZONE PPI Jan (9pm)

Unemployment Rate Jan exp 7.0%, previous 7.0% (9pm)

UK Nationwide House Prices Feb (6pm)

FRIDAY

EURO ZONE

Retail Sales Jan exp 1.4%, previous –3.0% (9pm)

(sources: Commsec, Refinitiv, Westpac and Investing.com)

ASX IPO calendar for this week

Catalano Seafood (ASX:CSF) was initially due on the 24 February with $6m at $0.20.

Catalano has plans to go bigger with its distribution network, hoping to roll out its Seafood Management Solution to supermarkets.

Omnia Metals Group (ASX:OM1) were also due on 21 February for an IPO worth $5.5m at, 0.20 cents.

The explorer will be focused on two projects – the Ord Basin project along the WA/NT border, and the Albany-Fraser project in the state’s southwest.

5E Advanced Materials (ASX:5EA)

Listing: due 2 March

5EA is set to become the new name and parent company of American Pacific Borates Limited (ASX:ABR), with the company set to list the US via a Nasdaq Direct Listing in February.

All shares held by ABR shareholders will be transferred to 5EA, and ABR says it will be possible to transfer holdings from ASX CDIs to NASDAQ shares and vice versa. The focus is still on the development of the Fort Cady Borate Project.

Many Peaks Gold (ASX:MPG)

Listing: due 2 March

IPO: $5.5m at $0.20.

This explorer and development has its eye on the southern part of the Yarrol Geological Province in Queensland, where exploration to date has identified three project areas – the Mt Weary gold project, Rawlins gold-copper project, and the Monal gold project.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.