Trader’s Diary: Everything you need to get ready for the week ahead

Picture: Getty Images

Major economic headlines last week

The recent focus on central banks’ dot-plotting interest rate rises took a back seat to old school geopolitics this week, as mid-week reports of shelling between the Ukrainian army and Russian-backed separatists injected another booster of uncertainty into global markets.

Equities got the most jitters, the tech-heavy Nasdaq stripped of 3% as traders looked to shed riskier assets.

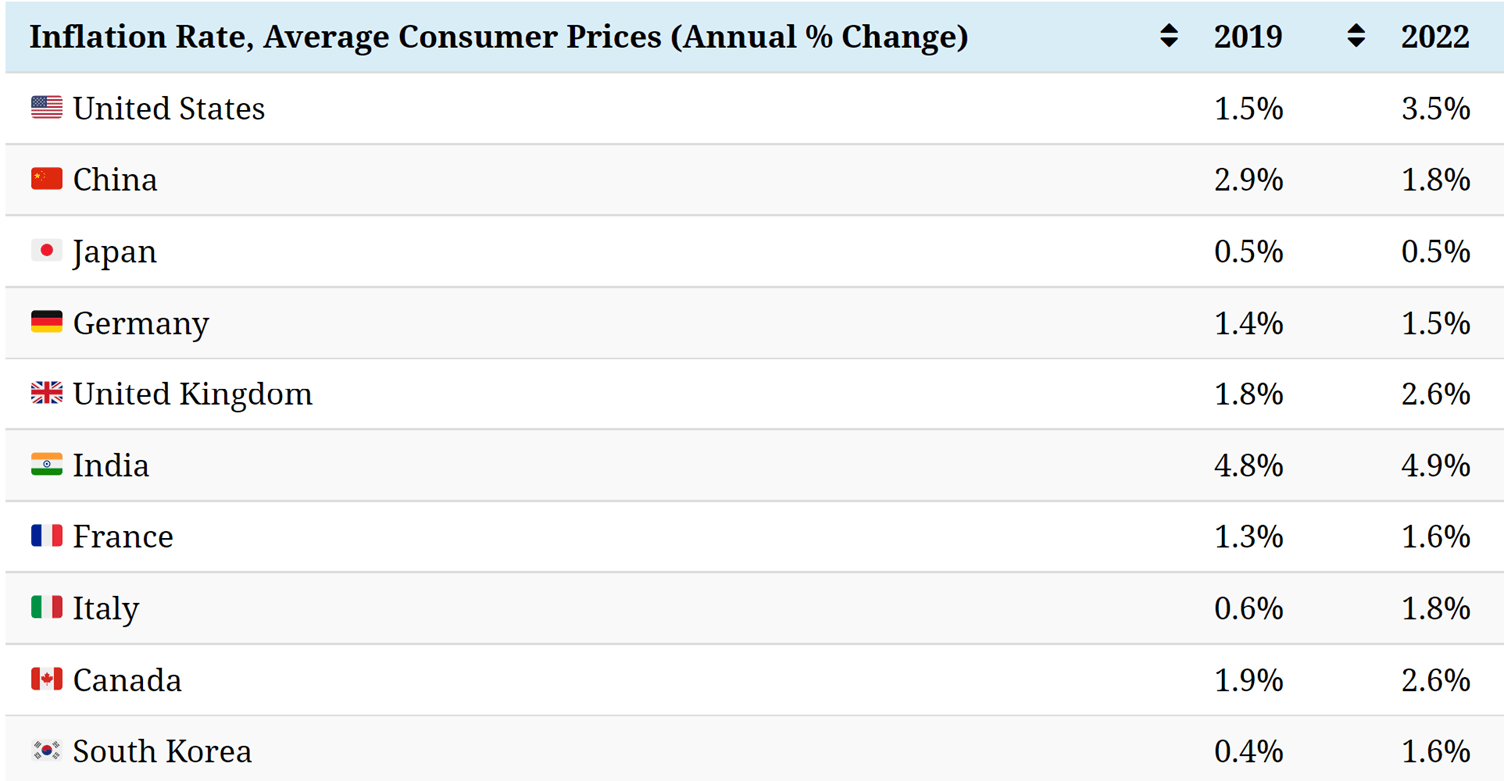

First up though, there’s been a lot of inflammatory jawboning about inflation, most especially in the States. Here’s a very handy, up-to-date forecast for inflation rates:

Still, the first key event for the week was the release of the RBA February meeting minutes.

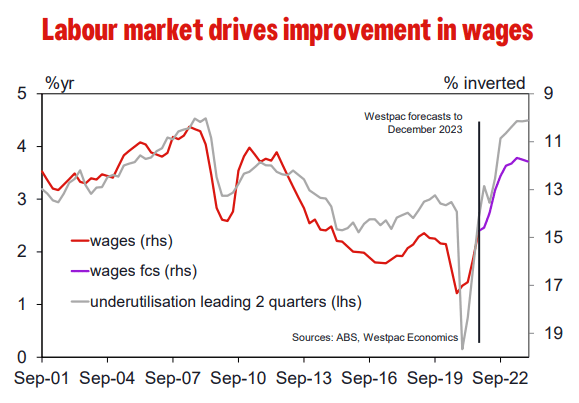

After digesting a speech and parliamentary testimony by Governor Dr P. Lowe, as well as the February (SOMP) Statement on Monetary Policy, Westpac chief economist Bill Evans says it all still points to a “patient” approach to policy, with two more CPI prints likely to be assessed before an interest rate decision is made.

“We remain comfortable with our current profile of a peak rate of 1.75% and a cycle lasting into 2024 but the legacy of the pandemic’s emergency measures certainly creates a much greater degree of uncertainty than we have seen in earlier cycles,” Evans said.

In the meantime, safe havens came back strongly. Gold prices waltzed to eight-month highs as demand against geopolitical mis-steps and the pullback in real Treasury yields led other investors to take shelter in bonds.

Once more without feeling

It’s hard not to admire this admirably chilling assessment from BCA Research:

“The Ukraine crisis is escalating as predicted. We maintain our odds: 65% limited incursion, 10% full-scale invasion, 25% diplomatic de-escalation.”

BCA says the key to sorting all this is, “a Western renunciation of defense cooperation with Ukraine after a verified Russian troop withdrawal.”

But, until then:

“Stay long gold, defensives over cyclicals, and large caps over small caps. Stay long cyber security stocks and aerospace/defense stocks relative to the broad market.”

And just quickly, prices at the pump haven’t been great, you’d have noticed. They certainly haven’t been impacted by the latest reports suggesting a new, Trump-free Iran agreement has already been drafted and includes a staged approach to lifting sanctions which would see Iranian oil supply hitting tight global markets.

XM’s Peter McGuire reckons oil prices are headed for “a substantial weekly loss” at the prospect.

“Admittedly, it’s quite encouraging oil prices haven’t gone into freefall on the news. This has been a huge risk for several months, and the fact it (returning Iranian supply) hasn’t hit oil prices even harder speaks to how thirsty the market is for energy,” he said on Saturday morning because weekends are for the weak.

Economic calendar for this week

Australia / New Zealand

TUESDAY

RBA Assistant Governor Kent addresses Australian Financial Markets Association, midday.

NZ Jan credit card spending

WEDNESDAY

Australia Q4 wage price index

Australia Q4 construction work

NZ RBNZ policy decision

THURSDAY

Australia Q4 private new capital expenditure

Australia 2021/22 capex plans

NZ Jan trade balance

FRIDAY

NZ Feb ANZ consumer confidence

NZ Q4 real retail sales

International calendar

US (LA time)

MONDAY

US public holiday

TUESDAY

Dec FHFA house prices

Dec S&P/CS home price index

Feb Markit manufacturing PMI

Feb Markit service PMI

Feb consumer confidence index

WEDNESDAY

US inflation for December. The current annual core CPI rate is at 4.9%

THURSDAY

US Jan Chicago Fed activity index

Initial jobless claims

Q4 GDP, annualised

Jan new home sales

Feb Kansas City Fed index

FRIDAY

US Jan personal income

Jan personal spending

Jan PCE deflator

Jan core PCE deflator

Jan durable goods orders

Jan pending home sales

Feb Uni. of Michigan sentiment

China/Japan

MONDAY

Feb Nikkei Japan PMI Services

Feb Nikkei Japan manufacturing PMI

Europe/UK (GMT)

MONDAY

Eur Feb Markit manufacturing PMI

Feb Markit services PMI

UK Feb Rightmove house prices

Feb Markit services PMI

Feb Markit manufacturing

TUESDAY

Germany Feb IFO business climate survey

FRIDAY

European Feb consumer confidence

UK Feb GfK consumer sentiment

(sources: Commsec, Investing.com, Refinitiv, ANZ, Westpac)

ASX IPO calendar for this week

Listings are subject to change. A lot.

Catalano Seafood (ASX:CSF)

Listing: 24 February

IPO: $6m at $0.20

The seafood processor, wholesaler, retailer and exporter has plans to expand its distribution network, aiming to roll out its Seafood Management Solution to supermarkets. Company will also use funds to upgrade processing equipment.

Omnia Metals Group (ASX:OM1)

Listing: 21 February

IPO: $5.5m at $0.20

The explorer will be focused on two projects, including the Ord Basin project along the WA/NT border, which represents “a district scale, greenfields exploration opportunity for copper, nickel and PGE deposit types.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.