Trader’s Diary: Everything you need to get ready for the week ahead

Pic: Getty

Once more with feeling: Major economic headlines last week

It’s still a little hard to talk about but here at home last week, it was all about how the Australian economy made us feel.

We had a very emotional NAB business survey update on Wednesday.

National Australia Bank (ASX:NAB) chief economist Alan Oster says on the plus side your confidence is back, although everyone’s still a bit of a wreck after it fell off an Omicron cliff in December.

But, you’re looking forward now to better things, like, Valentine’s Day maybe, or that international border reopening later this month.

“Confidence fell sharply in December as the Omicron variant began to spread, but rebounded in January, reflecting that the outbreak looks to have peaked quickly and lockdowns have been avoided,” Oster said.

But – and here it is – while you were celebrating a quick recovery from PTOD (post-traumatic Omicron disorder), the Reserve Bank of Australia popped round to warn you of impending rate rises at some inconclusive date in your near future.

Consistent with the global backdrop, the January edition of NAB’s survey just serves to highlight – it’s the damn cost of stuff and not the desire to buy stuff which remains the dead weight on all our backs.

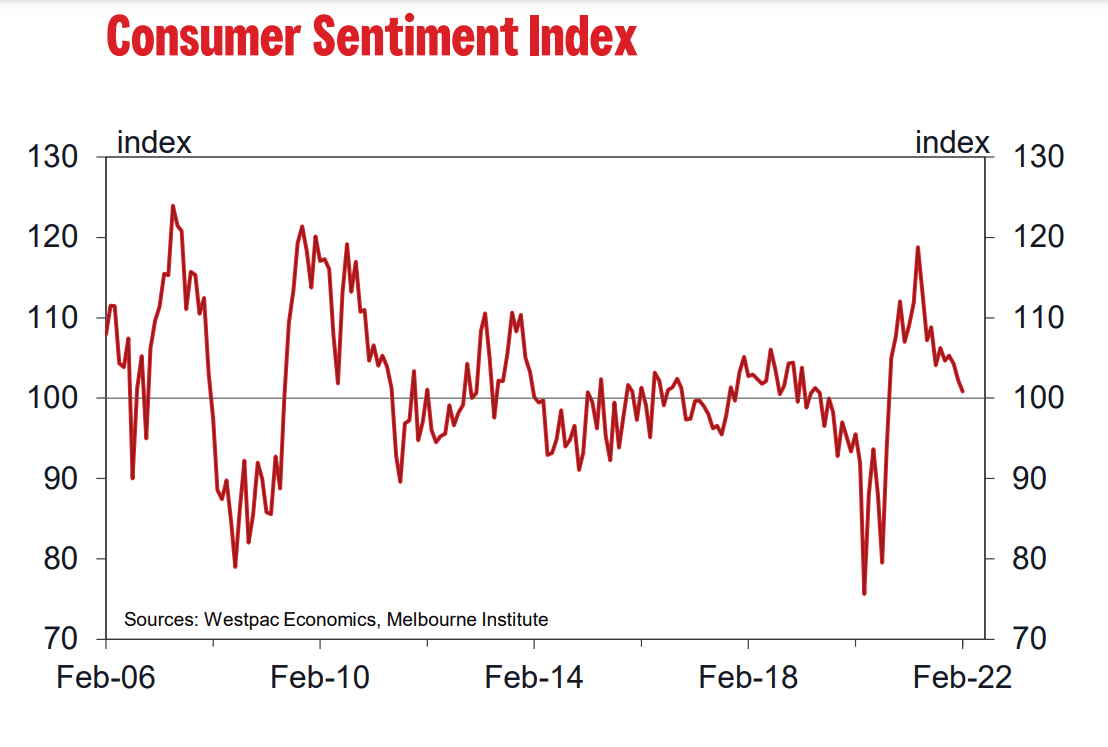

The Westpac-MI Index of Consumer Sentiment

Also on Wednesday the February index – that merciless measurement of how buying stuff feels – took a slide for the third month in a row, down by 1.3% to 100.8 from 102.2 in January.

There were some mildly positive numbers like this reassuring +7% which the index says describes our feelings on how the economy is looking one year from now.

But everyone’s despondent on Family Finances Vs. A Year Ago. The index fell nine points in one woebegone month to a below average read.

Down in Doldrum Town they are… where the air is heavy with the sickly odour of persistent inflation and lurking on every street corner is the shadow of an interest rate rise just waiting to jump out and steal your sneakers.

Meanwhile, this is us shopping by Jackson Pollack and Westpac-MI:

And in the United States of Pandemica…

Another historically inconsolable annual CPI print really went to work on the nerve of market participants, politicians and policymakers alike.

Over the past week and a half it seems a bunch of members of the US Federal Reserve’s Federal Open Market Committee (FOMC) sombrely affirmed the ‘three to four rate hikes this year’ ground zero plan. This glum group of fiscal emos includes regional Presidents George, Daly, Harker, Mester and Bostic – all known fans of The Cure.

Now the word is they’ll be getting in a quick meet on Monday.

Also on rotation as a voting member is the notorious Pink Floyd and Joy Division fan, St Louis Fed President Bullard who says he just wants to rip the Band-Aid off, because life hurts anyway.

Bullard is now calling for a 50bp hike at the March meeting to be followed by another 50bps of hikes by end of June.

Yes James, that should bring The Wall down nicely on every last one of them… I mean, on inflation.

Economic calendar for this week

Australia

TUESDAY

RBA minutes – likely detail around rates

Jan REINZ house sales – last read: 8.2%

Jan REINZ house prices – last read as a % on yr: 23.3% – higher mortgage rates and tighter lending should make an impact

WEDNESDAY

January Westpac MI Leading Index

NZ Global Dairy Trade auction prices – big start to 2022

THURSDAY

ABS January employment – last read: 64.8k – market consensus: flat

ABS January unemployment rate – last read 4.2% – market consensus: 4.1%

International calendar

US (New York time)

MONDAY

US Federal Reserve expediated meeting (TBC)

TUESDAY

February Fed Empire state index

Jan PPI – last read: 0.2% – market consensus: 0.5% supply issues should promote producer prices

WEDNESDAY

January retail sales – last read: 1.9% – market consensus: 1.8%

January import price index – last read: 0.2% – market consensus: 1.3%

January industrial production – last read: 0.1% – market consensus: 0.4% – supply issues, Omicron continued volatility

December business inventories – last read: 1.3% – market consensus: 2%

FOMC January meeting minutes – Likely focus on discussions of how many and when for rates in 2022. (The Bullard Path could get a mention.)

THURSDAY

Initial jobless claims – last read: 223k

January housing starts – last read: 1.4%

FRIDAY

January existing home sales – last read: 4.6%

January leading index – last read: 0.8% market consensus: 0.2% – robust economic momentum likely to continue

China / Japan (Beijing Time)

TUESDAY

Japan Q4 GDP – last read: 0.9% – market consensus: 1.5%

Japan December industrial production – last read: 1.0%

WEDNESDAY

China January Producer Price Index PPI – last read as a %yr: 10.3%

China January Consumer Price Index CPI – last read as a %yr: 1.5%

FRIDAY

Japan January CPI – last read as a %yr: 0.8% – market consensus 0.6% – Inflation at pre–pandemic level; BOJ focus on wages growth.

Europe (EU time)

FRIDAY

Europe Feb consumer confidence – last read: 8.5 – market consensus: 7.6 – as Omicron anxieties have, yes, infected confidence.

UK January retail sales –last read: 3.7%

(sources: Commsec, Westpac, Refinitiv, Investing.com)

ASX IPO calendar

According to the ASX, these companies are set to make their debut:

Equity Story (ASX:EQS), (March listing, actually) They do market trading advice, research, investor education and fund management

Far East Gold (ASX:FEG), a mineral explorer that raised $12m at 20c.

Omnia Metals (ASX:OM1) . Mining explorer $5.5m at 20c. Set down for February 21, possibly earlier.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.