Traders’ Diary: Everything you need to get ready for the week ahead

Via Getty

- Biden drops out, setting the scene for a market-moving US election showdown between Trump and Harris

- Aussie inflation data drops Wednesday

- US Fed rate decision also on the bill

What grabbed the headlines last week?

Last week started out with the volatility a little earlier than usual, when on Sunday night in Sydney news broke US president Joe Biden gave VP Kamala Harris the job of beating Donald Trump in November.

That mucked with a lot of recent big bets on Wall Street.

While Monday began with the odds of a Democrat victory suddenly being recalculated, the general feeling after the events in Pennsylvania on July 13 remain the following:

a) God now almost certainly exists

b) He really is American and is taking an active role in US politics

c) Donald Trump has been his chosen vessel this whole time and must be given free rein.

Adding to the froth, Wall Street is still banking on at least three rate cuts by mid-Jan, which is driving the continued outperformance of some unexpected names among the less-celebrated US mid and small caps.

With that knowledge slowly digesting, the ASX 200 ran the full gamut of emotions during a rollercoaster week.

By Friday close we were down only 0.6%, a credit to the miners who were implicated heavily in the terrifying 100 point dive on Thursday.

But in the end, the sudden gyrations were far more spectacular on a stock and sector level as traders went the full rotation with the scene rippling across global equities.

The key rotation thematics from top tech into small caps and rate sensitive sectors were pretty well veiled here by the high drama across ASX resources via global commodity price falls.

The miners did get an important win back on Friday.

Seven of the 11 ASX sectors ended lower last week.

Industrials and consumer discretionary saved the most face. The energy sector was abominable, down 5.6%, twice the loss of any other sector.

With July all but done on the ASX, we are still about 2% to the better. Local large cap tech stocks don’t carry quite the same extra weight as US mega tech stocks, so this week, we’ll find out exactly what they can unwind as global events and peak interest rate expectations continue to rattle markets.

ASX Sectors last week

ASX 200 (XJO) Top Five:

Iress (ASX:IRE) +17%, Computershare (ASX:CPU) +5%, Cochlear (ASX:COH) +5%, Zip Co (ASX:ZIP) +4.7%, SiteMinder (ASX:SDR) +4.2%, Super Retail Group (ASX:SUL) +3.9%.

ASX 200 (XJO) Least Five:

Bellevue Gold (ASX:BGL) -21%, Regis Resources (ASX:RRL) -13.3%, Paladin Energy (ASX:PDN) -9.6%, Woodside Energy Group (ASX:WDS) -7.8%, Goodman Group (ASX:GMG) -7%.

Not the ASX

Fascinating on the surface in China, so what’s actually happening deep in the depths must be scary to witness.

Last week brought no policy easing and then more policy easing in China.

First, China’s central bank the PBOC cut its 7-day lending rate by 0.1% and this was then followed by a 0.2% cut to its medium term lending facility rate taking it to 2.5%.

These moves are small and may be pushing on a string, but a move to provide RMB300bn (circa $63bn) in subsidies for capital equipment, EVs and consumer appliances may have “a more significant” impact, according to Dr Shane Oliver, chief economist and head of investment strategy at AMP.

“These moves still remain modest though suggesting further policy stimulus will remain incremental, including following the upcoming Politburo meeting. They will probably be enough to achieve GDP growth around 4.5% to 5% though.”

Things were comparatively less ropey in “The Land of the Free to do as we Please”. Still, last week the country’s political, social, cultural, moral, ethical, economic, cinematic and market volatility would shock any Martian unfortunate to have just stopped in for a casual look-see

The excitement probably peaked on Wednesday night, when the mightiest of the mega tech stocks unravelled on tepid earnings

Shares in Elon and Tesla shares crashed about 13% in after market trade while Alphabet copped its worst day this year, down a relatively dazzling 5%.

The not as heavy with tech Nasdaq dropped more than 2.5% for the week.

Everyone’s new US bestie, the Russell 2000 small caps index, jumped 3.5%.

US Earnings

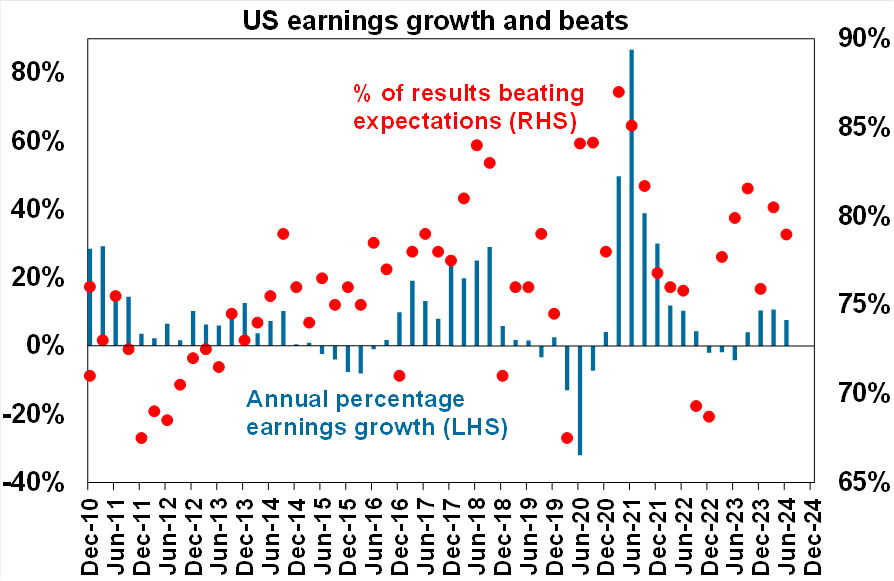

As of Friday in New York, 41% of US S&P 500 companies have now reported June quarter earnings, but the results are looking a bit softer this time around with only 78.6% beating expectations, which is above the norm of 76% but below the experience of the last reporting season.

Wall St expectations for earnings growth are now at 7.6% YoY, down from 7.8% at the start of this reporting season.

Still in the States, things were fairly Goldilocksian on the macro-economic side of things.

The personal consumption expenditures price index, a key inflation gauge for the Fed, rose 2.5% from a year ago, in line with expectations.

US Q2 GDP grew at 2.8%, well above the 2.1% expected.

So. Even as the signals out of Europe and China look more problematic, it seems the American economy, like its presidential aspirants, can look, and behave oddly, even irrationally … yet somehow keep dodging bullets.

Which brings us to Nashville, Tennessee …

On Saturday night at the Bitcoin 2024 conference, crypto got its best moon-wards call out since Elon Musk was Twittering those awful, randy looking dogs, when the ex-Pres with a nose for the Doge, promised thousands of screaming acolytes on Day One of his return to the White House, he’d end the sector’s Democrat-led “persecution”.

“I pledge to the bitcoin community, the day I take the oath of office, Joe Biden and Kamala Harris’ anti-crypto crusade will be over.”

He’s also planning to fire SEC chair Gary Gensler.

Coinheads want less regulation and Trump wants to read less, making the removal of red tape a win for both sides.

The week ahead

This week, briefly.

It’s time for a real Aussie inflation check when June quarter inflation data drops on Wednesday.

Doc Oliver says it’s likely to show a 1.1% QoQ rise, taking annual inflation to 3.9% YoY from 3.6% with trimmed mean inflation of 1% QoQ or 4% YoY.

“The key drivers are likely to be solid increases in prices for food, health, rent, electricity, petrol, clothing and insurance but softness in communication, car prices, recreation and culture and education.

“Our forecasts are slightly above the RBA’s forecast for a 1% QoQ headline CPI rise and a 0.8% QoQ rise in the trimmed mean making another rate hike a high risk, but on balance we continue to see the RBA holding rates where they are if inflation comes in at or below our forecasts as: monetary policy is already restrictive, the risk of recession is high and falling inflation is likely to resume as we have seen in the US this year.

“And for what it’s worth,” Dr Oliver adds, “June monthly inflation is likely to signal a slight slowing to 3.8% YoY from 4% YoY in May.

Oliver expects the RBA to hold, with the first cut in February, but with a rider…

“That said if trimmed mean inflation comes in above our forecast at 1.1% QoQ or more the RBA would likely see it as too high for comfort and so would likely hike again.”

Local markets are now pricing in just a 21% probability of another hike and the first cut in May.

Also this week we have building approvals on Tuesday, CoreLogic data for July and housing finance on Friday.

Meanwhile, in Europe, it’s July inflation reads on Wednesday.

June quarter GDP growth is also significant.

In London, on Thursday, the Bank of England is expected to cut its key policy rate by 0.25% to 5%.

Then be ringside on Wednesday when the US Fed’s expected to leave rates on hold at 5.25-5.5%, but the presser afterwards could be rich in unwinding confidence, setting the cliffhanger for a September cut.

The June quarter earnings reporting season introduces the books of Messrs Apple, Amazon, Meta and Microsoft.

The Economic Calendar

Monday July 29 – Friday August 2

MONDAY

Thailand Market Holiday

Taiwan Consumer Confidence (Jul)

United Kingdom Mortgage Lending and Approvals (Jun)

TUESDAY

Japan Unemployment Rate (Jun)

Australia Building Permits (Jun, prelim)

Spain Inflation (Jul, prelim)

Eurozone GDP (Q2, flash)

Eurozone Economic Sentiment (Jul)

Germany Inflation (Jul, prelim)

Mexico GDP (Q2, prelim)

United States S&P/Case-Shiller Home Price (May)

United States JOLTs Job Openings (Jun)

United States CB Consumer Confidence (Jul)

WEDNESDAY

South Korea Industrial Production (Jun, prelim)

Japan Industrial Production and Retail Sales (Jun)

Australia Inflation (Q2)

China (Mainland) NBS PMI (Jul)

Japan BoJ Interest Rate Decision

Japan Consumer Confidence (Jul)

Japan Housing Starts (Jun)

Germany Retail Sales (Jun)

Saudi Arabia GDP (Q2, prelim)

France Inflation (Jul, prelim)

Germany Unemployment Rate (Jul)

Taiwan GDP (Q2, advance)

Hong Kong SAR GDP (Q2, advance)

Eurozone Inflation (Jul, flash)

Italy Inflation (Jul, prelim)

United States ADP Employment Change (Jul)

Canada GDP (May)

United States Fed Interest Rate Decision

Brazil BCB Interest Rate Decision

THURSDAY

Switzerland Market Holiday

Worldwide Manufacturing PMIs, incl. global PMI* (Jul)

South Korea Trade (Jul)

Australia Trade (Jun)

Indonesia Inflation (Jul)

United Kingdom Nationwide Housing Prices (Jul)

Eurozone Unemployment Rate (Jun)

United Kingdom BoE Interest Rate Decision

United States ISM Manufacturing PMI (Jul)

FRIDAY

South Korea Inflation (Jul)

Australia Home Loans (Jun)

Switzerland Inflation (Jul)

Italy Industrial Production (Jun)

United States Non-Farm Payrolls, Unemployment Rate,

Average Hourly Earnings (Jul)

United States Factory Orders (Jun)

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.