Traders’ Diary: Everything you need to get ready for the week ahead

Keep a close eye on global macro this week. Pic via Getty Images

What grabbed the headlines last week?

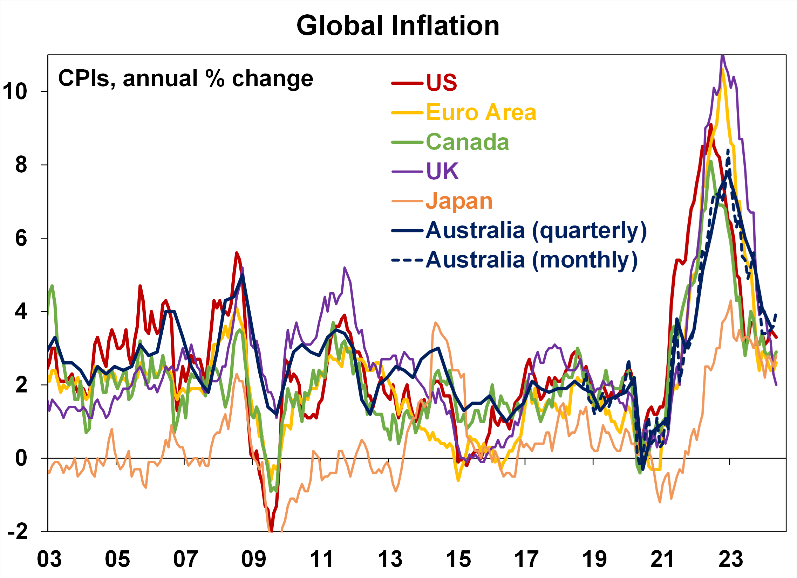

Last week was dominated at home by the hotter-than-hoped for May CPI Indicator.

It indicated that while everyone else goes out to play with shiny new lower interest rates, we’ll be sitting in the corner with an unfunny hat on.

The print of 4.0% was above consensus of 3.8%.

Futures markets and economists are now factoring in an interest rate hike by the Reserve Bank sometime before Christmas, possibly August – not least because the next few months will likely see Albo’s extra budget spend start flooding the economy.

On this front, we’re on our own.

Tardy to the raising party and last out the door to the cutting.

The Swiss have cut, Team Lagarde at the ECB have cut. Even the Canucks at the BOC have cut rates.

The US Fed is more or less a likely contender to soon do the same after a gentle week of US data, which keeps the kids tilting to the dovish side..

For the week, the benchmark ASX200 (XJO) index finished down 24.9 points or 0.32% lower, while the IT (XIJ) and Consumer Discretionary (XDJ) indices closed up +2.60%, and down 1.33%, respectively.

Despite ending on a week of relative weakness, all in all, FY24 was kind to investors and fanboys of equities.

According to the calculator of AMP’s chief economist & head of investment strategy, Dr Shane Oliver, stocks were actually the star performers over the last financial year.

Shane says US shares returning around 25%, global shares around 21% and Aussie share shares around 12%.

“Cash returned around 4.5% and bonds returned around 2-3% but unlisted commercial property remained negative as office valuations remained under pressure.”

The main drivers of stock market strength (for some time) has been the apparent promise of lower interest rates on the back of lower inflation, stronger than expected economic activity and profits particularly in the US and, for US shares, the enthusiasm for AI.

Shane says local markets did well but were “relative laggards on the back of ongoing China worries” and angst about the impact of rate hikes on Australian households.

“More constrained and more volatile returns are likely over the 2024-25 financial year reflecting:

- poor valuations evident in the narrow earnings yield less bond yield gap;

- elevated levels of investor sentiment; and technically overbought conditions with narrowing breadth in the critical US market at a time when Nvidia and the tech sector is seeing some wobbles;

- high geopolitical risks around France and the US as the first presidential debate focusses attention on the big negative of a renewed trade war if Trump is re-elected (with Biden’s awful performance not helping at a time when Trump is already ahead in the polls).

Meanwhile, the only ASX stock of any cap to break on through to the +100% side for the week was Encounter Resources (ASX:ENR), although my comrade in work and play, Mr Gregor ‘I Wanna Know What Love Is’ Stronach did note that mining and resources governance software provider K2Fly (ASX:K2F) was indeed pretty fly.

“The stock gained about 80% last week after the company has closed a deal with Accel-KKR to buy the whole kit and kaboodle at 0.19 cash per share,” Gregor wrote.

ENR proved to be the best of a pretty ordinary bunch last week, after unearthing a bunch of niobium at the company’s 100% owned Aileron project in the West Arunta region of WA.

The pick of the intercepts:

- 2m at 3.0% Nb2O5 from 81m to EOH including 16m at 6.0% Nb2O5

- 32m at 2.5% Nb2O5 from 67m to EOH including 12m at 3.3% Nb2O5

- 15m at 1.5% Nb2O5 from 120m to EOH including 2m at 3.3% Nb2O5

The ASX Small Ords (XSO) and the ASX Emerging Co’s (XEC) indices ended the day higher; the week lower, the month more lower and FY24 ahead by +6.5% and +3.85% respectively.

Over the past five days, the index has lifted 0.93% and is now 1.45% off of its 52-week high.

Seven of the 11 ASX sectors made gains over the last week. IT added an impressive 3.7% over the past five days.

ASX Sectors last week

Not the ASX

US equities fizzled in New York on Friday as traders jostled for premium portfolio positioning to close out the half. Made doubly urgent as US President Joe Biden turned into an incoherent dribbling mess on live telly.

The S&P500 fell -0.4%, the CAC40 lost 0.7% and the Euro STOXX50 dropped -0.2% with some music being faced by the French as I write.

We spoke to friends on Sunday in Paris and the mood in Le Marais district in the 4th arrondissement – once the Parisian Jewish quarter – is apparently très tense.

Let’s do some bullets:

-

The abysmal Trump vs Biden US presidential debate went south from the get go. Trump was the clear winner. Everyone else the clear losers.

-

The ex-president spent the night lobbing insults and sprouting vagaries, but at least he was comprehensible.

-

The president, on the other hand, was not.

-

On Wall Street, we’re midway through 2024 and the major US indices have blitzed it.

-

The S&P 500 and Nasdaq Composite are scaling regular new all-time highs, up 15% and 18%, respectively year to date.

-

The Dow Jones Industrial Average, which has less exposure to tech stocks, has risen nearly 4% year to date.

-

Behind most of the fireworks are a handful of companies, led by AI chip monster, Nvidia.

-

In the past few weeks of business, Nvidia surpassed Microsoft to join Apple beyond the $3 trillion threshold to become the world’s most valuable listed company.

-

The market darling added the latest $1 trillion to its market cap.

-

From around January 2023, NVDA has grown its market cap by circa +800%. It’s the moon around which other markets orbit now.

-

If Nvidia sneezes, Wall Street gets Athlete’s Head.

-

Last week, Walgreens Boots Alliance was the worst performer in the S&P 500 and Nasdaq, according to Dow Jones Market Data. The pharmacy line lost more than 21% after slashing its outlook following soft results and a sudden strategic shift.

Closer to home, a gaggle of PMIs out of China this weekend were profoundly middling in size, strength and nature. Beijing just appears disconcertingly disinterested in getting out front of an economic revival amid weak demand, deflationary factors and most worryingly, the lingering uncertainty surrounding the country’s giant property market.

The week ahead

The new financial year starts with a bang of macro data releases including worldwide PMI data, while key official updates include US payrolls, EU inflation and Japan’s Tankan updates.

First things first, though.

On Wednesday in Istanbul, the Turkish version of our Bureau of Numbers – the TÜİK – will drop another set of always stunning consumer price inflation (CPI) numbers.

Economists are expecting a CPI lift of 2.2% in June which would take Turkey’s annual inflation rate to 72.6%

The RBA releases its latest meeting minutes, in the states, there’s also the June Fed minutes due to drop – and elections in the UK and in Europe.

The first week of July also sees the release of worldwide manufacturing and services PMI data on Monday and Wednesday.

At home we can also look forward to Aussie trade data, while The Bureau also drops Building Permits and Retail trade data on Wednesday.

Finally, this morning is the monthly CoreLogic read on national home prices.

CBA expects Aussie home prices rose by 0.7%/mth in June, a slightly lower pace than the 0.8%/mth recorded in May. The gains continue to be led by the mid‑tier capital cities of Perth, Adelaide and Brisbane.

The Economic Calendar

Monday July 1 – Friday July 5

MONDAY

Canada, Hong Kong SAR Market Holiday

Worldwide Manufacturing PMIs, incl. global PMI (Jun)

South Korea Trade (Jun)

Indonesia Inflation (Jun)

Japan Consumer Confidence (Jun)

United Kingdom Nationwide House Prices (Jun)

United Kingdom Mortgage Lending and Approvals (May)

Germany Inflation (Jun, prelim)

United States ISM Manufacturing PMI (Jun)

TUESDAY

South Korea Inflation (Jun)

Australia RBA Meeting Minutes (Jun)

Eurozone Inflation (Jun, flash)

Canada Manufacturing PMI (Jun)

United States JOLTs Job Openings (May)

WEDNESDAY

United States Market Holiday (Partial)

Worldwide Services, Composite PMIs, inc. global PMI (Jun)

Japan Tankan Index (Q2)

Australia Building Permits, Retail Sales (May, prelim)

Turkey Inflation (Jun)

Brazil Industrial Production (May)

United States ADP Employment Change (Jun)

Canada Trade (May)

United States Trade, Factory Orders (May)

United States ISM Services PMI (Jun)

United States FOMC Minutes (Jun)

THURSDAY

United States Market Holiday

Hong Kong SAR PMI (Jun)

Australia Trade (May)

Switzerland Inflation and Unemployment Rate (Jun)

Germany Factory Orders (May)

United Kingdom Construction PMI (Jun)

Eurozone HCOB Construction PMI (Jun)

Canada Services PMI (Jun)

Global Sector PMI (Jun)

United Kingdom General Election

FRIDAY

Japan Household Spending (May)

Thailand Inflation (Jun)

Germany Industrial Production (May)

United Kingdom Halifax House Price Index* (Jun)

France Industrial Production and Trade (May)

Taiwan Inflation (Jun

Eurozone Retail Sales (May)

Canada Employment (Jun)

United States Non-farm Payrolls (Jun)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.