Traders’ Diary: Everything you need to get ready for the week ahead

Pic via Getty Images

What grabbed the headlines last week?

An under pressure ASX200 did well to get both hands to the ball, climbing above the pack to almost 1% last week.

And while it was no screamer, regional indices largely fell away while the local benchmark led from the front after Wall Street went missing for large parts of the week and didn’t even turn up on Monday.

Without the US markets calling the shots from centre half back, it was the rate sensitive Aussie sectors (gold, utilities, financials) which outperformed.

Utilities stole the show on Friday.

Still, this an index which won’t be hitting any great heights until its overweight and underperforming Resources stocks come into their own. Somehow.

The S&P/ASX200 closed up Friday, gaining 26.60 points or 0.34% to 7,796.00.

The headline act of the week at home without doubt belonged to the most warmly welcomed , action-packed IPO of note since… well, probably the last one, back somewhere in 1986.

Guzman y Gomez (ASX:GYG) made a fairytale debut on Thursday – they done good and we duly recorded bits of it here, here and even here.

Gregor did the bullet points:

• The company IPO’d with 11.1 million shares at $22 a pop – a staggering price that proved to be extremely popular for anyone with the cash to stump up.

• The stock went live on the market at 12pm, and was rangebound at $30 per share within 30-40 minutes, where it stayed for the rest of the afternoon.

• That put a market cap on the company of more than $3 billion, which is crazy (in my humble opinion) for a chain of overpriced Mexican food eateries.

• The market corrected on Friday, profit takers grabbing what they could and the GYG price was down about 4.5-5.0% by the close of play.

It was largely positive and probably helped shift sentiment toward a positive week. and those gains were perhaps even more unexpected following some of the hawkish language which followed the Reserve Bank of Australia’s decision to hold interest rates for a seventh straight month on Tuesday at 4.35%.

The first red flag for Dr Shane Oliver head of investment at AMP on this hawkish tilting, came in the RBA’s Statement where the Board reiterated it’s go to “not ruling anything in or out” line, which suggests a neutral bias is maintained, but with the important rider that nothing gets a free pass and that drastic measures are still on the table if need be.

“(The RBA’s) language remains relatively hawkish – particularly around inflation declining more slowly and continuing excess demand – with Governor Bullock confirming that the option of another hike was again discussed but a cut was not,” Dr Oliver said last week.

A team effort last week. Gold stocks did well. while on the sector level Utilities, Healthcare and Financials did best.

Over the last five days, the index has lifted 0.93% and is now 1.45% off of its 52-week high.

Eight of the 11 ASX sectors made gains over the last week. Utilities added an impressive 4.2% for the past five days.

ASX Sectors last week

Not the ASX

Elsewhere, the major global equity markets were a mixed bunch.

US stocks pushed higher during a holiday shortened week, the tireless buyers of US mega tech – evidently still in the total thrall of AI optimism added about 0.6%, despite some hefty bit of profit taking at the end of the week.

EU indices regained some of what the idea of another French election took. But le stress returned to Europe on Friday as the first stage of the French election came into view.

Le great problem is that both front runners are making arguably unsustainable spending promises.

France’s newly formed New Popular Front (NPF) left-wing alliance has made campaign promises ahead of the snap parliament election that would push public spending up 100 billion euros in 2025, while the “Far Right” party led by the firebrand Marie Le Pen (slightly ahead in polling) appears almost tame in comparison as it pushes an agenda of tax cuts and greater public investment combined with a large dose of French protectionism.

The positive aspect for equities is the uncertainty around France will largely be over on Sunday July 7.

Last week, the Bank of England (BOE) left interest rates unchanged despite inflation easing to its 2% target area, although the minutes following the BOE’s decision stated that the decision was finely balanced for some of the nine members.

Eurozone shares rose strongly, adding 1.1%.

Closer to home, we did well, South Korea went okay, Japanese shares were maudlin 0.6% and Chinese stocks were awful, down 1.3%, a sixth straight week of declines.

The worry here for Beijing is that on Friday news broker that foreign direct investment (FDI) into the mainland has now collapsed.

FDI, a significant catalyst to China’s economic success, is down 28.2% year-on-year to RMB 412.5bn (US$56bn) for the five months from January-May.

A seriously big record decline.

At least The source of FDI from Germany and Singapore rose by 24.2% and 16.2%, respectively. Better than nothing, which is probably where we’re headed unless Beijing takes a little of the geopolitical risk out of its dealings with the West.

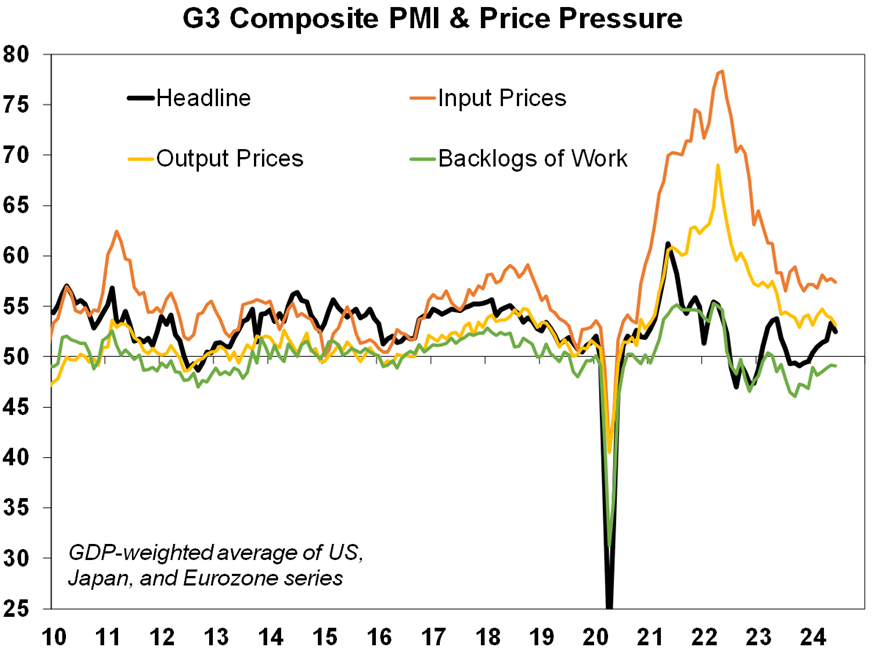

Finally, June business conditions PMIs rose slightly in the US but fell in Europe, the UK, Japan and here in non-nuclear Australia, with the G3 average edging down.

According to AMP, G3 input prices remain elevated but output prices fell to 2018 levels and work backlogs continue to fall which is positive in terms of inflation.

The Week Ahead

Locally, it’s a right good look at the May CPI indicator, which should get the blood moving this week.

CBA anticipates that the CPI indicator nudged higher to 3.7%/yr following 0.1%pt increases in both March and April.

“We expect unfavourable base effects a year ago, the roll‑off of energy rebates in Melbourne, and ongoing high inflation in areas like insurance will obscure the expected further progress made on market services disinflation.”

While a tick up in the CPI indicator will not be welcomed by the RBA, which is increasingly vigilant on the future path of inflation, caveats in the measurement of prices in the CPI indicator mean that some caution should be used when looking at purely the headline annual rate.

We also have job vacancies for Q2 24, which again CBA reckons should show a further decline as the labour market continues to gradually loosen.

RBA Deputy Governor Andrew Hauser and Assistant Governor Chris Kent will drop some central bank speak.

The offshore calendar is also fairly light next week. Inflation data for Canada is expected to show continued progress towards the middle of the Bank of Canada’s 1‑3% inflation target range in May.

In the States, the thinking is the PCE deflator will show the start of a weakening inflation impulse as softer household income growth saps consumer demand.

But we’ll see, eh.

The Economic Calendar

Monday June 24 – Friday June 28

MONDAY

ECB Schnabel Speech

JP BoJ Summary of Opinions

US Fed Waller Speech

DE Ifo Expectations JUN

EU 10 and 3-Year Bond Auction

TUESDAY

FR 12-Month BTF Auction

US Dallas Fed Manufacturing Index JUN

EU ECB Schnabel Speech

US 6 and 3-Month Bill Auction

US Fed Daly Speech

AU Westpac Consumer Confidence Index JUN

JP Coincident Index Final APR

JP Leading Economic Index Final APR

JP GDP Growth Rate YoY Final Q1

US Fed Bowman Speech

CA Core Inflation Rate MoM MAY

US Chicago Fed National Activity Index MAY

US Redbook YoY JUN/22

WEDNESDAY

US S&P/Case-Shiller Home Price YoY APR

US House Price Index APR

US CB Consumer Confidence JUN

US Richmond Fed Services Index JUN

US Dallas Fed Services Index JUN

US Fed Bowman Speech

US API Crude Oil Stock Change JUN/21

AU Westpac Leading Index MoM MAY

AU Monthly CPI Indicator MAY

DE GfK Consumer Confidence JUL

FR Consumer Confidence JUN

GB 15-Year Treasury Gilt Auction

FR Unemployment Benefit Claims MAY

FR Jobseekers Total MAY

GB CBI Distributive Trades JUN

US MBA Mortgage Market Index JUN/21

EA ECB Lane Speech

US Building Permits Final MAY

US Building Permits MoM Final

THURSDAY

US New Home Sales MoM MAY

US EIA Crude Oil Stocks

RU Corporate Profits APR

RU Industrial Production YoY MAY

US 5-Year Note Auction

US Bank Stress Tests

KR Business Confidence JUN

GB Car Production YoY MAY

JP Retail Sales YoY MAY

JP Foreign Bond Investment

JP Stock Investment by Foreigners JUN/22

AU Consumer Inflation Expectations JUN

CN Industrial Profits (YTD) YoY MAY

FRIDAY

Stay tuned.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.