Traders’ Diary: Everything you need to get ready for the week ahead

Via Getty

What grabbed the headlines last week?

Friday night in New York (Saturday morning in Sydenham), as the S&P500 and The Nasdaq Composite both again made light work of their all-time highs, wafting moonwards on the whiff of a dove (or two) at the US Fed and all the while the blue chip Dow Jones Industrial slid 0.2%, dragged down as Caterpillar dug itself an ugly 6% hole.

And yes, for unconnected reasons, the ASX200 done bad too.

Perhaps weirdest of all – ‘dumb things Europe do’ – is once again a thing for us down south.

After making easy work of the year so far, the Euro Stoxx 50 crashed another 2% as fears of a really weird snap French election weighed on everyone and their stocks.

Marine Le Pens’s Far Right Party and the Far Left Alliance are both in with a real chance of victory, while incumbent at the Elysee, Emmanuel Macron’s pro-business Renaissance Party could make its own version of Brexit, upending stability at the heart of Europe’s economy.

But first, the local benchmark closed weaker on Friday, dropping 25 points or 0.33% to 7,724.30, crossing below its 50-day moving average.

The benchmark’s worst on field were Deterra Royalties (ASX:DRR) and Orora (ASX:ORA) , down 6.95% and 4.6% respectively.

The index has lost 1.73% for the last five days, and is now 2.35% below its 52-week high.

Friday’s best 10 ASX200 stocks, the index’s worst 10 stocks and the most unexpected major traders on Friday are as below:

At home, most shortened weeks are welcome. This last one might be worth handing back.

The benchmark finally closing down -2%, after showing so much promise going into the long weekend.

With the likes of all the major mining blue chips wondering where the next meal would come from, messrs BHP (ASX:BHP), Rio Tinto (ASX:RIO), Sandfire Resources (ASX:SFR) and South32 (ASX:S32) all found fresh multi-week lows, it was always going to be a tough ask for the resources heavy benchmark to advance.

On t’other hand, the madly less influential ASX IT Sector coped far better, all the big names on the local list of decent IT co’s crept higher under the auspices of the tech heavy Nasdaq’s whole new, new records we’ve previously touched on.

The ASX Materials Sector is currently 21.7% of the All Ords, compared to the IT Sector’s insignificant 4.3%.

Ahead of the EOFY local markets could become an anxious place to be as volatility continues and fund managers try to get out from under ahead of the 30th of June.

Historically, Market Matters’ James Gerrish says the strong usually get stronger and the weak weaker.

“Usually ‘window dressing’ dominates proceedings, but from our perspective, it can create opportunities in both directions, and we wouldn’t be surprised to see one or two alerts from MM into the EOFY.”

Europe threw up some market volatility with the important election looming fast, and the markets might not like the outcomes.

Things have swung sharply against incumbent French president Emmanuel Macron who won the 2022 presidential election with 58.54% of the vote, his far-right rival Marine Le Pen won 41.46% of votes, according to the French Ministry of the Interior.

Around 14 million voters in France refused to chose between the two finalists at that rather unpopular poll. This next one could be dire.

Last week after watching Le Pen’s far right dominate European parliamentary elections, Macron called a highly surprise snap election with two rounds of voting set for June 30th and July 7th.

But the sheer shock at the sight of E. Macron dissolving the National Assembly and taking his complaints to the people has made the fears of an extremist France a bit more of a terrifying reality.

There goes any hopes for reform and the certainty of more uncertainty, how about a divided Europe? A post-Fascism France? Or how about a Euro Area breakup?

Eurovision?

Paris had a x2 whammy last week as well. French annual inflation rate edged up to 2.3% in May above April’s over-two-and-a-half-year low of 2.2%. Almost all sectors were under pressure, with financial stocks falling sharply, Axa, Crédit Agricole, and BNP Paribas all lost between almost 4% and 5.5%.

That’s the kind of uncertainty which could send the CAC 40 plunging 6.2%. Which it did last week.

Not too far away, UK prime minister Rishi Sunak called his own extermination election for the 4th of July. The Poms’ Labour Party is forecast to win a landslide victory to bid goodbye to the Conservative Party.

US markets ended the week mixed – which these days can mean anything. The S&P500 for example, on Friday clocked its best weekly advance in over a month, adding 1.6%.

Next door, the blue-chip Dow Jones Industrial lost -0.5% while the Nasdaq Composite climbed 3.2%.

All this happened largely on the back of America’s surprisingly soft inflation read where the headline CPI for last month flatlined – its first unchanged reading for almost a year.

That news in the US scooped the other headline act last week when the Federal Reserve made its latest non-move monetary policy call and the boffins were left to pour over the Fed’s famed Summary of Economic Projections, (the so-called dot plot).

The Fed kept US rates steady at a 23-year-high, but now expect but one 25 basis point cut this year (and not x3).

Other curiosities…

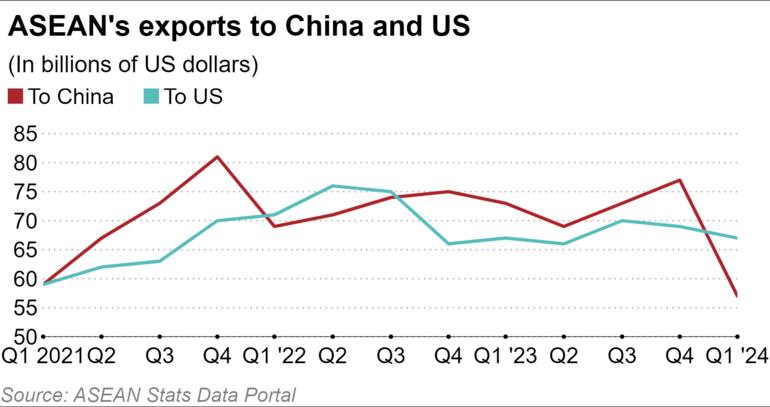

ASEAN countries’ exports to the US stormed past those to China for the first time in almost two years as the region’s trade appears to be shifting along with moves in the global supply chain.

Last week, Nikkei Asia compiled data for ASEAN’s 10 members based on statistics from the bloc’s secretariat, individual governments and local media reports.

ASEAN exports to the States came to US$67.2 billion in the March quarter, topping China’s US$57 billion.

According to Nikkei this reflects America’s increasing procurement of semiconductors and electrical parts from ASEAN and China’s lacklustre economy.

Malaysia’s exports to the US increased 8% year-on-year in the quarter, whereas China-bound exports decreased 3.3%.

“The current trend is driven by both structural and cyclical factors,” economist Nadia Jalil at CIMB Group told Nikkei Asia.

“While China remains an integral part of the [electrical and electronics] value chain, rising costs as well as political and institutional factors — chief of which are trade tensions between the two superpowers — have increasingly driven US firms to relocate from China, with Malaysia being one of the beneficiaries.”

On the other side of the world, the FT.com reported on Friday in Belgrade that Serbia is preparing to give Rio Tinto (ASX:RIO) the green light to develop what would easily be Europe’s largest lithium mine.

The news is good for all. It comes as Russia, over the weekend, eclipsed the US as Europe’ largest source of natural gas.

In May LNG imports from Russia overtook supplies from the US for the first time in almost two years, utterly making fruity mince out of the EU’s apparent efforts to at least look less dependent on Russian fossil fuels, since Moscow invaded Ukraine turning the natural order (according to Brussels) as well as the natural gas order, out of whack.

At least some home-sourced lithium might give Europe’s laughable EV sector a little oomph. Rio brings project experience as well as ESG assurances to Serbia.

Which would go some way to addressing the fact that Europe has virtually no domestic lithium production at all.

Serbia’s Jadar would alone deliver some 13% of the continent’s forecast demand in 2030, according to the commodities research firm Fastmarkets.

The Week Ahead

More central bank meetings are anticipated in the UK, Brazil, Switzerland, Norway and Indonesia in a busy week for fans of central bank stalking. And there’s more of us now than ever.

The same cohort will be munching candy and watching US retail sales, then there’s the late, late show of descriptive inflation reads from London and Tokyo.

But the headline act is when the Reserve Bank Board meets on Tuesday June 18.

If there is an expensive jar of something at the local Woolies or Coles and it says Reserve Bank of Australia (RBA) on the label, then inside you will find fresh pickles.

The central bank theme continues on Tuesday when the RBA meet to keep the wicket flat at its June policy decision in Martin Place.

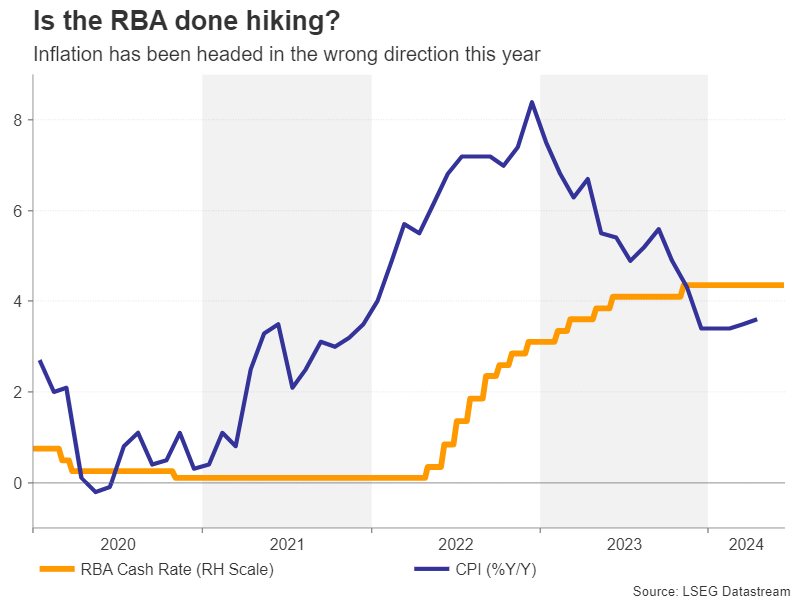

Like most central bankers outside of Turkey, our local policymakers would’ve been hoping that their job was going to get a lot easier as the year progressed.

A rate hike was considered at the May meeting, but ultimately, policymakers judged the risks to the inflation forecasts to be balanced. The June statement will likely strike a similar tone, with the cash rate expected to remain on hold.

However, Peter McGuire, CEP at vXM.com Australia says although investors have in recent weeks priced out any probability of a rate increase, the inflation trend in “Australia remains more worrisome than in other countries” and it may be too soon to rule out a hike.

“Nonetheless, any policy shift is unlikely before the August meeting when new economic projections will be available. The timing of how long it will take for inflation to fall back within the RBA’s 2-3% target band will be crucial to future rate decisions.”

But a muddy economic picture and sticky inflation have complicated the policy path.

Inflation has been gradually edging higher all year, with the monthly CPI reading ticking up to 3.6% y/y in April, reversing some of the sharp drop seen in 2023. Meanwhile, the labour market appears to be tightening again.

However, doubts about the strength of the broader economy have deterred policymakers from hiking rates. GDP grew by just 0.1% in the first three months of the year.

Westpac economist Matthew Hassan expects the bank to again leave the official cash rate unchanged, repeating the view that restrictive policy is bringing inflation back towards target but that uncertainty around the timeframe means it needs to remain vigilant to upside risks.

“Updates over the last six weeks would have given the Board some comfort that the economy is continuing to see a ‘rebalancing’ of demand and supply.

“Recent revisions to consumer spending are expected to have limited implications while other updates suggest cost pressures emanating from the labour market and weak productivity are starting to moderate.”

Despite this, Matthew says the RBA will still be wary about recent upside surprises on inflation.

“And will need to see more evidence that it remains on track for a sustained return to target over a reasonable timeframe before it can be confident enough to relax its messaging on policy risks.”

Meanwhile, in Londinium, the Bank of England (BoE) will be providing the usual pre-meet fireworks, with the June flash PMI and UK inflation figures, due just ahead of the BoE decision. It’s no secret the British service sector is pricey and that’ll be where the hit most likely comes from.

For now, markets aren’t pricing in a rate cut until closer to year’s end, though August may still be in play.

According to S&P Global Market Intelligence, US industrial production alongside US Q2 retail sales figures, will be picked apart for evidence of US economic growth.

“This will be important to watch after the Fed expressed further hesitation with just one rate cut now signalled in 2024 and policymakers keen to see demand come into line with supply. June’s S&P Global Investment Manager Index revealed that investors’ risk appetite has deteriorated amid concerns over US economic growth and as monetary policy continues to be seen as a drag for US equities.”

Closer to home, China will offer numbers on industrial production, retail sales and fixed asset investment.

These follow Caixin PMI data showing business activity expanding at the fastest pace in a year with better conditions cutting across both manufacturing and service sectors.

And Japan’s May CPI will also be due just around the time of June’s au Jibun Bank Flash PMI release.

US Futures on Sunday night:

The Economic Calendar

Monday June 17 – Friday June 21

MONDAY

India, Indonesia, Malaysia, Philippines, Saudi Arabia,

Singapore, Turkey, UAE Market Holiday

Japan Machinery Orders (Apr)

Singapore Non-oil Exports (May)

China (Mainland) Industrial Production, Retail Sales, Fixed

Asset Investment, Unemployment Rate (May)

Italy Inflation (May, final)

Canada Housing Starts (May)

United States NY Empire State Manufacturing Index (Jun)

TUESDAY

Indonesia, Turkey Market Holiday

Australia RBA Interest Rate Decision

Eurozone Inflation (May, final)

Eurozone ZEW Economic Sentiment (Jun)

Germany ZEW Economic Sentiment (Jun)

United States Retail Sales (May)

United States Industrial Production (May)

United States Business Inventories (Apr)

WEDNESDAY

US, Turkey Market Holiday

Japan Balance of Trade (May)

Japan BoJ Meeting Minutes (Apr)

Indonesia Trade (May)

United Kingdom Inflation (May)

South Africa Inflation (May)

Canada BoC Summary of Deliberations (Jun)

Brazil BCB Interest Rate Decision

THURSDAY

New Zealand GDP (Q1)

China (Mainland) Loan Prime Rate (Jun)

Germany PPI (May)

Indonesia BI Interest Rate Decision

Switzerland SNB Interest Rate Decision

Norway Norges Bank Interest Rate Decision

United Kingdom BoE Interest Rate Decision

United States Building Permits, Housing Starts (May)

Eurozone Consumer Confidence (Jun, flash)

FRIDAY

Australia Judo Bank Flash PMI, Manufacturing & Services

Japan au Jibun Bank Flash PMI, Manufacturing & Servicesa

India HSBC Flash PMI, Manufacturing & Services

UK S&P Global Flash PMI, Manufacturing & Services

Germany HCOB Flash PMI, Manufacturing & Services

France HCOB Flash PMI, Manufacturing & Services

Eurozone HCOB Flash PMI, Manufacturing & Services

US S&P Global Flash PMI, Manufacturing & Services

Japan Inflation (May)

United Kingdom Retail Sales (May)

Canada Retail Sales (Apr)

United States Existing Home Sales (May)

United States CB Leading Index (May)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.