Trader’s Diary: Everything you need to get ready for the week ahead

Economics and coporate calendar for the week ahead. Picture: Getty Images

Last week’s global headlines were dominated by the virtual meeting between Presidents Biden and Xi.

Both leaders have verbally agreed to cooperate on a range of issues, but there were no breakthroughs in the matter of Taiwan.

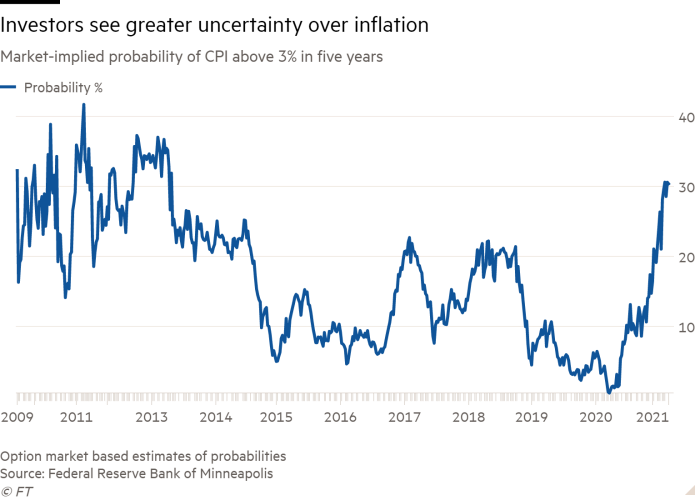

Meanwhile inflation still remains the main concern for investors worldwide.

Biden told reporters he will announce a nominee for Federal Reserve chair in the next few days, casting doubts on whether incumbent Jerome Powell will be re-elected.

Over the Atlantic, UK inflation jumped 4.2% YoY, its biggest leap in a decade.

The price growth is similar in other parts of the continent, with the Eurozone CPI rising to 4.15% amid shortages of materials and ongoing supply chain issues.

Back home, Australia’s wages rose by 0.6% over the quarter, and are up 2.2% for the year.

But in a speech last Tuesday, RBA Governor Philip Lowe is still adamant that interest rates will not be raised next year, contrary to what the bond market has priced in.

“I would like to repeat a point I made a couple of weeks ago – that is, the latest data and forecasts do not warrant an increase in the cash rate in 2022,” Lowe said.

“The economy and inflation would have to turn out very differently from our central scenario for the board to consider an increase in interest rates next year.”

Economic calendar for this week

Australia

The focus this week will be on payrolls and retail trade data.

TUESDAY:

Consumer confidence index.

Speech by RBA official, Andrea Brischetto.

WEDNESDAY:

Speech by RBA official, Michelle Bullock.

THURSDAY:

Business sentiment for September quarter.

Weekly payroll.

FRIDAY:

Retail trade for October.

International calendar

US (US time)

The focus this week will be on US Fed meeting minutes and GDP data.

MONDAY:

Exisiting home sales for October.

WEDNESDAY:

US Fed meeting minutes.

US GDP.

US jobless claims for the week.

Europe (European time)

The key focus this week will be on the speech by ECB’s President.

MONDAY:

Consumer confidence survey.

THURSDAY:

Speech by European Central Bank President, Christine Lagarde.

ASX IPO calendar for this week

MONDAY:

Nimy Resources (ASX:NIM), a mining explorer that has raised $7.5m at 20c a share.

TUESDAY:

RAS Technology (ASX:RTH), a provider of premium data, enhanced content and SaaS solutions to the global racing and wagering industries. The company raised $29m at $1.50.

WEDNESDAY:

EBR Systems (ASX:EBR), a US-based medical device company that is focusing on heart failure. The company has patented technologies, and has raised $110m at US$1.08.

THURSDAY:

Winsome Resources (ASX:WR1), a mining explorer that has raised $18m at 20c.

Radiopharm Theranostics (ASX:RAD), a clinical stage radiotherapeutics company targeting cancer. The company has raised $50m at 60c.

FRIDAY:

Artrya Ltd (ASX:AYA), a medical technology company developing software which automates the analysis of heart computed tomography (CT) scans to assist in the diagnosis of Coronary Artery Disease. The company raised $40m at $1.35.

Parabellum Resources (ASX:PBL), a mining explorer that has raised $5m at 20c a share.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.