Traders’ Diary: A week of War, Worry and Wall Street earnings

Via Getty

The Week That Was

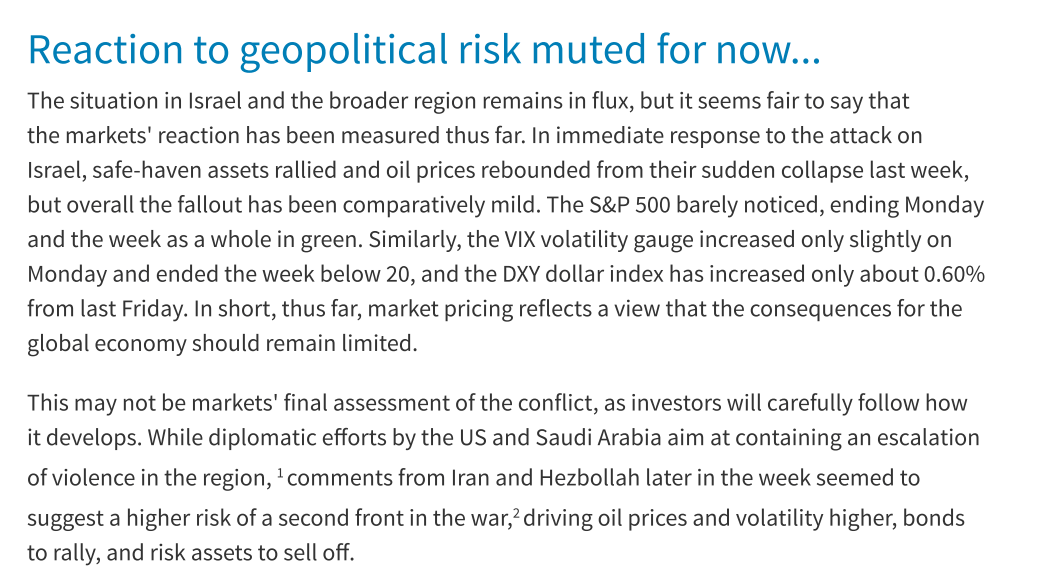

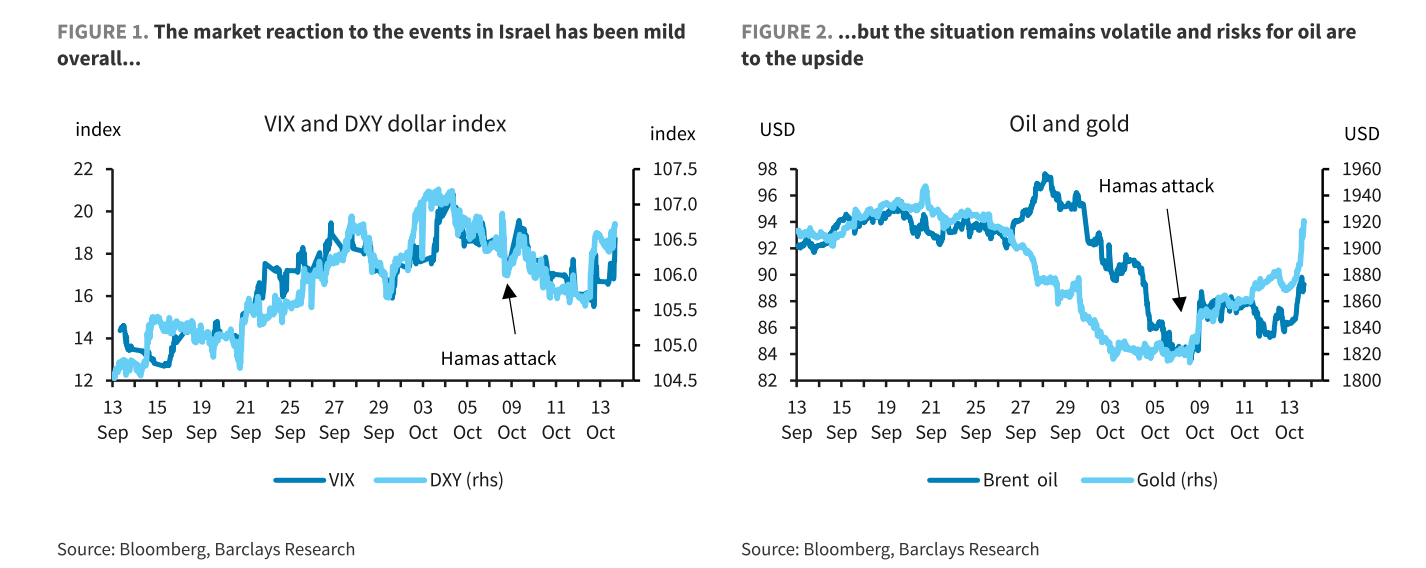

The world looks very different this week after the addition of what Barclays economic team calls ‘a complex cocktail of geopolitical risk, mixed macro data, a nervous oil market,’ and a US Fed finding nice things to say about financial conditions.

The Fed chatter turned tack last week, as renewed focus on financial conditions lowers the likelihood of a November hike, while weak China data fuel talk of stimulus.

A US November Fed hike now seems less likely.

But some throaty Chinese stimulus appears more likely.

For now, the global market remains in a pincer-grip of bleak yet hopeful suspense after last week threw up both pure geopolitical insanity and yet some equally incongruous encouraging cues for punters with a positive close for equities.

The Israel-Palestine conflict is now in Week 2.

Peace looks incredibly unlikely to suddenly break out, that’s for sure. If gold is a useful measure of safety, then Friday night in New York was a bunker, the gold price lifting +3.1% as oil took on almost +6%!

On Thursday night, the US CPI read came in higher than expected, triggering US bond yields back toward their traumatic decade highs – until the flight to safety reversed the direction of bonds (higher) and yields (lower) for the week.

It was a generally quiet week for domestic economic news. The private sector bank releases were of note in the absence of any data from the official statistician. The Westpac‑Melbourne Institute consumer sentiment survey showed that confidence lifted by 2.9% from very low levels. The takeaway from October’s numbers is the same as it has been since mid‑2022 – consumers are feeling extremely pessimistic.

War in the Middle East

Last weekend was the 50th anniversary of the start of the 1973 Yom Kippur War (6th October – 25th October 1973), also know as the Ramadan War, the Fourth Arab–Israeli War, or the October War.

The Palestinian military group, Hamas, launched a highly co-ordinated assault on Israel breaching what was assumed to be one of the world’s most impenetrable borders across multiple points in what’d quickly become the worst attack inside Israeli territory since the aforementioned attack by the coalition of Arab states led by Egypt and Syria half a century earlier.

You don’t need me to go into what happened other than the following dispassionate assessment of the new conflict’s potential impact on markets and economies.

Considering the historic regularity of mis-matched Palestinian-Israeli conflicts, confined as they usually are to the afflicted Gaza Strip, the impacts on an inured global economy and associated markets has been pretty limited.

This one looks and feels different – and not merely for the shocking scale, scope and resounding success of the attacks.

The Israeli Prime Minister Benjamin Netanyahu is a wild card. His loose and divisive right-wing coalition, distracted by the social upheaval deriving from a heavy-handed attempt to sequester Israel’s judicial system, has now of a sudden secured the kind of sweeping, blank-cheque emergency powers and accompanying national unity which comes with any existential threat to the state of Israel.

That incredible national cohesion’s been exemplified in times of crisis over and over. A quick study of the extraordinarily decisive Israeli state response to the initial surprise attack which began the so-called Yom Kippur conflict.

The bristling Israeli security apparatus and its response to the attacks will be indelibly tied to Netanyahu’s political survival. In anticipation of Israel’s response, Hamas has taken a lot of hostages, including Israeli military prisoners, civilians, kids – reportedly some holocaust survivors – the first time that’s happened on almost 20 years.

Global share markets rose over the last week as US Fed officials sounded less hawkish indicating they would allow for the rise in bond yields, which offset uncertainty over the Gaza conflict.

The Dow Jones closed 39 points higher on Friday, while S&P and the Nasdaq Composite dropped -0.5% and -1.2%, respectively.

Some positive big bank results, offset by falls in the mega tech stocks, amid persistent concerns over inflation outlook. At the same time, the surge in oil prices and the escalation in the Middle East conflict also weighed on investors’ mood.

Tech monsters Tesla, Nvidia, Apple, Alphabet, Microsoft and Amazon all reversed between -1% and -3%.

On the week, the S&P 500 is up 0.6%, the Dow Jones added 0.8% and the Nasdaq added 0.3%

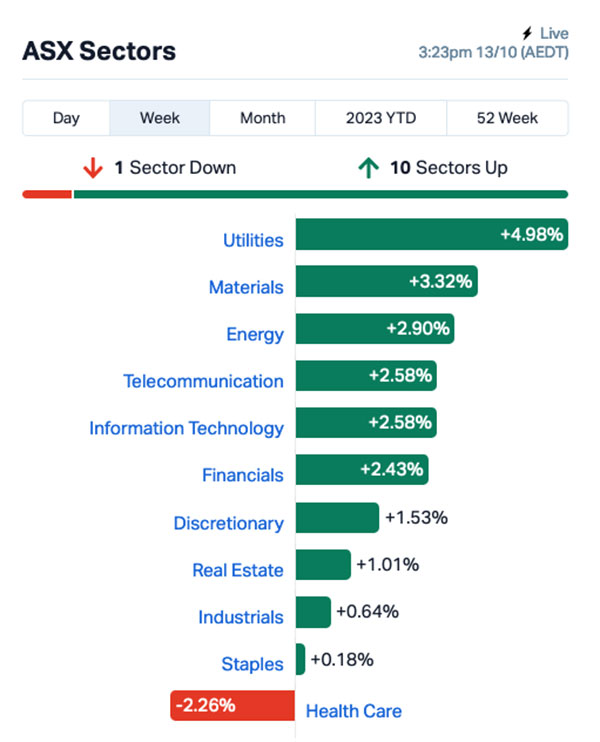

The positive global lead along with talk of more stimulus in China saw Australian shares gain with a rise of around 1.7% led by utility, energy, IT, telcos and material shares.

The less hawkish central bank commentary saw bond yields fall back. Oil prices initially rose by around 4% after Hamas’ attack on Israel, but then fell back to only just above where they were a week ago. Metal and iron ore prices fell as did the $A, as the $US rose.

“The rebound in share markets from their recent lows after falls of around 8% is impressive given the wall of worries around Israel, US politics, recession risk, share market valuations, China, etc, according to Shane Oliver, chief economist and head of Investments at AMP.

The Week on the ASX

On the local bourse, Utilities had a wonder run – gaining more than 5% for the week.

Given the upheavals taking place around the world this week, the ASX has performed rather well, thanks in no small part to a surging gold price.

It proved to be hard yards for a few of the other Israeli companies that are listed on the ASX at present, including a very difficult 10.5% slump for HeraMED (ASX:HMD) and a 13.3% fall for Way2VAT (ASX:W2V) .

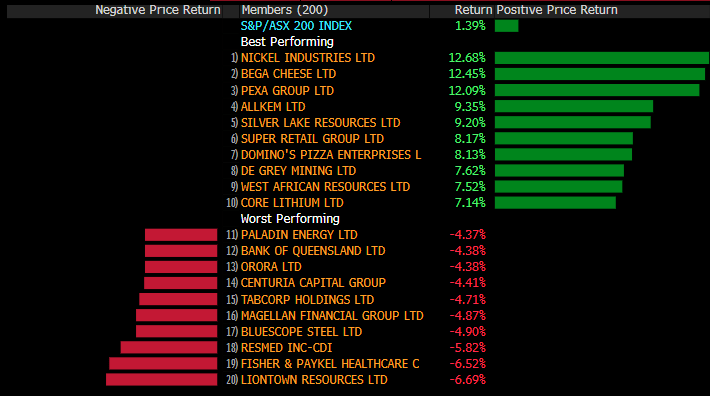

The ASX200 closed up +1.4% for the week on broad-based gains; on the sector level, only the healthcare names closed lower.

Under the hood of the Heathcare Sector things are happening all over on the stock level, as the global “wonder drug” Ozempic messes with medical investing minds. Megacaps CSL (ASX:CSL) and ResMed (ASX:RMD) both ending the week well over -4% lower.

James Gerrish at Market Matters observed: “The ‘if in doubt, get out’ attitude continued to dominate investors’ mindsets, especially when it came to the ramifications of the GL-1 drugs.”

But overall, the market has behaved itself and turned in a decent showing – here’s what it looked like from a sector breakdown perspective.

As you’d expect in the face of global turmoil, Utilities, Energy and Materials all did rather well, as oil and gold prices surged.

With a little over a fortnight to play this month, the ASX in October is back into positive territory.

The benchmark index is up +0.03%, while six out of the 11 sectors are higher.

While Financials and Consumer Discretionary stocks remained firm, gold stocks surged following the Middle East conflict, and the lithium names finally regained their mojo, albeit from a low base, e.g. Pilbara Minerals (PLS) +6.1% and Core Lithium (CXO) +7.1%.

ASX 200 BEST & WORST

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks from 09-13 October:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| FIN | FIN Resources Ltd | 0.023 | 109% | $11,799,672 |

| ZAG | Zuleika Gold Ltd | 0.02 | 82% | $9,414,911 |

| KRR | King River Resources | 0.017 | 70% | $24,856,399 |

| DDT | DataDot Technology | 0.005 | 67% | $4,843,811 |

| PIL | Peppermint Inv Ltd | 0.014 | 56% | $28,529,996 |

| FGR | First Graphene Ltd | 0.105 | 50% | $64,984,167 |

| CCE | Carnegie Cln Energy | 0.0015 | 50% | $31,285,147 |

| MOB | Mobilicom Ltd | 0.009 | 50% | $13,266,767 |

| TG1 | Techgen Metals Ltd | 0.03 | 50% | $1,929,207 |

| MAUCA | Magnetic Resources | 0.4 | 48% | $8,167,545 |

| IPB | IPB Petroleum Ltd | 0.016 | 45% | $7,346,592 |

| STK | Strickland Metals | 0.1025 | 39% | $144,066,690 |

| MGT | Magnetite Mines | 0.395 | 34% | $24,948,641 |

| AXP | AXP Energy Ltd | 0.002 | 33% | $11,649,361 |

| HOR | Horseshoe Metals Ltd | 0.012 | 33% | $5,147,829 |

| MOH | Moho Resources | 0.008 | 33% | $2,720,355 |

| SRY | Story-I Limited | 0.004 | 33% | $1,505,619 |

| ABY | Adore Beauty | 0.97 | 32% | $82,168,951 |

| BIT | Biotron Limited | 0.1 | 32% | $82,089,157 |

| AX8 | Accelerate Resources | 0.03 | 30% | $13,980,066 |

| PL3 | Patagonia Lithium | 0.15 | 30% | $7,350,525 |

| 5EA | 5Eadvanced | 0.455 | 30% | $155,337,677 |

| SPX | Spenda Limited | 0.013 | 30% | $47,804,024 |

| BPH | BPH Energy Ltd | 0.026 | 30% | $26,541,824 |

| NGL | Nightingale Intel | 0.065 | 30% | $6,638,386 |

| CRS | Caprice Resources | 0.04 | 29% | $4,670,277 |

| CZR | CZR Resources Ltd | 0.18 | 29% | $42,432,236 |

| NGY | Nuenergy Gas Ltd | 0.032 | 28% | $47,390,576 |

| VN8 | Vonex Limited. | 0.019 | 27% | $7,960,230 |

| CMD | Cassius Mining Ltd | 0.039 | 26% | $21,359,313 |

| AMD | Arrow Minerals | 0.0025 | 25% | $7,559,413 |

| LNU | Linius Tech Limited | 0.0025 | 25% | $10,574,477 |

| MTL | Mantle Minerals Ltd | 0.0025 | 25% | $15,368,615 |

| TOY | Toys R Us | 0.015 | 25% | $11,997,935 |

| AMA | AMA Group Limited | 0.046 | 24% | $81,525,758 |

| LPI | Lithium Pwr Int Ltd | 0.435 | 24% | $261,133,587 |

| A11 | Atlantic Lithium | 0.52 | 24% | $296,937,205 |

| AIS | Aeris Resources Ltd | 0.21 | 24% | $148,553,303 |

| JAT | Jatcorp Limited | 0.37 | 23% | $30,808,574 |

| CCA | Change Financial Ltd | 0.069 | 23% | $43,308,636 |

| BUY | Bounty Oil & Gas NL | 0.008 | 23% | $10,278,757 |

| M2M | Mtmalcolmminesnl | 0.032 | 23% | $3,274,992 |

| SER | Strategic Energy | 0.016 | 23% | $8,258,857 |

| HIO | Hawsons Iron Ltd | 0.059 | 23% | $52,387,050 |

| CTQ | Careteq Limited | 0.027 | 23% | $5,997,318 |

| PGY | Pilot Energy Ltd | 0.027 | 23% | $28,014,055 |

| FEG | Far East Gold | 0.19 | 23% | $34,315,180 |

| GT1 | Greentechnology | 0.495 | 22% | $100,099,436 |

| NHE | Nobleheliumlimited | 0.22 | 22% | $50,383,993 |

| RVS | Revasum | 0.165 | 22% | $19,064,998 |

The standout performer for the week was undoubtedly Fin Resources (ASX:FIN), up handsomely thanks to some welcome news from the company’s maiden fieldwork program at Cancet West in James Bay, Canada.

The news is simple enough: the company’s had a solid look around the site, and identified “abundant spodumene crystals within a broad pegmatite outcrop” – which is music to the ears and eyes of anyone looking to get into the lithium game.

Mobilicom (ASX:MOB) has had a geopolitics-defying week, considering the massive upheavals in its home nation of Israel.

Despite the unfolding horrors there, the company still managed to put on around 67% for the week.

Zuleika Gold (ASX:ZAG) rounds out the top three performers for the week, up around 64% on news that super-investor Mark Creasy sunk $3 million into a subscription cash deal with Zuleika, via Yandal Investments.

All of those are covered in more detail down below, so do read on…

ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks from 18-22 September:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| PUA | Peak Minerals Ltd | 0.003 | -40% | $3,644,818 |

| RHY | Rhythm Biosciences | 0.195 | -39% | $40,911,379 |

| MHC | Manhattan Corp Ltd | 0.004 | -38% | $11,747,919 |

| KZA | Kazia Therapeutics | 0.099 | -38% | $25,998,431 |

| VTI | Vision Tech Inc | 0.26 | -35% | $7,589,138 |

| TMB | Tambourahmetals | 0.11 | -35% | $10,782,246 |

| VMT | Vmoto Limited | 0.15 | -33% | $47,889,648 |

| KNM | Kneomedia Limited | 0.002 | -33% | $4,514,356 |

| LVT | Livetiles Limited | 0.006 | -33% | $7,062,664 |

| MCM | Mc Mining Ltd | 0.1 | -33% | $37,968,194 |

| ZEU | Zeus Resources Ltd | 0.01 | -33% | $4,592,810 |

| FAU | First Au Ltd | 0.0025 | -29% | $4,355,980 |

| RML | Resolution Minerals | 0.005 | -29% | $6,286,459 |

| VAR | Variscan Mines Ltd | 0.01 | -29% | $3,566,147 |

| GRE | Greentechmetals | 0.28 | -27% | $16,978,667 |

| CR1 | Constellation Res | 0.11 | -27% | $5,988,651 |

| IBX | Imagion Biosys Ltd | 0.0125 | -26% | $20,892,265 |

| EWC | Energy World Corpor. | 0.028 | -26% | $86,209,795 |

| AVW | Avira Resources Ltd | 0.0015 | -25% | $3,200,685 |

| BP8 | Bph Global Ltd | 0.0015 | -25% | $2,002,095 |

| G50 | Gold50Limited | 0.105 | -25% | $12,840,086 |

| IS3 | I Synergy Group Ltd | 0.009 | -25% | $2,601,723 |

| KEY | KEY Petroleum | 0.0015 | -25% | $2,951,892 |

| LBT | LBT Innovations | 0.009 | -25% | $3,914,904 |

| MRD | Mount Ridley Mines | 0.0015 | -25% | $15,569,766 |

| SIX | Sprintex Ltd | 0.015 | -25% | $5,022,595 |

| TSO | Tesoro Gold Ltd | 0.015 | -25% | $15,804,189 |

| WFL | Wellfully Limited | 0.003 | -25% | $1,478,832 |

| YPB | YPB Group Ltd | 0.003 | -25% | $2,230,384 |

| YAR | Yari Minerals Ltd | 0.013 | -24% | $6,753,009 |

| 1AE | Auroraenergymetals | 0.1 | -23% | $16,716,728 |

| DTR | Dateline Resources | 0.01 | -23% | $8,854,428 |

| ZNC | Zenith Minerals Ltd | 0.1 | -23% | $35,238,088 |

| MFG | Magellan Fin Grp Ltd | 6.81 | -23% | $1,277,280,569 |

| SOM | SomnoMed Limited | 0.55 | -23% | $64,068,924 |

| AVJ | AVJennings Limited | 0.275 | -22% | $140,334,142 |

| ERW | Errawarra Resources | 0.105 | -22% | $7,645,440 |

| RDS | Redstone Resources | 0.007 | -22% | $6,971,028 |

| XPN | Xpon Technologies | 0.042 | -21% | $6,895,947 |

| BRX | Belararoxlimited | 0.48 | -21% | $27,530,331 |

| SEG | Sports Ent Grp Ltd | 0.195 | -20% | $50,916,845 |

| AHK | Ark Mines Limited | 0.18 | -20% | $8,803,228 |

| CT1 | Constellation Tech | 0.002 | -20% | $2,942,401 |

| DCX | Discovex Res Ltd | 0.002 | -20% | $6,605,136 |

| EMU | EMU NL | 0.002 | -20% | $2,900,043 |

| ERL | Empire Resources | 0.004 | -20% | $4,451,740 |

| GTG | Genetic Technologies | 0.002 | -20% | $23,083,316 |

| KPO | Kalina Power Limited | 0.006 | -20% | $9,091,175 |

| MRQ | Mrg Metals Limited | 0.002 | -20% | $5,514,797 |

| NES | Nelson Resources. | 0.004 | -20% | $2,454,377 |

The Week That Will Be

Gold and oil stocks are the prettiest sitting ASX stocks on Monday morning, assuming Wall Street leads still count for anything.

This week we get updates on global economic growth and inflation trends with some useful activity reads – retail sales and industrial production figures – from the States and GDP in mainland China including retail sales and industrial production figures.

In the US, manufacturing conditions in the New York (Monday) and Philadelphia (Thursday) regions for October are likely to be soft. Retail sales in September may’ve slowed a bit and then US September quarter earnings results will also start to flow. Also in the States, a key focus will be on the onset of the earnings season featuring major players like Tesla, Bank of America, Johnson & Johnson, Procter & Gamble, and Netflix.

Quarterly GDP growth is an important one in China on Wednesday – September monthly data is expected to show an improvement in growth for retail sales, a slowing in industrial production and investment data looks flat. Better, but still soft by Chinese standards as the sluggish post-pandemic activity across the mainland, per previous indications from Caixin’s PMI data reads.

Inflation readings will also pepper the week – the UK, EU, Japan and Canada for assessment of price developments.

Central bank meetings in South Korea and Indonesia are on the cards, the Bank of Korea (BoK) is expected to stay on hold until the end of the year and then cut in early 2024 making the BoK the likeliest Asian central bank to begin the trim.

September inflation is expected to show slight falls with Canada (Tuesday) and in the UK (Wednesday) and in Japan (Friday) where prices are expected to ease to just 3%yoy.

UK jobs data for September (Tuesday) is likely to show a further easing in labour market conditions.

At home, it’s the minutes from the last RBA meeting for fans of that fine document (Tuesday). If that’s not enough, new governor M. Bullock is up for a “fireside chat” and maybe share a few words on when we might move to active Quantitative Tightening (ie beyond just letting bonds roll off the balance sheet as they mature) with assistant governor Kent saying RBA had “no current plans” to undertake it.

CBA’s Global Economic & Markets Research team have declared that “the November RBA Board meeting is ‘live’”

“Our central scenario has the RBA on hold from here and we continue to look for an easing cycle to commence in mid-2024. But there is a clear near term risk that the RBA delivers on its long-held hiking bias and increases the cash rate by 25bp at either the November or December Board meetings (we assess the probability of rate hikes at both meetings to be low),” the bank’s team, led by Gareth Aird says.

September jobs data (Thursday) is expected to show a 5000 gain in employment after the 64,900 gain in August with unemployment rising to 3.8%.

This is as the October S&P Global Investment Manager Index signalled reduced risk aversion among US investors on the back of easing valuation concerns, though worries were found to have intensified central bank policy and the macroeconomic environment, both domestically in the US and globally.

Josh Gilbert’s 3 things to watch for the week ahead

Josh Gilbert, market analyst at eToro, shares his three things to watch in Australia in the coming days.

1) Rate call minutes – On Monday, the RBA’s Meeting Minutes from the latest rate call will be published. With the RBA delivering a fourth consecutive pause, it’s unlikely we’ll see a significant change of tack in its newest statement. RBA assistant governor Christopher Kent reaffirmed in an address to Bloomberg this week that some further tightening may be required, but he also stated that the lagging impact of this year’s significant run of consecutive rate increases are still yet to be felt.

Chris Kent, the RBA’s assistant governor for financial markets, also indicated that heightened home loan repayments are now having their intended impact of reducing household spending. Essentially, the RBA leadership team sees inflation heading back towards target levels, suggesting a bias for keeping rates on hold for the time being.

2) Australian unemployment – On the topic of the RBA, another major piece of its economic puzzle will fall into place on Thursday with the monthly AU unemployment figures.

Last month’s figures came in at 3.7%, and given the RBA wants to see signs the labour market is cooling, any pick-up above 3.7% will reaffirm the view that the RBA will remain on hold for the foreseeable future. Conversely, a drop in unemployment gives the RBA a sensible reason to hike again, particularly if the Q3 CPI is hotter than expected.

3) China GDP – More bad news is forecast for the Chinese economy on Wednesday, with the nation’s GDP expected to slow to 4.4% from a position of 6.3% in Q2.

China originally set a GDP growth target of around 5% for the year and this will likely remain their focus. However, we’ve seen a very cautious approach to launching any substantial stimulus measures, even despite mounting pressure from investors and key industry.

Additional data points due to be released today may provide greater insight into the path ahead for our biggest trading partner but with the country’s GDP continuing to slide backwards and growth targets unwavering, we may see more significant economic measures announced before year’s end.

Thanks Josh.

The Australian Economic Calendar

Monday October 16 – Friday October 20

We’ve got a quiet one at home on the data front.

Source: Commsec, Trading Economics, S&P Global Research, AMP

MONDAY

RBA Speech

TUESDAY

Australia RBA Meeting Minutes

WEDNESDAY

RBA’s Bullock-Fireside Chat

Westpac Leading Index MoM

THURSDAY

NAB Business Confidence

Australia Employment Change (Sep)

The Everyone Else Economic Calendar

Monday October 16 – Friday October 20

Monday

Indonesia Trade (Sep)

Japan Industrial Production (Aug, final)

Germany Wholesale Prices (Sep)

Italy CPI (Sep, final)

Eurozone Balance of Trade (Aug)

Canada Manufacturing Sales (Aug, final)

Tuesday

South Korea Export and Import Prices (Sep)

New Zealand CPI (Q3)

Singapore Non-oil Domestic Exports (Sep)

United Kingdom Labour Market Report (Aug)

Germany ZEW Economic Sentiment (Oct)

Canada Inflation (Sep)

Canada Housing Starts (Sep)

United States Retail Sales (Sep)

United States Industrial Production (Sep)

United States Business Inventories (Aug)

Wednesday

China (Mainland) GDP (Q3)

China (Mainland) Industrial Production (Sep)

China (Mainland) Retail Sales (Sep)

China (Mainland) Unemployment Rate (Sep)

China (Mainland) Industrial Capacity Utilization (Sep)

United Kingdom Inflation (Sep)

South Africa Inflation (Sep)

Eurozone Inflation (Sep, final)

United States Building Permits (Sep)

United States Housing Starts (Sep)

Thursday

Japan Trade (Sep)

South Korea BOK Interest Rate Decision

China (Mainland) House Price Index (Sep)

Malaysia Trade (Sep)

Indonesia BI Interest Rate Decision

United States Initial Jobless Claims

United States Existing Home Sales (Sep)

Friday

China (Mainland) Market Holiday

New Zealand Trade (Sep)

Japan Inflation (Sep)

China (Mainland) Loan Prime Rate (Sep)

Malaysia GDP (Q3, prelim)

Malaysia Inflation (Sep)

United Kingdom Retail Sales (Sep)

Taiwan Export Orders (Sep)

Hong Kong Inflation (Sep)

Canada Retail Sales (Aug)

Canada New Housing Prices (Sep)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.