Totally Unreserved: Gold holdings up 3000pc in Hungary; China hordes 4% of it all; Australia buys 100kg in 10 years

Hungary for gold. Via Getty

It’s all been happening for gold in 2023.

Gold bulls will love this, but you’d have to admit prices have remained rather golden in the face of the surge in US long-term Treasury yields and a roid-raging US Dollar.

The Fed’s been saying ‘higher for longer’ all year when it comes to the cash rate, but last week global markets really took the message home and have been chewing on it since.

With persistently forthright US economic data dropping weekly, the questions facing gold bugs and global central banks alike is what impact will uncertain headwinds like these wreak on the safe haven over the coming months.

On one hand we have ANZ bank economists expecting gold to trade near $2,000 by the end of this year. On the other foot, we have Rich Dad, Poor Dad Author Richard Kiyosaki forecasting the price of gold to top US $5,000 in the next few years*.

*Full disclosure, my Dad was rich and I’m poor, so unless that’s the entire point of the book (and probably is) I’d take that $5K forecast on advisement.

Having said that, aside from gold being generally great for rings and stuff, the precious metal does have a rich history as the go to safe haven asset – an asset which traditionally has a negative correlation to global markets. So it’s pretty and is a great hedge against financial troubles.

And we have financial troubles. $5k worth? It’s not inconceivable.

Super-heightened uncertainty is all about. War. Inflation. Greed. Stupidity. These things we do not lack in 2023.

Geopolitical tension has done a right number on stability, affordable energy and everything prices. And although a peek through history suggests the fog of war is usually transitory, that epigrammatic legend Mark Twain was on the money when he said: “History doesn’t repeat, but it often rhymes.”

Very pithy, Twain, very pithy.

Because the risks are accumulating. China’s deflating on lost property. Inflation is sticking like Araldite. Even stagflation is making an appearance.

And these are but the tips of various icebergs national economies will have to negotiate in order to make a successful crossing into 2024 and beyond.

So a rising USD – usually a bummer for gold prices – and other headwinds don’t look strong enough to stop investors and entire nations sinking funds into the golden safe haven.

Who’s gone gold greedy?

Well, I can tell you that China’s been quietly and consistently hoovering up what it can to add to its already sparkling gold reserves, which among other things often run in correlation as a handy yardstick to a Dictatorship’s level of paranoia.

The Chinese Communist Party has a lot to be paranoid about at the moment. It’s a muddle of their own making – simultaneously reducing its hoardings of US Treasuries in a conscious decoupling that students of the disintegrating Sino-American romance are watching with wide-eyed fascination.

One of China’s leaks in the economic dyke is a floppy Yuan, right at a time when the CCP has been trying to flog it to the world as an alternative to the USD. And while gold prices haven’t gone on a rampage since May, the enduring strength of the US economy, rising bond yields, and the stronger US dollar are tearing holes in the Chinese currency.

And now the market for bullion in China has surged. On Wednesday, an ounce of gold in Shanghai cost $2,007, about 6% higher than the price in London or New York, according to calculations by Bloomberg. Bullion in Shangers has clocked record premiums over international prices of more than $100 an ounce, compared with an average over the past decade of less than $6.

“China seems to be selling treasuries and buying gold, possibly signalling a reduction in support for the bond market,” notes David Bassanese, BetaShares chief economist.

The World Gold Council tracked the purchase of some 23 tonnes of gold by China through July, bringing its total net gold acquisitions for 1H 2023 to 126 tonnes.

China’s official gold reserves rose to 69.62 million ounces at the end of August, up from 68.69 million ounces a month earlier, marking the 10th consecutive month of rising purchases, according to China’s State Administration of Foreign Exchange.

The market tracker Wind Info says that from November last year to the end of last month, China gorged on 6.98 million ounces, bringing the country’s official gold reserves to a new record high.

China’s gold reserves now stand at circa 2,136 tonnes, representing roughly 4% of all global bullion reserves.

And while it’s easy to pin the tail on China’s actions, Beijing is merely out front of a broader trend among global central banks which have been falling over themselves to enlarge and diversify their holdings of the precious metal.

In July, central banks globally collectively acquired a net total of 55 tonnes of gold, with Notably, the Central Bank of Uzbekistan and the National Bank of Kazakhstan, two of the largest sellers, decreased their holdings sourced from domestic mining operations.

In July, according to the World Gold Council, central banks worldwide collectively snapped up a handsome total of 55 tonnes of gold. And not just any gold. Notably July saw some rapacious moves from both the Central Bank of Uzbekistan and the National Bank of Kazakhstan – traditionally two of the world’s largest sellers, as they sought to balance their holdings sourced from domestic mining operations.

According to City Index, gold investment jumped 18% to 4,741t in last year, almost on par with 2011 when there was really exceptional investment demand.

And while Google searching might not be the best measurement for asset demand, City Index does say that search volumes for “gold investment” soared by 809% in Q3 2023.

Let’s start at home

Australia is the second largest gold producer in the world.

According to City Index research released on Thursday, Australia’s gold reserves have remained stable over the last decade, at 79.85 tonnes.

This is because anyone with a fondness for the ASX can tell you we have a pretty significant gold mining sector – consistently ranking among the world’s top gold producers.

As a result, we can and do sit on our hands instead of buying up additional gold reserves.

Most of our gold production gets exported to international markets, where it’s sold to central banks, jewellery makers, Mariah Carey and individual investors.

As central banks seek to use gold as an inflation hedge – seeking that reassuring measure of protection against purchasing power risk – individual consumers especially in China and the United States, often do the same on a micro-level, in the form of coins or jewellery, which is why there’s been a proliferation of those little shonky-looking ‘buy and sell gold’ boxes in your local Westfield.

A golden age of anxiety

Back in July, the World Gold Council – like gold needs a council – said that since the Chinese central bank (PBoC) began going for it in November 2022, their gold reserves have grown by 165 tonnes – an increase of 8%.

Of this, 103 tonnes has been bought in 2023 alone, making it the largest buyer this year till now.

Other top buyers of gold include Poland, Uzbekistan, the Czech Republic and Qatar.

Elsewhere in the hood, India’s been getting in on the action this year too, featuring strongly among the top gold buyers.

The Reserve Bank of India’s (RBI) gold reserves touched 794.64 metric tonnes in fiscal 2023, an increase of nearly 5% over fiscal 2022, when it held 760.42 metric tonnes of gold.

India’s gold reserves, which were less than 600 tonnes 10 years ago, have now risen to about 795 tonnes.

In 2022, the net purchase of the yellow metal by the central banks stood at 1135 tonnes —the highest since 1967.

France meanwhile hasn’t been buying much at all. Pourquoi, you ask? Well, who needs to when your President’s a banker and there’s already 2,430 plus tonnes sitting in the vaults under Paris.

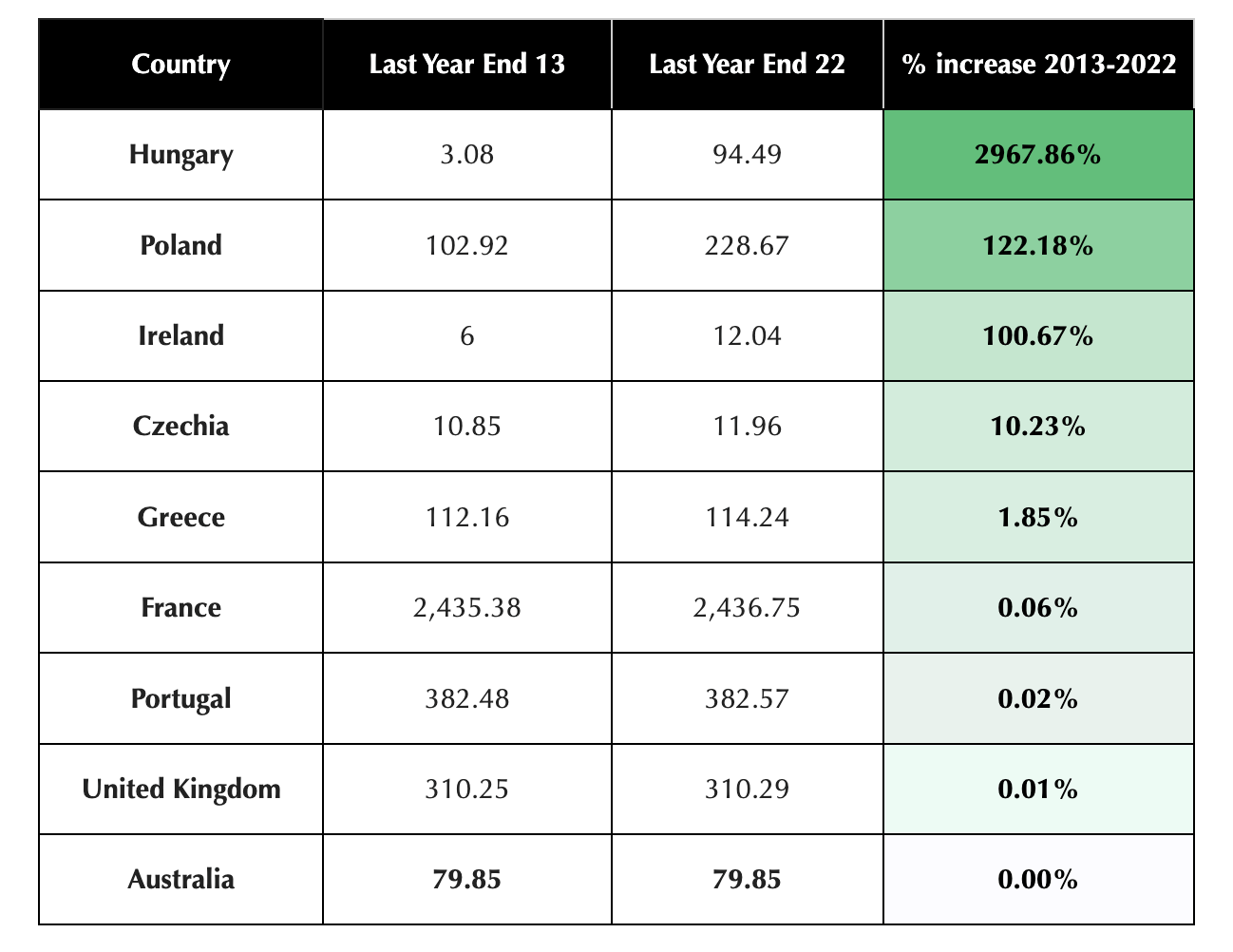

Looking at gold investment trends in European countries further, City Index plugged into WGC data to get an idea of who’s gone and binged biggest in gold reserves over the last decade.

It’s a fun read:

Firstly, It’s great to see Australia is both a European nation these days and has upped its gold holdings by 0.00% over the last 10 years.

In contrast to lots of our European neighbours, which are actively increasing their gold reserves, the Reserve Bank of Australia (RBA) has ‘a differing perspective on gold as a safe-haven commodity,’ says City Index.

The RBA reports that gold hasn’t ever played a significant role in mitigating our various economic crises, ‘which has informed its decision not to augment gold reserves.’

Following the sale of two-thirds of the RBA’s gold holdings in 1997, the RBA’s refrained from bolstering its reserves at all.

Matt Weller at City Index says unlike its international peers, Australia has in fact, actively reduced its gold acquisitions in recent years.

“This shift can be attributed, in part, to the country’s traditionally stable economic climate, which has reduced the need for gold as a hedge against economic volatility. The RBA’s approach to gold reserves reflects a carefully considered evaluation of its economic context, marked by economic stability and a relatively insulated position on the global stage.”

Strip us out of the equation and things get weird pretty quickly.

Hungary: So hungry for bullion

Hungary’s gold holdings have increased by almost 3000%, says Matt.

“Gold reserves in Hungary averaged 3.08 tonnes from 2013 until 2017, before reaching an all-time high of 94.49 tonnes in 2021, the largest purchase by a Sovereign leader since Poland in 2019.

“This is an increase of 2967.86% from 2013, the largest rise in Europe, with Hungary now holding 89% more gold than the neighbouring country of Czechia (or old Bohemia for the gothic/romantic readers) with 11.96 tonnes.”

If gold is primarily a safety net – serving as a reliable hedge against inflation in times of crisis or financial distress – then the Central Bank of Hungary (MNB) is looking safe as houses right now.

Hungary confronted the global crises of the 2020s while holding substantial gold reserves, and the subsequent upsurge in the international gold price post-2020 has further elevated the MNB’s gold reserves.

Matt Weller again:

“The MNB first decided to significantly increase the gold reserve in 2018, based on long-term national and economic strategic considerations. Hungary’s significant increase in gold holdings in the last decade is likely an attempt to diversify its foreign reserves, a move that is consistent with its broader strategic goals. This trend is part of a larger global shift in which countries are increasingly looking to reduce their reliance on the US dollar, and we expect this trend to continue as geopolitical tensions persist.”

Poland now holds 94% more gold than Czechia

Poland has had the second-largest increase in gold reserves in the last decade in Europe, increasing by 122.18% from 102.92 to 228.67 tonnes.

This is 94% more than Czechia (11.96 tonnes) where gold reserves have increased by 10.23% in the same period. In 2021, governor Adam Glapinski announced his intention for Poland to acquire an additional 100 tonnes of gold in the coming years, as part of an effort to reduce dependence on the US dollar.

Ireland gold reserves up by over 100%

In the last decade, Ireland’s gold reserves increased by 100.67%, from 6 to 12.04 tonnes, the third-highest increase in Europe.

The most significant surge occurred in the final quarter of 2021, with the Central Bank of Ireland purchasing 3.52 tonnes of gold, bringing its total reserves to 9.52 tonnes.

“This expansion is part of the central bank’s long-term investment strategy aimed at diversifying its assets and bolstering its balance sheet resilience,” Weller notes.

Gold reserves in Australia by comparison increased by 100kg to 79.85 tonnes in the second quarter of 2023 (from 79.84 tonnes in Q1). Possibly as a goodbye gift to outgoing RBA Guv’nah Dr P. Lowe.

As of 2022, we hold over 500% more gold reserves than little Ireland, a country also full of Irish and considered to be similar to Australia by several key metrics.

Except rugby. Sigh.

A wrap on Australian Gold Reserves

- The value of Australia’s Gold Reserves was reported at US$4.788bn in Aug 2023

- Up from US$4.334bn for Jul 2023 (there’s your hundred kegs)

- Reserves hit all-time high of US$5.356bn in Jan 1980

- And a record low of US$129.920 in Jan 1958

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.